Retail sales by volume have dropped for the third consecutive quarter, according to Stats NZ. The result was considerably worse than economists had expected.

The seasonally-adjusted 1.0% fall in volume of sales (these figures take out inflation) for the June quarter follows drops of 1.6% in March and 1.1% in December. Both the latter two figures have actually been revised down (IE the falls are bigger than earlier indicated) by Stats NZ.

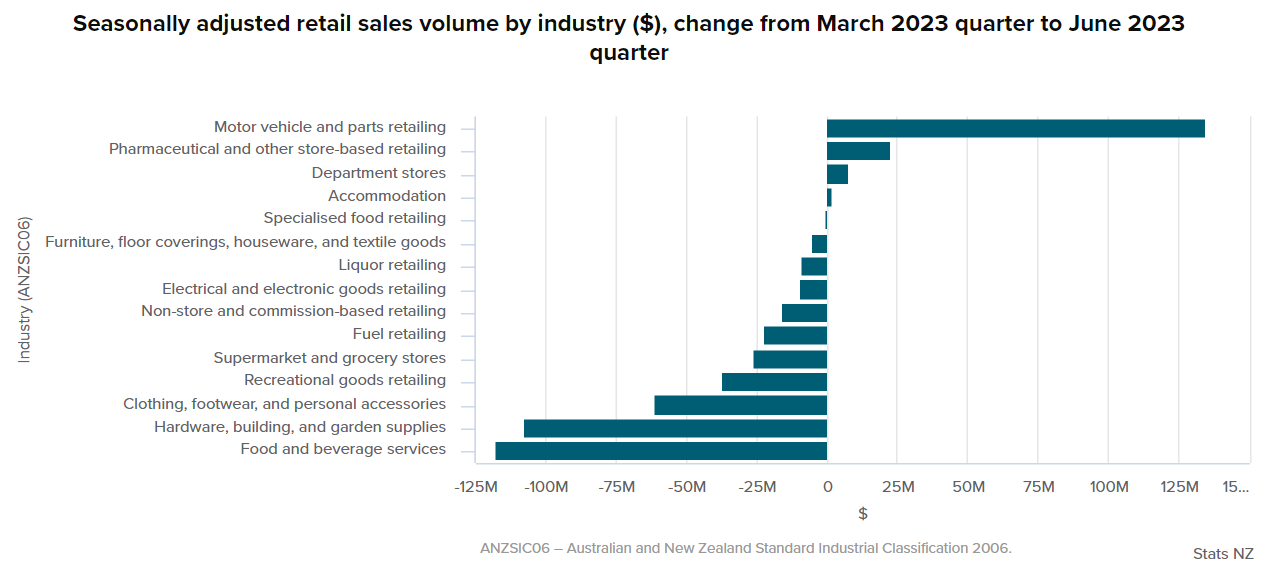

But poor as these figures are, they would have been worse without a surge in motor vehicle sales (up 3.7%) as customers scrambled to beat the changes to the Clean Car Discount Scheme from July.

Sales volumes in the 'core' retail industries, excluding motor vehicles and fuel fell 1.8% on a seasonally-adjusted basis in the June quarter - following falls of 1.6% in March and 1.7% in December.

Comparing the June quarter volume figures with those for the same quarter in 2022 shows an annual fall for the all-industries figure of 3.5% and a fall of 5.1% for the 'core' industries.

Westpac senior economist Darren Gibbs said the retail figures highlighted that financial pressures are continuing to eat away at households’ purchasing power, with the value of total spending also declining despite very strong population growth and a recovering tourism sector. He said that excluding the pandemic period, per capita spending fell to its lowest level in four years.

"Spending volumes are dropping sharply as rising prices squeeze households’ finances," he said.

By industry, big contributions to the latest quarterly fall came from:

- food and beverage services – down 4.4%

- hardware, building, and garden supplies – down 4.8%

- clothing, footwear, and personal accessories – down 4.8%

- recreational goods retailing – down 4.8%

Eleven of the 15 industries had lower seasonally adjusted sales volumes in the June 2023 quarter compared with the March 2023 quarter.

Measuring the volumes of sales as against just the value removes the impact of inflation from sales data and therefore gives a clearer picture of levels of spending.

Other highlights in the latest quarterly figures were:

- total volume of seasonally adjusted retail sales was $25 billion, down 1.0%

- total value of seasonally adjusted retail sales was $30 billion, down 0.2 % ($60 million)

- total value of actual retail sales was $29 billion, up 2.5% ($725 million), compared with the June 2022 quarter

The latest retail sales figures would indicate a continuation and certainly, arguably, intensifying of the slowing in spending that the Reserve Bank (RBNZ) is looking for as it attempts to take heat out of inflation, which has been falling, but was at an annual rate of 6.0% as of the March quarter. And within this, domestic generated inflation was looking very 'sticky' at 6.6%, down only from 6.8% as of the March quarter.

