Economists are warning the Official Cash Rate (OCR) could climb back to 4% by 2027, as the Reserve Bank’s looser policy settings risk overheating the economy next year.

In a note released on Friday, Infometrics said it expects the OCR to hit 3% by mid-2027, with a risk it could go higher.

Chief forecaster Gareth Kiernan said the Reserve Bank (RBNZ) was “walking a fine line” between reigniting growth and overheating the economy, warning that stimulus already in the system will peak around mid-2026.

“There is an increasing chance that monetary policy is again overdoing the stimulus and exacerbating future ups and downs in the economic cycle,” he said.

Infometrics expects GDP growth to reach 2.3% by early 2027, with per capita growth comfortably above the 1.4% a year average of the 2010s.

“We expect households to respond with stronger spending growth in the near term, and we also see faster growth in business investment and residential construction in 2027. A new round of monetary policy tightening is likely to be needed from late 2026 to get interest rates back to neutral.”

“An official cash rate of 4% by the end of 2027 to bring economic growth back to a more sustainable rate is not our central view, but it’s not out of the question either,” he said.

Big calls

Economists from NZ’s big banks mostly welcomed the extra rate cuts. Kiwibank’s team said the RBNZ was “finally hearing the struggles of Kiwi businesses”, while ASB described it as a “clear-cut decision and the right one”.

But Infometrics was not alone in raising concern. Salt Funds chief economist Bevan Graham also said he was worried the RBNZ was overdoing it.

He said the 50 basis point cut in October was a “double handful of fertiliser” on the so-called ‘green shoots’, but the stimulus would be constrained by NZ’s weak potential growth rate.

“The upshot of that is that once the current, and admittedly large, amount of spare capacity in the economy is used up, we will likely hit growing pains quite early, requiring the bank to step on the brakes again quite soon, possibly quite aggressively.”

Graham said the neutral OCR was likely between 3% and 3.5%. The further it drops below that range, the sharper the hikes that may follow. He said borrowers, home buyers, and investors should not expect current low rates to last beyond early 2027.

“I do wonder if the RBNZ is in a pattern of exacerbating the economic cycle to smooth inflation. It would be great if we’re not sitting here in a year’s time debating whether the RBNZ over did it again. Again – only time will tell.”

Zealots on balance

SFS Private Wealth chief investment officer John Carran also questioned whether the RBNZ was being “overzealous” by moving the OCR too far and too fast.

“A more incremental approach, with further OCR cuts contingent on evolving economic and inflation signals, may deliver a more sustainable economic path than we've seen lately,” he said.

The RBNZ’s 50 basis point cut was unanimously backed by the Monetary Policy Committee, suggesting none of its members strongly shared those concerns.

RBNZ Chief economist Paul Conway told Interest.co.nz there was a “good chance” inflation could break out of the 1% to 3% target band this quarter, but also a risk of a “prolonged period of excess capacity”.

He said the double cut was meant to “rebalance” those risks after weak data releases, and that there was no guarantee of further easing now the outlook was more balanced.

