The recently published drop in GDP for the December quarter "seems to have given things a decent shunt south" in respect to business confidence, according to ANZ economists.

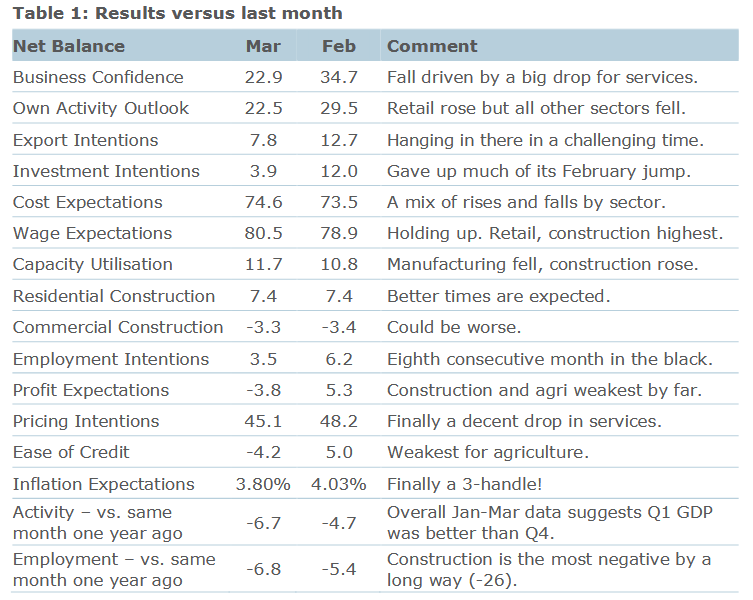

The latest (March) ANZ Business Outlook Survey shows that recorded business confidence levels fell 12 points to +23, while the expected own activity measure fell 7 points to +23 and past activity eased 2 points to -7.

"The March ANZ Business Outlook survey showed weakening activity indicators and a slight fall in inflation pressures," ANZ Chief Economist Sharon Zollner said.

She noted that a a strong 'recession headline' impact was evident in the consumer confidence data published by ANZ earlier on Thursday.

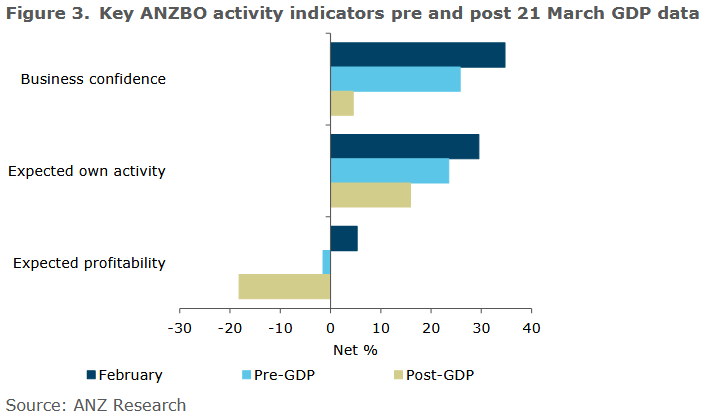

"For this [business confidence] survey, 14% of responses came in after the Q4 GDP data was published and a similar pattern is evident: activity indicators were sliding, but the GDP data seems to have given things a decent shunt south," Zollner said.

"Reported past activity, which has the best correlation to GDP, suggests the economy may eke out low but positive growth in Q1. That’s consistent with our current forecast of a modest 0.2% q/q lift. This month it was a mixed bag, with a bounce for retail, agriculture and construction, but falls elsewhere."

Zollner said "smoothing through the monthly volatility" shows that construction is experiencing the largest fall in activity, followed by retail, but the picture for retail appears to be brightening. "That’s an interesting contrast with the sharp fall in consumer confidence this morning".

"Strong population growth likely helps explain the discrepancy – even though consumers are warier, there are now a lot more of them."

Commenting on the survey findings, Westpac senior economist Satish Ranchhod said it’s clear that there is increasing nervousness creeping through the business sector.

"On the activity front, a net 7% of businesses reported that their trading activity has declined over the past year, including particular weakness in the retail, construction and manufacturing sectors. There’s also been a drop-off in the number of businesses who expect trading activity will improve over the coming months. Consistent with that, there’s also been a drop in the number of businesses who are planning to take on more staff or increase their capital spending.

"Overall, today’s survey is in line with our expectations for soft activity and slowing inflation. The key issue to watch going forward is how quickly inflation drops back," Ranchhod said.

