By Hamish Pepper & Chris Di Leva*

Looking back on 2021 it is interesting to ponder how it will go down in history. Could it be seen as the year that inflation had a momentary resurgence before fading back into the background, or the year that entered us into a new normal? Could it be seen as the year that the 2021 United Nations Climate Change conference (COP26) brought about meaningful climate change mitigation? Could it be seen as the year that sent Chinese stocks into a bear market or the year that provided the buying opportunity of a generation?

2022 will no doubt provide some of the answers to these questions, while likely raising many more. Here are our top 10:

1. COVID-19 treatments facilitate a return to relative normality

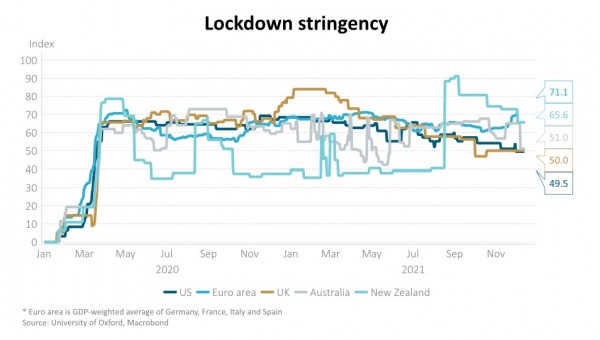

The Omicron variant has led to countries keeping relatively strict containment measures in place with many countries, particularly in Europe, recently tightening restrictions. However, treatments may continue to progress such that living with COVID-19 is increasingly possible. Recent trial results for Pfizer’s PAXLOVID were promising on several fronts. Firstly, it is a treatment for COVID and additionally it is administered orally and can be taken at home, potentially relieving pressure on hospital systems. This, combined with booster vaccinations, could allow broader re-opening, supply chain normalisation and healthcare pressures to ease.

2. De-carbonisation of energy

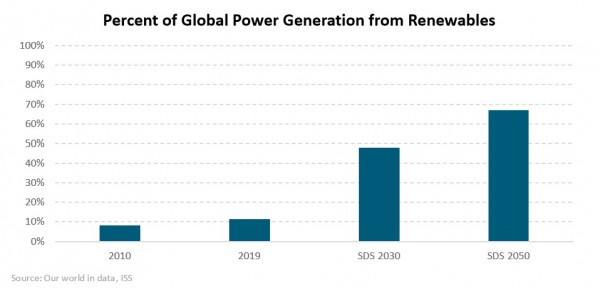

More than 130 countries have now set a target of reducing emissions to net zero by 2050, with many companies and investment funds also committing. To get on track with this target, countries need to cut emissions by 45% by 2030 compared to 2010 levels, a goal the world is not nearly on track to achieve. Achieving this goal will require a radical change to how we invest, live and produce energy. However, we are seeing green shoots of progress in capital markets; in the first half of this year alone there was almost as much money raised for climate-related venture capital funds than any other full year on record with just shy of US$15 billion raised. This only accelerated in H2, with Brookfield on track to raise a US$15 billion climate technology fund, along with numerous others. This will help drive the massive investment needed to get the world to 70% energy renewables by 2050 in the UN’s Sustainable Development Scenarios. Based on the global energy trends below which show renewables account for just 11% of energy, 2022 must bring about swift progress.

3. Growth vs. Value

Since the Global Financial Crisis (GFC), market dominance has moved away from asset-heavy companies (think oil companies and banks) and towards higher growth asset-light companies (think companies such as Microsoft, Amazon and Alphabet). Part of this shift has seen value companies, most typically characterised as companies with a lower price to earnings ratio and low price to book ratio, underperform. While the market focus tends to be on the valuation of growth stocks, we think that this ignores some disruptive trends that are going to negatively impact value stocks more than growth stocks.

As we look forward to 2022, these trends, particularly the energy transition and digitisation, could create value traps. The case for strong earnings growth for companies that are continuing to invest in technology increases the probability that high quality growth stocks maintain a large valuation premium.

