Regular readers will know we have been following bond yields more closely than usual recently.

Our last two Breakfast Briefings have noted the rise in benchmark government bond yields in major economies, like the US, China and Japan.

Overnight, even the European Central Bank signaled its next policy rate move is likely to be up.

This matters for home loan borrowers - a lot - because there has been a herd shift to floating mortgage rates, perhaps driven by mortgage broker recommendations on the basis the Official Cash Rate (OCR) will keep on falling.

But it looks increasingly like poor advice.

The strategy to take a higher floating rate now only works if you can switch to a lower fixed rate in the future.

However, fixed rates may already be at the bottom of the cycle.

And money markets are giving direct signals that they don't see any more OCR rate cuts over the next few years. Tuesday's pricing has seen the already small chance of an OCR cut virtually vanish.

What's more, they are pricing for a 75 basis points rise over the next two to three years. True, the pricing doesn't show any rises until well into 2026. But the current 2.25% OCR could rise to over 3.00% in the next cycle.

That completely undermines the idea of accepting high floating rates now, for lower fixed rates in the future.

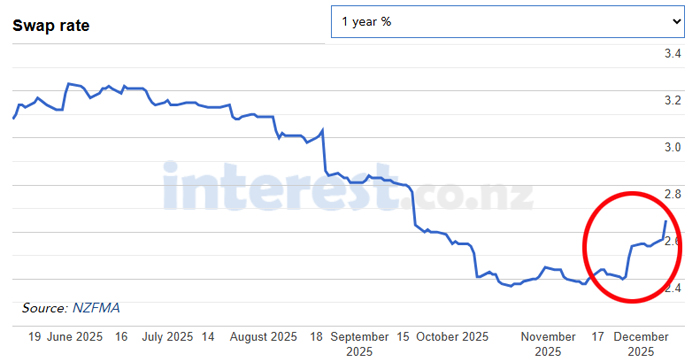

Worse, those rising international benchmark rates are pushing up swap rates. On Monday they jumped sharply again. Fixed mortgage rates are influenced far more by wholesale swap rates than by the OCR.

And it is these swap rates that set the cost of money for banks offering fixed rates.

It seems increasingly unlikely fixed mortgage rates will fall from here. It seems increasingly likely that they will rise.

And while we are at it, we should note that New Zealand policy rate expectations priced by the money markets are far more aggressive than for Australia. They are only facing only a 30 basis points rise over the next year or so.

6 Comments

Can we get some background as to why the markets are reacting this way and why it wont drop back? Nothings really changed for the NZ economy, inflations still within zone and RBNZ have more or less said they'll hold OCR unless data suggests otherwise...

In my opinion the market thinks the RBNZ made a mistake and demands more return due to the real inflation risk in the economy. ie the market thinks the RBNZ is wrong with its forecasts and OCR decision (and I agree - I was saying that the RBNZ should not cut at the last review).

The CPI data has been consistently tracking up in a steady trend for the past 12 months right to 3% (the upper limit) and the RBNZ cut anyway!! The market is telling us it thinks this is wrong and now believe rates will need to go higher again in the future - simply because they have gone too far with the cuts....

No one wants to hold government bonds when real inflation is higher than the official figures. Investors are moving into gold instead. The 40 year bull market in bonds ended in August 2020, and it doesn’t matter how much the RBNZ cuts the OCR, the bond market is in control.

October 2025 was the best time to fix, with both NZ2Y and NZ10Y selling off since then. I fixed long term in June, a bit early.

October 2025 was also the peak for Equities and Crypto.

Just been looking at the Japan 10 - 30 year bond yields and they're really taking off.

In my view, the world we knew economically for the past 30 years is exactly that, a thing of the past.

We appear to be heading into a new era in which things could be the exact opposite of what most adults have experienced their entire working/saving/investing lives.

I suggest people should get used to the concept of flat or rising interest rates for decades ahead, and make decisions based upon that scenario - but this is the exact opposite of what many have been doing (always believing the cost of debt gets cheaper over time).

Mortgage brokers are just the gym bros of the finance world, with the “evidence” behind their reckons being mostly vibes-based. I have never found the advice our mortgage broker has given to be of any use, and have consistently chosen a better course than their suggestions over the past 4 years. I have no financial/banking background, so either they’re useless or self-serving.

Yeah always amazes me the advice that mortgage brokers and real estate agents provide, given their lack of understanding of how the system works that determines the behaviour of the product they sell.

Example (real world) - asking a mortgage broker about their thoughts on recent movements in interest rate swaps in wholesale markets and how that might impact mortgage rates, but just got a confused look in return. Then you realise they are just selling a product (mortgages) for cartels (banks) who are selling a product. Not that dissimilar to how a drug distribution network might work where everyone wants to clip the ticket along the way to make money - but never knowing where the product is sourced from, nor whether it is good or bad for the end user - its just about making profit. "here buy my stuff, no idea who makes it or how but I promise you its good".

I'd be inclined to add the financial advisors I've met to that class as well.

My background includes a little data analysis, and when you start talking risk-return ratios, cost structures, their margins and so on, while they try and justify what they're trying to sell you, I've found they tend to look a bit panicky and there's a strong push to get away from numbers and back to the vibe. 'We like (insert name of company here)' is not grounds for investment.

And they really will not engage with you when you talk about the statistics around diversified index trackers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.