An independent inquiry into the Reserve Bank of New Zealand is very unlikely without a change of Government late next year, although opinion polls currently show that is a very live prospect, in part because of the combined effects of fiscal and monetary policy in helping create the newly-modern scourge of high inflation and a 'cost of living crisis.'

Finance Minister Grant Robertson dismissed the Opposition's call for such an inquiry into the bank's 'tidal wave of cash' in 2020 and 2021 this week, calling National Leader Christopher Luxon 'Captain Hindsight' and saying the Reserve Bank had only just gone through a full review that led to legislative tweaks to how it runs monetary policy in 2018, including getting an extra mandate to 'support maximum sustainable employment' and formally making decisions via a Committee, rather than directly by the Reserve Bank Governor individually. Those changes followed a full review and select committee process.

"I just did that, and I don't think I'll put the Reserve Bank through that again," Robertson said.

But National Finance Spokeswoman Nicola Willis is not backing off and has said she wants all parties in Parliament to agree on terms of reference for a truly independent probe. Australia's new Labor Government launched an independent inquiry last week into the Reserve Bank of Australia's operation of monetary policy during Covid. It is being led by outside experts and is expected to challenge the RBA's use of Quantitative Easing (QE), often described as money printing, to stimulate the economy.

The Reserve Bank of New Zealand is, coincidentally, conducting its own statutory five-yearly review of how monetary policy is operating at the moment, but its own terms of reference leave little room to challenge its decisions in 2020 and 2021 to create $55b to buy Government bonds, to remove loan-to-vale ratio (LVR) restrictions and to lend banks $12.6b cheaply through the Funding for Lending Programme (FLP).

But if a truly independent inquiry was launched by a new National-ACT Government, what sorts of questions should it ask? And what sort of questions might a National/ACT inquiry prefer not to ask? Just in case the answers did not please its voters, especially those median-voting homeowners still sitting on more than $500b of capital gains because of the Reserve Bank's interventions.

When monetary policy became redistributive policy

National would find itself in uncomfortable territory if it was to go ahead with a proper and full inquiry. But it would be justified because by choosing to use the wealth effect to rescue the economy, the Reserve Bank was making both a monetary policy decision and a wealth redistribution decision.

It was effectively choosing to make one section of society (home owners) much wealthier at the expense of the rest (young renters with renting parents, and their unborn children).

It did so at the risk of an inflationary surge that would hurt renters on precarious and low incomes much harder than asset owners. Accidentally on purpose, Governor Adrian Orr and Finance Minister Grant Robertson agreed the best way to rescue the economy was to create a new housing boom.

None of the new lending unleashed by QE, LVRs and FLP went to business or job creation. It went straight into open homes and auction prices.

So what did Robertson know, and when did he know it?

But also to be fair to the Reserve Bank, it made that decision with the clear and clearly-advised approval of the Government of the day through Robertson. Treasury told Robertson the money printing would boost asset prices. It turned out that approval, came from a Labour Finance Minister, but could just as easily have been a National Government.

What was the alternative? The Reserve Bank could have chosen not to remove the LVRs, a move other central banks did not do, or introduce cheap loans for banks, which only a few other central banks did. The Reserve Bank could have chosen to distribute stimulus directly as one-off helicopter cash payments to consumers. That may have created inflation, but not the massive asset price inflation we saw due to the unleashing of massive new bank leverage in the form of new mortgages.

I opposed QE and the LVR removals, and proposed ‘QE for the people’ (helicopter money) from the start. I also think the scale of the $20b in cash payments to businesses was too much, and not necessary after the end of the first lockdowns. Ultimately, those payments were put straight into the bank accounts of home owners, and were weaponised by extra mortgage lending through late 2020 and early 2021.

The $20b of cash paid to asset owners and the $55b printed to buy Government bonds off banks and pension funds were in effect metastasized into a 45% rise in house prices, which made home owners more than $500b richer.

