The pricing intentions of Kiwi businesses "went the wrong way" in the latest monthly ANZ Business Outlook Survey.

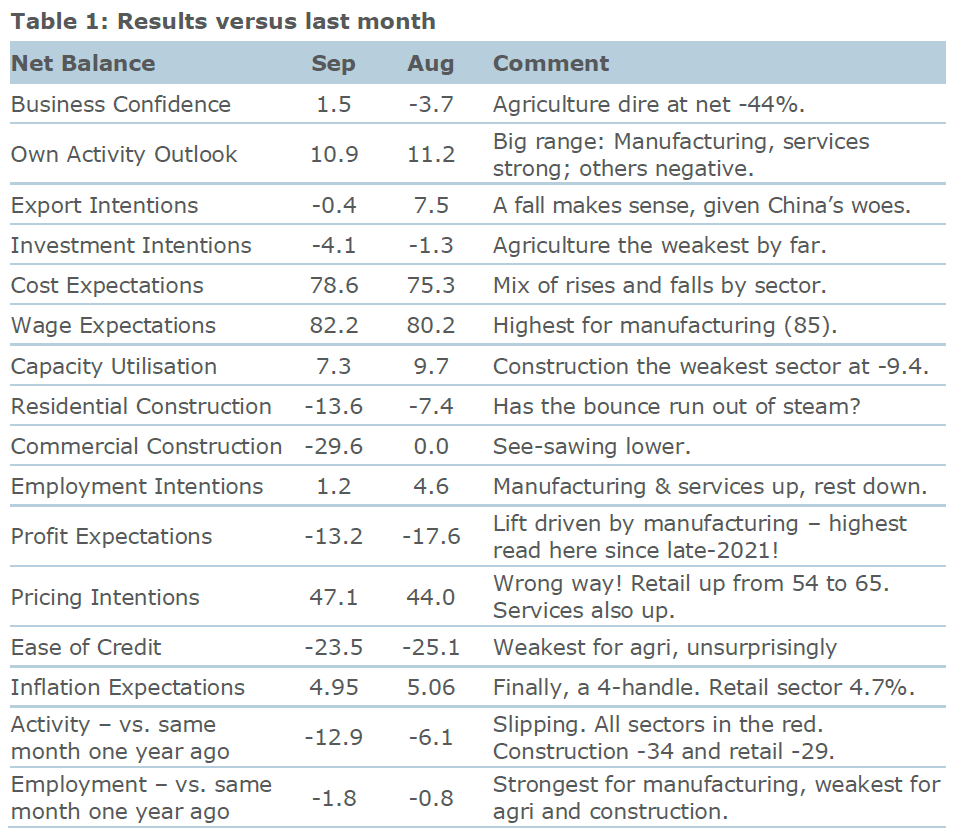

While overall 'headline' business confidence rose 6 points to a +2 reading in September, expected own activity was flat at +11 - and many activity indicators slipped a little, ANZ chief economist Sharon Zollner said.

"The New Zealand economy is certainly patchy, and the rebound in activity indicators – that’s been evident since the start of the year – may be running out of steam," she said.

"Inflation pressures are gradually waning in the big picture, but not rapidly nor in a straight line, and the jury remains out on whether it’s occurring fast enough to bring core inflation pressures down in a timely fashion.

"Cost and wage expectations remain very elevated, as do inflation expectations. Pricing intentions, one of the best inflation indicators in the survey, went the wrong way in the month, and both the exchange rate and oil prices have the potential to interrupt or halt downward progress."

Zollner said the outlook for the construction sector remains key for the inflation outlook.

"A meaningful decline in construction costs is part of the plan for getting inflation down. The proportion of construction sector firms expecting higher costs jumped to the highest in four months. The turnaround in the housing market is one to watch in this regard."

Zollner said the ANZ economists continue to expect that the Reserve Bank will conclude it has more work to do to be confident that inflation is on its way back to the target band, with a 25 basis point hike to the Official Cash rate - which would take it from the current 5.5% to 5.75% - expected in November.

BNZ head of research Stephen Toplis said there were "disconcerting signs" in the latest survey that inflation is not falling as fast as the RBNZ might like.

"Disconcerting this may be but not altogether surprising given the ongoing increases in input costs that the business sector is facing. Top of the list, in this regard, are surging oil prices," he said.

"Are these inflationary signs worrying enough to have the RBNZ suggest it might be raising interest rates again some time soon? We think not. And, anyway, with mortgage rates continuing to drift higher, monetary conditions are edging tighter anyway."

