Household spending in the March quarter was especially weak, say Kiwibank economists. And the signs are that rising costs and a weaker housing market will dampen consumer spending as the year goes on.

In the latest quarterly release of spending data from Kiwibank customers, Kiwibank chief economist Jarrod Kerr, senior economist Jeremy Couchman and economist Mary Jo Vergara said household consumption has been a key source of economic momentum since the recovery after the first lockdown in 2020 took shape.

"But rising prices, rising interest rates and a housing market in retreat eat into households’ discretionary spending. And weaker consumption points to weaker economic growth," they say.

Consumer spend was weak over the March quarter for a variety of reasons, the economists say. This included seasonal weakness, payback from the Delta lockdown rebound, and the Omicron outbreak. The deepest decline in spending was seen in high -contact services including retail, hospitality and entertainment.

"Beyond the March quarter, household consumption faces several headwinds as budgets are stretched thin by rising inflation, rising mortgage rates, falling house prices and recent revisions to regulation."

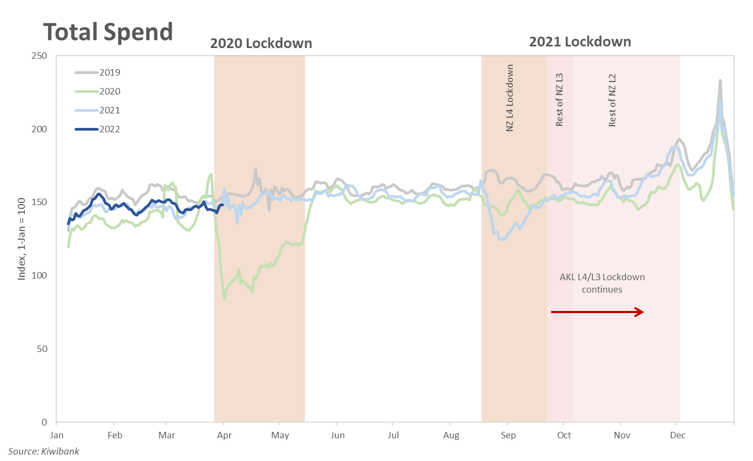

Kiwibank electronic card spend fell 9.1% in the first quarter of 2022. However, the economists point out that spend over the March quarter is "typically soft" as it follows a surge over the holiday period.

"However, the March quarter this year was especially weak. It’s payback for the massive spend-up over the Dec-21 quarter as Auckland exited lockdown."

The Kiwibank economists say a "rampant" housing market has underpinned much of the strength in housing-related spending.

"However the market is cooling, and spend dropped 22% over the March quarter. Seasonality may explain the pullback. However several surveys over the March quarter revealed weakening consumer confidence as households face the Omicron outbreak, rising mortgage rates and rising inflation. Today’s climate is not ideal for splurging on big ticket items."

They say another culprit for weak spend may be the stricter consumer credit legislation (CCCFA) that’s binding new bank lending.

"For households in pursuit of a mortgage (or wishing to top up), changes to the CCCFA ultimately mean cutting back on spending. No more new pools, new furniture, or new pets.

"The new responsible lending rules have been hard to swallow. Given the backlash, the Government has tweaked the rules so that going through past expenses with a fine tooth comb is no longer necessary. These changes are expected to come into effect by the second half of the year, at the earliest. We are unlikely to see a meaningful change in spend behaviour until then."

The economists noted, however, that flight bookings climbed a massive 80% over the quarter.

"There’s pent up demand to venture beyond our four walls. And the decision to leave has been made easier with the removal of MIQ. The ability to return home without the need to enter managed isolation may explain the sudden surge in bookings."

Looing ahead, the economists note that there's a price and wage growth "mismatch".

"Inflation is at a 30-year high and a 7%+ peak looks increasingly likely by the day. But at 2.5%, wage growth is not keeping up with the rapid rise in living costs.

"Kiwi households are seeing their real incomes being eroded. A more expensive shopping trolley eats into disposable income, making budgeting that much more difficult. And inflation hurts more for those who don’t have as much wriggle room.

"Households on low or fixed incomes are disproportionately affected, as food and fuel typically make up a larger share of their budget. With prices expected to continue rising in the near-term, households will be forced to tighten their belts and shorten their shopping lists."

And then there's rising interest rates...

"In the face of rising inflation, the RBNZ has hiked the cash rate [OCR] to 1% in successive moves. And fixed mortgage rates have lifted in lockstep. We see another 150bps of hikes in the pipeline for the cash rate this year (to 2.5% by November).

"All mortgage rates have further to rise. Most rates will be 2-2.5%pts higher than the lows seen early in the Covid crisis. A strong labour market, however, ensures households are still capable of making good on their mortgage and rent payments. But there’s little doubt that a more expensive bill will also squeeze discretionary spending."

And finally, there's the "weaker wealth effect"...

"Following unsustainably high house price growth last year, the housing market is now in full retreat," the economists say.

"February marked the third consecutive month of house prices in decline. And we expect a cumulative 5% decline by the start of 2023.

"Housing, however, is the single largest form of wealth among Kiwi. Households also consume some of the capital gains generated in the good times in the form of mortgage top-ups or by downsizing and crystalising gains.

"But a cooling market, as is the case today, adds another dampener to consumer spending. Falling house prices and tighter lending rules are not supportive of borrowing and spending."

24 Comments

Weak spending AND runaway inflation, bit of a conundrum...

It's not really a conundrum.

Most of the runaway inflation is supply-side and imported.