4. High global inflation persists

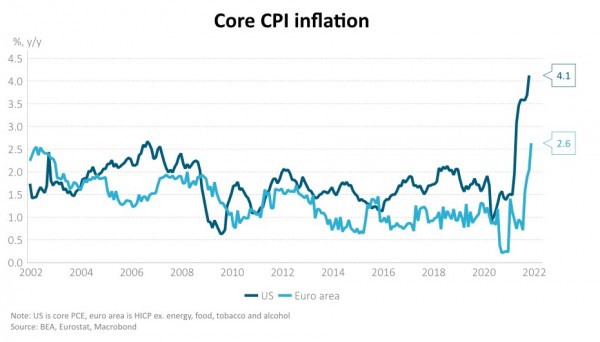

Economists and financial markets expect inflation to moderate through 2022 as supply chain disruption eases. The associated reduction in goods prices will mean that tradable inflation for many countries, including New Zealand, will approach zero in 2022 and perhaps become negative in 2023. In the US, annual core inflation is expected to drop from more than 4% currently to around 2.5%. This is also reflected in US breakeven inflation rates (the difference between nominal government bonds and those that provide protection against inflation).

There is a risk, however, that inflation pressures related to supply chain disruption give way to those from rising wages and higher housing rents. Developed economy labour markets are already showing signs of tightness, despite unemployment rates that are still above pre-COVID levels. Lower rates of labour force participation have helped US wages increase 3.7% in the past year, the most since 2004. Early evidence suggests that the US Phillips curve, that plots the relationship between the unemployment rate and wage growth, is much steeper than in the decade that followed the GFC. New Zealand wage growth was 2.5% y/y in Q3, the highest since 2009, and expectations of inflation are 3.0% y/y. Housing rent inflation is also likely to contribute to more persistent inflation. Developed economy house prices have increased notably from their pre-COVID levels. Recent work by the International Monetary Fund suggests that recent house price gains will continue to place upward pressure on rents for years to come. A high inflation environment is likely to see real assets, such as real estate and inflation-linked government bonds outperform. Within the economy, however, it may act to erode consumers’ purchasing power, reduce the real value of savings and distort price signals.

5. More persistent inflation requires a faster tapering of the US quantitative easing (QE) programme and more aggressive monetary policy tightening that may trouble asset prices

Fed tapering, despite its rapid pace, hasn’t had a large impact on financial markets so far. US 10-year nominal government bond yields are roughly where they were two months ago. US 10-year real yields are lower, at closer to a negative -1%. The muted bond market reaction reflects mild tightening expectations. For instance, the market currently implies the Fed, BoE and RBA will not increase policy interest rates beyond 2.0% over the next three years – despite neutral policy rates sitting somewhere between 1.5-2.0%. Should inflation prove more persistent, larger tightening cycles are likely be necessary to tame inflation. Historically, sharp and unexpected interest rate rises have troubled asset prices. Within an equity risk premium framework, where forward-looking earnings yields are compared to the real return from bonds, the prospect of large increases in real yields may create a challenge for equity markets if earnings aren’t able to beat expectations.

6. New Zealand housing market downfall

Most economists are forecasting very mild declines in house prices in 2022 as the labour market remains tight and economic activity is healthy. While the narrative of lower house prices may have filtered through the equity market, the fixed income market appears sanguine on house price risks. There is still 1.5% of Reserve Bank of New Zealand (RBNZ) official cash rate (OCR) hikes anticipated over the next 12 months. We think there are a confluence of challenges to the housing market, that may result in a larger fall in house prices than fixed income markets expect:

- Higher mortgage rates will challenge buyers and increase debt servicing costs for existing owners. Mortgage rates have already increased 1.5-2.0% and are likely to increase a further 1.0-1.5% over the coming year. The average outstanding mortgage rate is just 2.8%, almost 1.0% below the lowest current rate. Many households will soon be exposed to these higher rates, as about 60 per cent of outstanding mortgages are fixed for less than one year. In the case of a 25-year mortgage, repayments increase by around 10% for every one percentage point increase in mortgage rates.

- Tighter lending standards. The RBNZ has increased loan-to-value ratio (LVR) restrictions and are considering the imposition of debt-to-income (DTI) ratio restrictions. The Commerce Commission has also tightened lending standards from December 2021 to require greater verification of loan affordability and suitability under the Credit Contracts and Consumer Finance Act (CCCF Act).

- Unaffordability. New Zealand’s house price-to-income ratio is about 11, vs. 5-6 in the early 2000’s.