Zollner said the economy is broadly following the path laid out for it by the Reserve Bank: "not a path strewn with rose petals, but a hard and rocky path through dangerous lands from which not all will emerge unscathed".

"It was back in November 2022 that the RBNZ admitted that they were going to deliberately engineer a recession, and here we are."

Zollner said, however, that "on the other side of this painful adjustment" lies not only low and stable inflation, but also a more sustainable external balance with the rest of the world.

"We are reliant on not so much the kindness as the self-interest of strangers abroad to fund our lifestyles, and that does put some non-negotiable limits on for how long we can keep living beyond our means.

"And we most certainly did that during the Covid era, as demonstrated by both the current account deficit and the fiscal deficit. Carrying on in that vein was never an option. And the sectors experiencing the biggest busts now are those that had the biggest booms."

The good news, Zollner said, is that the economy is making solid progress. The current account deficit is narrowing. And inflation is clearly on the way down.

"There are some concerning signs of stickiness in some of the inflation measures in this survey, and despite the marked slowing in the economy there is still a good deal of uncertainty about the inflation outlook. It's certainly too soon to declare victory. But eyes on the prize; we’re getting there."

Business confidence - General

Select chart tabs

49 Comments

Have a look back at the GFC and I'm sure prices started rising at the same time confidence hit rock bottom in mid 2009

I dont know how or why that is

When do you expect confidence to hit rock bottom this time?

Hey I'm just informing you what I saw, its up to you whether you accept it

What's your opinion

Not disputing your opinion just interested to hear if you think we're currently around rock bottom confidence and if you're now expecting prices (of housing I'm assuming) to increase.

I've think we've got a lot further to go yet as far as negative GDP figures/recession goes before any marked turn around happens.

For me personally its my time to buy a house and have been looking since October but have since changed my dream buy from beachside to rural

Fine choice, more for the money

OCR was halved in two months Dec/jan 2009 then the bottom in nominal terms was found after that. In real terms the bottom was 2011 IIRC

If only we had a great national economic plan that could unleash the skills and abilities of our people to our economic benefit. We'll be calling him "One Term Luxon" if he doesn't get going (and if his government survives the full term.)

Indeed, the main difference between him and John Key is that JK came with confidence and charisma which got people on board with this parties plans, and convinced the country that we will all have to weather a couple off years off down turn before we'll see results in their actions. He also came with an accounting background which people gave credibility to him for. Luxon sadly has no charisma, and seems to be making decisions that aren't along with any substantial long term plan that has any credibility thus far. They have the rest of their term to prove themselves however, as we are still early days.

I don't think charisma is that important, it's the decision making that's important. He did a great job at Air NZ.

Its all the restructures, people seeing workmates jobs disestablished is causing the falls in consumer confidence..... having to do the cuts must be because of business outlooks - the flow on impacts will last at least 12 months..... so my gut feel is it bottoms out H1/25 for both business and consumer

Confidence started lifting in early 2023 on the prospects of a change to a more business friendly Government. Landlords became excited and some here even said the final opportunity to enter the housing market was August to October! Now that we're being served daily reminders this Government over promised, the honeymoon effect is wearing off and the reality is now kicking in...

Selling overpriced houses to each other has proven itself a fruitless venture and is showing up in our dismal productivity.

It doesn't help either when many are hearing about people getting laid off and businesses going under. This year and possibly into 2025 is when we feel the worst of this environment.

Interest rate lag effect + reduction in savings + higher cost of living + rising unemployment = more pain to come.

Agreed mate, I've jumped over to your dgm side, lol.

The term dgm always relates to the return on investment in specific markets in an economic downturn.

In reality there is always opportunity. It just means to switch to a new track.

The term dgm here seems to apply to residential housing. In fact for many tech related industries (and I am sure other markets) the markets are booming as businesses shed staff in favor of productivity boosts.

End of the confidence bounce post-election. The new blue Govt is just as clueless as the old red one.

Construction wage expectations holding up? I wonder how long that will last...

Lots of hopium

The Russians are coming.....lol

but not here, other than a few russian migrants

“Oligarchy is when men of property have the government in their hands,” ...theyre here already...lol

As a business man, I find it silly that the release of GDP figures for 3-6 months ago, should influence my thinking over what's going to happen in the future. I far rather look at my own business(es), my clients, my strength and weaknesses, and do my best to do well, rather than think "oh no, GDP figures for last year were bad, therefore my business is looking bad in the future".

Fair enough, but does your current intel suggest things look better than they might have 3-6 months ago?

I cannot answer your question honestly, without attracting more hate from the majority of posters…

Maybe where you guys live, but not where I'm building. .

