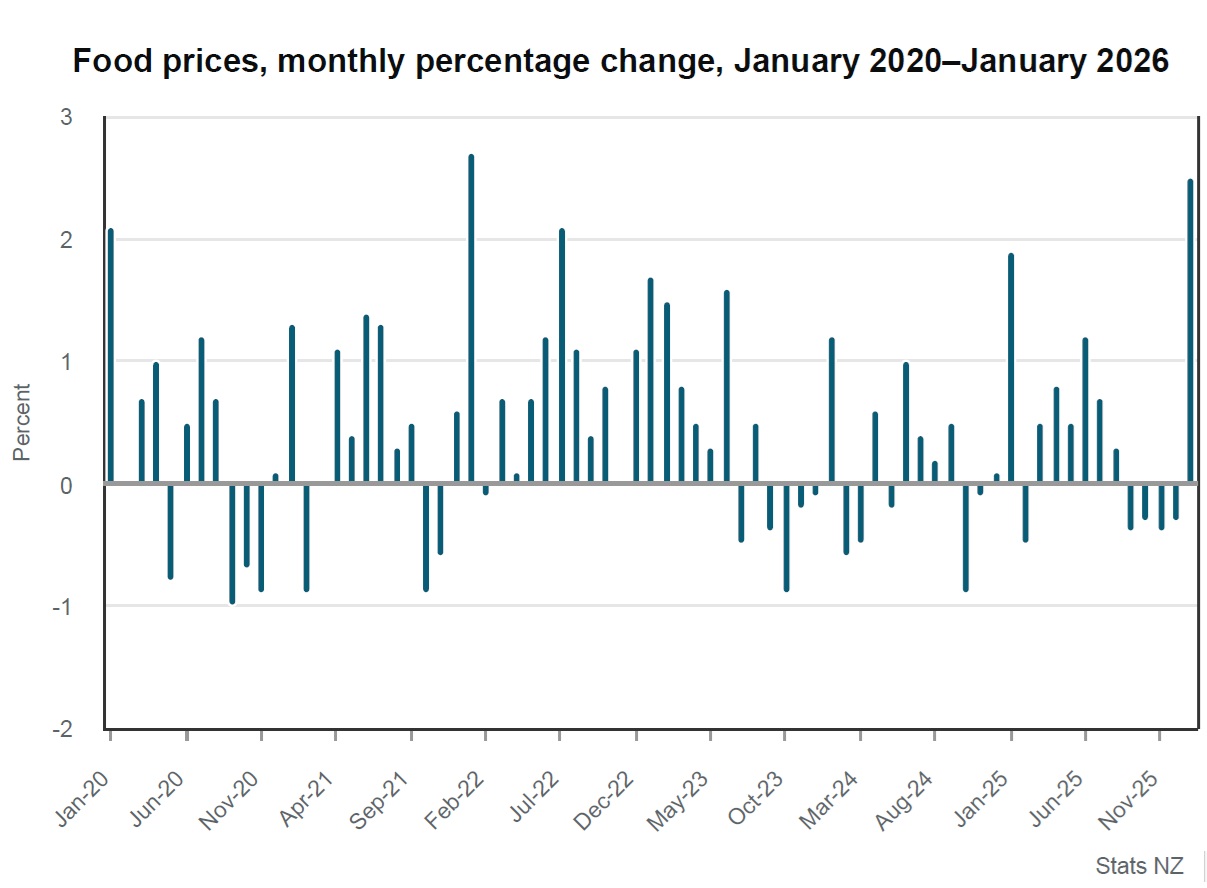

Food prices rocketed 2.5% last month - the biggest monthly rise in four years.

The sizable increase drove the annual rate of food price inflation as of January up to 4.6% from 4.0% in December.

Stats NZ says all food subgroups increased from December 2025 to January 2026.

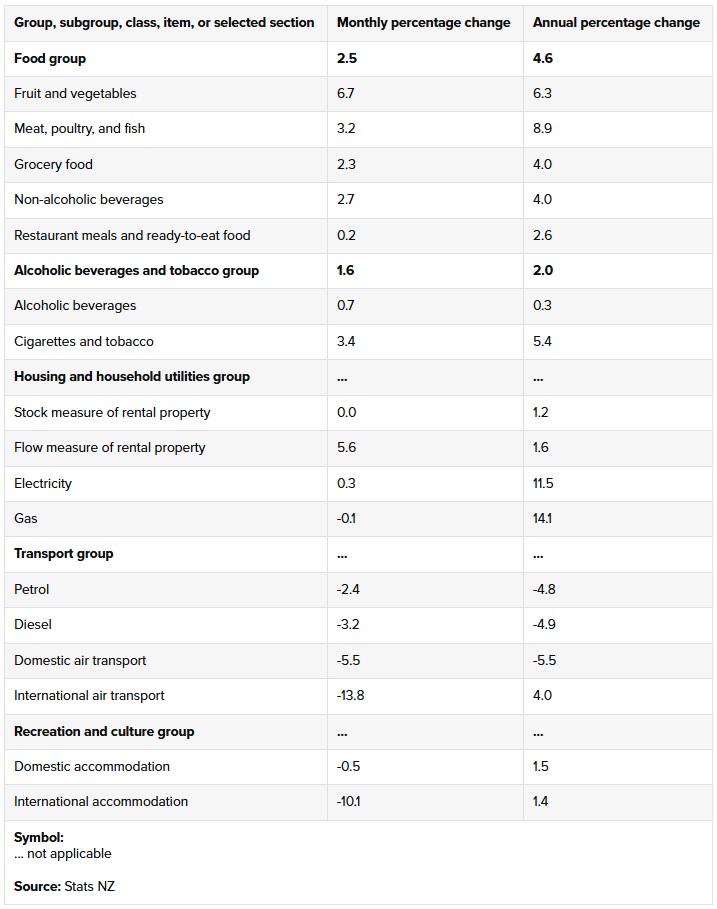

Higher prices for the grocery food group, up 2.3%, contributed the most to the monthly increase in food prices. This was followed by fruit and vegetables, up 6.7%.

