TWI

90 seconds at 9 am: Italian stocks fall 5% and bond yields spike after comedians create electoral vacuum; Rabobank faces LIBOR rigging fine; France calls for ECB to join 'currency wars'

27th Feb 13, 8:51am

3

90 seconds at 9 am: Italian stocks fall 5% and bond yields spike after comedians create electoral vacuum; Rabobank faces LIBOR rigging fine; France calls for ECB to join 'currency wars'

90 seconds at 9 am: Italian election outcome confused, euro at risk; China PMI falls unexpectedly; tough US budget deal emerging; Aussie banks in China food focus; NZ$1 = US$0.838, TWI = 76.6

26th Feb 13, 8:43am

15

90 seconds at 9 am: Italian election outcome confused, euro at risk; China PMI falls unexpectedly; tough US budget deal emerging; Aussie banks in China food focus; NZ$1 = US$0.838, TWI = 76.6

Roger J Kerr says watch the Canadian dollar and you may see the future for the NZD is a lower track. Your view?

26th Feb 13, 7:59am

Roger J Kerr says watch the Canadian dollar and you may see the future for the NZD is a lower track. Your view?

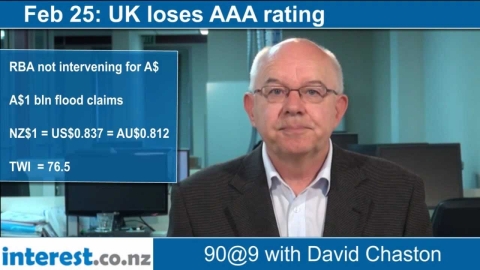

90 seconds at 9 am: UK downgraded; Italians voting - deadlock predicted; US manufacturing expands; Australia won't intervene on currency; floods costly; NZ$1 = US$0.837, TWI = 76.5

25th Feb 13, 8:51am

11

90 seconds at 9 am: UK downgraded; Italians voting - deadlock predicted; US manufacturing expands; Australia won't intervene on currency; floods costly; NZ$1 = US$0.837, TWI = 76.5

90 seconds at 9 am: Global stock markets fall; poor EU data; France at risk; Libor 'made up'; China tackles housing, credit growth; NZ$1 = US$0.836, TWI = 76.3

22nd Feb 13, 8:44am

14

90 seconds at 9 am: Global stock markets fall; poor EU data; France at risk; Libor 'made up'; China tackles housing, credit growth; NZ$1 = US$0.836, TWI = 76.3

90 seconds at 9 am: Equity markets falter; oil down sharply; gold lower; King outvoted; big Japan deficit; Foxconn freezes hiring; NZ$1 = US$0.837, TWI = 76.5

21st Feb 13, 8:45am

11

90 seconds at 9 am: Equity markets falter; oil down sharply; gold lower; King outvoted; big Japan deficit; Foxconn freezes hiring; NZ$1 = US$0.837, TWI = 76.5

John Walley explains why he thinks our 1,000 significant exporters should get policy help on the exchange rate and why that won't really affect workers. Your view?

20th Feb 13, 3:18pm

27

John Walley explains why he thinks our 1,000 significant exporters should get policy help on the exchange rate and why that won't really affect workers. Your view?

90 seconds at 9 am: Dairy prices rise; Dow up; German investors confident; new US budget plan; US Fed worries about image; PPP failure; NZ$1 = US$0.847, TWI = 77.0

20th Feb 13, 8:52am

10

90 seconds at 9 am: Dairy prices rise; Dow up; German investors confident; new US budget plan; US Fed worries about image; PPP failure; NZ$1 = US$0.847, TWI = 77.0

90 seconds at 9 am: Germans securitising SME debt as 'covered bonds'; TD rates to fall; Draghi worries about USD:EUR; NZ$1 = US$0.845, TWI = 77.0

19th Feb 13, 8:46am

11

90 seconds at 9 am: Germans securitising SME debt as 'covered bonds'; TD rates to fall; Draghi worries about USD:EUR; NZ$1 = US$0.845, TWI = 77.0

Roger J Kerr says fx market intervention by the RBNZ is not going to happen, and a weaker AUD and EUR against the USD means the NZD will come back down. Your view?

18th Feb 13, 3:49pm

2

Roger J Kerr says fx market intervention by the RBNZ is not going to happen, and a weaker AUD and EUR against the USD means the NZD will come back down. Your view?

90 seconds at 9 am: Oil and gold fall; dairy up; G20 talks tough on currencies but does nothing; NZ$1 = US$0.844, TWI = 76.8

18th Feb 13, 8:43am

8

90 seconds at 9 am: Oil and gold fall; dairy up; G20 talks tough on currencies but does nothing; NZ$1 = US$0.844, TWI = 76.8

90 seconds at 9 am: Record TWI; Buffett bids for Watties; EU economy shrank, to adopt FTT; Japan's economy shrank too; CBA rejects outsourcing; NZ$1 = US$0.847, TWI = 76.9

15th Feb 13, 8:38am

14

90 seconds at 9 am: Record TWI; Buffett bids for Watties; EU economy shrank, to adopt FTT; Japan's economy shrank too; CBA rejects outsourcing; NZ$1 = US$0.847, TWI = 76.9

NZD opens today at record post-float high; TWI = 76.94 exceeding July-07 high of 76.88

