This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

Facebook had a bad day...

Source: Bloomberg.

1) Mortgages designed for bank shareholders rather than customers?

Writing for The Conversation, Richard Holden looks at why Aussie banks don't offer fixed-interest rate, 30-year mortgages like their US counterparts. Here in New Zealand the longest term home loan currently on offer from banks is five years. TSB offered a 10-year rate for a while and BNZ a seven-year one.

In Australia most borrowers take out floating rate mortgages although Holden, Professor of Economics at the UNSW Australia Business School, cites a growing move to fixed-term mortgages, which are more popular than floating rate loans here in NZ. Holden notes there's an active Aussie government bond market with maturities from one year to 30 years, thus providing a benchmark to price mortgages. NZ has swap rates out as far as 10 years, and there are 30-year government bonds on issue set to mature in 2051.

Holden argues that effectively Aussie mortgage settings benefit bank shareholders at the expense of bank customers.

Longer fixed-rate loans would insulate Australian borrowers from big swings in interest rates. In the US you can refinance a 30-year fixed mortgage if long-term rates drop. So you benefit if rates go down but are protected if they go up.

Another idea to improve loan contract terms for borrowers – long advocated by University of Melbourne economist Kevin Davis – is the so-called “tracker mortgage”. These contracts limit borrowers to paying a certain “spread” over a benchmark interest rate.

Such offerings depend in large part on competition in the banking sector. The US has lots of competition in banking. Australia has very little.

When costs go up, two groups can bear that cost: customers or shareholders.

In Australia when bank funding costs go up, customers bear pretty much all of the cost, and shareholders zero. That’s the best evidence you’ll ever get of true market power.

Behind its paywall The Australian Financial Review takes a look at a how Westpac has gone from being bigger than ASB's parent Commonwealth Bank of Australia, by share market capitalisation, to less than half its size in a little over a decade. The story looks at problems and mistakes at Westpac, and things CBA has done well.

IT woes, bad management, compliance problems (hello AUSTRAC, APRA and ASIC), and Westpac's costly regional bank strategy, are all issues probed by the AFR. Westpac has also had its problems in NZ, getting offside with the Reserve Bank.

Here's the AFR;

Westpac surpassed the CBA in market value terms in 2008 after it bought St George Bank in a scrip merger deal worth $12 billion. It had a market cap of $42 billion, about $2 billion more than CBA.

The two banks had fairly similar franchises and almost the same key financial ratios. Westpac and CBA controlled about half the residential mortgage market with $265 billion each of mortgages.

Both banks traded at twice their book value, had cost to income ratios – a measure of efficiency – of 46 per cent and total capital ratios of about 10.5 per cent.

Westpac’s return on equity at 22 per cent in 2008 was superior to CBA’s 19 per cent and the market was willing to pay more for Westpac’s management expertise, as shown by the fact Westpac had a higher market value even though its assets of $590 billion were less than the $620 billion at CBA.

Today, the gap between the two banks is $86 billion, with Westpac’s market cap at $75.6 billion and CBA’s at $162 billion. The market’s poor assessment of Westpac’s prospects is summed up in its share price being equal to book value while CBA trades at twice its book value.

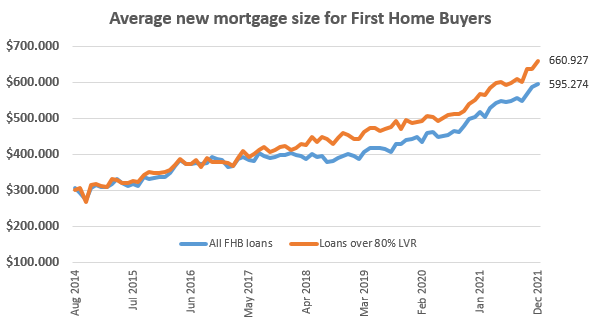

3) The rise and rise of average home loan sizes.

A report from Australia's BankingDay this week, saying the average Aussie owner-occupier home loan size reached A$602,035 in December, got us thinking about what it is in New Zealand.

David Chaston's chart below, from Reserve Bank data, shows the average new mortgage size for NZ first home buyers has been steadily climbing over recent years. In December it reached NZ$660,927 for low equity loans, and just under $600k for all first home buyer loans. The high loan-to-value ratio loans, based on house prices and incomes, suggests plenty of debt-to-income ratios for borrowers north of six times.

4) Banksy and a New Zealand trust.

Writing for the International Consortium of Investigative Journalists (ICIJ), Scilla Alecci - with help from the Pandora Papers - exposes how thousands of art works were secretly traded through shell companies in tax havens.

Alecci details how London financial broker Maurizio Fabris used a New Zealand trust to buy more than a dozen art works by British street artist Banksy, noting that when a trust becomes the legal owner of assets, the collector may be able to avoid or defer taxes on wealth, estate and capital gains.

The British-born Fabris, a former car racer and now a partner at a classic car investment fund, co-founded Enigma Securities in 2004 in London. Enigma, an investment brokerage firm, had outposts in Milan, Malta and Dubai.

