Keep hiking rates. That’s the message from the OECD to central banks including the Federal Reserve and European Central Bank as it urges them to stay focused on the big threat to the world economy - inflation.

In its new global economic outlook, the OECD says central banks shouldn’t be distracted by weaknesses in banking and financial systems or concerned with economic recovery. It says monetary policy needs to remain restrictive until there are clear signs that underlying inflationary pressures are "lowered durably."

We’ve seen plenty of instability, with Silicon Valley Bank being rescued, European bank Credit Suisse sold to rival UBS, a coalition of midsize US banks reportedly have asked regulators to extend federal insurance to all deposits for the next two years, and now six central banks have signed up to a new currency "swap line" to keep money flowing.

Despite these wobbles, the OECD upped its projection for global economic growth, from 2.2% to 2.6% for this year.

It expects the global economy will grow by 2.9% in 2024, up from an earlier 2.7% prediction in November.

But both of these statistics are well below trend; the OECD says global growth has slowed from 3.2% since the beginning of the Russian war in Ukraine, the cost of living crisis and China’s economic slowdown.

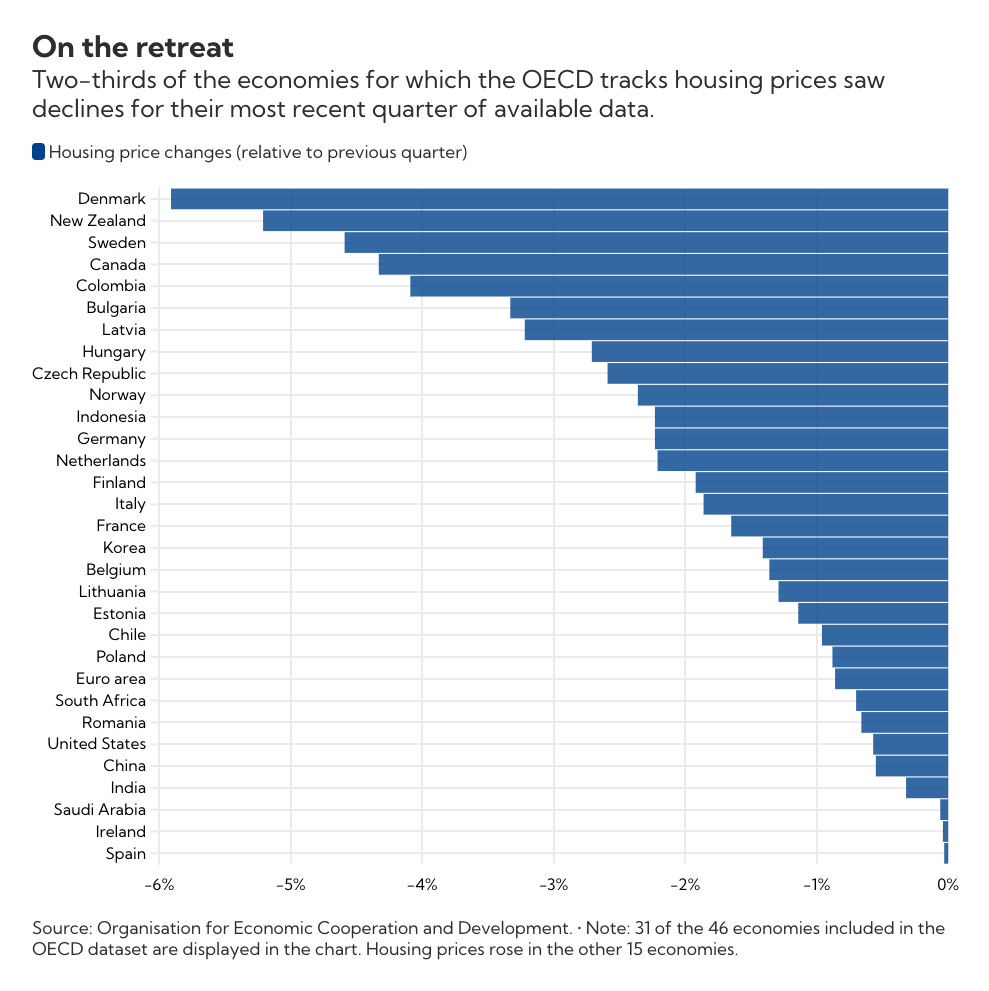

New Zealand got a mention in this report, and of course it was for housing.

The OECD gave NZ a shout out for having the housing market with the largest fall, at 14%, from a market peak, which it says is evidence of rising interest rates working.

Sweden had the second largest fall from peak in housing prices, followed by Australia with a 9% fall and Canada rounding out the top four.

Other key takeaways from the OECD’s March economic outlook involve inflation.

While it revised up its global growth predictions for 2023 and 2024, a key factor in this improvement in activity and sentiment in early 2023 was brought by a recent decline in energy and food prices.

It says while inflation levels are still relatively high compared to before Russia’s Ukraine invasion, this drop in energy and food prices is boosting purchasing power for most firms and households and is helping to lower headline inflation.

Headline inflation is what is measured in the consumer price index basket of goods.

