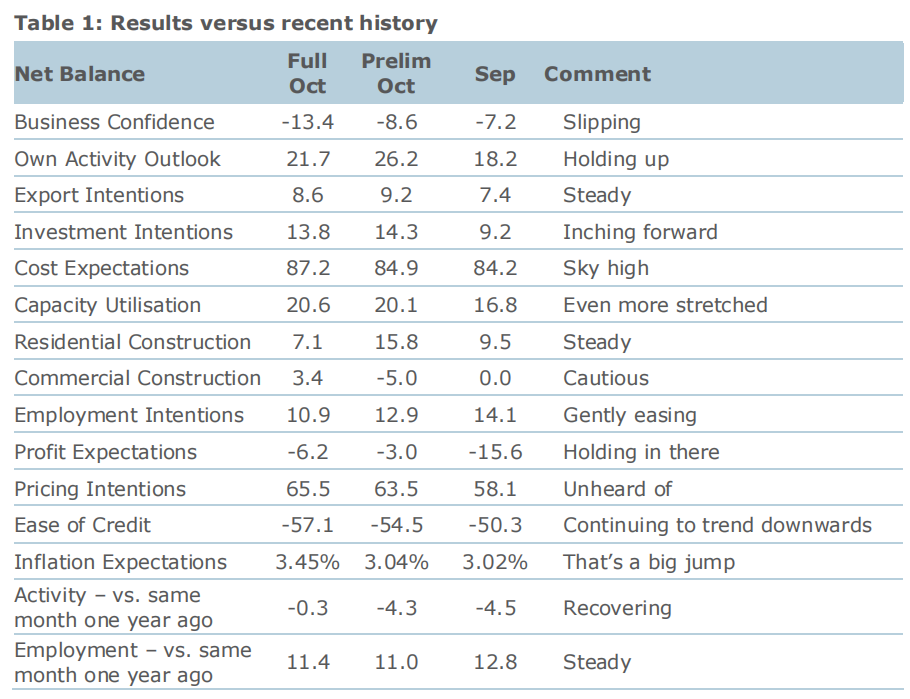

The latest ANZ Business Outlook Survey has found that more than 90% of firms in every sector apart from services (where the percentage is just short of 80%) report higher costs.

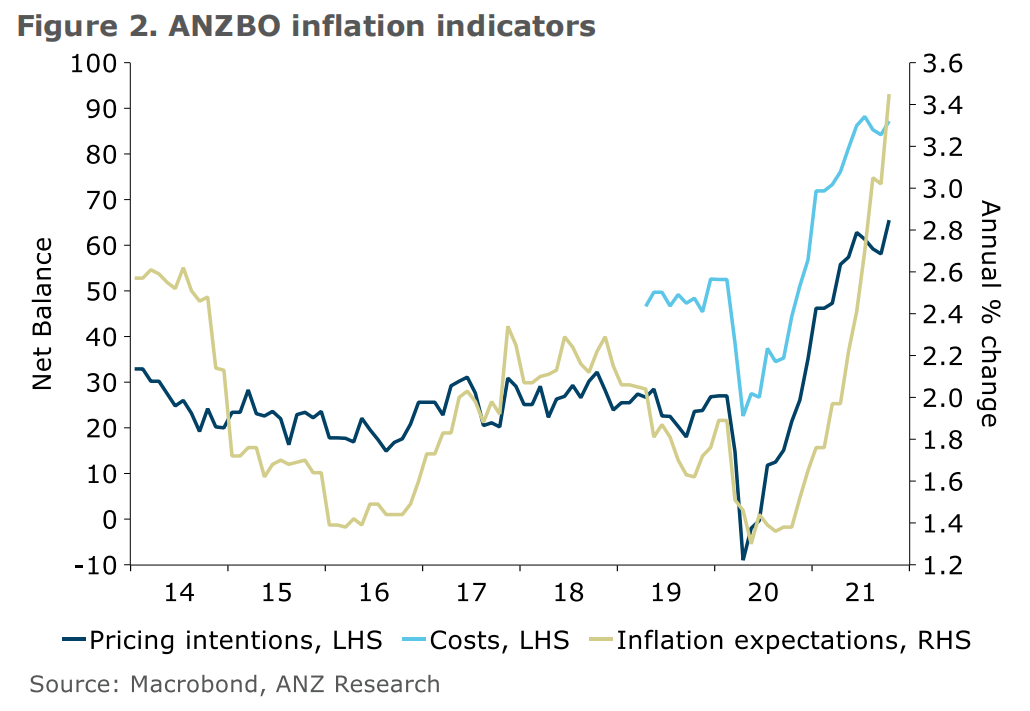

And across the whole business sector, 12-month inflation expectations have risen sharply to 3.45%, which is well outside the 1%-3% range targeted by the Reserve Bank.

The strong increase in inflation expectations was likely influenced by the super hot inflation figures released on October 18.

About two-thirds of firms responding to the survey are planning to increase prices. That's up from 58% in September.

As far as the so-called 'headline' figures in the survey are concerned, headline business confidence fell 6 points; own activity rose 4 points.

ANZ chief economist Sharon Zollner said despite Covid-related uncertainty, medium-term indicators remained "broadly robust".

"However, unrelenting cost pressures highlight that it’s tough going," she said.

"Cost and inflation pressures intensified further in October.

"The sharp jump in inflation expectations in the late-month sample was undoubtedly related to the unexpectedly high Q3 CPI data release."

In terms of business activity, Zollner said manufacturing saw most activity indicators lifted in October.

"This sector is above its historical averages for activity indicators (except exports, notably), whereas most sectors are sitting below par."