In 2008, Fabris established the Heritage International Trust in New Zealand with the help of Asiaciti, a Singapore-based financial service provider whose internal documents are among those in the Pandora Papers leak. Trusts are commonly used to protect assets or reduce taxes by transferring legal ownership of the assets ー stocks, cash, real estate ー to another party, often a professional firm such as Asiaciti.

At the time, New Zealand offered anonymity and tax exemptions to foreigners who established trusts there. It didn’t require trust managers like Asiaciti to disclose a trust’s real owners or what it held.

A chart of Fabris’ offshore holdings and other leaked records reveal that he used the New Zealand trust to buy two luxury cars ー a Ferrari and an Alfa Romeo ー, invest in an Italian firm that patented automotive technologies, and hold shares in shell companies registered in the British Virgin Islands, the Marshall Islands and Switzerland.

Fabris, who described himself in a recent newspaper interview as “an entrepreneur with a passion for architecture and design,” used the shell companies to buy property and to hold shares in the Maltese affiliate of his Enigma brokerage firm.

In 2009, Fabris’ trust paid about $750,000 for 12 Banksy works, including a copper rendition of “Girl with Balloon.”

ICIJ reports that in 2017 a Milan court found Fabris and two Enigma co-founders guilty of evading about US$6.6 million in Italian taxes and collaborating with an international criminal network, and sentenced them to more than three years in prison. A year later, an appeals court dismissed the international collaboration conviction and overturned the verdict, saying the tax crime had occurred outside the statute of limitations.

5) Britain's partying PM.

Someone with a bit of time on their hands had some TikTok fun with Britain's lockdown partying Prime Minister Boris Johnson. The result is below, with a little help from the Beastie Boys.

Well this is outstanding pic.twitter.com/Rhct4e4aEY

— Sanjeev Kohli (@govindajeggy) February 1, 2022

For those wanting something more serious, this podcast from Tortoise Media, The Ministry of Untruths, probes Johnson's relationship with the truth against the backdrop of the Covid-19 pandemic.

149 Comments

With an average FHB home loan of 660k, does anyone how what is their average take home per year?

How long will it take them to get over this debt, a life time, a generation or will be leaving some for the next generation to pay off.

The average income is 56 grand from a quick squizz. So 11-12 years income.

However, some things to contemplate:

- How many incomes does the average family have now? How many in 1970?

- What happens to incomes over someone's career?

- What are interest rates going to do? Some say sky high, some say we are at QE Infinity.

As for how long, how long do you think someone needs to provide for themselves?

Although the average wage is 56k, households borrowing 600k for a house (& that might be conservative for some) are likely to have 2 incomes, & anyone who is qualified in a reasonable skill, trade or profession is likely to be earning 70 - 110k (x2) which makes the loan quite doable.

Maybe the contributing issue(s) to housing poverty is actually the lack of skills training by many (low earners) and the changing household formation models ( 2 are better than 1).

But the 70 - 110k x2 assumption ignores something pretty important - it's only x2 if neither of you takes any time off work to have a kid, and then even once both are working again it is x2 minus childcare costs.

Which is why so many mothers go back to work after 6 months.

Terrible for children, in my opinion.

And yes, then chuck in not insignificant childcare costs, which with 2 children could spread over 5-7 years.

Also, 600k at 2.5% interest is a very different beast to 600k at 5% interest.

Btw, realistically in Auckland now many FHBs will need mortgages of at least 700-800k.

Only the Uber-wealthy or beneficiaries ( who receive greater income as family grows) can really afford to have kids.

There are some other options though. Plenty of ex-Aucklanders where we live.

Correct. Most of my middle class friends in their 30's plan not to have children.

If my observations are indicative of the wider population it has massive implications for our demographics in the next 20 years. Since the poor tend to have more kids than the rich we'll have a massive underclass, almost no working class as the few remaining leave the country, and a small uber wealthy elite. That should work out well...

How much of the reasoning to not have kids is financial?

I imagine some of it could also be lifestyle, environmental or a mix.

Its not just financial HM. Better educated people who are smarter and get into a career have less kids, that's a fact. Not having any kids will become mainstream for people that also look forward to the future of this planet. If you came to the realisation that this planet is toast by 2050 would you have kids ?

Large family sizes are reserved for beneficiaries and for the super-rich.

Toast in 2050? It was demise as cinders from a nuclear war that obsessed my 1960's generation. Don't let fear stop you having children - world history up to the 1850s had serious epidemics and wars every couple of decades and a child mortality over 25% - fortunately your ancestors didn't let fear for their children stop them.

That's hard to quantify, yes it's a complex mix of what you've mentioned, - the financial impacts substantially alter your lifestyle for example.

Yes that's the trajectory, sadly. Of course, the immigration tap will be turned on again to get that important layer of low-middle income earners just floating above the underclass.

I believe only a small portion of women have benefitted by having smashed the glass ceiling. I would dare to say that the majority of woman would still rather not work full-time and would rather stay home and bring up a family.

