Baucher Consulting

Inland Revenue gets back to its core business; GST changes for the platform economy to proceed & more

6th Mar 23, 9:30am

9

Inland Revenue gets back to its core business; GST changes for the platform economy to proceed & more

Te wiki o te tāke; Terry Baucher has been exploring what more can be done for victims of the recent bad weather disasters, and thinking more broadly about the climate and demographic challenges ahead

26th Feb 23, 3:11pm

11

Te wiki o te tāke; Terry Baucher has been exploring what more can be done for victims of the recent bad weather disasters, and thinking more broadly about the climate and demographic challenges ahead

Terry Baucher looks at what the taxman can do for people hard hit by Cyclone Gabrielle and recent flooding

24th Feb 23, 4:01pm

Terry Baucher looks at what the taxman can do for people hard hit by Cyclone Gabrielle and recent flooding

Terry Baucher is back, and assesses the big issues that connect households and businesses to the tax collector. These range from policy issues to gritty practical ones

19th Feb 23, 7:00am

20

Terry Baucher is back, and assesses the big issues that connect households and businesses to the tax collector. These range from policy issues to gritty practical ones

The New Zealand Tax Podcast – Terry Baucher looks back on the big tax issues of 2022, a number of which will stay big issues in 2023. After all, taxes are what we pay to get, maintain and keep a civilised society

18th Dec 22, 10:41am

23

The New Zealand Tax Podcast – Terry Baucher looks back on the big tax issues of 2022, a number of which will stay big issues in 2023. After all, taxes are what we pay to get, maintain and keep a civilised society

Vivien Lei introduces her award winning tax reform idea to introduce weighting factors into environmental tax loads, ensuring the full costs are brought into business decisions, and nudging behaviour away from polluting outcomes

11th Dec 22, 2:16pm

Vivien Lei introduces her award winning tax reform idea to introduce weighting factors into environmental tax loads, ensuring the full costs are brought into business decisions, and nudging behaviour away from polluting outcomes

Te wiki o te tāke; Insights from the latest OECD tax statistics, the Government's financial statements. And new rules about Provisional Tax when you haven't previously been a provisional taxpayer

4th Dec 22, 12:00pm

8

Te wiki o te tāke; Insights from the latest OECD tax statistics, the Government's financial statements. And new rules about Provisional Tax when you haven't previously been a provisional taxpayer

Te wiki o te tāke: Inland Revenue wins an award but loses a case, tax advisers overwhelmingly support a CGT and how much tax do 16 and 17-year-olds pay?

27th Nov 22, 12:02pm

40

Te wiki o te tāke: Inland Revenue wins an award but loses a case, tax advisers overwhelmingly support a CGT and how much tax do 16 and 17-year-olds pay?

Te wiki o te tāke: GST changes ahead for Airbnb and Uber operators, Inland Revenue about to target 80,000 over incorrect Cost of Living Payments, and what about a tax-free threshold?

20th Nov 22, 5:56pm

8

Te wiki o te tāke: GST changes ahead for Airbnb and Uber operators, Inland Revenue about to target 80,000 over incorrect Cost of Living Payments, and what about a tax-free threshold?

Te wiki o te tāke – a GST lesson from the UK, thousands here could be potentially subject to UK Inheritance Tax. And Airbnb and Uber are not happy about a GST law change

13th Nov 22, 7:00am

23

Te wiki o te tāke – a GST lesson from the UK, thousands here could be potentially subject to UK Inheritance Tax. And Airbnb and Uber are not happy about a GST law change

Te wiki o te tāke: the Green Party quotes Margaret Thatcher with approval, the Australian Tax Office's latest corporate tax transparency report, and the latest from the OECD on the carbon pricing of greenhouse gas emissions

6th Nov 22, 12:04pm

5

Te wiki o te tāke: the Green Party quotes Margaret Thatcher with approval, the Australian Tax Office's latest corporate tax transparency report, and the latest from the OECD on the carbon pricing of greenhouse gas emissions

Te wiki o te tāke: Inland Revenue’s annual report: the good, the not quite so good and the concerning

30th Oct 22, 1:04pm

17

Te wiki o te tāke: Inland Revenue’s annual report: the good, the not quite so good and the concerning

Te wiki o te tāke; recovering wage subsidy payments from MNCs, chasing crypto tax transparency, Frucor decision a lost cause

23rd Oct 22, 2:03pm

6

Te wiki o te tāke; recovering wage subsidy payments from MNCs, chasing crypto tax transparency, Frucor decision a lost cause

Te wiki o te tāke; The OECD proposes a crypto-asset reporting framework; new levy proposal for farmers greenhouse gas emissions; TOP’s bright idea about tax rates

