Oil

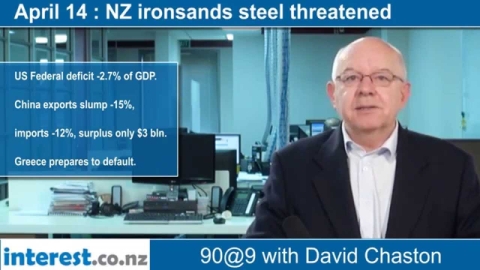

US budget deficit grows; China trade surplus slumps; Greece prepares to default; NZ Steel on the ropes; Aussie budget stress; NZ$1 = 74.4 US¢, TWI = 80.1

14th Apr 15, 7:27am

47

US budget deficit grows; China trade surplus slumps; Greece prepares to default; NZ Steel on the ropes; Aussie budget stress; NZ$1 = 74.4 US¢, TWI = 80.1

Roger J Kerr says low interest rates won't last forever and when they reverse the impact could be 'swift and severe'

13th Apr 15, 1:07pm

Roger J Kerr says low interest rates won't last forever and when they reverse the impact could be 'swift and severe'

China says AIIB will be graft-free; China inflation stable; German frustration with Greece grows; UST 10yr yields rise; oil and gold up; NZ$1 = 75.4 US¢, TWI = 80.8

13th Apr 15, 7:20am

6

China says AIIB will be graft-free; China inflation stable; German frustration with Greece grows; UST 10yr yields rise; oil and gold up; NZ$1 = 75.4 US¢, TWI = 80.8

US labour markets stronger; Greece makes IMF repayment; France investigates HSBC; Moody's says NZ doing well; gold price falls; euro slumps; NZ$1 = 75.4 US¢, TWI = 80.8

10th Apr 15, 7:33am

9

US labour markets stronger; Greece makes IMF repayment; France investigates HSBC; Moody's says NZ doing well; gold price falls; euro slumps; NZ$1 = 75.4 US¢, TWI = 80.8

US Fed on track for rate hikes; Negative yields in euroland; Mexico's century bond; ATO audits tech multinationals; oil and gold drop; NZ$1 = 75.5 US¢, TWI = 80.5

9th Apr 15, 7:27am

5

US Fed on track for rate hikes; Negative yields in euroland; Mexico's century bond; ATO audits tech multinationals; oil and gold drop; NZ$1 = 75.5 US¢, TWI = 80.5

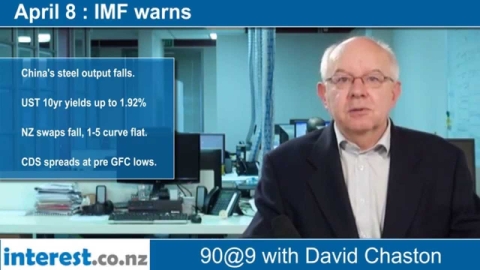

US job openings rise; IMF warns on aging and productivity; China steel output falls; CDS spreads at pre GFC levels; NZ swaps flat; UST 10yr yield 1.92%; NZ$1 = 74.9 US¢, TWI = 80

8th Apr 15, 7:24am

20

US job openings rise; IMF warns on aging and productivity; China steel output falls; CDS spreads at pre GFC levels; NZ swaps flat; UST 10yr yield 1.92%; NZ$1 = 74.9 US¢, TWI = 80

Cheaper money will be here for a long time says Roger J Kerr. That means investment hurdle rates can be lower. Now is the time to take advantage he says

7th Apr 15, 8:28am

Cheaper money will be here for a long time says Roger J Kerr. That means investment hurdle rates can be lower. Now is the time to take advantage he says

US jobs data disappoints; NZ dollar almost at mid-rate parity; Greeks print drachmas; China wants housing bank; gold and oil higher; UST 10yr yield 1.9%; NZ$1 = 75.8 US¢, TWI = 80.5

7th Apr 15, 7:07am

18

US jobs data disappoints; NZ dollar almost at mid-rate parity; Greeks print drachmas; China wants housing bank; gold and oil higher; UST 10yr yield 1.9%; NZ$1 = 75.8 US¢, TWI = 80.5

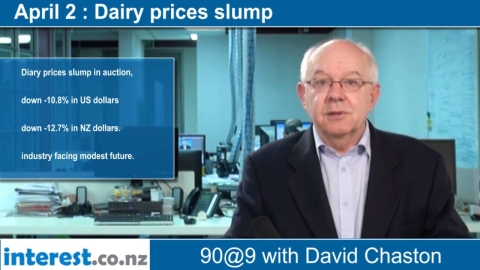

US factories regain momentum; job growth questions; AU banks resist capital requirements; dairy prices fall hard; oil and gold up; bond yields lower; NZ$1 = 74.7 US¢, TWI = 79.8

2nd Apr 15, 7:23am

73

US factories regain momentum; job growth questions; AU banks resist capital requirements; dairy prices fall hard; oil and gold up; bond yields lower; NZ$1 = 74.7 US¢, TWI = 79.8

US consumer confidence rising; Greece's plan rejected, looks to Russia; China gets deposit insurance; RBA pressured to cut; bonds, oil and gold unchanged; NZ$1 = 74.7 US¢, TWI = 80

1st Apr 15, 7:25am

4

US consumer confidence rising; Greece's plan rejected, looks to Russia; China gets deposit insurance; RBA pressured to cut; bonds, oil and gold unchanged; NZ$1 = 74.7 US¢, TWI = 80

US savings rise; US house sales rise; China cuts deposit requirements; oil and gold prices lower; NZD edges closer to parity; NZ$1 = 75.2 US¢, TWI = 80.2

