Warning signs are flashing for the New Zealand economy's performance in the second quarter of the year, with services sector activity slumping hard last month and mirroring a similar fall in manufacturing.

BNZ senior economist Doug Steel and economist Matt Brunt said the combined services and manufacturing data for May "look nothing short of disastrous".

"Sure, [first quarter] GDP growth looks set to be strong but there are clear warnings that the New Zealand economy has hit a brick wall in Q2, and this is despite the substantial revenue growth flowing from the agriculture sector. If there was ever an argument for the provision of further stimulus from the central bank [Reserve Bank], then this is it," they said.

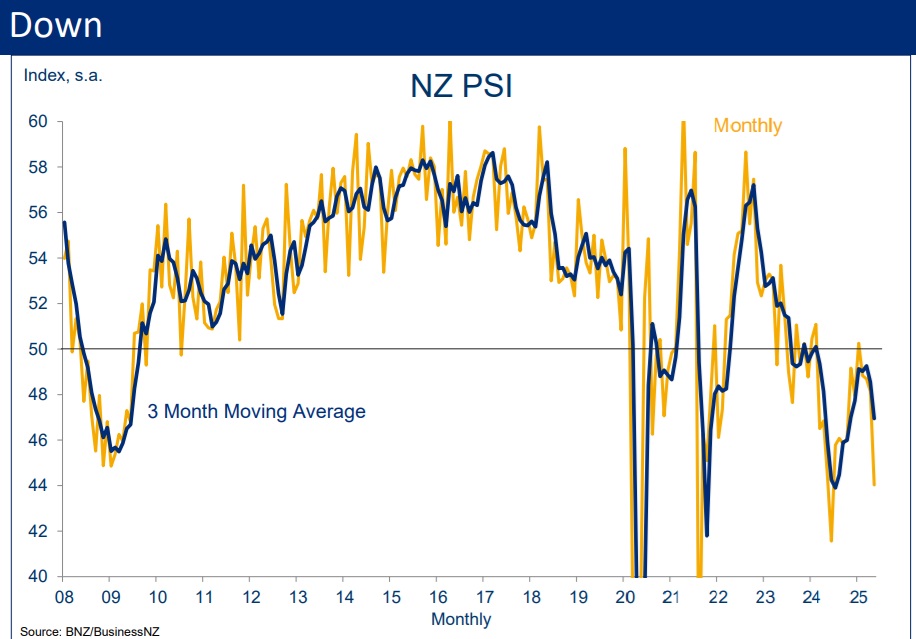

The BNZ – BusinessNZ Performance of Services Index (PSI) for May showed a substantial 4.1 drop in the month to 44. (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The average level during the history of the survey has been 53.0.

The services sector makes up about two-thirds of our GDP. This latest fall in fact takes the index back to levels seen in June 2024, which was the start of a steep recession.

"It is now at a level seldom seen and consistent with a rapidly shrinking services sector," Steel and Brunt said.

The latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI) that was released on Friday also came down with a bump in May, from 53.3 to 47.5.

Steel and Brunt said the two index results together, "are consistent with the economy returning to recession".

"We’re a long way from forecasting this, but the data are a reminder of just how vulnerable the economy currently is.

"Ironically, we anticipate this week’s Q1 GDP figures to show an increase of 0.7% for the quarter (data due on Thursday).

"Our economic forecasts are then for a modest recovery over the rest of the year.

"A key driver of this expectation was the recent strength in the combined PMI and PSI. The big question now is whether the suggested softening in activity will outweigh the starting point optimism."

13 Comments

"Sure, [first quarter] GDP growth looks set to be strong but there are clear warnings that the New Zealand economy has hit a brick wall in Q2, and this is despite the substantial revenue growth flowing from the agriculture sector

I'm still skeptical on the agricultural 'boom times'. Something doesn't add up. The narrative is that global dairy commodity prices, especially in Oceania, have surged to multi-year highs so far this year, driven by supply constraints and this strong export demand.

However, analysts have been anticipating strong downside risks in the second half of 2025 due to expanding supply and uncertain demand, particularly from China.

Plenty of contradiction on display. I would be wary of the snake oil being sold by the banks.

https://en.edairynews.com/global-dairy-commodity-prices-rise-strongly-i…

Here's a question for the author of the article - imagine you are a business owner operating in a contracting economy and imagine that interest rates fall to 2.5% and the cost of debt is now really low.

You have falling sales and a diminishing pipeline of future work to sustain your business and the overall economic outlook is grim - un-employment is rising and growth forecasts are falling. Given all of these factors - do you rush down to the bank and take out a big loan because interest rates are low?

You have falling sales and a diminishing pipeline of future work to sustain your business and the overall economic outlook is grim - un-employment is rising and growth forecasts are falling. Given all of these factors - do you rush down to the bank and take out a big loan because interest rates are low?

“Does a struggling salesman start turning up on a bicycle? No, he turns up in a newer car – perception, yeah? They got to trust me – I'm taking these guys into battle, yeah? And I'm doing my own stapling.”

- David Brent

Was once doing work for the owner of a large kiwifruit block. He was looking for a new management team. I said so n so was looking for new orchards. He said yes he's really excellent, but nah he drives a shitty 20yrold station wagon . He was prepared to sacrifice 100s $1000s just to have a nice shiny car owning manager. I just shook my head, and left Te Puke for better places .

I think the govt, MFAT, NZTE could all learn much from Murray (Flight of the Conchords). Why? Murray was constrained and realized that it's all about sales. He didn't have the flash Harry budgets of the Aussies. Even now, there seems to be too much gin slinging, workshops, traveling circus, etc among our camp.

Interest rates set by the RBNZ are NOT a stimulus - interest rates are set based on the condition of the underlying economy - they are a lagging indicator.

Yes and no. Sure, interest rates are lowered because of weak economic output, which supports your claim that they are a lagging indicator. But they will result in less money spent on interest expenses, hence more money available to be spent into the economy. So, yes lower interest rates will stimulate the economy, it's just that this process takes time, on average about 18 months.

https://www.oneroof.co.nz/news/man-its-a-big-drop-new-cvs-spark-confusion-as-council-braces-for-barrage-of-calls-47702

The animal spirits have not been released it seems?

Goodall said that based on the latest sales data, Auckland’s CVs might have been hit even harder than the average 9% drop if they had been carried out this month.

“The other key thing here is that they're very old now. Have property values changed much since May last year? I think the Auckland figure has seen a further 2.7% decline since last year. People are going, ‘Man, it's a big drop’, but in many cases, people might find that their property would sell for less than CV right now.”

This from yesterday about unpcoming Q1 GDP figures:

by Yvil

15th Jun 25, 10:51am

Disregard this article completely, the data is utterly out of date. Yes, the March 2024 quatery GDP figures will likely better than last year, but these are figures 3-5 MONTHS OLD, and things have deteriorated significantly since April 2025!

Sounds much like Auckland CVs ?

Keep your mortgage terms short folks. There's more room for further falls.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.