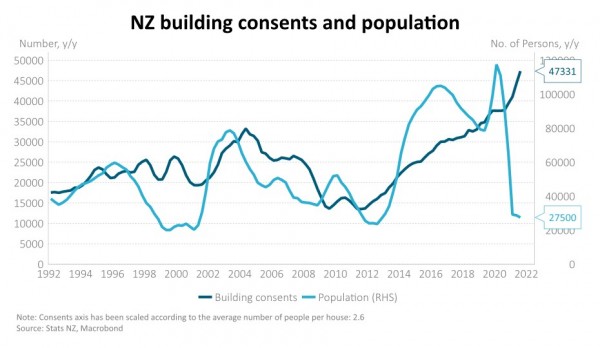

- Housing supply deficit is rapidly being resolved as building consents continue to grow faster than population. This may also be exacerbated if we see net outflows of New Zealanders as borders open.

- Less appealing investment. Rental yields have declined. Capital gain bright-line test has been extended from 5 to 10 years and interest costs are no longer allowed to be deducted from taxable income.

7. China eases policy more aggressively in response to the slowing property market

Most analysts recognise that China’s recent prioritisation of its longer-term goals of reducing income inequality, de-carbonisation and deleveraging is likely to cause a slowing in economic growth in 2022. Policy stimulus is expected to be limited and the property sector is likely to be a key source of economic weakness. The Chinese economy is expected to grow by about 5% in 2022, versus an average of almost 7% y/y in the five years prior to 2019.

Greater-than-expected policy support, however, may result in higher economic growth and present an opportunity for investors in 2022. The People’s Bank of China (PBoC) recently cut banks’ reserve requirement ratio (RRR) for the second time this year to increase liquidity. This might represent the beginning of a shift in policy priority from some of China’s longer-term goals to supporting the economy.

8. Equity markets continue to deliver double digit returns

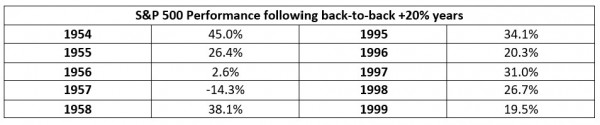

If you feel like we are in a rare period of high returns, your feeling is right. That often makes one think we are due for a big correction, but history would beg to differ. If markets hold their gains, it will be the third time post WW2 that shares have had back-to-back 20% years (if we include the US market as a barometer).

Bottom line: Bull markets don’t die of old age. While equity market gains have been strong in 2021, the gains have been relatively concentrated across major indices. For example, 60% of the Nasdaq’s year to gate gain is down to two stocks, whilst the New Zealand market is down in 2021. Chinese stocks are also down so far in 2021 due to regulatory concerns as well as concerns around the delisting of ADRs (American Depositary Receipts – instruments that allow Chinese companies to list in the US). A bounce back from the more unloved parts of the market, the resumption of buybacks and a capex boom are potential upside risks for 2022.

9. Geopolitics

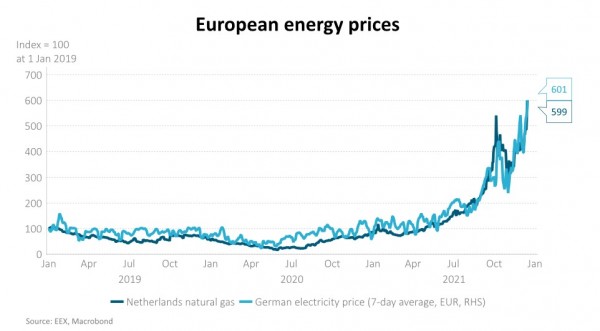

Tensions between Russia and Ukraine are high, and a partial re-invasion of Ukraine is possible in 2022. Ukraine offers strategic value to Russia as a land buffer to potential invaders and as access to the Black Sea. Russia has amassed 95,000-120,000 troops on the Ukrainian border in recent months and the military balance heavily favours Russia. Western country sanctions since 2014 have done little to change Russia’s approach to Ukraine and the threat of additional sanctions may not be enough to stop conflict. In the event of re-invasion and the imposition of additional sanctions, Russia may choose to limit energy exports at a time where global energy supply is already under pressure, particularly in Europe. This could create additional global inflation pressure and damage economic activity.