I contend most women around 50 years ago had a better life wheeling the children in prams or push-chairs down to the shops and stopping to have a natter with other women doing the same thing. Neighborhoods were more stable and women would invite their neighbors over for afternoon tea.

Some women, the high-flyers, could still pursue career paths but they would be a minority. This group would contain the descendants of yesteryears feminists and good on them. But they are not the majority: these are working fulltime, are underpaid, and still having to bring up a family unless they can afford to dump their children in an expensive nursery.

Yesteryears feminists only won a partial victory; but they have done a disservice to the vast majority of women.

Yes and then the men become unhappy as they are no longer the primary breadwinner and come home to chaotic households because the wife has also been at work and is as exhausted as the children when she gets home and the children want Mum/Dad time but they’re burnt out and just need to cook dinner and then put the kids to bed - repeat x5 workdays.

As you point out, I’m sure things were simpler a few generations ago.

For sure and I am sure all those stresses are a factor in higher rates of divorce.

Man you are so far out of touch it's funny. I am a woman, and I do strangely enough speak to lots of women. Literally every single woman I know wants to work, but just wants it to be a lot more flexible and to be getting more support at home.

The only woman I know who wanted to be a career mum was my mother in law. She was a full time mum (most of her generation were). Then she ended up with a master's in infant mental health.

I have been working 15 years, have a very good salary and am about to give birth to my second child. My husband stayed home with no. 1 because he lost his job March 2020 due to obvious factors. However I was working from home, so the blow was significantly softened. This time around my workplace will ensure I get my full salary for 5 months after I give birth. When I return after 1 year of parental leave, I will do 2x6 hour days from home for as long as I please, and will make the most of my employers unlimited sick leave policy if I have to stay home because my child is unwell.

My husband carries the load at home equally, so I feel very supported, and having small children is always going to be an intense cluster for a few years, but how would that be any different if one person was doing it? Wouldn't it be way worse??

I am a weapon at my job and I will enjoy going back and helping them out, although being a mum is far and away my most important role and I would drop everything to do that not just adequately but well. But I don't need to........

Solve- it - yeah it’s so funny reading men explain what women want. No idea at all

I believe only a small portion of women have benefitted by having smashed the glass ceiling. I would dare to say that the majority of woman would still rather not work full-time and would rather stay home and bring up a family.

I contend most women around 50 years ago had a better life wheeling the children in prams or push-chairs down to the shops and stopping to have a natter with other women doing the same thing. Neighborhoods were more stable and women would invite their neighbors over for afternoon tea.

Some women, the high-flyers, could still pursue career paths but they would be a minority. This group would contain the descendants of yesteryears feminists and good on them. But they are not the majority: these are working fulltime, are underpaid, and still having to bring up a family unless they can afford to dump their children in an expensive nursery.

Yesteryears feminists only won a partial victory; but they have done a disservice to the vast majority of women.

Re household formation and income to provide housing needs: increasingly young single NZers stay single or intermittently coupled, which means they often don’t have combined financial goals or shared housing ownership compared to previous eras where couples married at 21, bought a house, had kids and stuck it out. So by their 30s they at least had some equity built up.

So the maturity milestones are pushed out later and later to the detriment of financial and property goals.

Great point.

That's something that this website's FHB affordability index could/should take more account of.

It's something that makes home ownership even less realistic for many FHBs.

Solved by a generous universal child benefit. Taxpayers are content to provide all children both rich and poor with costly education (buildings and teachers) - it is a wise investment. So why not put money into children under 5 - most would benefit from a stay at home parent.

I looked at a tenants books for a childcare center in Auckland over covid when they wanted rent relief.....

76 kids on the role......$850k in MOE funding

> $10k a child

How much more would you like?

Why not give that 10k to everyone with children rather than directly paying for peoples childcare. My wife is stay at home, I have to pay a lot of top tax rate even though our combined income is less than average family and on top of that we don’t really need childcare but we are effectively subsiding everyone else’s. If they want stay at home parents they need to correct those two major financial benefits to working families.

How much does it cost to educate a child? The MOE pays $600 per year to families homeschooling. Per child, reducing by ~$100 per additional child. The amount hasn't changed for decades...

For all families. All children. $10,000 seems rather little - don't taxpayers pay more for a tertiary student? Foreign students at a state school pay over $12,000 so that must be the rough cost for each Kiwi child. Nobody is arguing for less to be spent on schools so why begrudge kids below the age of five?

Bring back the universal family benefit, indexed to inflation. Universal benefits tend to be universally supported. Also bring back the ability to capitalise it to buy a first home. Bring back properly progressive taxation too.

Still something that needs to be factored in when comparing DTI/affordability over time.

An average income could buy a home in 1965, you can't expect it to still do so when the nature of household incomes has changed significantly.

The median income in NZ is currently 58K.....that tells us half the workforce earns less than that, skilled or not. Assuming 2 full time incomes is also a mistake.

So it’s the fault of the ‘unskilled’ that they cannot afford to buy a house and not government policies. Gotcha. Perchance you wouldn’t happen to belong to the PMC?

We were exploring contributing factors to housing poverty: which, sure, includes govt policy and financial environments.