The RBNZ has since October 2021 increased the Official Cash Rate at unprecedented speed, taking it from just 0.25% to the current 5.5%. This has led to mortgage rates now, in many instances, of over 7%. The intent of all this is to reduce spending and take the heat out of the economy. Clearly, spending is reducing.

Westpac's Gibbs said with around $15 billion of fixed mortgages repricing at higher interest rates each month, the pressure on households’ finances will continue to build.

"Unfortunately for households, as the Reserve Bank made clear last week, interest rates are likely to remain at or above current levels for some time yet, and certainly until inflation is much closer to returning to the midpoint of the 1-3% target range.

"While we had anticipated a soft result, today’s figures are weaker than we had expected. Nonetheless, after two quarters of contraction, we continue to estimate that the economy rebounded somewhat in the June quarter, led by what is likely to be a short-lived lift in export volumes. Even so, annual growth in the economy is very likely to have continued to slow in the June quarter and will almost certainly slow further in the September quarter."

ASB senior economist Kim Mundy said 2023 is shaping as a very challenging year for the retail sector.

The consumer backdrop is very muted "and spending has declined faster than we had anticipated" over the first half of the year.

The second half "is likely to be even more challenging for consumers and, by extension, the retail sector".

"Household savings buffers have been eroded, wage price inflation is cooling and by our estimate there is at least another 50bps of [Official Cash Rate] tightening to work its way through the system, despite our expectation that the RBNZ will leave the OCR on hold at 5.5% for the rest of this year," she said.

"As a result, there are few bright spots, but the earlier than expected turn in the housing market is the most notable. Nevertheless, at this early stage it looks like the housing market will turn gently and, on its own, is unlikely to offset the numerous headwinds facing the sector. At the very least, a per-capita consumption recession is likely to remain in play over the remainder of 2023."

60 Comments

So we're spending our money on drugs and boxes to move people around in.

Boomer economy

As opposed to the 'rock star' economy where we sell houses to each other while the banks are laughing themselves senseless at our expense?

You don't laugh when you're taking money from people

You tell them they are very wise and thank you and come again

We have a new selection, right this way

All the spruikers need to open their eyes to the reality of what's going on and not just lament about house price rises

What about those "cashed up" migrants coming in to buy our overpriced houses and spend up large around the economy?

Oh wait, it appears thousands of businesses were accredited by INZ to hire workers from overseas with no checks on low and medium-risk employers and a "quick Google search" on high-risk employers.

One INZ staff estimates there may be tens of thousands of migrants already here on fake jobs or on a cash-for-job arrangement with their employers.

I am confident I could set up a business, get accredited, not prove anything, charge a migrant $20,000 for a job, and INZ wouldn’t do anything about it - they are just accepting it Link

Labour/Cindy's legacy is exactly this - a complete s**tshow on all fronts!

Personally I'm expecting a great leap forward on the s**tshow front if the Gloriavale party manage to get a majority of pews in parlament.

Undoubtedly, but Cindy and Chippy have failed NZ on many fronts, including housing, inflation, public debt, economy and migration.

They simply went National-lite on most of their promises for a fairer tax system, more affordable housing, higher-skilled migration, etc. and wasted time trying to stick co-governance down our throats without ever bringing it up during elections.

They did ok on housing in the end, lots have been built (whether that is due to Labour or happened regardless is debateable). But then they opened the immigration flood gates to ruin all their good work. The housing tax changes are probably the only real positive they achieved in 6 years. Although I can't think of any positives in National's previous 9 years.

So extending the Bright Line is good but introducing it in the first place doesn't count? Just... need a moment to get my head around this.

And I think you'll also find a huge volume of the housing increase in Auckland was driven by National strong-arming the Auckland Council during the 2016 Unitary Plan process. Labour simply came along later and stuck their crappy building program brand on a bunch of already-consented developments. Which ended being the same price as the Axis Affordable Housing ballots in Auckland, so in the end it simply ended being a marketing exercise for stuff that was already happening, which they stopped talking about when they had to actually deliver houses that weren't already in the pipeline. I'm sure Chippy will be alonng to re-announce the announcement about the Unitec development again, now that they've re-announced the busway for the North West they already downgraded from the Light Rail they announced in 2017 and then did no work on.

Imagine buying a house or apartment built by these Chinese construction workers. I predict a whole new generation of "leaky homes". Or "falling down" homes if the Australian experience is anything to go by.

Stuff understands INZ have set up two specific inquiries - one on the Indian and Bangladeshi workers, and the other on the treatment of Chinese and Malaysian construction workers, an issue Stuff has repeatedly written about.

https://www.stuff.co.nz/national/crime/132784074/the-system-is-f-immigr…

Like the odd TikTok video I've scrolled onto with Mexican builders showing off how quickly they can knock together load bearing framework with an air tool.