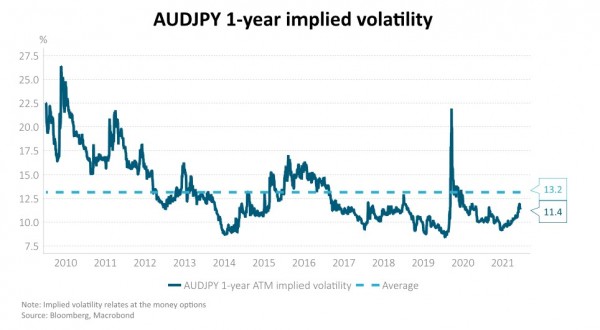

10. Increased volatility

Given the plethora of risks over coming year, financial markets appear somewhat complacent. The value of the Australian dollar versus the Japanese Yen (AUD/JPY) is often used as a proxy for risk sentiment. Australia is seen as being highly sensitive to global growth prospects and investor sentiment. It’s an open economy with a reliance on the rest of the world to fund it. Japan, in contrast, is seen as a “safe haven”. Its economy is relatively closed, and it is a net provider of savings to the world. We can use the price of 1-year AUD/JPY options (derivatives that give the holder the opportunity to buy or sell AUD/JPY in one year’s time at a rate determined today) as an indication of expected volatility over the coming year. This implied volatility is currently well below its post-GFC average.

Any 12-month period has scope for large surprises, COVID-19 has taught us that. The lesson may be to be ready for change, have a culture that enables adaptation and to ensure adequate access to liquidity.

*Hamish Pepper is Fixed Income & Currency Strategist and Chris Di Leva is a Portfolio Manager & Multi Asset Specialist at at Harbour Asset Management. This article first appeared here and is used with permission.

79 Comments

I think if we are going to see any meaningful 'correction' to the housing market, 2022 is going to be the year. If inflation persists and rates continue to rise there are going to be a lot of people exposed to some hefty increases when they come off their fixed term.

This combined with a brain drain when borders open, shift in housing supply/demand as more property's come on the market and new builds completed.....will be interesting.

The only thing interesting will be if house prices remain steady for the whole of 2022 and 2023, will finally talk on here of a crash finally come to an end ?

I’ve always felt there is a lack of financial literacy in NZ, particularly with property investment and the associated risks. Next year is damage limitation. It’s not if it’s going to fall… it’s how hard is it going to fall? Anyone with an opinion outside of that will have their eyes opened. I personally think it’s a really good thing for long term prosperity (sorry but I’m one of these fluffy rainbow types that likes to see everyone in society get a shot at home ownership without having to live on half a baked bean and wear loin cloths to scrape together a quarter of a million dollars for a lifetime of debt). Bring it on I say, and for the record, I have always owned the roof over my head and so do the majority of the DGM on here.

They are good people in my book, the ones with a heart.

I am sorry too... that your opinion of what 2022 housing brings is worth as much as "half a baked bean" and is simply your preference for what you think is best. No reasons given for why prices WILL fall or an estimate of how much by. I can hazard a guess of your estimate but I shall leave that to your good self. Merry Christmas!

Hi HW2. The main reason I feel that the ponzi will stutter is due to credit supply drying up. It’s simple really… FHB can’t and won’t be able to get the finance to pay the insane prices. That alone is enough to stall the upward momentum. Put all the over leveraged investors into the conversation and I can’t see how people like you still expect a flat market? It’s half baked. Merry Christmas to you and the family, ATB Tom.

Exactly.

Access to credit going down, cost of credit going up.

Referring to the property market as a "ponzi" makes your comment rather lightweight.

If it walks like a duck and quacks like a duck...

But it doesn't....

Yeah calling the housing market a Ponzi is a bit stupid. Sure its manipulated but what market isn't. Ultimately every market is one way or another.

Can we dispense with the name calling Carlos? Of course its a ponzi..same as the FIAT system we currently operate under. Love to hear another one of your predictions for BTC? Still counting on going to Zero in 2022?

Opinion: Without the eagerness of banks to lend increasing amounts of debt to house buyers, current "obscene" prices would not be possible, writes Michael Rehm.

https://www.auckland.ac.nz/en/news/2021/04/14/obscene-housing-ponzi-dri…

“Ultimately there’s no natural income streams to be able to service and repay loans. What you have is capital gains which are contingent on the game continuing. So it’s a Ponzi scheme. says Werner.