Accidentally on purpose, they sparked a bonfire in the auction rooms

A supposedly independent central bank that was supposed to be focused solely on keeping inflation low and our financial system stable, ended up working with a Finance Minister to spark a once-off redistribution of wealth from one group in society to another.

Were they hoping no one would notice? There were always going to be consequences. Now they’re starting to dribble out at the edges through the likes of this call for an inquiry and doubts about the reappointment of the Governor (and the Government) that did it.

But would a National Government have done any differently? I doubt it. The wealth shift benefited the median voters that both major parties need to win elections.

National has also not framed this issue as a wealth redistribution issue. It has framed it as a cost of living issue. The subtext is that higher inflation creates the danger of higher interest rates, which in turn risks reversing some of the multi-decade capital gains created by lower-than-expected inflation from 1990 to 2020.

But didn't everyone do it? Doesn't that make it alright?

This use of the arms of the state to rescue and benefit asset owners was not unique to Aotearoa-NZ. Every major central bank in the world did it repeatedly during the Global Financial Crisis and through much of the following years, until a major acceleration in 2020 and 2021. They too used their independence to rescue banks and keep asset owners confident and whole.

Few of the bankers for the GFC were prosecuted. Almost all kept their jobs or were soon employed again and earning bonuses. If you can’t remember or weren’t around, have a read or watch The Big Short again (or for the first time). Effectively, central banks and Governments ‘got away with it’ in the 15 years to Covid, although the Tea Party, Trump and Brexit political reactions could be seen partly as the political revolts in response.

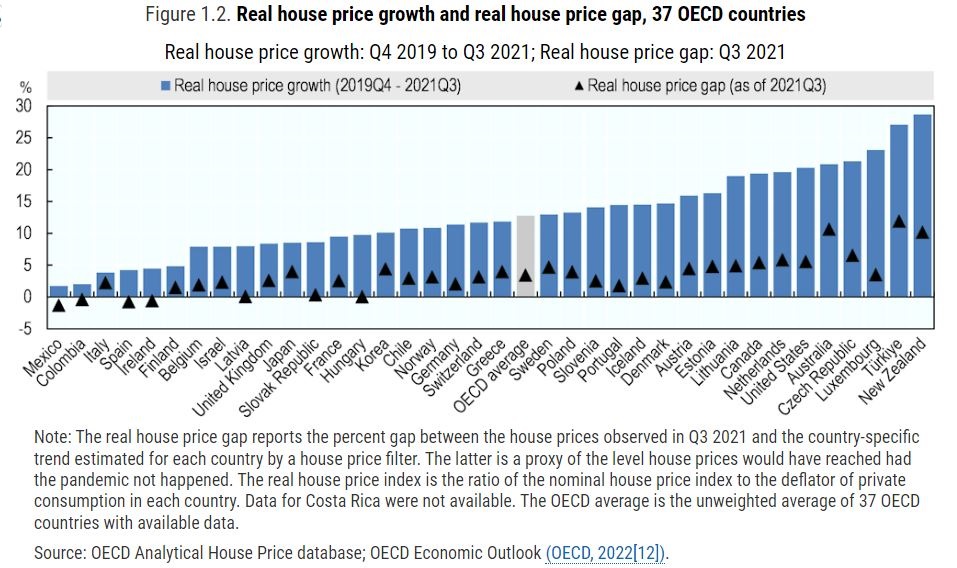

The difference for us here in Aotearoa-NZ is that our central bank and Government did it for the first time deliberately in 2020, and at a much greater scale than the rest, once the LVR removal and the Funding For Lending programmes are accounted for. Our house prices rose by much, much more than in other economies where other central banks printed money.

This is a big rodeo, but not our first

I think we saw an early preview of it here in late 2008 and early 2009 when the Reserve Bank lent $7b to banks so they could roll over their frozen loans on international markets through a little-known Term Auction Facility, and when first Labour and then National Governments created temporary wholesale and retail deposit guarantees for banks and finance companies in late 2008 and 2009.