Any positive economic news to bag?

Wheres that light switch

I am not sure how those retailers are going to put up their prices!

Inflation is dead in NZ (except for the one off fuel tax removal), I'm not sure what data the RBNZ are looking at.

Mortgage rates < 4% next year guaranteed, the gods have spoken.

Not sure it’s that simple. Some things are definitely getting cheaper…..I’ve managed to pick up some high priced gear that I would normally buy online from overseas locally with great discounts. On the other hand some food items and services are inflating like no tomorrow. I feel for retailers, as discretionary dollars are reduced they will have to discount stock to move it. Wouldn’t be surprised if the smaller ones disappeared.

Everyone was warned about the wealth effect phenomenon. Most didn't listen and the ruling elite and its beloved media and foot soldiers just do what they're told.

The people who use this website were told daily don’t buy into over priced market they took the million dollar mortgage at emergency rates and thought it would stay low for years now refinancing weekly payments for the million gone up from 900 to 1600 only a matter of time before defaults start to become regular and the house prices have dropped 20% so no escape without big losses.

Way way before, the mighty Audaxes demonstrated succinctly how credit is created for non-productive purposes. You were better informed than most of your leaders.

"The people who use this website were told daily don’t buy into over priced market"... since Interest.co.nz was established in 1999. Those who didn't listen to that advice own an almost mortgage free house today!

Yvil back in 1999 you could have purchased 2 X lifestyle blocks with house around Auckland for a million now people like yourself are buying 3 bedroom house on small section for a million this is 16 x average income. The prices have crash around 20% and will continue to fall much further making the housing price crash one of the biggest in modern history.

How is it possible that the retail sales have slumped. Something is not right.

Still can't find a car park at my local mall on Sunday or Saturday.

Or kiwis has nothing better to do and come to Malls for window shopping?

Would you notice if they are spending 5% less?

Our local Bunnings carpark was half empty last weekend, first time I have seen it like that for a long time...

Went to a local cafe to work remote this week.. was very quiet.. staff said weekdays are pretty dead now.

A year ago same cafe was buzzing all day every day.

People are reining in spending. For sure.

And a year ago they were struggling for staff and now they are not? That also seems to be the case from what I am noticing.

I noticed it in the weekend too. Not long back Bunnings the place to be on a Saturday.

Wandering around the local mall and buying the kids an ice-cream is a cheap day out for many struggling families.

Seriously, this the only entertainment option for many.

And it's cheaper than heating the house.

Yeah it's so annoying how they charge you to go for a walk in nature or to the beach now.

We wholesale product to retail outlets. We are down around 20% yoy.

All my clients who sell through retail are noticeably down too.

The economy is still running OK in some areas - parts of Auckland and some of South Island. You can see this in a range of data - filled jobs, number of people that are dependent on a benefit for their primary source of income, change in earnings etc.

However, as I have been saying for over a year, if Govt stop spending more than they tax, and people stop borrowing more than they repay, the economy grinds to a halt. It's been slowing for a year - not that you'd know it given the crap about overheating etc that the dumb ass bank economists have been throwing out week after week.

The stagflation doom loop scenario has now arrived for NZ. Spending being reined in will feed on itself, triggering the unemployment rate to move up fast in early 2024, while interest rates stay high due to international pressures.

I get the stag but where does the flation come from? How does anyone raise prices or demand a pay rise in that scenario? Sure we could get imported inflation like the 80s, but that’s not really happening now.

Prices on food rarely drop same with wages but asset’s prices will drop big time. The way NZD is tumbling inflation will stay well above 2% range so rates will stay around this level.

Prices don't need to drop for inflation to be lower, prices simply need to stop raising DTHR, that's JJ's point.

Maybe we need deflation in everything so our tokens of exchange can regain some sort of meaning as a store of value.

Deflation would be epic.. if a little destructive.

And yet all it would destroy is a bunch of made up numbers... it doesn't destroy anything real. The people and infrastructure will still exist.

It would only be our organising systems that prevent us from making the most out of it and emerging renewed.

I imagine it would destroy quite a few people along with the made up numbers. We have painted ourselves into a corner as per normal.

Enough damage to the currency could do it, which would tie in with economic collapse in China (looking increasingly bad). NZ's balance of payments is lurching alarmingly already.

Likewise, terrible fiscal policy could do it. If the gov't decides on massive tax cuts, or benefit/supplement increases, or a huge lot of infrastructure spending and increased migration - all of which they are *likely* to try in a recessionary environment - we could see domestic inflation return. Imagine a National gov't announcing big tax cuts, full tax deductibility for landlords, and the building of twelve new motorways - the wealth effect would be switched back on, people in their thousands would be out there buying new Rangers with not a care in the world even as the currency collapsed.

Government deficit spending is one part contributing to inflation.