….and your heavyweight counter argument is??

I was being much more generous with my criticism than Carlos.

Using the "ponzi" in relation to the housing market is just plain wrong. It's the wrong word to use. Those that create ponzies are carted off to prison if they are caught because investors are paid returns that were not generated from the investments but stolen from new investors. Investors lose their investments and often there never was an investment in the first place. With property we have real returns being generated like rent as well as profits from actual sales. People are happy with their purchases. They get to live in real, actual houses. People are even happy when they get accepted as a tenant. There is a huge industry surrounding property investment along with laws and regulations and visibility that are entirely legitimate.

Consider using the term "investment bubble". Think of this as feedback because I am sure I am not the only one that rolls their eyes when reading the word ponzi.

Zachary,

I have often disagreed with you, but on this I entirely agree. It is just lazy thinking to equate the housing market with a ponzi scheme for the reasons you have laid out.

There is much wrong with the property market, but that still doesn't make it a ponzi scheme.

"Those that create ponzies are carted off to prison if they are caught because investors are paid returns that were not generated from the investments but stolen from new investors."

You do realise that Parliament is Sovereign?....the law could be passed tomorrow to criminalise property investors IF there were considered enough votes in it

I think it's a rather apt analogy, I mean if people refer to the market as a "property ladder", because that's a nice and easy way of understanding the process of benefitting from rising house prices without it actually being a ladder, why can't people also use Ponzi to describe what's happening without it actually being a ponzi?

It does have similarities. For instance, if the market were to fall next year, the biggest losers would be recent first home buyers.

Metaphors and analogies can be useful. You could refer to taxation as extortion for example but it would be somewhat sophomoric to do so on an investment focused web site.

I could be wrong, but I think people do use the word "ponzi" literally.

I mean if people refer to the market as a "property ladder", because that's a nice and easy way of understanding the process of benefitting from rising house prices without it actually being a ladder, why can't people also use Ponzi to describe what's happening without it actually being a ponzi?

Because property bubbles rely on marginal buyers paying higher prices, that is why it's referred to as a 'Ponzi', even if it's not technically correct.

Yes, and it's not intended to be a precisely analogous term.

SolidGranite

You seem to have a misunderstanding of the term “property ladder”.

The “property ladder” is simply trading up as one’s equity improves from paying down one’s mortgage. Yes, increase in one’s property value will assist that but the “property ladder” has been a feature for the past fifty years and has been a feature even when the market has been flat or falling.

Most of my generation have traded up the property ladder three or four times over that fifty years. The first houses we purchased were - as Brock would describe them - “shit holes”. My first home was on the border of Papatoetoe and Mangere East - it was all I could afford but it was never intended to be my home for life; five years later with the mortgaged paid down and increases in salary due to promotion and inflation I moved up the property ladder - in that period the market was relatively flat and was definitely not a factor in climbing up a rung.

As to a fall in the market; if you actually did do the maths regarding differentials, you will find that advantageous to trading up. Try doing so before I need to explain.

As an aside; I note Brock claims he wouldn’t buy one of the “shit holes”. That is one of his significant errors in judgement.

Getting on the Property Ladder and going up is what Life is all about for many humans.

Cool story.

There is nothing wrong with buying a "sh*thole", if it's priced appropriately, and if you are starting out.

Neither of those are things are the case.

But thanks for your pearls of condescending boomer wisdom. It's a rare gift to be such an expert on the individual circumstances of strangers.

I did the same, but started in Abbotsford - definite shit hole that we made slightly less shitty before trading up after 2-3 years. As for Brocks "condescending" comment, before he went on to call you a boomer. Most of us have bought and tidied up a house before trading up, the original purchase price is all relative though between then and now. I'm not a boomer, Gen X instead, but still did the same.

It has all the characteristics of a Ponzi only worse. At least Charles Ponzi was honest enough to steal real earned capital from individuals localising the destruction. Banks cowardly conjure credit out of nowhere and lend it into housing their preferred asset class, stealing from everyone not already vested in that asset class causing broader destruction on many levels.

Jimmy

You are welcome to keep on with that attitude - not a problem. Unsuccessful FHB thinking that are just using that as an excuse.