16th Oct 22, 11:48am

31

Te wiki o te tāke; The OECD proposes a crypto-asset reporting framework; new levy proposal for farmers greenhouse gas emissions; TOP’s bright idea about tax rates

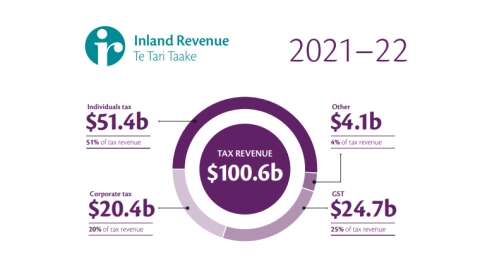

Te wiki o te tāke: Change on the way for GST recordkeeping requirements, a clear-eyed dissent by a Supreme Court justice, and tax revenue exceeds $100 bln for the first time

9th Oct 22, 1:46pm

4

Te wiki o te tāke: Change on the way for GST recordkeeping requirements, a clear-eyed dissent by a Supreme Court justice, and tax revenue exceeds $100 bln for the first time

Te wiki o te tāke: Inland Revenue gets tougher on FBT compliance, the Government ignored Treasury and Inland Revenue advice on its build-to-rent tax proposal, and the British mini-budget implications for Kiwis

2nd Oct 22, 9:28am

5

Te wiki o te tāke: Inland Revenue gets tougher on FBT compliance, the Government ignored Treasury and Inland Revenue advice on its build-to-rent tax proposal, and the British mini-budget implications for Kiwis

Te wiki o te tāke: Details on IRD's handling of the cost-of-living payments. A doomed tax case highlights the need for change. The OECD on international tax policy reforms

26th Sep 22, 9:42am

1

Te wiki o te tāke: Details on IRD's handling of the cost-of-living payments. A doomed tax case highlights the need for change. The OECD on international tax policy reforms

Te wiki o te tāke: Watch out for those tax traps, Treasury points the finger at current tax settings for housing, a long overdue AML ruling, and the Queen avoids hundreds of millions in tax

18th Sep 22, 10:15am

1

Te wiki o te tāke: Watch out for those tax traps, Treasury points the finger at current tax settings for housing, a long overdue AML ruling, and the Queen avoids hundreds of millions in tax

Te wiki o te tāke - PM's Department warns IRD off looking at a CGT. The IRD admits not having the data on non-compliance with fringe benefit tax. And residential property investment looks very undertaxed compared to other investments

11th Sep 22, 8:02pm

25

Te wiki o te tāke - PM's Department warns IRD off looking at a CGT. The IRD admits not having the data on non-compliance with fringe benefit tax. And residential property investment looks very undertaxed compared to other investments

Te wiki o te tāke - The Government backdown on GST reform is another example of how short-term politics will nearly always trump good longer-term policy

4th Sep 22, 10:01am

15

Te wiki o te tāke - The Government backdown on GST reform is another example of how short-term politics will nearly always trump good longer-term policy

Te wiki o te tāke: an inadvertent interest loophole for provisional taxpayers, time to consider a residential land value tax, and the $1 bln shortfall in the National Land Transport Fund

28th Aug 22, 10:07am

16

Te wiki o te tāke: an inadvertent interest loophole for provisional taxpayers, time to consider a residential land value tax, and the $1 bln shortfall in the National Land Transport Fund

Te wiki o te tāke - a big tax break for build-to-rent developers; the role tax has played in the housing crisis; clarifying the treatment of donations to private schools

22nd Aug 22, 9:26am

73

Te wiki o te tāke - a big tax break for build-to-rent developers; the role tax has played in the housing crisis; clarifying the treatment of donations to private schools

Te wiki o te tāke insights from the Budget information release, the IRS is a big winner in Biden’s tax proposals and Inland Revenue writes off $100 million

14th Aug 22, 1:50pm

17

Te wiki o te tāke insights from the Budget information release, the IRS is a big winner in Biden’s tax proposals and Inland Revenue writes off $100 million

Te wiki o te tāke – because tax is basically about politics (benefits for your supporters, paid for by your opponents), there are fights over the cost of living payments, who will pay for climate adaption, trusts, and who can unethically rort the system

7th Aug 22, 2:50pm

12

Te wiki o te tāke – because tax is basically about politics (benefits for your supporters, paid for by your opponents), there are fights over the cost of living payments, who will pay for climate adaption, trusts, and who can unethically rort the system

Te wiki o te tāke – The IRD explains when business losses can be carried forward, applies the blowtorch to a director over tax debts. And what about windfall taxes?

31st Jul 22, 1:09pm

3

Te wiki o te tāke – The IRD explains when business losses can be carried forward, applies the blowtorch to a director over tax debts. And what about windfall taxes?