So what should an (unlikely) inquiry any time soon examine?

The question is whether any independent inquiry in the Reserve Bank’s actions happens (unlikely) and if it did, whether the redistributive aspects and morally hazardous aspects would be examined (even more unlikely).

Ultimately, there will be a political fallout over many generations. Social licenses will be lost, if they haven’t already been. Governments will change and maybe laws will be rewritten. Or maybe nothing will change. Little has changed of substance in the United States and Europe.

The same central bankers and finance ministers are in place with the same powers. The only difference is they don’t have the excuse of low inflation any more, although it is a very useful way to inflate away Government debt.

The most interesting question for me right now is whether National launches an independent inquiry if it wins Government late next year, and whether it will ask these sorts of questions about the redistributive consequences.

It will depend on who it has to partner with. If TOP and/or Te Pāti Māori are part of any coalition, these would be sorts of questions that could be inserted.

34 Comments

Just 2020 and 2021? How about the 50bps slash in 2019?

Yep, people have forgotten about that one. Totally out of the blue and motivated by nothing other than Orr wanting to stamp its credentials. Removed a lot of the "dry powder" the RBNZ would have had during the actual Covid crash.

I think a lot of credentialed and competent people are hesitant to work for the RBNZ given its publicized pagan ideology and idols.

Good - the only thing that will save us now is magic.

I agree with the author that the 'money printing' bout - a combination of QE, ultra-low OCR, and 'COVID-support' - should be critically reviewed. This has led to a massive and unhealthy housing boom and its effect was ultimately inflationary.

More importantly, the current actions of the RBNZ should be carefully monitored. Many people think we can unwind the above errors by simply drawing the newly created money back out of the economic bloodstream, via OCR hikes. This will simply not work, it will lead to cardiac arrest of our economy, a free fall with a chain of credit defaults, a financial crisis.

The money that has been printed back in 2020/21 found its way into auction rooms, as the author aptly puts it. This same money is now in the hands of the property vendors, it is no longer in the hands of the borrowers! We simply cannot get this money back anymore.

We have to find a way to engineer a soft landing. This cannot be done via OCR hikes, these would hurt the borrowers, not the vendors. The borrowers are short of money, they don't have any. The only way forward would be a middle-of-the-road OCR of say 1 or 2%, with some inflation allowed.

Yes, it was obviously morally and economically wrong (obviously - with the benefit of hindsight) to create all this money via QE and so on. But two wrongs don't make a right.

We are now standing at the edge of a cliff: Our credit markets are freezing up, we are at the brink of a massive financial crisis in New Zealand.

We have to be careful that the RBNZ does not make another crucial mistake by raising the OCR too high, pushing our whole country over the cliff.

"The only way forward would be a middle-of-the-road OCR of say 1 or 2%, with some inflation allowed"

Inflation...of what? Property Prices? That's the last thing we need, and what 'we' are trying to correct. Wages, then? What if that turns into Wage Falls as the unemployment levels rises from the historically low level we had reported recently? Consumer prices? That will embed the very problem that the RBNZ is intent on stamping out.

The whole problem the World faces today is the result of the pursuit of 'a bit of Inflation', and look where we are. Standing at that cliff edge, and hoping; praying, that somehow we won't go over.

Trying to re-engineer what got us here; more of what hasn't worked (several times over, and each time bigger and 'better') is not the answer. A change in direction is. And if that entails some unpleasant outcomes in the short term, so be it.

'And if that entails some unpleasant outcomes in the short term, so be it.'

Spot on - we live in a world that is trying to fight the natural order of things. Economies (like most other aspects of our world) are cyclical and we need to stop trying to manipulate matter so we avoid the down cycles. All we will achieve is to create a bigger boom and bigger bust. Recessions serve a useful purpose, the world doesnt stop, useful lessons are learned and economies tend to come out stronger.