An important factor you overlook is Ponzis are about profiting and generally short term; buying a first house is about a home and long term.

You really need to step back - FHB bitching and finding excuses doesn’t get them any closer to their first home. In the past year RBNZ figures indicate 60,000 FHB got into their first home and bitching wasn’t a contributing factor in doing so.

Banks should only be able create currency for first home buyers. If they hadn’t unnecessarily created so much currency for investors then those first home buyers wouldn’t be in so much debt buying in such a greed distorted market. I have a house by the way.

Credit supply killed the housing bubble in Ireland.

House prices are closing in on their 2007 peak again now.

Hi Tom Jones the 4th. I am just curious but is it only the NZ property market that you refer to as a "ponzi" or is there others? ... "but wait theres more" (the line from Suzanne Paul)

Hi Home Wrecker the 2nd. It seems my use of the word ‘ponzi’ has triggered a few people. The day a DTI is introduced at a rational level (say 6).

I’ll stop referring to it as a ponzi. That’s a pretty profound answer to your question… a lot to unpack there

If you think anything in the future is certain, it is you who lacks financial literacy.

Financial literacy and predictions are not the same thing.

Nothing is ever impossible, but yes if there's not more than say a 5% correction over the next 2 years then one could conclude that structurally there is something very resilient in the NZ housing market and it might only be a gargantuan event that could bring it down.

But let's see how the next 2 years play out.

I think people forget about general inflation when getting all riled up about house prices also. If we currently have inflation of 5% and prices stay flat. Then they gave actually fallen 5% in real terms.

I know this is blindingly obvious to most of us, but I never see people subtracting inflation when working out how much prices have risen or fallen.

Government don't consider inflation in their CGT shceme (sorry, bright line test) rules either. Seems stupid - but I don't expect more from Ardern et al.

IMO this whole DGM rant is becoming tiresome and quite pathetic. Yeah if we are commenting that an asteroid is going to destroy earth or there is going to be a major global economic collapse causing starvation, war etc etc then yeah DGM. But when people are simply predicting or even hoping for a stalling of house prices, a correction, a decline (or whatever you want to call it) that would potentially benefit many many NZer's and generations to come who want to own a home, then that is not doom and gloom. Some people have become very precious trying to justify the game and ‘their own’ future.

Well said.

I think some people are worried.

How relevant is Double Grammar Zone when education in the school environment itself has been proved redundant in the Covid era ? The last 2 years have shown that Bricks and Mortor schools are not that vital. If the trend continues what will happen to these preferred zones ? And the premium they attract ?

Indeed. Suffice to say there are two distinct groups. One hoping for a "normal" market and debt to income dynamics. And one very invested in debt leveraged appreciation, outside the normal dynamics of yield and income. Throw in a once in history debt market (lowest ever) and you have today's mess.

If I have to pick an asset reset or hyperinflation, I'm for the reset. I prefer the risk takers get their margin call vs. that the entire economy getting twisted in a wage and price spiral that is now well underway.

Sad to say as Orr and the Govt continuing to slow time doing anything looks more and more like they are taking instructions from Blackrock ahead of the interests of voting tax payers.

Little coverage on the formal default of Evergrande in NZ though. Nothing bad could happen to the global pricing of debt...right?

One group for whom housing is successful wealth extraction from following generations, having gotten in cheap themselves.

Another for whom housing is about homes for New Zealanders, who recognise that government policy used to be about boosting affordable supply not high prices.

Hahahaha! I doubt it! The legacy of Bernard Hickey (where is he now?) lives on, at this website.

Excellent article.

Except that the Geopolitics section does not include China and its aggressive antagonistic behaviour.

Good point, big omission.

Downgrade to 'good-ish', for that and a couple of reasons.

Their housing market analysis is good.

"Firstly, it is a treatment for COVID and additionally it is administered orally and can be taken at home"

talk about not being able to see the forest for the trees. c19study.com

Mortgage rates have already increased 1.5-2.0% and are likely to increase a further 1.0-1.5% over the coming year

The authors are mixing their %s up here.

Mortgage rates going from 1% to 2% is a 100% increase NOT a 1% increase.

(Although they do sort of clarify with this tautology "repayments increase by around 10% for every one percentage point increase in mortgage rates")

Early evidence suggests that the US Phillips curve, that plots the relationship between the unemployment rate and wage growth, is much steeper than in the decade that followed the GFC.

