Afterpay

[updated]

Buy now, pay later the most common first-time path to credit/debt

[updated]

Gareth Vaughan questions whether the fintech buy now, pay later sector deserves the special treatment it's getting from the Government

9th Sep 24, 5:00pm

23

Gareth Vaughan questions whether the fintech buy now, pay later sector deserves the special treatment it's getting from the Government

Government exempts buy now pay later providers from complying with CCCFA default fee provisions to help keep them in business

7th Sep 24, 9:25am

5

Government exempts buy now pay later providers from complying with CCCFA default fee provisions to help keep them in business

If it looks like debt, let’s treat it like debt. Why ‘buy now, pay later’ schemes need firmer regulation in NZ

8th Sep 23, 9:30am

If it looks like debt, let’s treat it like debt. Why ‘buy now, pay later’ schemes need firmer regulation in NZ

Grant Halverson on the rise and fall of the buy now pay later sector and what the future may hold for it

5th Mar 23, 6:30am

28

Grant Halverson on the rise and fall of the buy now pay later sector and what the future may hold for it

Three threats to Australasian banks from Afterpay's acquisition by Square

Buy now, pay later service providers tipped to replace banks as the dominant issuers of Visa and Mastercard cards

17th Aug 21, 10:08am

Buy now, pay later service providers tipped to replace banks as the dominant issuers of Visa and Mastercard cards

Square's swoop on Afterpay is a 'game-changing deal', addressing nearly all the issues Square faces as it strives to become 'a dominant payments ecosystem'

9th Aug 21, 12:14pm

1

Square's swoop on Afterpay is a 'game-changing deal', addressing nearly all the issues Square faces as it strives to become 'a dominant payments ecosystem'

Buy now, pay later service provider Afterpay set to be acquired by Jack Dorsey's Square in major payments sector acquisition

2nd Aug 21, 11:39am

10

Buy now, pay later service provider Afterpay set to be acquired by Jack Dorsey's Square in major payments sector acquisition

Concerned about any consumer harm from buy now, pay later services, Commerce and Consumer Affairs Minister David Clark says government to consult on possible regulation

9th Jun 21, 9:15am

6

Concerned about any consumer harm from buy now, pay later services, Commerce and Consumer Affairs Minister David Clark says government to consult on possible regulation

Gareth Vaughan looks at what merchant service fee regulation may mean for loyalty & rewards schemes, surcharging, and buy now pay later service providers, and why

16th May 21, 6:01am

22

Gareth Vaughan looks at what merchant service fee regulation may mean for loyalty & rewards schemes, surcharging, and buy now pay later service providers, and why

With Westpac reviewing its ownership of Westpac NZ, Gareth Vaughan ponders the questions of why anyone might sell an oligopoly bank, and who might want to buy an oligopoly bank

5th Apr 21, 6:31am

37

With Westpac reviewing its ownership of Westpac NZ, Gareth Vaughan ponders the questions of why anyone might sell an oligopoly bank, and who might want to buy an oligopoly bank

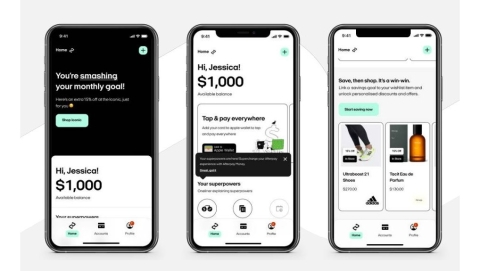

Buy now pay later service provider Afterpay prepares banking app as ASB's parent Commonwealth Bank of Australia readies buy now pay later service

19th Mar 21, 9:24am

Buy now pay later service provider Afterpay prepares banking app as ASB's parent Commonwealth Bank of Australia readies buy now pay later service

British government acting on advice buy now pay later credit sector needs to be regulated 'as a matter of urgency' to protect consumers

4th Feb 21, 12:08pm

6

British government acting on advice buy now pay later credit sector needs to be regulated 'as a matter of urgency' to protect consumers

Google Pay and banking-as-a-service business model seen making competitive landscape tougher for banks

28th Jan 21, 3:13pm

Google Pay and banking-as-a-service business model seen making competitive landscape tougher for banks