What is interesting this time is not just the potential for a bigger downturn but the timing of Russias war, and their constraint of energy supply to Europe - which they seem to be using to thwart the wests attempts to stop inflation - every time the markets think the supply is expanding they cut off a bit more and mess with expectations. China also seems to be playing a bit of a 'inflationary game' at the same time by locking down and constraining supply chains at just the wrong times.

By inflation I mean consumer price inflation. Some pain in terms of consumer price inflation has to be endured. The alternative would be death by economic collapse. House prices should stabilize (hopefully, to prevent economic collapse), but I don't see any danger of them going up significantly in real terms any time soon. If house prices could stabilize, they would become more affordable via inflation.

Unemployment rises more in deflationary settings, not so much in inflationary ones. For example, the GFC of 2008 was a deflationary collapse. Without emergency action, this would have turned out like 1929-32, with mass unemployment. We are facing the same danger again now.

To give an example of how a soft landing could be engineered (perhaps), Germany has quite high consumer price inflation but their business outlook remains positive, because the ECB interest rate is moderate at 0.5%. Ours is crippling at 2.5%. The ECB is allowing some inflation to flow through the economy for some time, to prevent outright collapse. This is a different approach from our RBNZ, where the hawks are out to kill, apparently.

You say there could be "some unpleasant outcomes in the short term" from OCR hikes. Those outcomes could collapse the entire system. Remember 2008, when the US real estate market corrected sharply (not even a real collapse), Lehman Brothers went bust, then almost the entire global banking system. Remember 1929, when the US stock market collapsed, two German/Austrian banks went bust, global depression with mass unemployment for three years was the outcome, followed by world war.

The EU has a major conflict occurring on its borders which is disrupting fuel supplies.

We have a housing bubble that is over inflated.

Not quite the same.

Could it possibly be that we've allocated far to much debt/capital to our housing market relative to incomes/GDP/productivity......which was entirely avoidable if we wanted it to be....but we have chosen this path over the last 2-3 decades because 'everyone wants to see the price of their home go up in value' so therefore its been impossible to actually get some sane leadership from government and/or the central bank.

Stupidity requires painful consequences in order to learn.

Rewarding stupidity gives confidence to misdirected thought and action. We are seriously guilty of this in NZ.

What is middle of the road OCR. The average since 1999 is 3.9 with the median 3.

We haven't reached middle of the road.

You seem to think inflation is somehow a painfree solution. I’d recommend going back to the 70’s to see what happens when you choose to “ignore” inflation. Rates were lowered too soon and the resulting inflation got completely out of control requiring even higher rates.

You seem to think it’s acceptable that every New Zealander has to pay the price of high inflation, just to protect asset prices

Inflation is not pain-free and should not be ignored. But a careful approach must be taken, where the shaky house of cards that our property dependent economy is not collapsed via deflation.

Deflation is much, much more painful than deflation. The reference point is 1929-32, mass unemployment, social unrest, election of Nazis in Germany.

Inflation is 3 times the targeted rate and you are scaremongering about deflation? Inflationary expectations are still elevated, even years out. Asset prices are still well above where they were just 2 years ago. We are not on the verge of deflation.

I suspect the truth is you are overleveraged in property and you want someone else to take the hit.

Yes I'm surprised he isn't being called a doom goblin...but if the bias is that we need deflation so that interest rates go back to zero, so that the housing ponzi can be protected....well I guess then you can't be both a doom goblin and a property spruiker at the same time...or can you?

Not only is it in the hands of those who have/are selling houses, a lot of that money is now being removed to Australia as NZers flee the country. Labour - Making Australia Great Again.

"We have to find a way to engineer a soft landing"

Why?

Won't happen under this Gummitt and i'm not sure if the general public actually care.

Bernard ... you're nearly as tall as Tane Mahuta ... watch out that Adrian Orr doesn't wander into the room and accidentally hang his metaphors on you !

