Kiwibank economists are reporting that the spending bounce back after this year's lockdown has been less sharp than it was a year ago.

This year of course, we have the situation where Auckland is still heavily restricted, which was not the case a year ago.

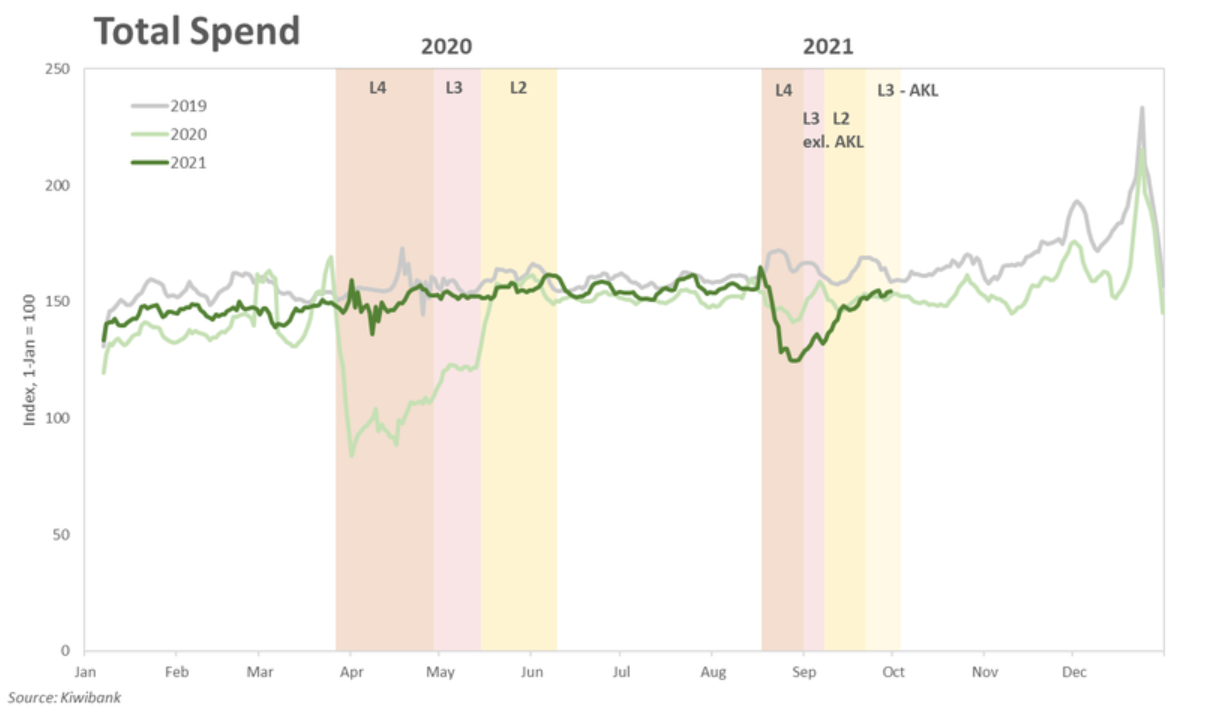

Kiwibank's latest quarterly Household Spending Tracker, based on spending data of its customers, shows that in August, which had the two-week nationwide lockdown, total Kiwibank credit and debit card spend was down almost 8% in the month. Spend picked up in September as restrictions outside of Auckland were gradually relaxed.

Kiwibank economist Mary Jo Vergara said overall, Kiwibank electronic card spend fell 1.6% in the September quarter.

"That compares to the 16% rise in spend in the June “lockdown” quarter last year," she said.

"...The rebound [this year] is looking less like last year’s Red bull-powered hill sprint, and more like a herbal tea inspired jog uphill."

Vergara noted that many restrictions remained in place, particularly within Auckland.

"The June 2020 quarter, however, not only captured the lockdown but also the move to Level 1 and the rebound in spend."

She also said the drop in spend last year was much deeper.

"The nationwide 2020 lockdown was considerably longer, totalling 33 days and leading to a 20% monthly drop in spend in April. Starting from a lower base, the subsequent spending spree saw spend rise in the quarter overall. In contrast, online purchases during the 2021 lockdown surged, which supported total spending. Households learnt that they need not wait until stores reopen to continue spending. And many businesses were better equipped this time around, having bolstered their online presence over the past 18 months."