For example, it said the brent crude oil price has dropped from US$130 a barrel in June 2022 to US$80 in March this year.

It says inflation for goods has started declining in most countries, due to the return of normal demand post-pandemic and the easing of global supply chain bottlenecks.

But that strength in core inflation, that’s stripping out energy and food costs, continues to be driven by service price increases and cost pressures from tight labour markets.

The OECD is predicting 5.9% inflation in 2023 for the G20, or group of 20 nations, which includes Australia, Canada, Mexico, Russia, the UK, US and European Union.

Annual inflation in NZ has crossed 7%.

The Reserve Bank has been aggressively hiking rates, but as Governor Adrian Orr has pointed out, there are other options to cool inflation that don’t involve NZ’s central bank hammering the populace with high interest pain.

As Orr observed, the government could rein in spending and also increase taxes to help pull demand and money from the economy.

14 Comments

'in core inflation, that’s stripping out energy and food costs'

Journalistic fail.

Nothing - repeat nothing - happens without energy being used.

PDK, this core inflation measure - like it or not - is commonly used by central banks...

Yes Gareth, but you can challenge what they issue, rather than fall into line.

What we have is a cohort who were not taught about the real world; specialisation shoehorned them into such a pointy-ended discipline (one which still refers to labour, FFS, in the same sentence as productivity). That cohort need to be held to account (pun intended).

If you input less energy to a physical system, you either need to be more efficient, or you'll be doing less. Add in the increasing need to parry entropy (which increasingly reduces net energy) and ll you are keystroking MORE proxy into existence, the proxy has to be becoming 'worth less'.

How about an article based on, say, this: https://open.umn.edu/opentextbooks/textbooks/980 and, say, this: https://www.thegreatsimplification.com/episode/61-gareth-roberts and this: https://www.thegreatsimplification.com/episode/53-william-rees

I put it to you that we are in the early stages of a one-off global event. I think it would be good to have people be informed...

Oh, and taxes don't 'pull demand from an economy'.

The Government cashes the proxy in like anyone else; roads, infrastructure, new - but getting ever-smaller due to just this effect - hospitals.

No government can afford to sit on taxes, un-spent; the neoliberal propaganda of the last few decades has translated into increasing under-funding of nearly everything. So the 'demand' is the same, just from a different proxy-holder.

I think you'll find Interest.co is here to report the financial news, using measures or metrics that are industry standard. Not to go out and change the way the data is presented.

Next you'll be asking Gareth to draw up a placard and demonstrate outside SVB headquarters because you think he should challenge the issues rather than report on them.

Industry? I query that word.

Standard? Yeah, maybe.

The system we have inherited is a First-World-WW2Winners/Bretton Woods self-serving construct. It ignored Soddy:

https://www.amazon.com/Wealth-Virtual-Debt-Solution-Economic/dp/1913890… and decided it knew best.

It didn't. It issued numbers (even before Bretton Woods, it was adrift from gold in real terms) related not to reality, but to future expectations. What do those numbers currently represent? is the 64,000 cabbage question. They are all struggling now - a series of jugglers on various decks of the Titanic - all counting the balls, none the sinking. How can they project what's coming by making projections about balls?

Some folk have gone part way: https://en.wikipedia.org/wiki/Tradable_Energy_Quotas

but they tripped over the emissions part; energy quotas (and energy-related proxy) is the only control way forward - the only thing that fits physical reality. But I suspect we'll push this overdrawn ponzi to the point of collapse. And beyond. Because folk insist on counting juggled balls.....

The link from the RBNZ below says that it is a poor way of picking up persistent changes in inflation.

https://www.rbnz.govt.nz/-/media/d71819db70ef47888a9da1151979bcd0.ashx?…

OECD is well worth ignoring.

Why do you think that? Too neo-liberal / right wing / free market?

Taxes are already increasing, as a result of the tax brackets not being adjusted for the inflation-driven component of wage increases.

The only difference is that doing it this way means you don't have to go to the electorate and be upfront about your spending plans requiring a lift in tax revenue, you can just ignore the tax admin side of things and let it do the heavy lifting for you.

As is GST increasing as the underlying product prices inflate. Problem is though, unlike tax bracket creep - it is the poorer people who are getting screwed more because GST is a regressive tax.

Robertson apparently loves GST. He is showing his true colours. He should be caucusing with ACT.

Growth undershoots mostly cf forecasts

Wages rise is 5% or more below inflation for most folk in OECD. So where is disposable income?

China being overhyped as growth engine ignoring leverage threat there. Think CCP can control deflation?

We expect some growth because trillion of printed dollars are still floating in the market. It will take another year to evaporate.

As Orr observed, the government could rein in spending and also increase taxes to help pull demand and money from the economy.

Our politicians need to up their game. Raising tax on those that are driving inflation would be a massive help to those young people with mortgages and young families.

Problem is - Orr doesn't know who they - those that are driving inflation - are.

Just like he doesn't know who is getting clobbered with the NZRB raising the OCR.

And our politicians are equally vacant!

Both the NZRB and our governments are not much more than medieval doctors letting blood.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.