We have nearly 262 million people ages 16 or older in the United States. Almost 60 percent — roughly 154 million people — are employed. That leaves us nearly 108 million on the sidelines. Of those, approximately 8 million are unemployed, defined as actively seeking employment. This translates to an unemployment rate of 4.8 percent. In South Carolina, that number looks better, at 4.2 percent.

But, as evident in this recovery, the unemployment rate tells only a part of the story. It misses the roughly 100 million individuals (about 1.8 million in South Carolina) who aren’t working and haven’t recently looked for work. Link

Exactly - there are major issues with mismatch between people who would work and jobs available in the US. I suspect we will similar issues here over the coming years as different skills are needed. I found this really interesting... https://www.richmondfed.org/publications/research/economic_brief/2021/e…

Audaxes,

I find it hard to understand why so much weight is still put on the Phillips Curve when it has been shown to be so unreliable.

I will give you a couple of examples; a paper produced in 2001 by Atkeson and Ohanian was one of the first to cast doubt on its usefulness finding that naive forecasts of inflation generally outperform those based on the Phillips Curve. In 2005, Dotsey and Stark examined whether large decreases in capacity utilisation added any forecasting power to inflation forecasts and found that they did not.

Another prospect in the future is that of stranded assets, if decarbonisation is as successful as it needs to be there may be a revaluation of affected assets. This could have substantial effects on international share markets leading to significant changes in valuations . The impacts on trading between nations may have unforeseen consequences such as countries that are perceived as not complying with decarbonisation requirements may have trade restrictions imposed on them eg coal exports from Australia. This may have employment ramifications another example could be dairy exports that are seen as failing to comply with methane emissions requirements. In countries such as Australia and new Zealand these would have large impacts on their economies rolling into employment and hence housing prices .

Stranded assets? Governments will do what ever they can to keep electricity prices down - note Cindy begged Huntly for more coal power when the market was put under stress by a cold windless night earlier in the year.

"Based on current trends, global coal demand is set to rise to 8025 Mt in 2022, the highest level ever seen"

https://oilprice.com/Energy/Coal/IEA-Coal-Set-For-Record-Highs-In-2022-…

Nothing about Cryptos ?

House price decliine is certainly not "downfall". It's a great thing for New Zralanders. We need somwhere decent to live we can afford.

How far do house prices have to decline before they become affordable?

It wouldn't matter if there was a 50% off sale next month on all houses, the usual suspects here still wouldn't buy one. There will always be a reason not to buy one for some people, like we are still waiting for the 60% off sale.

60% would be lovely. Here's hoping.

A 60% drop in house prices would cause the worst recession this country has ever seen. Here's hoping?

Please name and shame all these usual suspects!

Keyser Soze?

My daughter and her husband both earn about $40k pa and they have a kid about to start school next year. They own and need one old car and haven't seen the husband's parents who live overseas for four years. In decent 2 bedroom accommodation at a cheap $470pw. Yesterday they asked if they could move back home with us for financial reasons.

These are the kind of people who used to buy homes.

Hmm not sure where you're going with this...

40k is a really low wage. Did they not think to become skilled in a better paid occupation? If not why not? And why did they think it's a good idea to have a kid first without having at least one decent income? Choices.

It is up to them to get better paying jobs. 40k even without price increases doesn't go far.

I've just checked NZ labour stats website. About $50k is a median income. 40K is above minimum and living wage. They are a receptionist and a head of security at a large store, both in their mid-thirties. Incidentally I do not know their income other than it is over $40k.

I'm guessing $40k is low for most people reading this article (although as a pensioner it seems a lot). Looking at the NZ stats you think everyone can be 'professional, technical or trade worker' and nobody needs be 'sales or labourer'. And only the above average wage can start a family!

My grandfather was a railway guard with stay at home wife and three young kids when he bought a new house; in 1974 I bought a house in London on a single average wage in my mid-twenties. The world is getting tougher for average families.

They just need to have two more kids.

3 is the magic number the bennie really kicks in in NZ. Then one of them will be able to quit work completely. 4 and they're laughing.

$20 per hour min wage x 40 hours = $800

$800 x 52 weeks = $41,600

Unless they are working part time they are working for less than minimum wage. Sounds like those roles definitely shouldn't be minimum wage either...