However, every fully-abled person living in NZ regardless of background has access to free education to 18, then a range of education & training options to gain skills to be able to earn a reasonable income. Every person owes it to themselves and their families to aim for income growth through their own nous and creativity - this will help their ability to buy a house.

i think mortgage belt is suggesting every year from year eight should involve a compulsory property class and opportunity to hit the ball running at 18....and peoples 21st should be to celebrate their first mortgage

people with focussed interests around science, math, people or the arts are to be considered losers

MB you're an idiot

Maths or Graphics Design majors have pretty good career prospects actually. And Science with a postgrad.

Too late waking up at 35 and looking for your 300k house in your parents suburb.

The 56k is before tax taken out so after tax and all other expenses food car petrol power water what is left. Also how long does it take to save 120 k for deposit while paying rent.

Petrol touched $3 which is appox 40% higher than last year when it was near $2.20 and data suggest that inflation is up just 5.9%.

Cannot say much about inflation data but average household cost has gone up by 20% and more, So is the data released a farce !

https://www.newshub.co.nz/home/money/2022/02/pain-at-the-pump-petrol-pr…

2022 will be interesting challenging year. Survived pandemic but will economy survive the brutal manipulation by reserve bank and government, who are still not ready to accept the blunder in their zeal of LEAST REGRET.

https://www.interest.co.nz/personal-finance/114081/petrol-prices-tipped…

Usually predictions are wrong, but geez, this one was a real doozy. Not even two weeks and there is Petrol on sale for $3+ within Greater Auckland.

Maybe the author meant $4L or $5L. The former is looking very likely by December with the Latter an outside chance.

Not quite right. The article predicts 91 at $3 at some point, from what I have seen over the past 2 days 91 is still typically 2.75-2.8 in Auckland.

Even so, it's climbing fast.

I picked petrol at $3 by Christmas but I really was referring to 98 but now I see even 95 has gone past the mark as well. The next prediction should be for when it hits $4 that may be closer than you think.

Really not regretting my decision to go EV last year. All the things people go on about in comments turned out to be non-issues (range, road trips, battery degradation, towing) and the operational savings keep increasing.

What did you get? Looking for a EV SUV right now but the choices are pretty limited. And some of the ranges are...not great.

Get a Mitsubishi Outlander PHEV - best of both worlds

Actually worst of both - a small battery, extra weight to carry around and still oily bits to service. A full EV is a better solution. Ticket price is the only barrier but operational cost savings make this up, especially if you do high km.

Don't know what their performance is like, but I like the look of the Mazda MX-30.

Looks good but poor value - only half the range of a Model 3 which is $8k cheaper

Yeah, but the Mazda is a proper car. With panels that actually fit together properly.

Happy for any extra EVs on the road and each to their own - some will even buy the new BMW i4 with the ridiculous grill and that’s ok.

However, the Tesla comment is outdated. All NZ Teslas are now sourced from the Chinese factory where build quality is much better.

We got a 40kWh Leaf for $29k after rebate. It has the same total cost of ownership as our previous $15k petrol car.

Which means you're $15k out of pocket?

kwimm,

Same here. We bought a second-hand Leaf last April as our second car. We use it for nearly all our local travel-Tauranga/the Mount- and its lack of range is just not an issue. Fully charged it does around 170ks and that is quite enough. That has barely changed since we bought it. It gets charged about twice a week at home overnight.

Every two car household should buy a cheap Leaf for their second car - saves a fortune on commuting and local trips.

Agree. I would say the vast majority of trips in nz could be done in a leaf and with most families having 2 cars or more the range is just a poor excuse.

Depends. If you're all in on a cheap EV and need it to do everything then those are valid concerns. If you're buying new or are budgeting for a replacement battery pack and have an ICE car you can fall back on for longer drives then they're ideal. I wish we'd bought one before we had our baby, currently looking at my options for importing one but our sliding dollar is making that harder than it needs to be.

It’s our only car for a family of 4. And it does long road trips, trailer runs with green waste and lots of running around town.

Battery degradation on the 40kWh is 7% in year 1 then 1.5% per year. So will take about 10 years for the battery to get to 80% (when it will still have 220 of range. No replacement battery needed.

It might be worth pointing out that so far we have survived 2y of govt control, the actual pandemic (where everyone gets sick from the rona) is only getting started. It seems to me, economically at least, that the prevention has been worse than the virus. The RBNZ is now taking actions typically associated with a recovery so it's interesting to me that they are doing this right when the virus starts to spread exponentially.

A gathering storm. Not only that, it’s a perfect one.

Cool clip of Boris.

Interesting the media & political forces growing against Boris (storm in a teacup or gin& tonic) - is it that any leader or country which goes against the narrative of lockdowns, mandates, restrictions will suffer attacks for not following the control directives? Eg Sweden earlier, Denmark, NSW, etc.

It's unreal that Boris is still PM, what's keeping him in that position is the question...

Perhaps those who supported Brexit ( the majority of the UK who rejected the corrupt EU governance) and those who support the concept of getting on with their lives & businesses despite SARS-2?

