It's a big new survey, the first official results are in - and they are not what the Reserve Bank (RBNZ) would have wanted.

Results of the RBNZ's new quarterly Tara-ā-Umanga Business Expectations Survey show Kiwi businesses are expecting inflation to rise across all the time periods featured in the survey.

This follows a similar result in the more longstanding RBNZ Survey of Expectations that came out last Friday and provides something of a headache and plenty to think about for the RBNZ ahead of its next review of the Official Cash Rate (OCR) on Wednesday, May 28.

The RBNZ has spent a considerable amount of time and effort creating the new business survey and clearly intends for it to become a key resource over time. It has been piloting the survey and has included the pilot results with the first official results for comparative purposes.

The notable thing about the new survey - and an obvious reason why it should become influential - is that it has a big sample size.

The data for this quarter were obtained from 636 businesses across a wide range of sectors by Research New Zealand – Rangahau Aotearoa on behalf of RBNZ.

The researchers went into the field on April 22, 2025, following Stats NZ’s March Consumers Price Index (CPI) release on April 17, 2025. Annual CPI inflation for the March 2025 quarter was 2.5%, up from 2.2% in the December 2024 quarter.

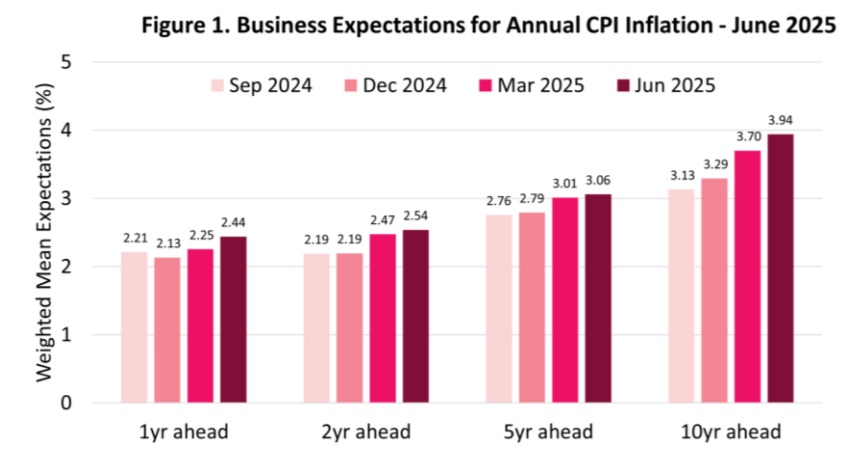

According to the summary of the results, overall, businesses’ expectations for annual CPI inflation "increased across all time horizons".

Mean one-year-ahead annual inflation expectations increased by 19 basis points from 2.25% last quarter to 2.44% this quarter.

Mean two-year-ahead annual inflation expectations increased by 7 basis points from 2.47% to 2.54%.

Mean five-year-ahead and 10-year-ahead annual inflation expectations increased to 3.06% and 3.94%, respectively.

The RBNZ tends to follow closely the views on two-year ahead inflation. And while the result in this first official survey gives expected two year inflation up seven basis points from last quarter at 2.54% its not a drastic outcome - given that the result is still within the RBNZ's targeted inflation range of 1% to 3%.

But the RBNZ will be undoubtedly bothered that the results across all timelines in this survey moved in the wrong direction.

The RBNZ works hard to stamp out expectations of future inflation because it is such expectations that will cause people to increase prices, in anticipation of inflation - and thus produce inflation. The self-perpetuating cycle.

In material released with the first survey results, the RBNZ said inflation expectations are important "because households and businesses reflect their expectations in their price- and wage-setting decisions".

"Improving the quality of our expectation surveys is part of the wider response to our 2022 review of how we formulate and implement our monetary policy. In this review, we identified several areas where better data could support high quality monetary policy decision-making."

How much credence the RBNZ will give to these first survey results we may find out next week when it reviews the OCR.

It's universally expected that the OCR will be dropped on May 28 from the current 3.50% to 3.25%, but there will be much interest in what signals the RBNZ gives for future decisions due on the OCR later in the year. Some economists are calling for the OCR to be dropped as low as 2.50% by the end of this year, but results like those in this survey may cast doubt on that.

The RBNZ gave this explanation of the new survey:

"Tara-ā-Umanga Business Expectations Survey is a representative sample survey of New Zealand businesses. The survey enhances our understanding of inflation and other macroeconomic expectations, to inform policy making and support research. It is our third expectations survey, alongside our Household Survey of Expectations and Survey of Expectations (professional forecasters, economists and industry leaders).

"Survey development commenced in 2023, and we ran pilot surveys in 2024. As a result of a successful development phase, we are commencing the regular quarterly publication of this survey.

"The results will be available prior to the quarterly Monetary Policy Statement, in line with our other expectations surveys.

"Field work for the May survey was run between the 22nd and 30th April 2025. For more information refer to the RBNZ website: Tara-ā-Umanga Business Expectations Survey (M15) - Reserve Bank of New Zealand - Te Pūtea Matua (rbnz.govt.nz) or contact: stats-info@rbnz.govt.nz"

4 Comments

Inflation expectations up.......worldwide Bond yields up.......interest rates to follow in short/medium order?

After however many years of hearing pundits tell me what happens when another indicator gets met, only to be totally wrong, who would know.

Most of the present and future inflation will be looked through.

Yeah.......it's just "Transitory" right.......

Get Real.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.