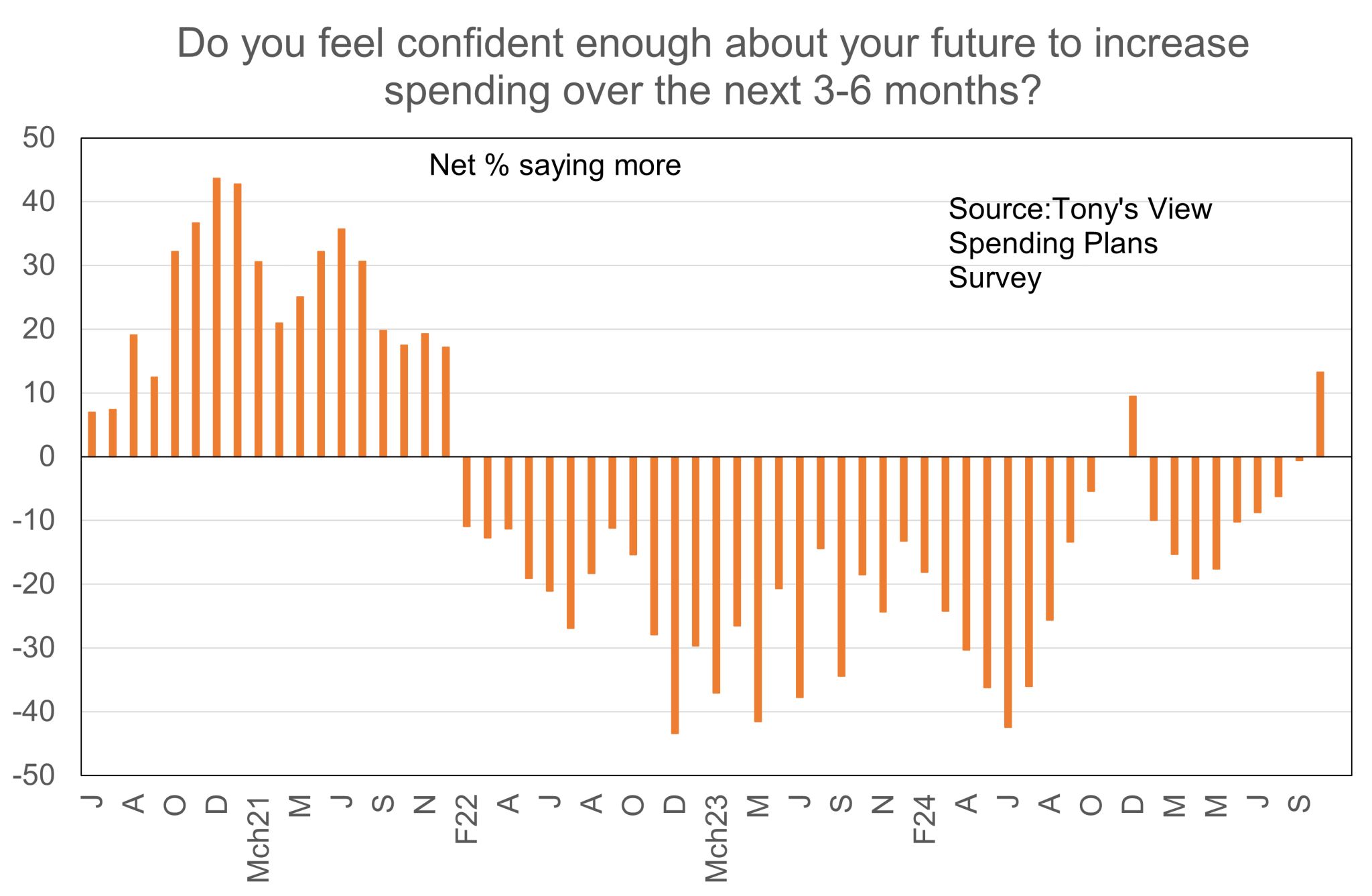

Economic commentator Tony Alexander said the surprise cut had sparked a strong reaction in one of his regular surveys, with the net share of people planning more purchases in the next three to six months rising from -1% to +14%.

“This is the best result in almost four years and shows light at the end of a long tunnel for the beleaguered retail and hospitality sectors. But note how quickly the +10% of December 2024 disappeared; the missing element still is employment confidence,” he said.

If the enthusiasm holds, it will add to other stimulatory forces now being unleashed on the economy.

Infometrics said the government was likely to accelerate infrastructure delivery ahead of next year’s election, while strong export prices should keep supporting provincial growth through 2026.

That raises the risk inflation won’t fall from 3% as quickly as forecasters expect, potentially forcing the RBNZ to lift the OCR back above neutral sooner than planned.

Conway said he worries about inflation expectations becoming embedded but doesn’t see underlying pressures as particularly strong. He said inflation would be at 2% if non-market prices such as council rates and car registration fees were excluded from the Consumers Price Index.