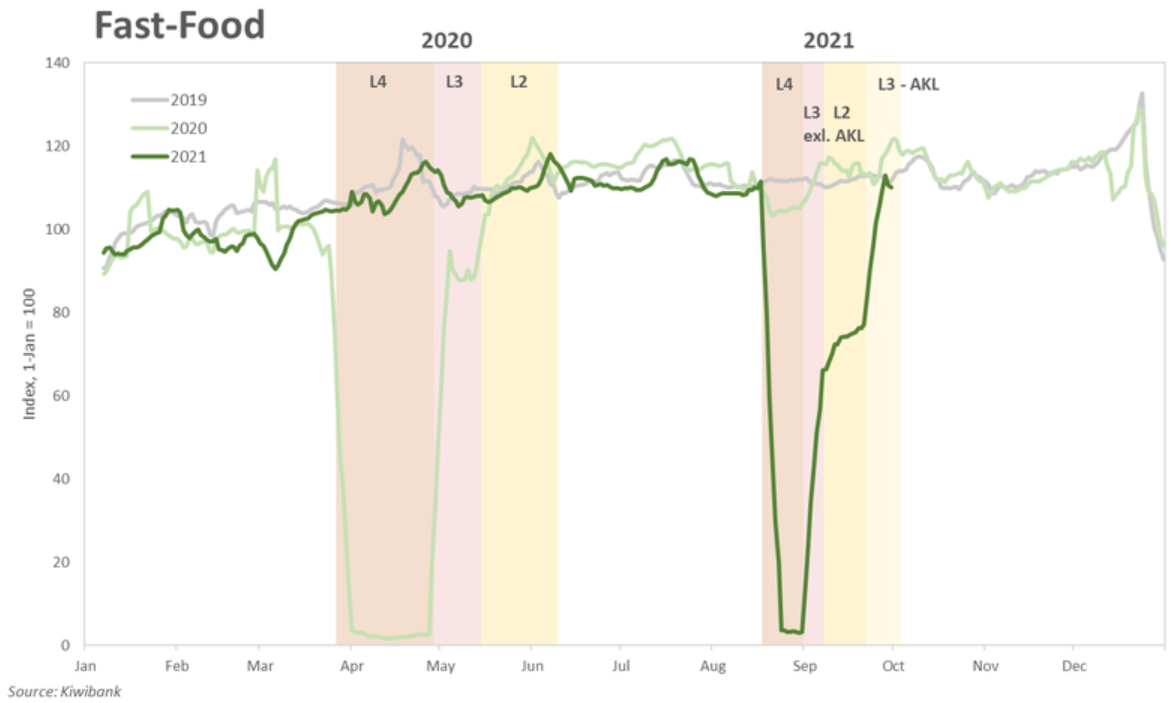

Last year sending spiked by 14% in the first week at Level 3.

"Given the more staggered easing of restrictions this time, spending has been slowly grinding higher. Spending rose 4.3% when the regions outside of Auckland moved to Level 3. Once Auckland sailed out of lockdown, spending was given another kick higher, rising 7% in the first 5 days at Level 3."

Vergara said spend on retail goods was well supported by online shopping throughout the lockdown period, "but inflation may also be working behind the scenes here".

"The September quarter inflation print is expected to be yet another strong one, with the annual rate likely to shoot above 4%. Firms are facing rising costs due to capacity constraints and global supply chain disruptions. The shallower drop in spend may in part be due to higher consumer prices, especially for durable goods."

Vergara said the ongoing disruptions to global supply chains raises questions of whether there is sufficient supply to meet demand.

"The struggle to get hold of stock has been well documented. With NZ sitting at the edge of the earth, shipping routes are being severed. Several media report international shipping companies abandoning the relatively remote and marginal trans-Tasman routes in favour of profitable routes between China, Europe and the US.

"Anecdotally, we’ve heard of retailers limiting their stock to just a handful of brands, and holding onto more inventory than usual. The business model has shifted form Just in Time to Just in Case. So don’t be surprised if you get the same Christmas presents as everyone else this year."

The drop to Level 3 saw an immediate bounce back in quick-service restaurant and café spend. And once Auckland moved to Level 3, fast-food spend was given another leg up. At the same time, spend at grocery stores fell and has since returned to pre-lockdown levels.