You forgot tax son, tax chomps out most of that. Brings take home to $653 a week or 34k a year.

Add in utilities, food and any other basic things in life, and poof, its gone.

There was no mention of whether it was before or after tax. As most people talk about pre-tax when discussing income I assumed that was the case.

It's hard to advise budget when you don't know the individual circumstances but IF they are both on minimum wage (which they shouldn't be based on age/job titles) then they are spending WAAAAAY too much on their rent. A rule of thumb is 25-30% of income, which there are 40 available in Auckland on TradeMe right now.

Yes how dare they even consider having a child with only a $80K income, the cheek of it!!

Human nature tends towards exaggerating ones income - especially in the facile world of social media. BTW I earn around 18k per year and live a very comfortable life (no exaggeration)

So do I but I have a younger wife who is working. Very comfortable.

House price decliine is certainly not "downfall". It's a great thing for New Zralanders. We need somwhere decent to live we can afford.

While that all sounds nice and dandy, unfortunately when property bubbles pop it affects everyone, not just property owners. Housing doesn't necessarily become 'affordable' because there are all kinds of 2nd-order effects such as less consumer spending thereby affecting business revenues, profits as well as incomes.

Sure, but it may be the lesser of two weevils. Continuing on funding the older generations' luxury is no great deal for younger Kiwis.

Good article. My two pennies worth...

My call on 2022 is that there will be no great housing market correction - because (a) the middle classes are sat on serious equity and they can afford the price of homes in the suburbs they want to live in, and (b) Govt are prepared to throw billions of dollars of accommodation supplement at supporting rental yields at the bottom of the market. So price stagnation, yes, major fall, not a chance. The fundamentals are totally different to 2008.

More persistent inflation requires a faster tapering of the US quantitative easing (QE) programme and more aggressive monetary policy tightening that may trouble asset prices

The idea that higher interest rates across the economy are the cure for US inflation is basically 'reckonomics'. It is pretty easy to show why....

Firstly, price increases are the result of a major swing in US consumer spending from services to goods, coupled with global supply chain issues and price gauging. Higher rates might take the edge off consumer spending (lowering demand), but US mortgages are typically fixed for very long periods of time (often full term) so it is hard to see increased rates making any difference to consumer demand - and interest rates are hardly a material consideration for the Saudis when they set the price of oil.

Secondly, US businesses are struggling to adapt to changes in demand, decarbonisation, labour market shifts etc. They need to finance adaptations like creating microchip manufacturing infrastructure, increasing automation, increasing energy efficiency. These adaptations are exactly what is needed to reduce inflation. So how does increasing the cost of borrowing to finance these adaptations make any sense?

Thirdly, the US Govt has about $20 trillion of 'debt'. An extra 2% of interest on that debt (recognising that this would take some time to work through) would create an injection of $400 billion per year of Govt investment into the economy. Quite how people think increasing the flow of free money from Govt to financial asset owners is deflationary is beyond me.

Interesting. I think we are seeing the final meaningful wave of Covid-19 play out now with this Omicron variant moving the world substantially closer to endemic. However the legacy of inflationary factors, particularly the accelerated decline in workforces and lower birthrates across the OECD, will haunt us for a long time.

I'm getting a brand new pair of high-powered binoculars for Christmas. To see into the future.

Some here use the binoculars by pointing the wrong way

Touché. Kudos on the wit there HW2

The value of the Australian dollar versus the Japanese Yen (AUD/JPY) is often used as a proxy for risk sentiment.

Good to see someone else talks about this. I harp on about it, but it gets little reaction at the BBQ. The sheeple cannot believe that NZD would fall against JPY and would have no idea as to why.

HW2 Let me help you - 2022 will likely see a recession, unemployment increases, jobless spend less as discretionery income evaporates, previous beneficiaries of now unemployed now have less turnover so possibly more unemployed and less tax taken whilst Govt costs unemployment & other benefits increase. The supply chain frees up but newly unemployed and possibly those who re fix debt at higher rates lose discretionery spending power which adds to above. Tighter credit means harder to borrow so less demand for assets, all this leads to supply exceeding demand and unless the laws of supply demand are banished then price will adjust accordingly. I have not mentioned the effect of inflation which acts like petrol on a fire.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.