How did you feel when David Clark resigned after going for a bike ride during lock down? Far lower risk than the collection of indoor, close contact parties enjoyed by government staff in the UK, including Johnson, in the depths of the initial lockdown.

Clark was right to resign - you can't set the rules and then think they don't apply to you. Likewise, Johnson should go.

I don’t think anyone could care less if Clark went for a - shock - bike ride during the lockdown. A bit of excitement for the media. The more people rebel against unreasonable government control the better.

can you elaborate on what is "unreasonable"? I don't want to get my pitchfork out without a good reason...

I'm sure they can't elaborate. Like many of the chronic moaners, it's just flailing arms and noise for attention.

The more people rebel against unreasonable government control the better.

100%

The problem was he made the rules!

... David Clark broke the lockdown rules 3 times ... refused to go to Wellington , even though he was minister of health ... and didn't resign immediately , it took weeks and weeks of media pressure before he caved in ...

the majority? Wasn't it 37% of the electorate?

as for "corrupt EU governance"....what have they replaced it with?!

there own corrupt govt

MortgageBelt,

Have you lived in the UK? I lived in Scotland for some 57 years and Scotland did NOT vote to leave the EU. I took an active interest in politics and while there was much about the EU I did not like, I would not have voted to leave. Nobody I knew voted that way. On the evidence to date, the UK has not gained by leaving, quite the contrary.

Boris is a clown, but worse, an incompetent clown who has twice been sacked for lying. Look it up.

At least he's entertaining.

Our PM is poor and boring.

He may yet survive. Bit like his idol Churchill, gets a lot wrong but gets the big things right. Very untidy character & operator though. Patience by the public may well rub off just like is happening here, regarding the facade & charade with which our government & PM operate.

... the difference between Boris & Jacinda is the local media perception of them ... the Brits news media are attack dogs , rottweilers with microphones ...

The majority of the Kiwi media have been Jacindaniacs , adoring of the Red Queen ... she hasn't suffered the harsh scrutiny Boris has ... and , when a Hosking or Soper gets under her skin , she's runs , and avoids them forever more ...

true about the British media but most of them are right leaning and supported Boris, but even they can see that he's a liability now. When the daily wail starts picking on a Tory you know the end is near...

Exactly, Boris over Jacinda any day!

150,000 dead Brits would strongly disagree.

Yep our govt have certainly been better overall on covid.

But dropping the ball on so many other things.

There is more to life than death. Some seem besotted with the tallies of the latter. Two things are indefinite. Firstly no nation appears to have accurate statistics recording, in the case of either hospitalisations or mortalities, how many were principally due to covid, ie who died from covid rather than an existing condition but with covid also present. Secondly projections of NZ mortalities have always been based on modelling from overseas examples, which even Minister Hipkins has admitted he viewed akin to weather forecasts. Prudently the test on that as hard fact was never required. Personally I fully supported all the governments measures for the first year but that was only half the game wasn’t it and you don’t ever win a game at half time. No thought or preparation to the second half and there have been issues, such as overextended MIQ enforcement, that would have been better avoided.

A huge unrecorded factor will be deaths due to delayed or refused treatment. They will be recorded as cancer, accident, aneurysm, infarction etc. Anything but Covid......

Now there is an irony. The grim reaper is as subject to spin as any other identity. On one hand over count covid mortalities by including covid as the cause, rather than say a gun shot wound to the head. Thereby enhance the power of fear. And on the other, avoid any recognition of mortalities that are a result of either diagnosis missed or treatment delayed due to covid precautions taking priority. Thereby reduce fear that hospitals are not functioning. And on the third hand a question. Why all those omissions and cancellations of electives etc if NZ has been successful in avoiding covid for two years?

"those omissions and cancellations of electives" showed up in the excess deaths every month in 2021 but the media was focused on partying Boris and other such distractions.

https://mpidr.shinyapps.io/stmortality/

Yep totally agree. Did well in the first year (apart from not making urgent moves to improve hospital capacity and staffing) , but their second year approach has generally been awful.

Most of whom died with COVID and other conditions.

Most of the UK public seem happy with their current more relaxed COVID settings.

The UK has reported an increase in their death rate over and above what would've happened otherwise due to covid. With, and, of, makes little difference, their government were lackadaisical in their initial response and that has cost them dearly.

Between that and Brexit, if you think the government in the UK have it over NZ then there's probably not much I could say to convince you otherwise.

Using such nations as UK & USA as comparison to NZ in terms of body count is a stretch isn’t it. Population density, high activity international borders& even higher domestic travel, underground rail, buses and on, harsher winters, just the sheer compacted mass of humanity going about its life. NZ had its own brush with that, with Delta. The underclass, the underworld and the high density living in areas of Auckland were easily penetrated & exploited by Delta but containing & controlling say 300k of those those sort of potential victims is hardly the same challenge as suppressing millions of citizens all the time in any one place. To point a self righteous finger in that direction, without thinking about any of that, is utterly smug.

