Well, thank goodness for the primary sector.

It's continuing to go gangbusters and is creating jobs into the bargain.

But elsewhere in the economy, not so much.

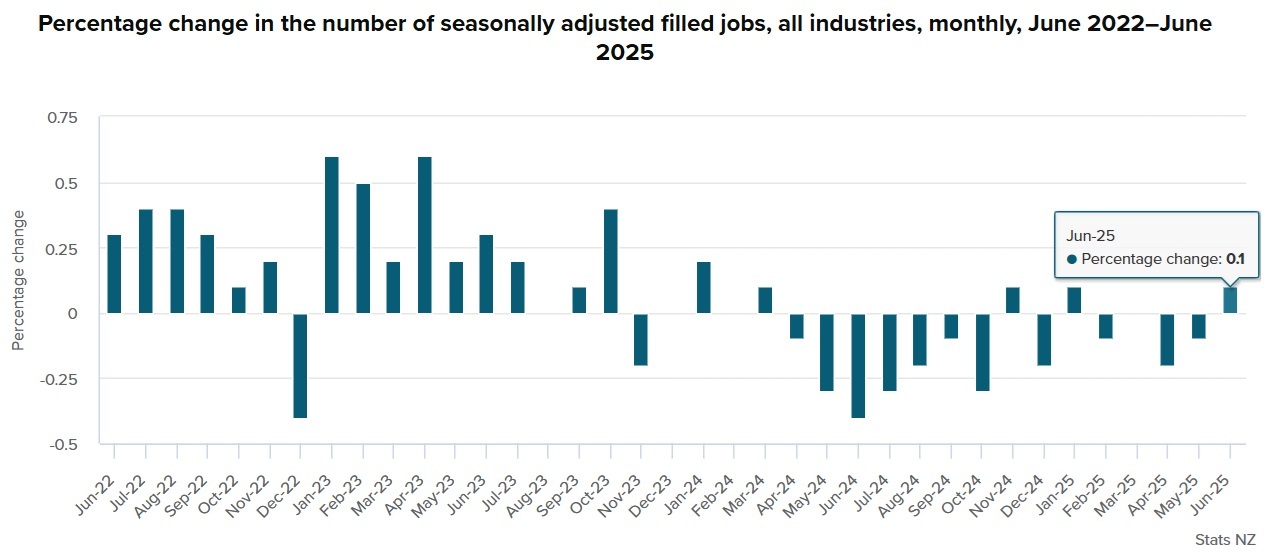

The latest figures from Statistics NZ's Monthly Employment Indicators (MEI) show that in June, on a seasonally adjusted basis, there was actually an increase of 3487 jobs (a 0.1% rise) taking the number of filled jobs to 2.34 million. This will be very welcome if it 'sticks' as a figure.

However, sorry to sound like a gloom-monger, but that figure needs to be taken with a bucket of salt because the recent track record of this data series is that figures are almost invariably revised down in subsequent months.

Indeed, the figures for May originally showed a 0.1% rise too - but with the latest release it's now been revised down to a 0.1% fall.

Since March of 2024 there's only been two months before now (November 2024 and January 2025) in which job numbers went up.

If the June figures indeed do end up being revised down it will mean we've gone five months without a rise in job numbers.

Things aren't looking too bright for the immediate future either, with the latest SEEK Employment Report showing a 3% fall in job ads during June after a 2% fall in May.

The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they have tended to be quite a good indicator of future trends.

The June quarter official employment and unemployment figures are due out on August 6. The RBNZ's most recent forecast in the May Monetary Policy Statement (MPS) is for a 0.2% rise in employment. Based on what we can see from the monthly MEI series, the central bank will likely be disappointed and we could even see a fall in job numbers in the quarter.

We will almost certainly see a rise in unemployment. The official unemployment figures for the March quarter as measured by Stats NZ's Household Labour Force Survey (HLFS) showed an unchanged 5.1%. The unemployment rate was just 4.0% at the start of last year. The RBNZ has forecast the unemployment number will rise to 5.2%. It's looking possible we may in fact see 5.3%.

Westpac senior economist Michael Gordon, commenting on the latest MEI figures, also noted that "this measure tends to be overstated on its initial release, so we suspect this will be revised to a small negative".

Gordon said the MEI results during the June quarter suggest a 0.3% fall in the HLFS employment measure.

"However, the biggest job losses have been among young people, who are more likely to drop out of the labour force altogether. This will dampen the extent to which the unemployment rate rises for the quarter."

ASB senior economist Mark Smith said he expects the June MEI figures to be revised lower as the "downward sequence of revisions shows few signs of abating".

