The last monthly ANZ Business Outlook Survey for the year paints a very mixed picture of rising business confidence, rising activity levels and falling inflation expectations.. but rising cost expectations and rising pricing intentions.

"The vast majority of indicators lifted. Inflation expectations took a decent step lower, but the proportion of firms expecting higher costs or intending to raise their prices both rose," ANZ chief economist Sharon Zollner said.

"Indeed, pricing intentions are the most reliable lead indicator for inflation of late, and they have stopped falling in recent months.

"If pricing intentions had continued on their previous downward trajectory they’d be rapidly approaching ‘normal’ ranges by now, but instead they’re currently looking a bit stuck at a level consistent with CPI inflation well above the [1% to 3%] target band.

"Specific numerical estimates of where firms’ own selling prices will be in three months’ time were slightly higher and in fact has been going sideways for six months. The data is clearly inconsistent with annual inflation anywhere near the 2% [inflation] target midpoint, and the stall in the downward trend is not encouraging."

Zollner said the Reserve Bank (RBNZ) has made it clear that they have "zero tolerance" for more delays in bringing inflation down.

"There’s a lot more data to come between now and the [RBNZ's] February OCR [Official Cash Rate] decision, but this survey read won’t be one of the [RBNZ Monetary Policy] Committee’s favourites."

Westpac senior economist Satish Ranchhod said the expectations of higher cost and intentions to increase prices were "worrying signs".

"Those continued cost and price pressures chime with comments we’ve heard from our own business contacts who have reported that operating cost pressures remain firm," Ranchhod said.

"In many cases, they’ve also told us it’s become harder to pass cost increases into output prices. We expect that continued pressure on operating costs will mean that domestic inflation eases only gradually over the year ahead.

"Overall, while confidence is up, we’re still left with a picture of limited momentum in economic activity and lingering inflation pressures."

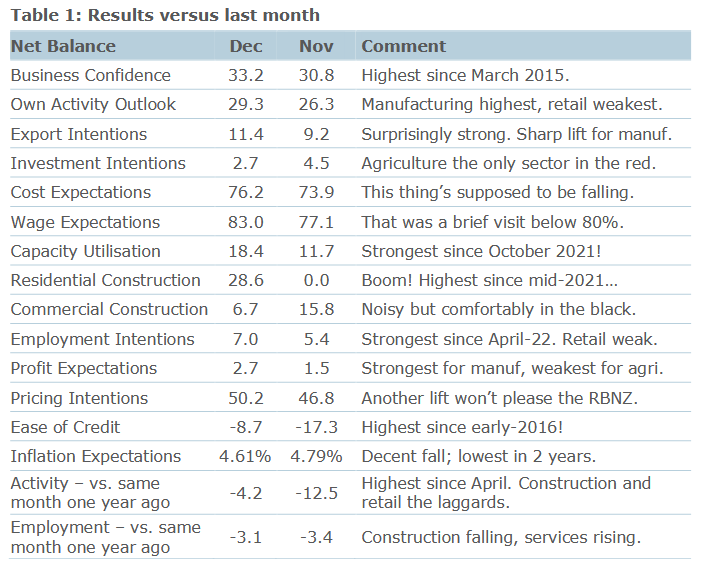

In other results in the survey, business confidence continued its post election surge, hitting its highest level since March 2015. Business confidence rose 2 points to +33 and expected own activity rose 3 points to +29.

One standout feature in the survey results was a big surge in residential construction intentions, taking these to the highest level since mid-2021.

ANZ's Zollner said this was "startling, and suggests that dwelling consents (and before long, residential construction) are about to find a floor, so to speak".

The survey asks additional questions every three months, including what firms’ largest problems are.

"Finding skilled labour still rates as firms’ largest problem. However, the share of problems that are inflationary continues to decline, while the disinflationary problems of low turnover and competition are growing.

“We also ask firms every three months what is driving their investment decisions. Of those firms who are intending to increase their investment, far fewer are doing it to replace hard-to-find labour, and more are investing due to the economic outlook.

“Of those intending to invest less, wariness about the domestic economic outlook is still highest on the list," Zollner said.

She said the New Zealand economy has "certainly been through a very rough patch", as amply demonstrated by the much lower third quarter GDP outturn than expected, and significant downward revisions to past GDP as well.

"However, the ANZ Business Outlook survey suggests the outlook is improving – and the backward-looking questions suggest that experienced activity may also be past the worst.

"The rebound in residential construction intentions is particularly striking, suggesting consents may soon start lifting meaningfully. Things are clearly very weak on a per capita basis, but population growth of more than 2½% does put a floor under how far aggregate activity can fall.

“The RBNZ noted that the surge of workers had had a disinflationary impact on the labour market, but that the demand-side pressures were still playing out and could cause inflation to hold up longer than anticipated.

“The inflation indicators in the survey were mixed at best, which is not encouraging data for the inflation outlook.

“While GDP data showed the RBNZ has gotten a lot more traction than they knew last month, and that’s very important, it’s also important to remember that a recession was their plan, and that the question of how much pain is needed to get inflation all the way down to 2% isn’t in fact settled," Zollner said.

Business confidence - General

Select chart tabs

23 Comments

Intentions and data are different. Property owners are in a similar boat; mistaking relief Labour is gone with any concrete evidence that we aren't in for a tough couple of years. The honeymoon will be over by Waitangi weekend. I just walked down Eat St in Rotorua on one of the last office days of the year, sunny and hot, expecting it to be humming with end of year lunches.

Nope. Graveyard.

Job listings down nearly 30%.

Agree, businesses may want to pass on increased costs but I think they will struggle. And some of their costs will start to stabilise - for example commercial rents can’t go up much if businesses are going under.