15th Feb 13, 6:43am

4

NZD opens today at record post-float high; TWI = 76.94 exceeding July-07 high of 76.88

Christian Hawkesby notes everyone is talking about 'currency wars'; with more consumption and investment the NZ economy is 'accelerating'

14th Feb 13, 5:25pm

36

Christian Hawkesby notes everyone is talking about 'currency wars'; with more consumption and investment the NZ economy is 'accelerating'

90 seconds at 9 am: US retail sales stuck; 'bullish for growth'; ING fires staff; UK facing inflation; Swiss fight house price rises with higher capital requirements; NZ$1 = US$0.841, TWI = 76.3

14th Feb 13, 8:44am

8

90 seconds at 9 am: US retail sales stuck; 'bullish for growth'; ING fires staff; UK facing inflation; Swiss fight house price rises with higher capital requirements; NZ$1 = US$0.841, TWI = 76.3

90 seconds at 9 am: G7 currency wars confusion; Dow above 14,000; Mixed signals from Barclays; Aussie mortgage market stalls; NZ$1 = US$0.843, TWI = 76.4

13th Feb 13, 8:44am

4

90 seconds at 9 am: G7 currency wars confusion; Dow above 14,000; Mixed signals from Barclays; Aussie mortgage market stalls; NZ$1 = US$0.843, TWI = 76.4

90 seconds at 9 am: Irish push Basel III early for EU banks; Germans say no to devaluation; US ready for cliff; Aussie mortgage approvals fall; NZ$1 = US$0.837, TWI = 76.1

12th Feb 13, 8:45am

4

90 seconds at 9 am: Irish push Basel III early for EU banks; Germans say no to devaluation; US ready for cliff; Aussie mortgage approvals fall; NZ$1 = US$0.837, TWI = 76.1

90 seconds at 9 am: China biggest trading nation; EU adopts reduced budget; BofE pessimistic; devaluation trouble; NZ$1 = US$0.836

11th Feb 13, 8:44am

1

90 seconds at 9 am: China biggest trading nation; EU adopts reduced budget; BofE pessimistic; devaluation trouble; NZ$1 = US$0.836

90 seconds at 9 am: ECB's Draghi warns about strong euro; Dow falls; NZ$ weaker vs US$, but not euro; BoE's Carney sticks with inflation targeting

8th Feb 13, 8:47am

4

90 seconds at 9 am: ECB's Draghi warns about strong euro; Dow falls; NZ$ weaker vs US$, but not euro; BoE's Carney sticks with inflation targeting

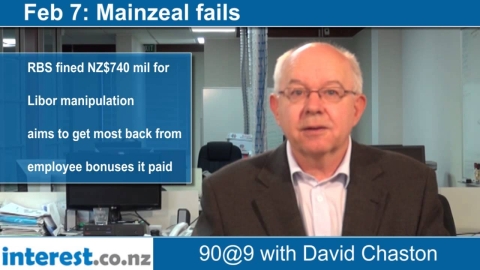

90 seconds at 9 am: BNZ puts Mainzeal in receivership; RBS fined over Libor, to claw back bonuses; China to need less coal; Aussie retail sales fall; NZ$1 = US$0.843 TWI - 76.3

7th Feb 13, 8:49am

2

90 seconds at 9 am: BNZ puts Mainzeal in receivership; RBS fined over Libor, to claw back bonuses; China to need less coal; Aussie retail sales fall; NZ$1 = US$0.843 TWI - 76.3

90 seconds at 9 am: Dutch bank nationalised; sharp US and UK bank crackdowns; Visa sued in Australia over fx conversion; Dow down, gold up; NZ$1 = US$0.846 TWI - 76.3

5th Feb 13, 8:45am

8

90 seconds at 9 am: Dutch bank nationalised; sharp US and UK bank crackdowns; Visa sued in Australia over fx conversion; Dow down, gold up; NZ$1 = US$0.846 TWI - 76.3

90 seconds at 9 am: US jobs expansion; Chinese PMI marking time, Aussie manufacturing in big contraction; Westpac makes bid for HK bank stake; NZ$1 = US$0.844 TWI - 76.1

4th Feb 13, 8:49am

2

90 seconds at 9 am: US jobs expansion; Chinese PMI marking time, Aussie manufacturing in big contraction; Westpac makes bid for HK bank stake; NZ$1 = US$0.844 TWI - 76.1

NZD ends week in NY trading higher than the last time the RBNZ intervened. TWI at 76.1, up sharply against AUD, JPY and GBP

2nd Feb 13, 12:13pm

4

NZD ends week in NY trading higher than the last time the RBNZ intervened. TWI at 76.1, up sharply against AUD, JPY and GBP

The RBNZ has sold NZ$¼ billion in the currency markets recently. Is this an attempt to push the NZ$ down?

30th Jan 13, 3:53pm

6

The RBNZ has sold NZ$¼ billion in the currency markets recently. Is this an attempt to push the NZ$ down?

HiFX's Dan Bell on currency wars, Japanese inflation targeting, and how the RBA may force the RBNZ's hand on the OCR this year

25th Jan 13, 3:58pm

1

HiFX's Dan Bell on currency wars, Japanese inflation targeting, and how the RBA may force the RBNZ's hand on the OCR this year