Air New Zealand, (AIR) has endured a "challenging" 2025, with declining profitability through the financial year, according to analysts from financial services company Forsyth Barr.

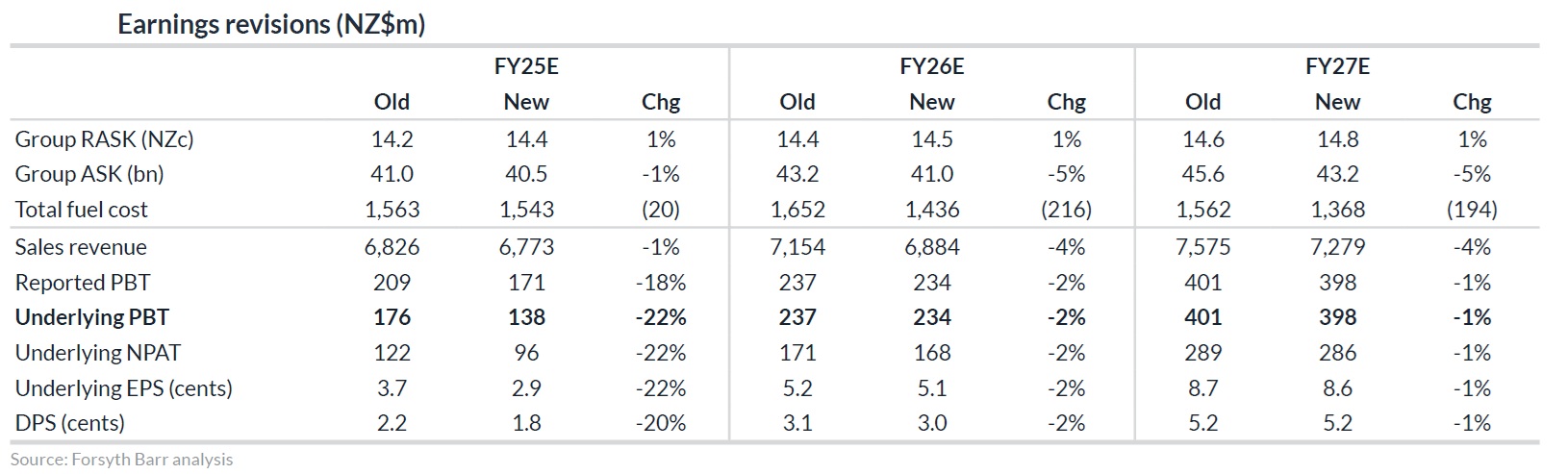

Forsyth Barr's head of research Andy Bowley and associate analyst Hugh Lockwood, in a report titled: Stuck on the tarmac, have downgraded their profit forecast for the year ending June 30,2025. Air New Zealand's due to report its earnings towards the end of this month.

In its own forecast issued in April, the airline, which has been beset by maintenance issues, forecast a pre-tax profit of between $150 million and $190 million for the financial year.

The analysts have lowered their forecast of pre-tax earnings from $209 million to $171 million.

"Excluding the non-cash benefit of COVID credit breakage, we estimate the company was loss-making through [the second half of the year] - or, at best, management’s earnings guidance implies a small profit," the analysts said.

They also said the airlines two key problems weighing on its financial performance "will take time to remedy".

"These are: (1) weak demand; and (2) the capacity and cost implications of additional engine maintenance requirements.

"The latter will be a bigger issue in FY26 than it was in FY25, before improving through FY27 and normalising during FY28. The former may improve gradually through FY26 - but akin to taxiing, rather than take-off," the analysts said.

They expect earnings and returns to improve over the medium term, but say such a recovery "is not without risk". They maintain a 'neutral' rating on the stock.

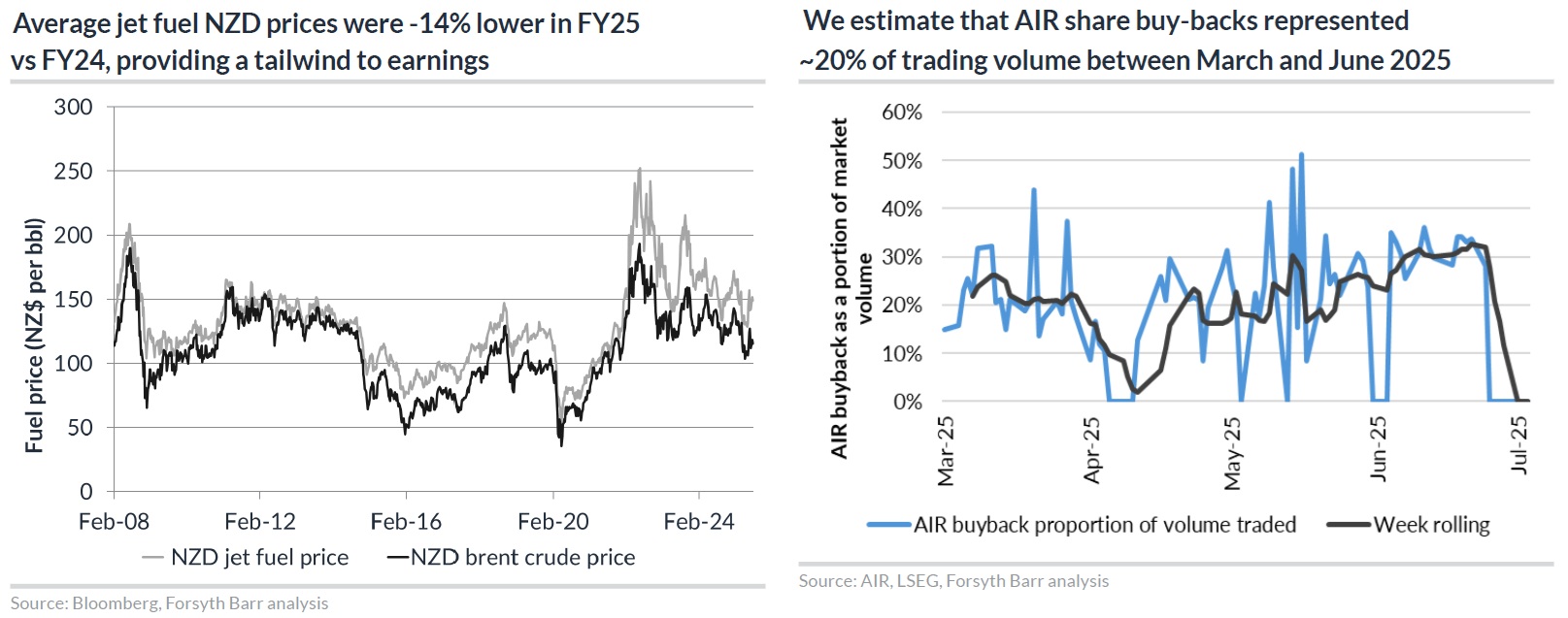

They say their analysis of Air New Zealand's announcements to NZX suggest it spent about $38 million on share buy-backs through the second half of the 2025 financial year, representing about 20% of average daily demand during the period since the buy-back began.

"We expect the buy-back to remain a feature through [the first half of 2026]. The decline in profitability through the year leads us to assume a final dividend payment of just 0.5 cents per share, amounting to a further cash outflow of ~NZ$17 million," the analysts said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.