Massive road works, traffic jams, new subdivisions selling out, road widening, 1,800 houses planned, new intersections, one retirement village on the drawing board and another one under construction, school extension, huge additions to the local shopping centre.

It's absolutely manic.

Queenstown?

Riverhead, Westgate, Huapai. And this is just the beginning. Land's been purchased to extend the NW motorway to Waimauku west of Kumeu.

Mate, no-one wants your underwater section out in the wop wops. Good try though.

Go and have a look Einstein. As we were driving through today my wife commented on the derelict houses and long grass near Riverhead.

The reason is because hundreds of acres have been purchased by a Fletchers consortium. Everything's selling out. There's a ' Lifestyle Blocks For Sale' sign near the Riverhead Bridge, and every lifestyle block has a 'SOLD' on it. It hasn't been up for more than a couple of weeks.

I think what you're describing is the last of the Covid boom. House completions in Auckland are now falling, as are new consents. Give it six months and I think you'll see activity in your area slow considerably.

Go for a drive up SH16 from Westgate and then post that. And that part's just the beginning.

Doesn't matter you can see. It's the numbers coming through the pipeline that matters, and they're heading south.

Every time it rains in Riverhead

https://www.tiktok.com/@twentyfour_13/video/7233166816703565057

Tik tok...seriously? You'll be quoting the Woman's Weekly next. Hahaha...OMG!!!

It's a video of someone driving out of their street in Riverhead. They've chosen to upload it to TikTok, but it could feature on Women's Weekly if you really wanted it to? Challenge the content, not the messenger....

It's moronic.

It could be anywhere on the planet. And even if it was in Riverhead, it's quite obviously nowhere near where the Fletcher's consortium plan their new subdivisions.

Maybe you'd better call these guys and tell them they've got it completely wrong.....422 apartments...in Riverhead.

https://thebotanic.co.nz/riverhead/

But anyway, feel free not to buy in Riverhead, it's not compulsory. There's an element of risk involved, and I can tell that's just not for you.

Having said that there are some big landowners who own lots of land on the periphery of Auckland. They have donated big time to the National party with the expectation that their land will be rezoned and they will get their bribe (sorry I mean donation) back.

There's a brand new lifestyle subdivision just listed near the Riverhead Bridge. 10 Lots. Want to get rich?

Haha dude please don’t tell me you’re building out west right now? Seriously, I’d try hold off on the brags its really embarrassing.

Everything's selling.

I made a list of all the economic activity out that way before I bought. There's 14 major projects in the works. It's a pity you're not on board, there's a few people around who are gonna be on Easy Street in a few years time. All these posts about a property crash are absurd. Contrarians swim against the tide.

I'm bragging? I went out on a limb and bought 4 sections (2 on the waterfront) and built 2 houses in West Harbour before anyone had ever heard of the place. When I was building my first house there, a dude wandered up and said, "nothing will ever happen out here". I love that story.

https://www.aucklandcouncil.govt.nz/plans-projects-policies-reports-byl…

https://www.aucklandcouncil.govt.nz/UnitaryPlanDocuments/02-r1-form-18…

https://www.nzta.govt.nz/projects/sh16-brigham-creek-and-waimauku/

https://www.nzta.govt.nz/projects/sh16-18-connections/

https://www.supportinggrowth.govt.nz/assets/supporting-growth/docs/Nort…

Some of these projects are decades away. It’s a nice area providing you don’t need to work / travel to the city. The traffic is probably the worst in Auckland.

You are correct on the traffic. I don't commute.

Yes, it won't happen overnight, but some of it's currently underway. There's a huge retirement village planned for central Riverhead, 422 apartments + leisure activities. It's probably 18 months before construction can begin. The land has already been acquired.

Noticing Auckland is grinding to a halt earlier each day...massive cars going no where fast . Public transport fares up ..including now full fares for kids....and Chris wants to double the population. It's a disaster 😔

If you read the news you'd know it was the last useless govt. that let hundreds of thousands in to this country, and they're still arriving. What do you think that's going to do to Auckland property prices?

At the current worse useless Government have done zip to stop inflow...but I suppose you can't taper a ponzi?

It's all a matter of supply and demand.

Building new houses and developing subdivisions are becoming more difficult and more expensive every year that goes by. The local councils are forever piling on more restrictions. it's pushing house prices up, so's the socialists letting hundreds of thousands of immigrants in. Luxon says he's going to address the problem.

so's the socialists letting hundreds of thousands of immigrants in. Luxon says he's going to address the problem....

Is your nickname the "goose"?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.