Was the wait worth it?

That's what some homeowners who have recently taken up new mortgages may be wondering after what's looking like a fairly abrupt halt to the downward direction for fixed interest rates on mortgages.

As we've commented regularly, the country's mortgage holders began to get shorter and shorter with their fixed mortgage terms from the start of 2024 as they anticipated the Reserve Bank (RBNZ) would start cutting the Official Cash Rate (OCR), which was then at 5.5%. The intention of this by the homeowners was, of course, to be able to take advantage as soon as possible of future cuts to mortgage rates.

The OCR cuts started coming in August 2024 and many mortgage holders kept going short in the belief the cuts would keep coming. And for a long time they did. The OCR is now at just 2.25%.

The RBNZ itself has actually cited the desire of home owners to wait for interest rates to drop further, and therefore staying on higher rates such as floating, as a reason why there has been a relatively slow transmission of OCR cuts into the economy.

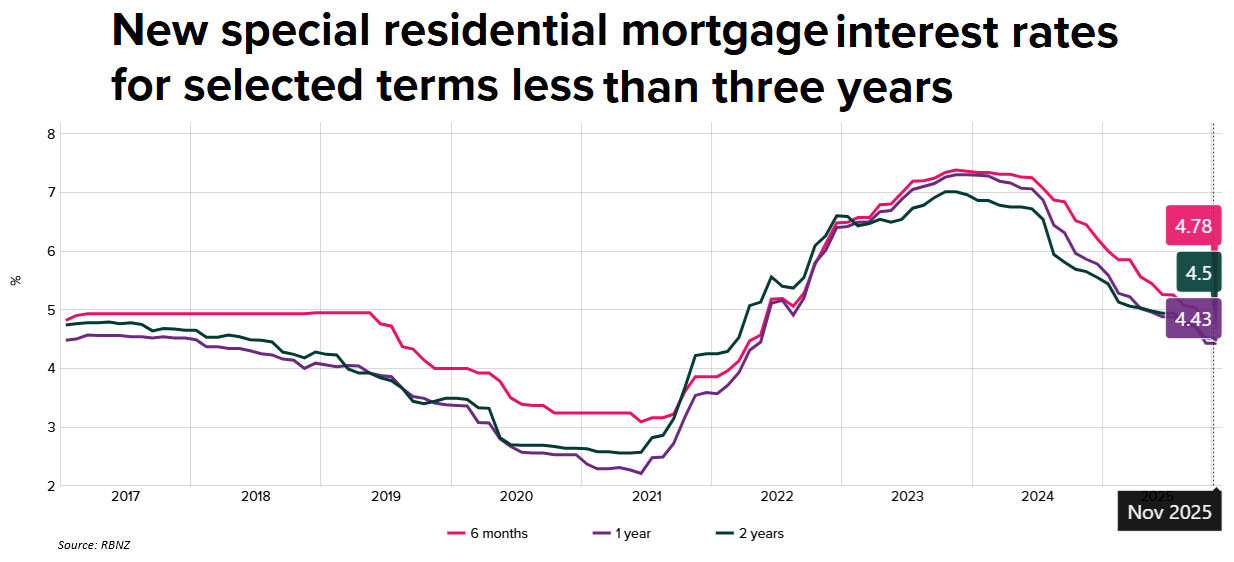

But even though the October OCR review and the November review brought a total of 75 basis points worth of cuts, fixed mortgage rates have since fallen by around only 25 basis points, and that might now be that. (See David Chaston's crunch on rates here).

I for one, admit to being surprised by how quickly things have turned as I felt there was probably another 25bps of easing still to come in fixed mortgage rates. And while we can never really tell what will happen - global meltdowns etc - there currently appears little room for further downward movement.

ASB chief economist Nick Tuffley said in the bank's latest Economic Weekly publication, that interest rates "are most likely as low as they will go".

"...In the case of term wholesale rates, they are already off the recent lows, given the RBNZ’s messages that it thinks it has done enough.

"Financial markets swung in quick order from pricing in a 50:50 chance of a further OCR cut and a 2026 year-end OCR of 2.3% to now price little chance of any further easing and a 2026 year-end OCR of 2.7%.

"It’s a big change in a short space of time. If people were hoping that the RBNZ’s Monetary Policy Statement would be the catalyst for lower fixed-term rates, it doesn’t look like it was – the cost to banks of providing fixed-term lending has actually lifted," Tuffley said.