In the survey detail, Zollner said export, investment and employment intentions, and construction intentions, both residential and commercial, all eased.

"However, the falls were small, and the overall survey is best described as ‘mixed’. Also, economy-wide profit expectations lifted. Less helpfully, so too did cost expectations and pricing intentions, but only a smidgen, and inflation expectations eased slightly and recorded the first sub- 5% read since December 2021."

A net 65% of firms in the retail sector expect to lift their prices in the next three months, up from 54% in August, Zollner said.

This may be related to the fact that the retail sector now considers the lower level of the exchange rate to be a significant problem.

"The RBNZ prefers to look through tradable inflation and focus on the domestic inflation that it can influence to a much greater extent, but its ability to do so is contingent on inflation expectations being well behaved. It’s a case of ‘so far so good, but a long way to go’ in that regard."

Reported past wage increases(versus a year earlier) edged lower at 5.5%, Zollner said.

"On the other hand, expectations for wage settlements over the next 12 months ticked up from 3.7% to 4.0%, increasing for every sector except retail, which was flat," she said.

"The downward trend in expected wage growth is looking like it could potentially be stalling at this point, but it would be a mistake to read too much into one month’s data."

Business confidence - General

Select chart tabs

18 Comments

Not sure how ANZ marries together there estimates of a rising OCR with their much publicised house price rise prediction for 2023.... Gotta generate that FOMO I guess.

‘Smart Ass Sharon’ has a way with words that’s for sure.

What's with the insult? An hour ago you were complaining about that very thing...

Economists and politicians are worthy of our disdain. They underpin most of the huge problems we face.

Let me fix that for you ...

Bank economists and politicians are worthy of our disdain.

Economists and politicians are worthy of our disdain.

Agree.

Sharon Zollner always comes across as "balanced" to me but you come away from her narrative not really feeling like you've gained any meaningful insight.

Its related to the current wide open immigration policies, enabling 100,000 new migrants a year into NZ. If we follow Australia's example with mass migration, the result is double digit rent increases, predicted 15% annum house price inflation this year, along with increasing interest rates, and continued high inflation will be coming to NZ soon. Of course both National and Labour have no plan for population growth to ease in NZ, its the only way to ensure a continued positive GDP, and avoid a recession.

It's the only economic lever the West has - fill our country with people, my question is, what happens when we are fill?

And the most amazing thing is, is that the exisiting populations don't riot and drag their leaders to the gallows.

Oh well, 'Boiling Frog' syndrome comes to mind.

quite simple .. it becomes someone else's problem then ..

OCR at 6% within the next 6 months, and not below 5.0% until end of 2025 at the least.

The way the government (outgoing and incoming) are proposing to run the economy, we will still have 5% PA inflation for years.

Not so sure about the latter. I think it’s very uncertain. The economy could take a real dive and nuke plenty of the inflation.

Agreed, OCR at end of 2025 could plausibly be anything between 0 and 10, or even beyond. I think 5 is a reasonable guess but predicting anything with confidence is impossible given the realistic possibilities of either severe inflation or severe recession. We're walking a domestic tightrope even before you account for the massive geopolitical uncertainties around the Chinese economy and war in Ukraine

We're getting to that inflection point where dumb businesses finally realise they can raise prices as much as they like but their clients don't have the money to buy their products. The clients will either delay, scale down, liquidate, or, go bust leaving the supplier stuffed.

It always takes while. But it is an inflection point that is guaranteed.

Smart businesses realised this as soon as the RBNZ made it clear they intended to punish the young and enrich the old. Smart businesses have been responding with 'discounts' for quite some time now.

Oh, lord. The input cost of most concern for businesses at the moment is not oil, it's the cost of credit! Businesses are carrying $200 billion of debt and paying out about as much in interest per year as the whole country spends importing fuel! So, obviously, the galaxy brain economists suggest putting the cost of money up!

They don’t realise they are CAUSING inflation with their interest rate hikes. Quite bizzare!

"Cost and wage expectations remain very elevated"

Of course wage expectations are elevated, costs have skyrocketed on daily essentials people need in order to survive. As have of course, profits for those selling the essentials.

When are we going to call time on this ridiculous OCR economic theory?

We haven’t got enough houses and the Reserve Bank is making it HARDER for developers to get funding? Huh?

Higher interest rates means higher costs for businesses, which get passed on as higher prices = more inflation.

The Reserve Bank and their stupid OCR are the problem, not the solution.

Interest rates at all times should be no more than 2 - 3% as this interest burden add directly to inflation/ reduction in purchasing power of the dollar over time.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.