The UK and USA didn't take it very seriously until the horse bolted. The US is busy having a culture war and part of that has them having very low compliance with vaccines, masks and other mitigating measures.

NZ has performed more like parts of Asia, who have the same sorts of additional factors like you mentioned, dense living, lots of people moving around, larger populations, etc.

It's not smugness, NZs covid response, while imperfect, has yielded better results than most of its traditional contemporaries.

No the horse never bolted. The horses flew in from China and stampeded out and through the land. Just a look at flight tracker in those days, Europe & Nth America illustrates that. Just too much population movement and contact to ever have a hope of reigning it in, in time. NZ advantaged by remoteness and no land border and in comparison sparsely populated had the ability to observe these developments, but even so only shut the border just in time. Yet mistakes were repeated here. No isolation of rest homes for instance. We have lived and worked in both the USA & UK. It became immediately apparent that citizens had no option other than to manage their own situations individually, independently. Just about all of our old friends did exactly that, and successfully, because they knew full well that both central & local government were overwhelmed. You miss the point. You made a bald and snide remark about UK death tolls simply to bolster your political bias. Smug is actually rather understated. If you had bothered to weigh up the circumstances and argue them instead, perhaps you might have been somewhat less subjective. Good night.

NZ was just as plugged into that international air transport, China was our second largest source of tourists up to 2020, direct flights you name it.

There's a clear body of evidence to show the benefits of fast, stringent lockdowns, and they diminish in effectiveness the more tardy central response is. Surely everyone remembers the flippant approach taken by the US in 2020.

Had the NZ government not taken covid as seriously in 2020, we would have succumbed to similar fates as other nations. Our continued vigilance has allowed us to avoid Australia's fate with Delta.

There is some truth to what you say; it helps having a big moat around the country, and our government has a host of inadequacies - at no point am I claiming perfection or discounting contributing factors. But NZ has taken covid seriously (many say too seriously, it's just like the flu don't you know), and that has appeared to pay dividends so far. There's nothing flippant about pointing that out, because again, any dead UK or US covid death would likely have preferred an approach more like our government than theirs, as would anyone close to them.

I have a bias, but it's less to do with the colours flown by whoever is at the helm of NZ, and more to do with our ability to still listen to reason and make pragmatic considered decisions at high levels.

I love his plummy accent

The mortgage term thing has always intrigued me. 30 years means you have certainty for the life of the loan, here it's Russian Roulette.

Banks say longer terms aren't popular here but that's because the interest rate on offer is usually a lot higher than the shorter terms.

To get that certainty you'd ending up paying more and then without US style optionality, you have problems with prepyment penalties. It is all about risk and return. In the US, the ability to prepay/refinance without penalty is not actually free either, the interest rate you pay is generally higher than it otherwise would be to cover the cost of optionality i.e. there is no free lunch here.

Would there be any demand for a longer fixed term? Every time I see data published it seems there is a heavy preference for short-term fixed rate contracts. This has probably been reinforced by falling retail rates for many years meaning people who did hedge using longer fixed terms ended up paying more interest time after time.

Also because the market has been hot, basically for two decades, there has been a push for people to keep buying more expensive houses so the average ownership duration is down to 7 years. This is part of the reflexivity cycle in credit where rising house prices make banks perceive homeowners as more credit worthy.

In the States their 30 year terms are lower than our 2 year terms. At the start of Covid you could get 30 years at 1.8% interest. Anyone in their right mind would take that.

Unless banks are going to start paying you for borrowing money.

I've always wondered why fixed rate mortgages are cheaper than variable in New Zealand. It makes no sense to me given the bank has to hedge fixed rates but not variable.

Also why is there no such thing as an ARM in New Zealand?

The banks want to have you locked in as well to stop you changing banks. Hence the calls and messages as your fixed term is coming up.

The short rates offered here absolutely are designed to maximize shareholder return a d nothing else.

Well, calls for a full Fed & central banking reset.

https://www.mauldineconomics.com/frontlinethoughts/time-to-rethink-the-…

“In many important ways, the financial crash of 2008 had never ended.” “This fragile financial system was wrecked by the pandemic and in response the Fed created yet more new money, amplifying the earlier distortions.”

Nice link - agree.

Best link of 2022 for me. Ending the dual mandate for the FED has equivalent implications for our own beloved RBNZ, with mandates multiplying like the leaves on Tane Mahuta.....here's what the spinmeisters have to say about That

yes, excellent piece.

“In many important ways, the financial crash of 2008 had never ended.” “This fragile financial system was wrecked by the pandemic and in response the Fed created yet more new money, amplifying the earlier distortions.”

Thanks for the DGM porn. Will read with interest.

Lowering interest rate to very low level may have helped in pandemic for very short time but has destructed the economy as very very low interest rate should have been to protect existing borrorowers from default in difficult tines and not not for promoting over borrowing to give artificial shot to economy, where anyone and everyone was borrowing to its maximum capacity and beyond.

Now what ?

Based on 30 years with 3% interest rate for five years, mortage for $600000 was appox $550 and today at appox 4.95% is $750 per week but if one takes average price of a million with 20% deposit , for $800000 mortage, earlier it was appox 740 per week and today will be appox $985 per week.