The last time there was a food price rise of this magnitude was January 2022, when prices rose 2.7% during the period in which the Consumers Price Index (CPI), the official measure of inflation, was rising sharply to its ultimate peak of 7.3% in June 2022.

The latest spike in food prices might raise some concerns about the current rate of inflation.

As of the December quarter the CPI was recording an annual rate of inflation of 3.1%, which is outside the 1% to 3% target the Reserve Bank (RBNZ) has. Food prices make up about 18.5% of the CPI, while rents account for about 11%.

The RBNZ has its first review of the Official Cash Rate for 2026 tomorrow. No change is expected, but figures such as those released on Tuesday will increase nervousness about what might happen later in the year - although the food price rises are being offset by weaker prices elsewhere, which will actually raise hope and expectation that the CPI will move back under 3% in the current quarter.

Westpac senior economist Satish Ranchhod said January's prices update probably won't alarm the RBNZ, with higher food prices but softness in rents and other prices. "However, there was a shocking rise in chocolate prices ahead of Valentine's Day."

The food prices information was released as part of the monthly Selected Price Indexes (SPI). These make up about 47% of the components of the CPI, including some of the more volatile ones.

While the news on food prices is not cheery, there were some offsetting moves elsewhere in the indexes. Rents didn't change in the month and have risen just 1.2% in the past year, while airfares - which rocketed in December, saw something of an unwinding of that in January. Petrol and diesel prices decreased by 2.4% and 3.2% from December 2025 to January 2026, respectively.

ASB economist Wesley Tanuvasa said dormant rental inflation and easing energy inflation are welcome, but the food price inflation remains elevated and the global factors holding this up look longer lasting.

"Hawks and doves can argue the implications of high food prices on a household, but it is irksome for it to be advancing as headline CPI is outside of the target band."

Westpac's Ranchhod said that overall, the latest update on consumer prices was close to Westpac economists' forecasts, "and we expect that it won’t be too much of a surprise to the RBNZ ahead of their interest rate meeting on Wednesday".

"However, under the surface, we’re seeing divergent trends in prices in some important areas.

"Notably, food price inflation remains strong, while inflation in other areas has moderated, including rents and fuel.

"Putting this altogether, we continue to expect that annual inflation will ease back from the current elevated level of 3.1% over the course of this year. However, we still expect that inflation will remain above 2% for some time, with core inflation set to remain in the upper part of the RBNZ’s comfort zone," Ranchhod said.

Back on the food prices, Stats NZ said significant monthly price moves included:

The average price for:

• chocolate boxes was $12.57 per 250 grams box, up 62.8% monthly

• chocolate block was $6.89 per 250 grams, up 16.6% monthly

• roast lamb was $24.96 per kilogram, up 36.6% monthly

• tomatoes were $5.70 per kilogram, down 8.9% monthly

• milk was $4.81 per 2 litres, down 2.2% monthly

• yoghurt was $7.45 per six pack of 150 gram pottles, down 4.7% monthly.

In terms of the annual 4.6% food price increase, Stats NZ said higher prices for the grocery food group, up 4.0%, contributed the most to the annual increase. This was followed by meat, poultry, and fish, up 8.9% annually.

The average price for:

- beef porterhouse/sirloin steak was $45.48 per kilogram, up 22.9% annually

- chocolate block was $6.89 per 250 grams, up 20.5% annually

- white bread was $2.21 per 600 grams, up 57.9% annually

- takeaway coffee was $5.16 per cup, up 6.6% annually

- soft drinks was $3.32 per 1.5 litres, down 3.5% annually

- potato crisps was $2.10 per 150 grams, down 5.0% annually

- olive oil was $17.61 per litre, down 21.7% annually.

Stats NZ's prices and deflators spokesperson Nicola Growden said coffee drinkers may have noticed their takeaway coffee becoming more expensive, with prices up $0.32 over the past year.

"The last time there was an annual increase this high (of more than 30 cents) was in the 12 months to March 2024," she said.

"The price of a takeaway coffee is now $1.12 higher than five years ago."

Here is the detailed SPI information for January as supplied by Stats NZ:

7 Comments

$5.16 for a coffee, praise Allah for my espresso machine!

I’d like to know where I can get my latte for $5.16 - cafes I frequent are $6.50 to $7.00+

Apparently Gold Card at McDonalds a coffee is $2.50; must be those boomers driving the average down.

$7 what the hell. McDonald's sells coffee now? I'm out of touch on coffee matters.

However I complained the other day about a $21glass of wine that would have seemed small to a pygmy dwarf!

🥂

Stats NZ have a lot more chocolate in their basket than we do...

Ironically as groceries are a necessity this actually acts like an interest rate tightening on the overall economy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.