He added that the neutral OCR was a moving target, and not a fixed point interest rates must return to in the future.

“It’s more of a zone than a specific number. And in different markets that are influenced by interest rates, neutral can be different. I think it’s a rough approximation of an abstract concept,” he said.

12 Comments

Conway said he worries about inflation expectations becoming embedded but doesn’t see underlying pressures as particularly strong.

I think the mighty Jfoe says inflation expectations as an important indicator is mumbo jumbo. I think he's quite possibly right.

They went too high in the first place, were too slow to start cutting, and the cuts were too small. And now that the public are well and truly sick of being in an RBNZ engineered recession, they will probably end up cutting too far.

They don;t have the foresight to see 1yr into the future, and only react to 'the now' based on current information. You could say otherwise, but seeing their statements over the last 4 years, while they mention the long term, most is focused on the medium term at best which is foolish. Their job is to pre-empt spending behaviour based on macroeconomic indicators and act accordingly to their mandate of inflation band.

“We expect households to respond with stronger spending growth in the near term, and we also see faster growth in business investment and residential construction in 2027. A new round of monetary policy tightening is likely to be needed from late 2026 to get interest rates back to neutral.”

Sounds like little more than copium to me. Expecting h'holds to spend like drunken sailors when they're actively buying store brands doesn't add up.

Lots of households (like my household) have been smashing the mortgage due to the higher rates. Once the principal goes down and interest rates go down those households may start wanting to spend again. And there’s still plenty of oldies with cash to spend who are a bit subdued right now by the state of the economy. I do think there is an argument that spending could pick up big time either next year or especially the year after.

I'm one of them oldies. Fortunately my mortgage is paid off. The problem is some of my spend doesn't do the balance of payments any good. All imported stuff. Thank goodness I bought most of the components for my new PC build before the NZ$ dropped from about 60c to 57c. May spend a fair amount on a building project but that's problematic.

"Graham said the neutral OCR was likely between 3% and 3.5%."

Would anyone care to hazard a similarly guess as to a (non inflationary) distribution?

Depends how far out you look doesn't it? He's probably right in the longer term IMO.

No, it makes no difference 'how far out you look'....the empirical evidence shows 'inflation' to be unconnected to interest rates.

The RBNZ themselves admit as much when they say they cannot control 'tradeable inflation'....and we run a persistent trade deficit.

And nor do the supposed 'automatic stabilisers' work...as that same persistent trade deficit demonstrates.

Infometrics expects GDP growth to reach 2.3% by early 2027, with per capita growth comfortably above the 1.4% a year average of the 2010s.

That's a very optimistic per capita growth forecast given that per capita gdp has declined steadily over the last 30 years.

Kiernan is among the very large group of economists who have got it very wrong ever since the covid boom went bust.

The Reserve Bank has finally done the right thing. When your focus is only on inflation and none of your attention is on the current destruction of companies and productive capacity in the economy then destruction of the economy is what results. Action is needed to stop NZ from going down the gurgler and this is hopefully a prelude to some fiscal action on the part of central govt.

Australia's house prices are getting less affordable but they have full employment, a growing economy and are an attractive destination for an increasing number of New Zealanders who can't find work in their own country or who can't run their companies profitably due to lack of aggregate demand in NZ.

Meanwhile I listen to business people here saying 'this is the worst time I have been in since I started in business 40 years ago. It's never been this bad' And it's telling me that between them the govt and the RBNZ have really gone way too far. They are just starting to realise that it's a major screwup.

Houses are very affordable in places where there is no work and there is depopulation. Houses are unaffordable in major cities where all the jobseekers are trekking to. New Zealand needs to ensure that it maintains growth enough to avoid the depopulation curse.

Looking at TAs bar chart, the drop in confidence happened at the same time as the drop in the property market. Recovery in employment isn't enough. NZers need the 30% capital gains they think they're entitled to, to get the warm fuzzies back.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.