Smith said the June quarter labour market data "are expected to show growing spare labour market capacity and cooling labour cost growth". This, he said, would be supportive of the RBNZ making a 25 point cut to the Official Cash Rate in August, which would take it down from the current 3.25% to 3.0%.

Getting back to the details of the latest MEI figures, these show that the primary sector is more than pulling its weight when it comes to job creation.

On a seasonally-adjusted basis in June, compared with May 2025 the primary industries saw a rise of 0.9% (934 jobs).

Meanwhile, goods-producing industries were down 0.2% (906 jobs), while service industries were up 0.2% (3,072 jobs).

In terms of actual overall figures, and looking at the comparison with 12 months ago, in June 2025 compared with June 2024, there were 2.34 million actual filled jobs, down 27,850 jobs (1.2).

By industry, the largest changes in the number of filled jobs compared with June 2024 were in:

- construction – down 6.0% (12,169 jobs)

- manufacturing – down 2.5% (5,850 jobs)

- professional, scientific, and technical services – down 2.7% (5,150 jobs)

- administrative and support services – down 4.7% (4,860 jobs)

- education and training – up 2.0% (4,289 jobs).

By region, the largest changes in the number of filled jobs compared with June 2024 were in:

- Auckland – down 1.9% (15,409 jobs)

- Wellington – down 2.3% (5,961 jobs)

- Manawatū-Whanganui – down 1.9% (2,184 jobs)

- Hawke’s Bay – down 1.6% (1,278 jobs)

- Northland – down 1.1% (831 jobs).

The young continue to bear the brunt of the job cuts. By age group, the largest changes in the number of filled jobs compared with June 2024 was in the 15 to 19 years age bracket, down 10% (12,410 jobs).

9 Comments

Last year I remember reading the forecasts from nearly every bank economist and commentator in NZ - with lower interest rates and lower taxes NZ consumers and businesses would deliver growth and recovery in 2025. These forecasts were very careful to avoid mentioning fiscal policy - as though it has no impact on the economy at all.

As a Keynesian I was sure I knew better than all of them. Turns out I was right. Government spending is the key to private sector success.

In a fiat currency monetary system the government creates new money when it spends - it is the spender of first resort. It underpins the private sector. Not the other way around.

I asked Chat GPT what this article is forecasting for the rest of 2025 and into 2026.

Chat GPT:

Unemployment will likely rise further

-

The unemployment rate is creeping up: from 4.0% (start of 2024) → 5.1% (March) → forecast 5.3% or higher.

-

Because many younger and discouraged workers are leaving the labour force entirely, the unemployment rate may understate the true level of slack.

-

Economists expect continued "growing spare capacity" — meaning more people are looking for work than jobs are available.

Outlook: A gradual rise in unemployment seems likely into late 2025, potentially peaking around 5.5–6.0%, depending on the pace of job losses.

Short term (rest of 2025):

-

Worse before better. Unemployment likely rises. Job growth remains weak. Business investment and hiring stay cautious. Interest rate cuts may not have much immediate impact.

Medium term (early–mid 2026):

-

If the RBNZ continues to ease and inflation stays low, we could see a gradual labor market recovery by mid-2026, but this depends on:

-

Business and consumer confidence returning

-

Government stimulus or support (currently unlikely)

-

Global economic stability (especially for NZ's exports)

-

Not a bad summary. Makes the recent pause by the RB all the more baffling.

One year, 27,850 jobs gone.

What an absolutely disastrous government we have, that are supposed to be "good at running the economy". Well we now have 27k fewer jobs than when they started, no part of that is good for the economy. That translates to lower tax take, lower spending, more requirement to borrow to fund core services that income and consumption taxes would have covered, higher debt to GDP ratio... basically all the things that National/Act campaigned on improving have got visibly worse.

And there is no end in sight, with almost all forecasters who previously said "2025 will be the year it all turns around" now saying "2026 will probably be the year it all turns around?".

2026 will be flat as well, this is a lost decade due to bad investment in housing hanging around peoples necks.

Its probably a reasonable time to be entering Uni right now, but a crap time to be graduating , hence so many new grads off to where they might find a job.

Fully agree, with Housing Debt still at preposterous levels, we are in for a some very tough years ahead, while the debt monkeys choke on the idiocy debt levels and leverage, many took on.

Many will drown on the debt swillings they engorged themselves on.

Pray for a recovery in the 2030s and hope it's not the "lost decades" that the much lesser, Japanese Debt binge created.

The debt can only be written off or paid back...many mortgages have 20-25 years to go,

a lot of housing debt was interest only and is now underwater.... this is the hidden risk.. its not being paid back at all yet.

Imagine impact on economy if banks changed their policy on this.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.