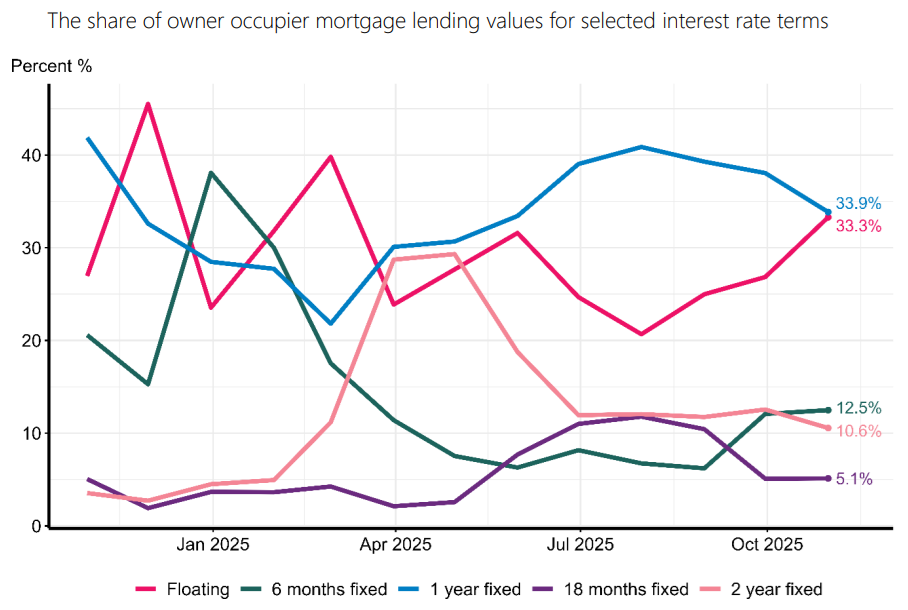

Latest RBNZ figures showing mortgages drawn down in October reveal exactly a third of new money for owner occupiers - just over $2 billion - was at floating rates.

That's the highest proportion on floating since February and is a spike up from 26.8% in September.

The big banks are currently offering floating rates in the 5.65% to 5.89% range, while one year-fixed rates as one example are mostly around 4.49% (advertised special rates).

One-year fixed rates were still the most popular option for owner-occupiers for new mortgages in October - although only just. The $2.097 billion taken out by owner-occupiers on one-year fixed terms made up 33.8% of the $6.196 billion total drawn down by owner-occupiers. The one-year fixed percentage share dropped from 38.1% in the previous month.

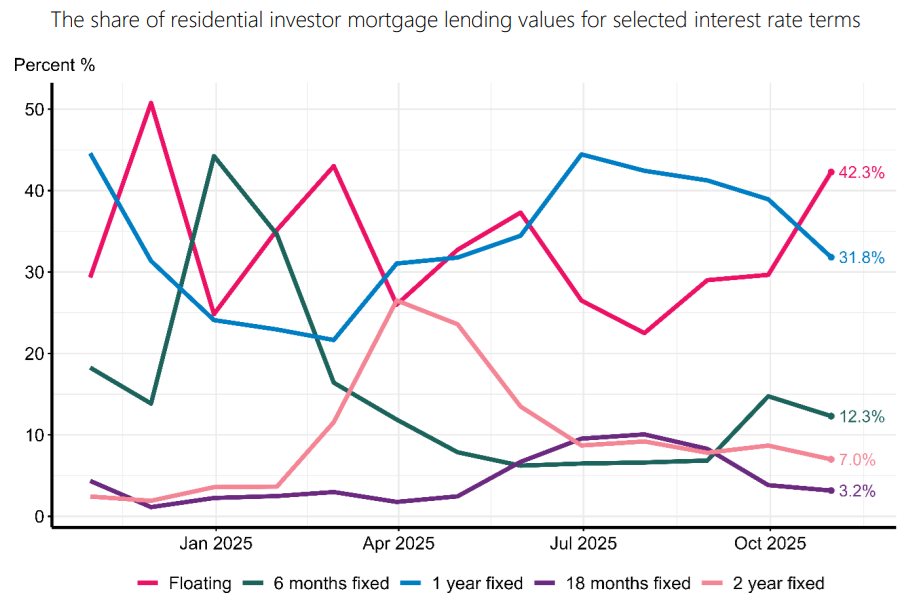

For investors, floating was the clearly favoured option in October, with the amount of investor mortgage money on floating rates hitting 42.3%, up from 29.7% in September.

For owner-occupiers in October, just under 80% of the mortgage money drawn down was either on floating or fixed for a year or less. For investors, the focus on 'short' is even more intense, with over 86% of the $2.555 billion drawn down by them on the month either on floating or fixed for a year or less.

With the mood of the marketplace having now turned considerably after a much less 'dovish' OCR review than was expected in November, and with wholesale rates having firmed in a way that's leading to talk that there may even soon be upward pressure on fixed mortgage rates, it will be very interesting to see how the owner-occupiers and the investors react and what options they take in coming months.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.