By David Hargreaves

The latest quarterly Reserve Bank Survey of Expectations, has shown a rise in expectations for the rate of general inflation, house price inflation and wage inflation.

The rises are all fairly mild, and from a low base, but will be watched with interest by the RBNZ - which pays a lot of attention to this particular survey and has been known to move interest rates largely on the basis of its results.

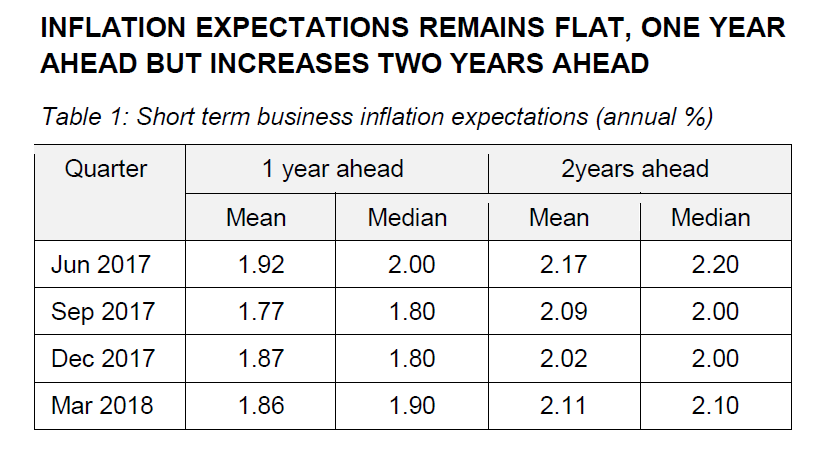

The most watched figure in the survey is the expected rate of inflation two years ahead. This has moved up significantly to 2.11% (above the RBNZ's explicitly targeted 2% level, but comfortably within the generally targeted 1%-3% range), up from 2.02% last November.

Such a rise is unlikely to cause sleepless nights at the RBNZ, nor will it likely change the RBNZ's immediate view - but the central bank will note it. However, the RBNZ is likely to be reasonably comforted by the view of inflation both in five years time and in 10 years time, which are largely unmoved in the latest survey at just a little over 2%.

The RBNZ will, however, also note the fact that wage rise expectations have also blipped up in the latest survey - though again from very low levels and certainly not up to stratospheric levels.

The expectation for annual wage growth in two years time is now 2.68%, up from 2.57% in November, while the one year expectation has firmed to 2.48% from 2.25% in November.

House price inflation, which is a relatively new question being asked in this survey - only introduced last year - has seen a rise in expectations after dropping sharply late last year.

The question involves expectations of the annual percentage change in the Quotable Value Quarterly House price Index for one and two years out.

The expectation for house price inflation in two years time has risen to 2.52% from 2.01% in November.

The one year out expectation has risen to 2.45% from 2.31%.

This too will be of interest to the RBNZ, which noted some firming in house price inflation during its review of official interest rates last week.

The RBNZ as of last month loosened the reins on mortgage lending somewhat through a slight relaxation in the loan to value (LVR) lending restrictions.

The Reserve Bank Survey of Expectations asks a sample of economists, business and industry leaders questions relating to perceptions and expectations on a range of economic indicators.

8 Comments

Modest increases in house prices over the next couple of years is likely on the cards. It's an unsurprising outcome from RBNZ's Survey of Expectations.

And a period of stability is, in my view, not a bad thing.

TTP

Modest increases in house prices over the next couple of years is likely on the cards

Why?

Hi J.C.

There are many reasons - most of which have been discussed on this website.

Suggest you do a search if you're not familiar with them.

TTP

I'm with J.C on this one.

You may not know the meaning of 'modest'.

The survey of expectations, which you make specific reference to gives the following info:

(bear in mind that these estimates normally carry a huge margin of error and these aren't necessarily well anchored to true inflation)

2 year

E(core infl): 2.11%

E(wage infl): 2.68%

E(hp infl): 2.52%

So, in real terms, where is the 'modest' house price increases that you talk of?

If you prescribe to the notion that long run hp appreciation is anchored to wage inflation, then in real terms house prices are expected to decrease.

If you anchor it to core inflation, house price inflation beats it by only ~0.4%.

So, hardly 'modest', at all.

Hi nymad,

Re the meaning of the word "modest", I suggest you get yourself a dictionary.

TTP

I'm sure there's a strong correlation between growth in "housing costs" (as defined in the CPI) and the overall CPI, but most people should understand that the growth in CPI and / or housing costs is not necessarily correlated with house price growth, particularly on the magnitude of the change.

And yes, "modest" is a rubbery modifier that has little meaning unless it's clearly defined. For most people, it's entirely subjective. Similarly, the use of "probably" means very little in the context of forecasts based on a probability function.

There are many reasons - most of which have been discussed on this website.

Suggest you do a search if you're not familiar with them.

So what people discuss enables you to predict house price movements? If this is the case, you need a social listening software tool.

To destroy savings and reward borrowers (especially the heavily leveraged). If this happens then Winston will have completely failed his voting demographic, as retired voters savings become increasingly worthless.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.