Icing on the cake was removing LVR and giving literally 95% if not full 100% with little manipulation of existing equity. So many who bought and got with 5% deposit, could be another $200 to to $300 extra per week and another point to note is that this is not the end of rising interest rate.

Add rates and insurance and many are in deep shit unless both are earning much above average - can do the maths. Spending $58000 annually on house is equvallent to $700000 job before tax.

Now housing market should be passing the parcel to each other within existing home buyers with FHB being silent spectators specially in Auckland unless the wages rises significantly or house price falls badly and this situation is when we are talking about low end houses.

Central banks have been pumping down interest rates for decades now, so the pandemic is a continuance of the same process, it just so happens that it was a pandemic that created the system shock. Is this the endgame this time, or just another instance in a much longer chain of monetary policy? I wouldn't bank on the former, but predicting the latter is less easy.

Housing occupies the forefront of most people's minds but theyre only one part of the puzzle. For instance, the same challenges you highlight for a home mortgage also applies to businesses, margins are now at a point where they cannot support higher interest rates without considerable price inflation, or failure.

The economy was likely to enter a recession regardless of the pandemic. Yield curves inverted in 2019 before the knowledge of the pandemic.

But the pandemic allowed central banks to step in and take unprecedented steps in unprecedented times.

I do wonder what would have happened if we had the recession without the pandemic… governments and central banks wouldn’t have had the mandates to wreck the havoc that they have, for which will have longer term (bad) unintended consequences

The next recession would likely have been met with more stimulus.

Very difficult to determine how much additional "havoc" there is due to pandemic spend, because a lot of the money has/is being spent to create a level of economic and employment continuity that wouldn't otherwise exist.

The tools used are pretty blunt but then again there's not the timeframe for more precision.

Yes agree. The impact of the pandemic seems to be additional cash in the system chasing reduced goods and services as a result of reduced productivity (inflationary).

And then Central Banks deciding that high inflation can be ignored, but the sniff of deflation at the onset of the pandemic required unprecedented intervention. Why? Asset prices must be protected at all cost. Is this their mandate…Orr says houses prices are his mandate when it suits him and then they are not when it doesn’t. The Fed appear to treat their share market like we treat our housing market.

I disagree that little is being changed currently because of an utmost imperative to protect asset prices.

My view is that it's because it's very very difficult to distinguish where the line between demand and supply side inflation really lies.

Dp

Don’t forget the $400-500 a week to repay principal so add that to your calcs.

RE: 5) Britain's partying PM.

An interesting insight in respect of Boris Johnson's Jimmy Savile slur directed at Kier Starmer:

How the Establishment Functions

Yes, there must be a lot more behind the attacks on Boris than just lockdown parties.

Obviously - great little video - and I'm sure in the interests of unbiased journalism can we also have the video of Keir Starmer boozing with staff during a lockdown?

Just for you profile... :)

https://www.thesun.co.uk/news/14826418/keir-starmer-beer-indoor-gathering/

He's a pathological liar, narcissist, adulterer and not very good at holding down a job?

... and yet ... I'd boot out Jacinda , and replace her as PM with Boris in a heartbeat ...

well they do say you get the govt you deserve...

... I didn't ... I voted for the only party that I thort had their ACT together ... labouring under a top delusion there , putting NZ first ...

i meant that if you voted Boris in here you'd be responsible for the ensuing sh**show.

someone put a video together of all Boris' best traits :) https://twitter.com/JonathanPieNews/status/1489605240659791873?s=20&t=DQI0q97IEDCbMsu0fNccmg

Ah, but that Hair....

... imagine a computer generated mash up of Boris & Jacinda ... his hair , her pearly whites !

I actually worked with someone who knew BoJo at Oxford. Apparently he was much more interested in his social life than attending lectures and, despite debating being one of the few things he regularly attended, he was terrible at it.

It sounds like he was very self-centered and lacked work ethic. Consequently I suppose politics was the obvious career for him.

RE:1) Mortgages designed for bank shareholders rather than customers?

NZ has swap rates out as far as 10 years..

ICAP NZ quote 12, 15 and 20 year IR swaps.

I have heard a well informed rumour that the government is about to crank into its mega housing development at the Unitec site.

Only about 2-3 years late, but I guess better than never.

They will want the first apartments built and occupied 2-3 months before the election.

Getting them ready for the influx of immigrants & international students...?

Or maybe FHBs who can't afford the market priced apartments and townhouses.

Maybe they should have already started it 2 years ago and used it as a MIQ facility then on sold it after the Pandemic ? House prices went up 40% in Auckland over that time, it would have paid for half of it by the time they sell them in a years time.

But Gubmint salaried shiny asses don't have commercial minds......so missed opportunities carry zero opportunity cost.

They will be going for shoebox type house or apartment as by their definition any roof over your head is home, going future even garage with attached bath will be given a go ahead to use as house - need number in election to get votes.

Those tiny houses being built are also going for a bomb.