I'm a property owner but would vote against these endless, excessive asset price increases - if I could. But I can't really because NZers don't have any say in what the RBNZ does.

Not accurate. "We" voted Labor in ; Labor added employment target to RBNZ mandate ; would not have happened under Nats .

I don't think that has had much effect because unemployment has been under 5% since Labour added the mandate. National representing business would obviously like to see it higher Labour not as they represent the majority of us who are workers.

Labour tells lies of omission and outright lies at election time.

Most of their policy has no electoral mandate.

That's certainly true of both major parties, in recent years.

Instead of going full bore on QE, the Reserve Bank of Australia started off with yield curve control, concentrating on just the 0-3 year part of the yield curve. They later started buying longer dated bonds and now have a market loos of $37 billion according to an analysis by Westpac. But that analysis also suggests starting off with yield curve control saved the RBA approximately $12 billion compared to full bore QE from the get go. So proportionately, that's a saving of about $2 billion off the mark to market losses of $8.6 billion for the RBNZ if they had followed the same strategy, So why didn't the RBNZ make the same choice as the RBA? On waht basis did they decide to just go all in instead ?

Wow we did even better than Turkey. Maybe we can beat Argentina now.

As they say, it's not a bug, it's a feature.

Whose special interests does the feature serve? Put another way, whose useful idiots are these people? Or who is pulling the strings? Where do their ideas come from?

It is clearly not our interests they are serving.

David Seymour called it from the very beginning. Nobody can claim that they didnt know. They just ignored it.

https://www.rnz.co.nz/news/political/430415/act-party-leader-david-seym…

"Currently the Reserve Bank's irresponsible approach to liquidity of the New Zealand dollar is inflating asset bubbles, it is meaning a generation of young people watch the future get further away from them as a result and that is a recipe for political dissatisfaction and unrest," he said.

David's solution? Throw open the borders, fuel property demand and depress wages. The man is a genius.

Just a small point Bernard, please don't include the odd "Manglish" terminology in your exposition. It is hard enough to follow complex economic issues with the usual "expert" acronyms, without introducing another language to complicate matters.

Maori is a beautiful language, but sprinkling your mainly English words with a few token Maori is senseless and really an insult to Maoridom.

I am saddened to see the attacks on Mr Orr just because he wants to decolonize the most colonial of institutions. Talk about magic and the like is so racist. Let’s remember that economic theory is no more science than Catholicism. Requires a significant amount of faith and belief to ensure that what you think happens actually happens. Economics is an art not a science, and the use and adoption of a Māori world view is I believe something that needs to be embraced rather than the neoliberal trickledown claptrap. At least the Māori world view is about guardianship and care for the common wealth. Not the pillage of the wealth of the community for the few oligarchs who control the current process. These attacks are quite racist and not appropriate for New Zealand.

... and it's still a complete mystery why those with functioning brains are fleeing abroad en-masse.

Why would anyone expect anything other than a mess from Price Control? Only double think expert civil servants would expect a social benefit because, after all, only They Know Best.

Since Price Control of goods and services has got a bad name because it causes shortages and gluts, the silly buggers deluded themselves that they could manage the economy in a hands off sort of way by managing the cost of capital, leaving the commoners to sort out the details amongst themselves.

The daft and deluded of this pleasant land have come up with an array of Obstacles To Production and Special Privileges for their Tribe, the Consumers with Steady Jobs and Good Pensions.

This leads to getting other people to make stuff for us so we can forget how to do it and make a living by washing and cleaning for wealthy foreigners who visit these pleasant but unproductive lands, buying holiday houses as they go.

Price Control of interest rates makes the country poorer.

Ooops, sorry, I forgot to mention, making everyone more indebted and poorer is a feature not a bug, at least according to Messrs Lenin and Alinsky, as poor people are supposedly easier to control. Of course, no one follows their deranged ideas any more, because we all know where it leads.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.