Interesting chart here - as a percentage of GDP, the US deficit spending is similar to what happened in the 1930's and 1940's and that period included a depression and a world war.

What we've seen since 2008 has been very similar.

US total public debt is also an interesting chart.

If the deficit keeps growing at this speed we'll get pinged by the credit rating agencies and the cost of this debt will hurt us next.

We have large sectoral imbalances in the economy. The private sector has taken on large amounts of debt and is now attempting to repay it, the foreign sector is running large surpluses with us of over $30 billion and so this only leaves the government running budget deficits to try to maintain our spending.

The major issue is that the government spending in NZ is generally low-quality and has not led to an increase in our productive capacity (upskilling, infrastructure expansion, etc.) in a very long time. The largest increases have been in welfare (our superannuation bill going through the roof) and back-office headcount from the public sector has been counterproductive for our economy.

MBIE's business policy and industry transformation programmes are complete garbage and should be refocused on improving access to high skills and business capital instead of handing more money to bureaucrats and consultants to play with.

That's what we hear from the opposition but they have never provided any figures to back up their claims. There are plenty of houses and roads being built when you look around and many thousands of apprentices trained. Kiwi Bank is 100% government owned again and Air NZ was kept afloat at great expense. Many jobs and businesses saved through the lock downs.

https://www.stuff.co.nz/motoring/news/131023952/a-closeup-look-at-the-t…

https://www.hud.govt.nz/stats-and-insights/the-government-housing-dashb…

And AirNZ is now making it too expensive to fly for most people/businesses who bailed them out... but making huge profits.. with crap customer service too.

Presume the govt then uses their returns from air nz (with our excess taxes from never adjusted brackets) to fund their many wasteful projects.

Taxation never finances anything though as it only deletes money and we spend the governments money and it never spends ours. https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

Oh yes, things are so great that I now have homeless people walking into my house and taking my stuff because they obviously had trauma, and bash me up in the process, so I decide to go to the hospital but cant get in because no one works there any more; obviously I am angry so I catch the light rail to go complain - but guess what literacy levels are abysmal so no one can read my complaint; I decide to hold perspective and get some food and go home - but then cant afford food anymore. So I sing and dance off to sleep. So much progress, the stone age people would be jealous!

But at least you got free wealth from land, even if pandering to land speculators for decades has brought us to this point. Can just hide in a gated subdivision in future, from all these benefits of the wealth effect.

I know I decided at the start of the year to buy nothing new unless a replacement. So far this year I've restrung a tennis racquet and bought two polo shirts.

Nice to hear you're a fellow tennis player !

I've very good at bad tennis.

Same here, it's not a bad thing imho.

Having an economy that only thrives because people buy too many things they don't need is inherently bad for most people and certainly for the planet. Hopefully it makes people re-think going forward when economic conditions improve.

Though i am sure we'll be back to our consumerish ways in no time.

The result was considerably worse than economists had expected

But hey, we'll keep getting the opinions of these economists anyway!

Haha where exactly was the heat in 'the economy'? The debt and asset markets silly.

"Borrow and spend, borrow and spend" shouted the priests from the pulpit.

"Don't spend, don't borrow, you must suffer hardship for your sins" Rules for thee not for thy.

It would be funny if it wasn't so tragic.

Blow asset bubbles for a couple of decades, solve a debt problem with more credit creation and bigger bubbles, and engineer aggregate demand (in what exactly?). Along comes an unprecedented supply shock (possibly not that unprecedented just bigger than past events) and the economic 'science' and modelling had no understanding. It's either flawed science, incompetent 'scientists' or both.

Said to be based in the science of human behaviour, economics in reality appears to dictate and drive human behaviour through its own narrative.

It's funny, school told me I excelled in mathematics and science. I for whatever reason followed a career as a Chartered Accountant, so in theory I'd be considered intelligent and good with numbers. Our current form of economics IMO is an illogical, irrational and mathematical clusterfuck. It's not fit for purpose and is no way to organise and govern society.

Economists should be trained in accounting first, even simple double entry book keeping and then they would realise that all they believe is nonsense.

Retail is always first to go. More people eating less food. Should deal to our overweight issues.

Stop buying takeaways & turn the bloody tv off. Read books. Listen to one another.

You are right wrong

People still watch TV?

Maybe the overseas trend for bricks and mortar retail to wither and die in the face of on-line competition has finally caught up with us.

And seriously: what value do most retailers add for us, as the chain stores offer cookie-cutter commodity goods at too-high prices. I do wonder if good speciality shops, run by the knowledgeable and where you need to actually look at goods, might do better in the long run.

I'm buying ever-more on line as things like 75% cheaper spectacles and half-price footwear are hard to go past - now all we need to do is push that idea across in to the building material market: we don't need retail space to buy commodity items like plasterboard, framing timber and screws.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.