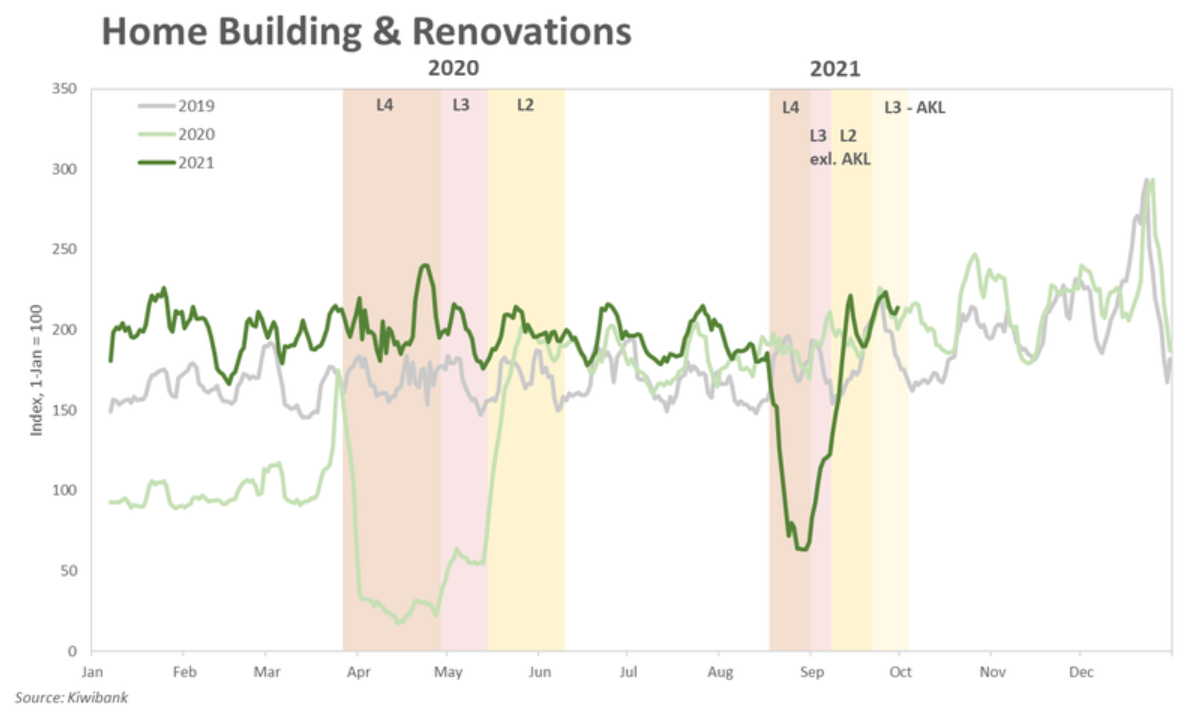

"But Level 3 isn’t just ‘Level 4 with takeaways’ but ‘Level 4 with takeaways and Mitre 10’. It wasn’t just under the Golden Arches where queues of cars were spilling onto the streets, but also at hardware stores. The option to click and collect saw many, from tradies to DIYers flock to their local hardware store, waiting bumper-to-bumper."

Vergara said the Kiwi economy entered the latest lockdown on a firm footing.

"Supercharged GDP growth of 2.8% was recorded in the June quarter, and the labour market had returned to full employment. But the Delta outbreak has disrupted the recovery. We are expecting a 7% fall in Q3 GDP. A short, sharp fall from lockdown."

She said the disruption is expected to be followed by a rebound in the December quarter.

"As we’ve learnt from previous lockdowns, demand is deferred not destroyed. Economic activity bounces back once the restrictions are relaxed. We’ve pencilled in a rebound in GDP of 8.5% in Q4.

"However, with some form of lockdown, especially in Auckland, dragging into the fourth quarter, there’s growing downside risk to our forecast. So long as lockdowns are part of the covid playbook, large swings in economic activity are expected."

9 Comments

Seems like the extended lock down may cause many retailers to go under if the year end season is missed. The lack of inventory to sell and higher costs may just be the final straw.

May be good for distressed business buyers though.

The lockdowns must be killing bricks and mortar retail stores. The proof is that NZ Post is already handling Christmas parcel volumes. The huge move that was already underway from retail to online shopping has been boosted through the roof. I still think that its vital to have the malls open for the whole of December at least and the spending should be a post pandemic record, people are going to go nuts.

..and how helpful is that to an economy? Consumer good arriving by subsidised air freight to be delivered to the front door and in several months to the garbage tip.

What a great way to spend all that borrowed/printed covid money.

The cost of shipping a 40' container from Chinese main ports to Auckland has gone from USD 2800 in Oct 2020 to USD 11000 in October 2021 (including USD 600 Auckland port congestion fee) and it's a big if as to whether you can actually get a container onboard . SME Importers must be suffering.

As a corollary, landfill operators must also be taking a hit

We're kind of between alert levels at the moment. Last time government was clearer on the path forwards, many of us are wondering now if lockdowns and restrictions will go on perpetually.

Agreed. I'm down in the South Island (so in L2.5) but have massively changed my spending habits/preferences this time.

I've cut all unnecessary spending - apart from food/shelter/insurance/transport and a few dollars for a flat white or two from my favourite local cafe.

I was ready to sign on a new car and some renovations to the house, but I'll be saving every penny I can while the government decides to hold us all hostage.

When you read/hear about lockdown, read/hear control.

With shipping costs so high, things will just keep selling at current prices until it's no longer feasible for importers to import goods and sell locally. I would suspect retailers are just offloading their existing inventory to get some cash in the door now. Time to load up necessities when you can still buy it until it's no longer available for sale.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.