The latest filled jobs figures can be described as both expected and very unexpected.

And if that sounds gibberish, it relates to revisions to previous figures.

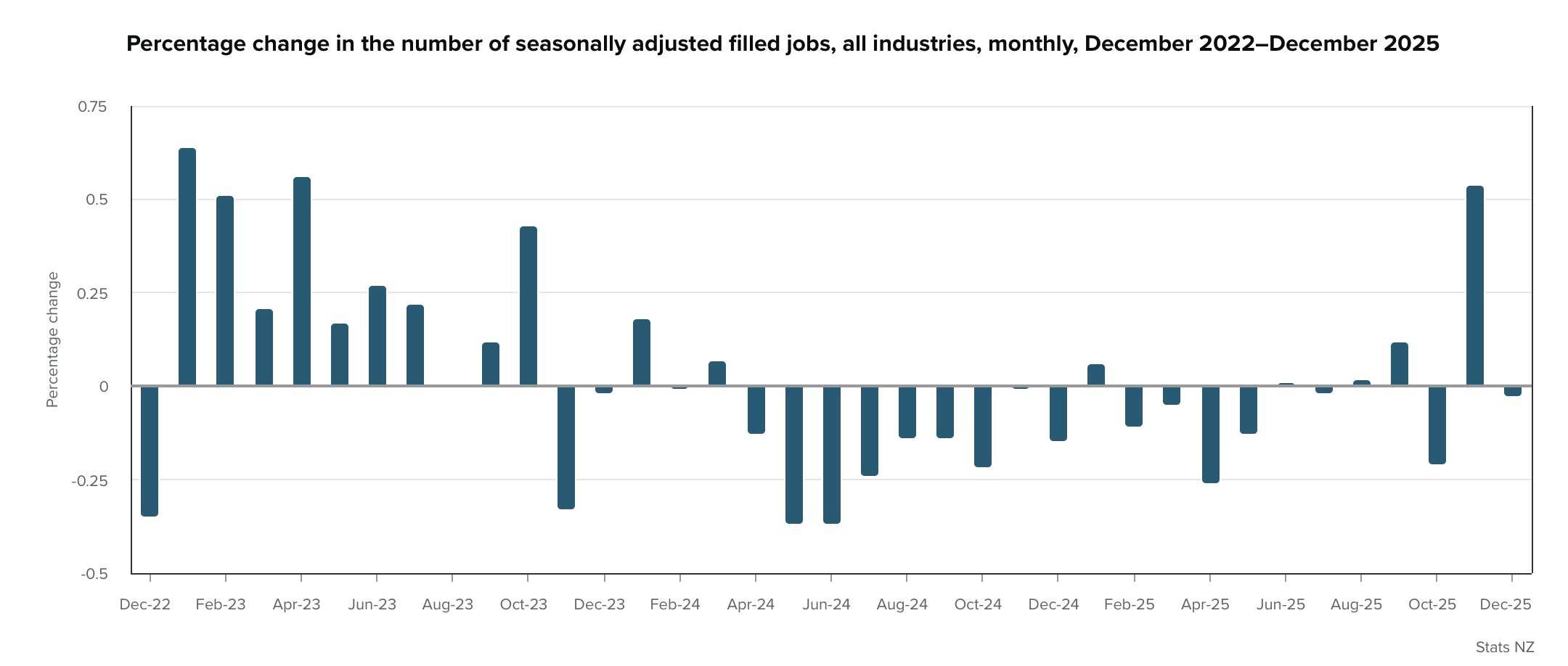

Latest Statistics NZ Monthly Employment Indicators (MEI) figures were officially described as 'flat' (IE 0.0%) for December, although there was a very small fall in the numbers. This was largely expected.

What was not expected was a very sharp upward revision to the November figures.

The recent history of this data series has shown that figures tend to be revised DOWN in subsequent months.

Therefore the decent 0.3% rise in filled jobs for November could reasonably have been expected to get a trim subsequently. However, the revised figure as shown with the latest release from Stats NZ has gone up, to just above a 0.5% gain.

That's actually the biggest rise in filled jobs since April 2023.

Since the start of 2024 the monthly figures have generally shown falls.

So, while the December figure shows a pause in jobs growth, the upwardly revised November figure bears out the suggestions that the economy is starting to recovery meaningfully.

Westpac senior economist Michael Gordon said the variation across November and December "looks to be largely a timing issue; the underlying trend appears to be that employment was stabilising towards the end of last year and even picking up in some sectors, though growth remains patchy".

"November was a rare instance of the jobs figures being revised up – typically the figures have been overstated on the initial release, due to incomplete information at the end of the month. That said, the initial +0.3% print for November was weaker than what was suggested by the weekly snapshots provided by Stats NZ. The revision brings the monthly seasonally adjusted results more in line with the weekly raw figures," Gordon said.

These latest figures come ahead of the official unemployment figures, which will be released by Stats NZ on Wednesday, February 4 as part of the suite of labour market data.

The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they nevertheless have tended to be quite a good indicator of future trends.

The latest MEI figures - particularly the November revisions - would therefore suggest we may soon start to see improvement in the unemployment figtures.

In the September quarter the unemployment rate rose to 5.3% from 5.2%, marking its highest point in nearly nine years. The Reserve Bank (RBNZ) forecast in its November Monetary Policy Statement (MPS) that the unemployment rate would still be 5.3% in the December quarter and remain there in the March 2026 quarter before very slowly starting to ease.

However, strength in the employment numbers as evidenced by the November figure, may yet see a different picture emerge and could yet indicate the economy is recovering faster than currently believed.

These are the key MEI figures (seasonally adjusted) for the December month, compared with November, as released by Stats NZ on Wednesday:

- all industries – flat (down 709 jobs) at 2.35 million filled jobs

- primary industries – down 0.2% (261 jobs)

- goods-producing industries – down 0.1% (433 jobs)

- service industries – flat (up 674 jobs).

In December 2025, there were 2.38 million actual (IE not seasonally adjusted) filled jobs, down 1,505 jobs (0.1%), compared with December 2024.

By industry, the largest changes in the number of filled jobs compared with December 2024 were in:

- construction – down 3.1% (6,118 jobs)

- health care and social assistance – up 1.9% (5,280 jobs)

- public administration and safety – up 2.9% (4,644 jobs)

- manufacturing – down 1.6% (3,849 jobs)

- education and training – up 1.5% (3,256 jobs).

4 Comments

In December 2025, there were 2.38 million actual (IE not seasonally adjusted) filled jobs, down 1,505 jobs (0.1%), compared with December 2024.

So, the overall number of jobs was less in December 2025 than it was in December of 2024. How does this indicate a recovery?

Economic recovery is not only just about creating jobs.

No but it's a fundamental part of it.

How does this indicate a recovery?

Because if you look at the graph, the rate of job losses is declining.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.