The Viaduct was pumping today. Although the food was a bit average. Perhaps restaurants are saving $$$ on quality ingredients.

I think its noticeable like when you used to get a really nice Chorizo sausage made by some local butcher at the cafe now its like one of those pre cooked ones you feed to the dog.

When you have chains like the Speights ale house charging $40 for a steak and you can get a lamb rack or great seafood elsewhere for mid 20's (only go out for special occasions given the cost) then it it clear many are hiking unnecessarily when they already have economies of scale in their favour.

Made me think of the 1m long USB A to USB C charging cable I saw for sale at the Rimutaka petrol station just today. Also $40.

Unfortunately old people do not know about AliExpress, the only downside is you have to wait for delivery. Amazing quality cables made by Essager bought 2 for $14.50 total including delivery.

I wonder what cost pressures businesses are talking about? Maybe it is people pushing for higher wages as they struggle to pay their rent / mortgage? I mean a 5% rise in wages adds about $6bn to business costs. Or, maybe paying over 7% interest on $200bn of business debt ($14bn per year) might be something to do with it? Many businesses (including food producers) are paying over 10% on their revolving credit arrangements.

It's a good point you've made again.

What if the RBNZ dropped the OCR very soon and by a large cut, say 0.75% but with the warning it'll be straight back with more if inflation raises its head?

Would there be a collective sigh of relief? With those pricing intentions just evaporating back into the OCR mist from whence they came?

(Hey Adrian, let's try something different and timely, ay? Go on. I know you want to. And NZ Inc needs you too!)

Surely they already increased their prices to cover that 7%? That was a one off inflation hit. Unless it goes up more.

Yes, but higher debt costs, wage costs, insurance costs, local Govt rates (etc) are still washing through the pricing structure - creating little price / price feedback loops. That's why I think our inflation will be stickier than in other places (well, that and our chronic lack of competition).

The maturation of the higher interest will vary, I believe the lag time for any of these rates hikes is 12-18 months.

At this stage of the economic cycle (where downwards momentum is clear) waffling on about "pricing intentions" is just that, waffle. But sure ANZ et al, lets have plenty of speculation that this means interest rates will stay high.

edit: I should add, that at this stage of the cycle consumers will have become very cost conscious and will be pricing alternatives - if they decide to buy at all. Ergo a business may plan to increase prices but finds that sales fall and they quickly reverse. Likewise, their customers may decide to find a substitute product, or substitute supplier, who does the same but at a lower cost. While a few others may see competitors fail and may be able to increase prices if they don't have enough capacity to keep up with the increase in demand.

To get inflation, or to maintain inflation, a specific set of circumstances need to coincide. And at this time those circumstance simply don't exist.(And haven't for months which is why inflation is falling.)

Just as another dirty anecdote, there are plenty of suppliers who have declared new year price increases over the past months. This is in construction, and agriculture. So some of the "intentions" from producers, manufacturers, and retailers will be guided partially from looming cost price increases.

I've already front run some of this by pre-purchasing inventory for my own forward commitments, so the price for those won't alter, but any forward contracts and work will have new rates.

Too soon to claim how clever you've been. You might have been sucked in by the old ruse "prices going up soon, get in now". Time will tell.

I have correspondence from suppliers identifying the % levels my cost prices are going up, and when. This is fairly common 3-6 months out from rises, due to the nature of how the production cycle works in the industries in question. Historically these cost increase notices have always happened true to form, no exceptions.

Or, you're right and this time is going to be totally different from how things have been the past 15 years or so.

Worst case scenario I have the stock I need at the pricing I'm committed to.

I have ‘zero-tolerance’ for Zollner’s widely inaccurate predictions

From Gareth Vaughan's article last Thursday:

"leading Westpac NZ's economists to revise down their December quarter CPI forecast to 0.3% from 0.6%"

0.3% for the quarter is only 1.2% annualised. Even if it comes in at 0.6% that is 2.4% annualised so well within the 0-3% band.

I definitely wouldn't say that the data is clearly inconsistent with annual inflation anywhere near the 2% target midpoint

What they're pretending is that 'data' is a survey of 'future intentions'.

data = 'facts and statistics collected together for reference or analysis'.

So stretching the meaning just a tad, ay?

As it's nothing much more than an 'infomercial' they can say what they like I guess. Personally I think we'd all be better off if they just stuck to the facts rather than trying to spin the facts for their own ends. (To be fair, I say the same thing of central banks 'jawboning the markets' too. People will never learn anything if you don't give them the truth.)

It depends on the calculation and the integrity of that, as with such high volume calculations there can be a margin of error as we saw with Stats revising the CPI earlier in the year which confirmed we had a technical recession. I get the feeling we are all just being shepherded and cajoled to slow the rate of the drop in spending and increase in saving that would cause a deeper recession, when the reality is much worse than is being reported.

0.3% would be embarrassing for the RBNZ after causing a recession and saying rates were not going down next year. I seem to recall the quarter before was 1% so that would be only 1.3% in half a year. Seriously overcooked if that comes to fruition, emergency rate cut territory.

We've seen the wider economics community consistently underestimate inflation, this time might be different but you'd have a pretty good track record now just by betting on the persistence of inflation.

Oh please. Not fair.

- We've had rooted supply chains thanks to covid (supply constraints)

- We had a RBNZ throwing mountains of cheap money into the economy when the government had already done enough

- And an energy shock thanks to pootin.

Some economists said inflation would be short lived due to 1.

Fewer said inflation would be short lived given 1 and 2.

And only economists selling stuff said inflation wouldn't be a problem given all three.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.