She said construction and services also generally saw more rises than falls in the month.

"Of all sectors, expected activity in construction has turned down most definitively."

On the other hand, the agriculture and retail sectors saw more falls than rises in activity indicators in October while costs and pricing intentions rose, "a tough combination".

“Business confidence, own activity, exports, and profits are generally sitting a bit under par, and expected ease of credit is well under, while pricing intentions are at historic extremes.

“Employment indicators remain positive everywhere except agriculture."

Looking at "Auckland vs the rest" in respect of the ongoing lockdown in Auckland and parts of the Waikato, Zollner said it was "a mixed bag, but on the whole, Auckland firms’ activity indicators continue to hold up surprisingly well. Forward-looking expectations and intentions continue to hold up.

"The resilience of Auckland businesses is impressive but this survey won’t capture cumulative balance sheet damage."

Zollner said despite "living week to week to some extent", firms appear to be getting on with it as best they can.

"There are clearly challenges, with costs extremely high and profits expected to fall, but more positively, activity expectations, investment intentions and employment intentions are holding up.

“The COVID situation remains unpredictable, however, and we’ll be watching closely for any evidence of that uncertainty derailing plans.”

21 Comments

Very very tight labour market out there and all staff can change jobs more or less at will in a number of sectors. Recruiters are targeting people in your workforce right now as they try to maintain their commission based income, just like RE Agents doing leaflet drops. Wage and price spiral is firing up, so the public sector and beneficiariy increases will soon be worthless if not already. More and more are betting long on realestate as a hedge against this. All adds up to further punish the retired saver, beneficiary, and non asset owner.

In the RE market today it seems like $1m is the new $100k. At this rate a cup of coffee and a scone will either be $100, or the RBNZ is going to have to put interest rates back to their long term average quickly (in NZ about 7-8%).

One recalls last time it looked this mismanaged interest rates were a lot higher than that. FYI the 1970s...

Those without the real estate hedge against inflation will be punished.

OCR peaking at 3% by end of next year is now a likely scenario, and I would not discount an even significantly higher peak.

Chile did not hesitate to suddenly raise its OCR by 125 basis points (yes, 125 bps) in one shot on October 13th (https://www.nasdaq.com/articles/chile-sharply-hikes-interest-rate-as-in…).

NZ is in a similar situation and I think it is quite likely that the RBNZ will be forced to act similarly in a very aggressive manner, even if unwilling to do so.

Be ready for interest rate levels not seen in years.

The piercing squealing will be deafening if your scenario plays out. And less spent into the consumer economy on the 'nice to haves' The NTH producers are quite prevalent in the NZ economy. Even with FMCG, the supermarkets are full of them at quite extravagant prices. These prices are necessary to survive in a market like NZ with limited market scale.

George Foreman couldn't hit as hard as an OCR increase that big would for many here.

Glad I've been living like a church mouse and paying extra off the house when I can.

Glad I've been living like a church mouse

Good for you. Simple pleasures. Before Covid, I sensed a bit of tension to 'keep up with the Joneses' related to the family winter holiday in Fiji. Seemed quite competitive among the different family cohorts to upstage their peers.

I've found it rather liberating to be honest.

When my career (and ultimately business) first started to pick up I was - in retrospect - too materialistic. I was definitely image focused in terms of wanting to outwardly display that I was doing well.

However, I've realised that isn't particularly fulfilling.

I'm happy riding my bike to client meetings now. If they expect someone to show in a brand new Audi, then they probably aren't the right fit for me.

I get a lot more pleasure out of simple things like taking my dog for a walk in the hills, or playing piano than I do from showing off "wealth" (for want of a better term).

I still work a lot, but I genuinely enjoy what I do so it's no biggie anyway.

I share a similar outlook and I think this whole pandemic thing has strengthened that view. I judge people on the quality of their character, not their wealth.

Good on you, we did the same since covid, and now in a position that any increase in OCR will be minimal if any on whats left on the mortgage. TD are slowly going up also which is nice to see.

The headline is deceptive. The following is more accurate:

Latest ANZ Business Outlook shows over 90% of firms in every sector including services (80%) facing higher costs

So what will an increasing OCR do? It will bankrupt some of those small businesses who leverage off their mortgage.

I have been talking to a few business brokers getting a feel for where we are in the market. They salivate when I talk debt levels (we have none) and assets (we have a lot) and then immediately pivot to acquisition chat leveraging off current business. Im guessing I am in the minority as an importer, so many must have very awkward looking balance sheets.

.

Inflation indicators still rising, and as we see elsewhere on Interest today, the trade deficit getting gnarly again.

Surely the $NZD will be under pressure at some point?

Nothing like inflation for an extended transitory period while the criminal central bankers continue to hold rates near zero and money printer goes brrrrrrrrrrrrrrrrr.

The NZD is now just another inflationary shitcoin. It will soon be worth less than DOGE.

At what point will the RBNZ be held accountable for its abject failure to understand the ramifications of its "emergency" rate settings? Least we forget, controlling inflation and financial stability are its primary mandates and they are failing at both.

How can we still have these emergency stimulatory rates when its been clear for months inflation was getting out of control?

Who exactly are they accountable to? Who is going to fire them or send them to prison?

They did a climate change presentation yesterday. Put a rope around the RBNZ, it's a crime scene.

The debt super cycle is about to come to a spectacular end. NZ's housing market is about to be nuked.

Looks like the employment rate may eventually fall.

"Oh, the grand old Duke of York,

He had ten thousand men;

He marched them up to the top of the hill,

And he marched them down again."

12% latest cost rise calc at my work for the latest thing to be revised.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.