31st Mar 15, 7:25am

21

US savings rise; US house sales rise; China cuts deposit requirements; oil and gold prices lower; NZD edges closer to parity; NZ$1 = 75.2 US¢, TWI = 80.2

Inflation is not dead, it is heading for 5% says Roger J Kerr who has 'a thousand words' to support that in two short images

31st Mar 15, 6:32am

25

Inflation is not dead, it is heading for 5% says Roger J Kerr who has 'a thousand words' to support that in two short images

US growth cools, confidence holds; Greece eyes drachma comeback; China wary of deflation; Aust to tax bank deposits; bond yields rise; oil and gold falls; NZ$1 = 75.6 USc, TWI = 80.2

30th Mar 15, 7:01am

18

US growth cools, confidence holds; Greece eyes drachma comeback; China wary of deflation; Aust to tax bank deposits; bond yields rise; oil and gold falls; NZ$1 = 75.6 USc, TWI = 80.2

Arabian Peninsula woes; Oil price surges; US jobless claims fall; yields higher; NZ$1 = US75.62

27th Mar 15, 8:32am

4

Arabian Peninsula woes; Oil price surges; US jobless claims fall; yields higher; NZ$1 = US75.62

US durable goods orders fall; Greece caught short; RBA worried about commercial property; 'rigged remuneration'; yields lower; commodity prices higher; NZ$1 = 76.1 USc, TWI = 80.4

26th Mar 15, 7:25am

6

US durable goods orders fall; Greece caught short; RBA worried about commercial property; 'rigged remuneration'; yields lower; commodity prices higher; NZ$1 = 76.1 USc, TWI = 80.4

US CPI suggests inflation uptick; US new home sales jump, factories busier; EU factories also busier; China sees slowdown; NZ$1 = 76.4 USc, TWI = 80.7

25th Mar 15, 7:26am

1

US CPI suggests inflation uptick; US new home sales jump, factories busier; EU factories also busier; China sees slowdown; NZ$1 = 76.4 USc, TWI = 80.7

US home sales rise; ECB commits to more printing; cash torrent causes global distortion; UST 10yr yields 1.93%; RBA security problem; NZD jumps again; NZ$1 = 76.3 USc, TWI = 80.6

24th Mar 15, 7:28am

18

US home sales rise; ECB commits to more printing; cash torrent causes global distortion; UST 10yr yields 1.93%; RBA security problem; NZD jumps again; NZ$1 = 76.3 USc, TWI = 80.6

Roger J Kerr says local importers should be topping-up hedging levels with current NZD/USD rates near the top end of the range

23rd Mar 15, 9:04am

Roger J Kerr says local importers should be topping-up hedging levels with current NZD/USD rates near the top end of the range

Greece teetering; China short of skills; Australian bank advisers 'abusing the system'; oil stable; gold recovers; NZD jumps; NZ$1 = 75.6 USc, TWI = 80.4

23rd Mar 15, 7:13am

11

Greece teetering; China short of skills; Australian bank advisers 'abusing the system'; oil stable; gold recovers; NZD jumps; NZ$1 = 75.6 USc, TWI = 80.4

US jobless claims steady; EU patience with Greece wearing thin; AU mining jobs evaporate; AU budget deficit jumps; benchmark bond yields slump; NZ$1 = 73.9 USc, TWI = 79.3

20th Mar 15, 7:24am

3

US jobless claims steady; EU patience with Greece wearing thin; AU mining jobs evaporate; AU budget deficit jumps; benchmark bond yields slump; NZ$1 = 73.9 USc, TWI = 79.3

US Fed sets up for rate rises but timing still unclear; Sweden cuts rates; China house prices fall; UST 10yr rates fall; NZD jumps; NZ$1 = 74.3 USc, TWI = 79.4

19th Mar 15, 7:18am

12

US Fed sets up for rate rises but timing still unclear; Sweden cuts rates; China house prices fall; UST 10yr rates fall; NZD jumps; NZ$1 = 74.3 USc, TWI = 79.4

WMP falls -9.6%, payout threat; US housing starts falter; inflation eludes Japan; Germans optimistic; Greece defies creditors; NZD falls; NZ$1 = 73.1 USc, TWI = 78.6

18th Mar 15, 7:26am

26

WMP falls -9.6%, payout threat; US housing starts falter; inflation eludes Japan; Germans optimistic; Greece defies creditors; NZD falls; NZ$1 = 73.1 USc, TWI = 78.6

US factory output sags; Russia cuts rate; China targets internet cars; GE Money plans growth spurt; crude oil prices fall, output rises; NZ$1 = 74.1 USc, TWI = 79.5

17th Mar 15, 7:20am

20

US factory output sags; Russia cuts rate; China targets internet cars; GE Money plans growth spurt; crude oil prices fall, output rises; NZ$1 = 74.1 USc, TWI = 79.5

Roger J Kerr says the risk of medium to long term rates increasing is dependent upon US bond market movements, not the RBNZ or the NZ economy or our inflation

16th Mar 15, 4:36pm

2

Roger J Kerr says the risk of medium to long term rates increasing is dependent upon US bond market movements, not the RBNZ or the NZ economy or our inflation

US debt limit brinkmanship resurfaces; China opens up, gets more support for AIIB; GE Money sells consumer arm; UST 10yr yields up; oil down; NZ$1 = 73.3 USc, TWI = 79

16th Mar 15, 6:59am

6

US debt limit brinkmanship resurfaces; China opens up, gets more support for AIIB; GE Money sells consumer arm; UST 10yr yields up; oil down; NZ$1 = 73.3 USc, TWI = 79