Boris has become the butt of so many jokes, in UK as well as internationally,

He has no credibility left, and his position is simply not tenable, both politically and personally.

The only reason why he has not resigned yet is that his love for power surpasses his lack of self-respect. Very sad.

Labour fought and won election on housing crisis. What does Jacinda Arden government does after getting absolute power and pandemic as an excuse : Instead of solving as promised, they turns it into a bigger monster and is now beyond control as admitted by great Robertson, well highlighted by Bernard Hickey.

Bernard Hickey :

https://thekaka.substack.com/p/robertson-says-voters-dont-really?utm_so…

"Grant Robertson and the Labour Government have effectively given up on making housing affordable for most home buyers any time in the next couple of decades. Robertson admitted that yesterday when saying he wanted house price stability, rather than the big drops most voters want and the OECD fears in the wake of the 40% spike in the last two years.

Robertson said he didn’t believe home owners wanted their own house prices to fall and has effectively repeated the Prime Minister’s underwriting of house prices at current levels. He is saying house prices only ever ratchet up. They can never, and will never, be encouraged or allowed to ratchet down in a way that would make housing affordable again for current generations of first home buyers."

DESPITE ALL DATA SUGGESTING THAT HOUSING PONZI IS AS STRONG AS EVER IF NOT MORE.

From Bernard Hickey weekly summary :

https://thekaka.substack.com/p/the-week-that-was-for-the-weeks-end-bc3?…

"CoreLogic reported an acceleration in the monthly rate of house value inflation in January this week, despite all the talk a credit crunch, higher interest rates and higher listings were already dragging prices down.

Elsewhere, a poll showed nearly 80% of voters wanted house prices to fall “a lot” (47%) or “a little” (29%). I asked Grant Robertson about that. He didn’t think home owners really wanted their own prices to fall and again refused to say he wanted prices to fall to achieve affordability. He said first home buyers priced out of the market would have to wait a while for an affordability problem created over decades to be solved."

Above reflects the mindset of Robertson and Jacinda that they only look for data and advise that suits their narrative - cherry picking so next time when Jacinda says that waiting for data or advice.....look beyond.

Democracy ....time to change VOTE BANK POLITICS AND POLITICIANS.

This is a telling graph... https://ibb.co/d265yh3

It's just BAU - under Labour & National...

Realistically, how could the govt moderate house prices?: Build many govt houses and so flood the market for low income families? Remove tax on interest earnt up to a limit to encourage alternative investment, influence the RB to pressure them to increase interest rates, etc?

House inflation is a global phenomenon with everyone piling in for ownership (safe haven) and investment (last arena not dominated by corporates) so what can govts do? Then if they try to help FHBs with subsidies they fuel more inflation!

Yes build lots of affordable homes, like Ireland is about to do.

The market can't deliver affordable housing.

House inflation is a global phenomenon

It is, but as you can see NZ has a much larger issue - one that none of the major political parties want to tackle.

The only party promoting the asset reset was TOP with their tax change policy. They attracted 1.5% of the vote so would require a mass swing in party vote to become the next king maker. Other wise BAU.

Nats and Lab are both sold out to putting debt enslavement ahead of NZ's social fabric. If you want change you will have to pick something else.

No fan of GR but he will do well to ignore Bernard Hickey . Following advice from Bernard has not worked out well for anyone , ever ..

https://i.stuff.co.nz/business/money/127633424/cccfa-rules-are-bad-but-…

Why did RBNZ create a situation in the first place which they are happy for bad policies to do what they actually wants to but are unable.

What is preventing them ......... politics...vested.....biased interest

A 230sqm new built in Hamilton for an asking price on 1.7mn+.

Isn't that a steal in heaven like NZ? That's what it is being marketed as.

I am sure this a heaven now and I am probably dead because I don't believe it's affordable for the living in this country.

What more examples do we need for this sleeping government to do Something about it? They talk about Mahi. What mahi do i need to do to be able to afford that?

This is the rot current government and their pet puppy RBNZ has created.

New builds already built are going to command a premium as supply shortages continue this year.

At 3000 per sqm then 230m = $690,000 plus landscaping and chattels plus 700k for a full section. Then the premium for a new build.

1.5m is now the minimum for newish builds in most cities now.

Are you an agent or working in the RE industry?

Filing your own pockets by killing everyone else in the country.

Who can afford that price mate? How many?

Neither. Just observing, not spruiking!

Building costs are a significant influence on house costs, and indirectly on the existing stock.

I agree with you - it’s otherworldly.

Yep, simply accurate observations.

You can buy a new 200m2 house in CHCH for under 600k. Buy that instead.

Anything above 200m2 incl a double garage is a mansion in my book. 150-200m2 is quite adequate for a family of 5.

It would be nice to have a politician that speaks facts over the housing issue and what's caused it...

Why is it no one in NZ talks like this?

Because in NZ both major political parties believe in housing ponzi.

Labour more than National or is it National more than Labour.....both compete in taking pyramid ponzi by invoking FOMO and are successful.

Well I think the best in this article is some light hearted relief in the link to the you-tube video on boris's "right to party"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.