Which aggressive hiking of the OCR will do little to contain, other than moderate imported prices a little through impact on currency.

Once construction starts slumping over coming months and demand for materials likewise slumps, that will moderate price increases in that sector.

As unemployment starts increasing later this year, and young Kiwis leave for Australia in droves, that will also moderate wage inflation pressures.

Fuel price increases have moderated, and food prices are likely to as well. And I think rental inflation will be very low over the next 6-12 months.

The RBNZ really shouldn't take the OCR higher than 2.

We printed more money than any other country with the exception of the USA, during Covid.

Do you think this inflation of the money supply could impact inflation too?

Most of the deflation used to justify continuous rates drops was also imported. Didn't stop the pumping of the property market over the last decade plus.

Demand destruction and inflation occurring simultaneously makes sense if you've had structurally excessive demand relative to actual productivity. Which I would argue we have, for a decade or so. $NZ is structurally overvalued; as that unwinds, imported products become more expensive hence inflation - and the higher prices suppress demand, but not enough to make a dent in prices that are set globally. We haven't seen the Kiwi unwind yet, but it's my Big Prediction for the next year. (probably wrong, but that's never stopped Treasure or the Reserve Bank from expressing an opinion so...)

Looking at the graph supplied, it seems the Q1 pullback is typical and no worse this year, than in the previous 3 years shown.

I see what the stats are saying and I know its a big country- but im actually seeing different data in the alst few weeks.

we know a welington "family style" restaurant owner whose saying hes seeing really strong numbers - booked out Friday, Saturdays and Sundays. spend per head is about 10% down YOY - but demand to eat out is strong - hes turning people away.

Personally went to dinner at an upper end Restaurant in Wellington last Wed and it was packed. They only seat about 40 people but it was a Wed.

Went to specsavers to get new glasses on saturday and it was packed with people picking up specs.

All of these items are discretionary spend - if confidence was down these places should also be shown sales as down.

Ah, ikimpaul, it's Wellington. You know, a place where a growing number of well paid civil servants get regular, predictable salaries. I've just come home to the south western suburbs of Auckland where my local large shopping centre is 70% closed, returning from a downtown CBD where a previously vibrant Queen Street is noted for its eery lack of people on the streets and plethora of CLOSED and FOR RENT/LEASE signs. Different planet/mentality.

Yep, likewise here. Town very quiet, shops and restaurants nowhere near full and very light traffic no matter what time of day.

Wellington is a bubble.

I hear you about the public service salaries - but its also a city where in 2018 the average house price was 600K and today its $1M - houses prices have doubled since 2015 - so I'm assuming the mortgages and interest rates increases would be being felt here more than any other region except for Auckland.

Its also a city where there are currently very few salary increases because of the public service wage freezes.

That said maybe everybody has paid their mortgages and the house price increase was everybody trading up with no new mortgage

It's also had far less time in lockdown than Auckland, so private businesses would have been nowhere near as affected, generally, as many in Auckland.

Equals less impact on incomes, equals less impact on discretionary spending.

Believed it until the Specsavers bit, realized you could of been seeing things!

part of the new Specsavers ad perhaps.

certainly not true in Auckland -- many hospitality businesses finally given up in the last two months -- empty as -- had dinner at Mission bay last week -- not a single place was more than a third full on a glorious sunny day - usually packed

traffic is still way lighter -- and apart from Pac and Save -- with more customers from countdown et al -- al the retail outlets seem empty

itchy feet holiday itus maybe as lots of people with 30 days plus leave desperate for a holiday -- but certainly not huge discretionary spending up here and despite what people think -- thats 30%+ of the countries spend up here

Wage subsidy gone, big tax tax time in Q1 and govt still restricting numbers. Is it any surprise that hospo is now pulling the pin and limiting their bleeding to the rent until the lease expires.

Maybe after next election we can reduce Wellington head count by 50percent and introduce performance based pay for any tax payer funded jobs.

Yes I am very worried , with 60% of the mortgage booked refixing at a higher rate and cost of living increases, the deman is being sucked out the equation and I genuinely think we are heading for a recession.

An inflationary recession.

Let's be honest....what are people spending their money on out there ??? ...you get to a stage where you just stop buying whatever crap, that you can't afford, to impress people, who really don't care !

This "inflation" has been planned to further "hollow out" the middle class in the western world and bring the middle class closer and closer to being classified as "working poor" , as their incomes don't actually cover their living expenses. I have seen this first hand overseas in the USA and it's is here too, where people have 2 or 3 jobs just to survive.

I have said for a decade now NZ Inc. would of been much better to concentrate on building new and innovative industries, research and development, better education, reduced immigration numbers etc rather than putting all it's eggs in the housing market for it's urban population.

Now that housing market is slipping away ........

While I said to a colleague in mid 2019, the standard of living in NZ will eventually drop - while the rich will just get richer - and here we are.

"SHORT SIGHTED & GREEDY, POLITICAL AND ECONOMIC GAIN, CREATES LONG TERM PAIN"

Very true. Governance for one's own and one's contemporaries' wealth, based on sucking it out of society rather than working and building society up. Nothing much of Burkean conservatism in that, just parasitic entitlement.

With all due respect to Jared and Jeremy, they are always late to the party with Housing. Evident July/August last year, esp Nov market was cooling. Now it's all shock horror despite them being bullish during the period since then.

Was at Takapuna Sunday. Glorious day. plenty of people out enjoying it. but half the restaurants/cafe's closed down permanently or shut.

Hand the problem to the bureaucrats. They could lock us in our homes to curb spending and mandate antidepressants.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.