It's the first look at business confidence levels since the start of the lockdown. And it's a shocker.

Tuesday's NZIER Quarterly Survey of Business Opinion, which was conducted just before the lockdown started, provided a sample of what was to come.

Wednesday's early look at the ANZ Business Outlook Survey for April is the main course. And it's huge.

"The preliminary data for April saw every activity indicator plunge. Most hit record lows by a very large margin," ANZ Chief Economist, Sharon Zollner said.

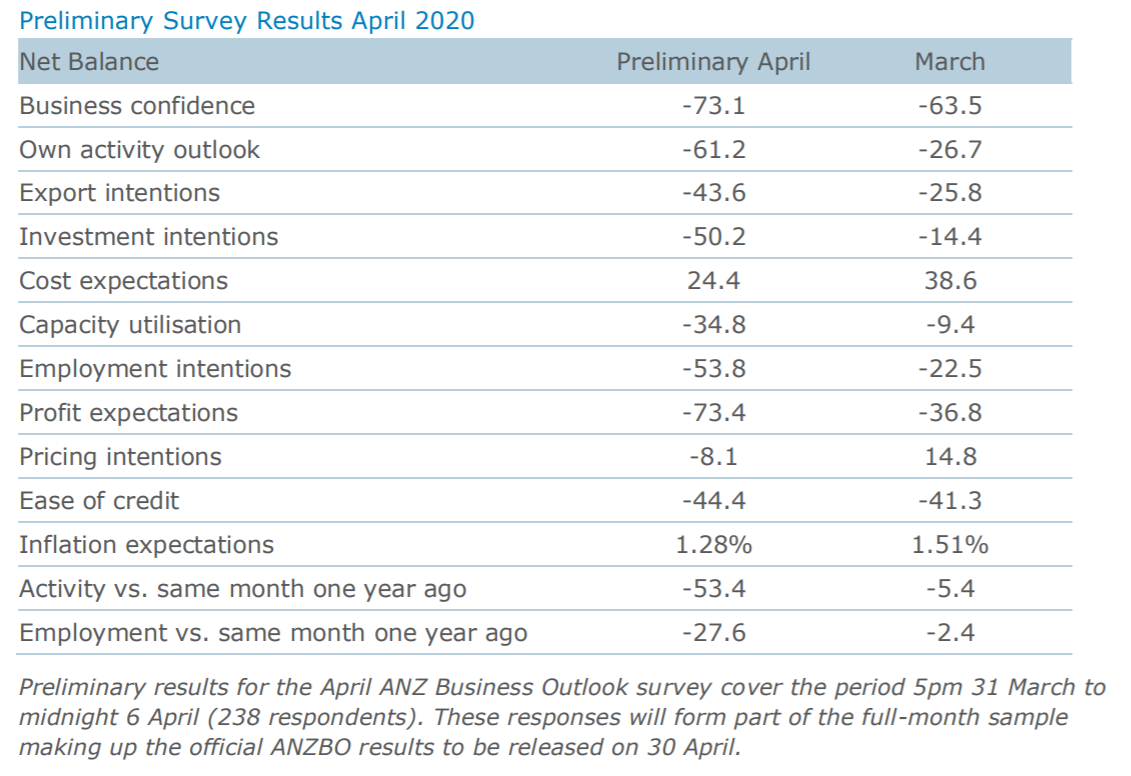

The 'headline' business confidence fell 9 points to -73%.

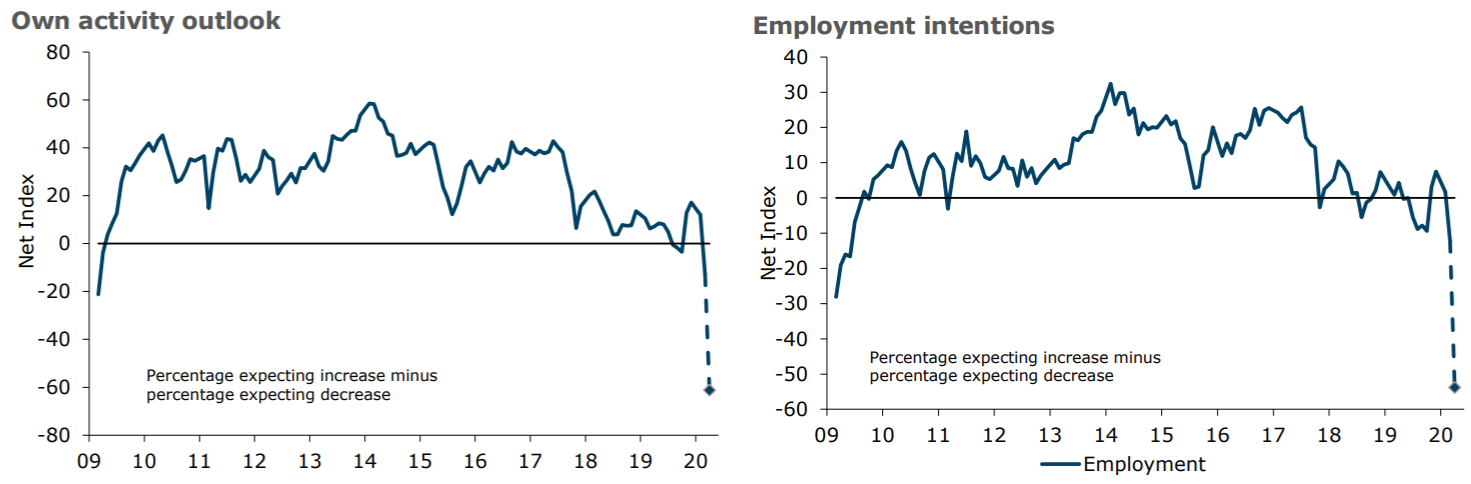

Arguably the more key figure though is companies' expectations of their own own activity. That reading plummeted 34 points, with a net 61% of firms now expecting lower activity for their firm in the year ahead.

“We’ve never seen numbers like these," Zollner said.

A net 54% of firms expect to cut jobs; a net 50% expect to reduce investment – both record lows.

"It’s an understandable response, given a net 73% of firms expect lower profits, also the worst reading ever," Zollner said.

A net 35% of firms expect lower capacity utilisation, which is the lowest reading since 1991.

Compared to the same month a year ago, a net 53% of firms report lower activity, and a net 28% already report having fewer employees.

"This is clearly a very deflationary shock," Zollner said.

She said companies' expected costs fell 15 points, pricing intentions dropped sharply "into negative territory for the first time ever", and inflation expectations fell from 1.51% to 1.28%, a record low.

"Firms are reeling from the abruptness and ferocity of the storm that has enveloped them, and with uncertainty extreme, planning a way out is very difficult. The quick-fire fiscal and monetary response will have helped, but times just don’t get much tougher than this," Zollner said

155 Comments

Total contributions to Kiwisaver providers (Employee + Employer + Govt) has averaged about $580m per month over the last 12 months. Average Hardship withdrawals are around $9m per month, and average First Home withdrawals are around $95m per month. It will be very interesting to watch these numbers change in the coming months, as both contributions and presumably First Home withdrawals go down, and hardship withdrawals go up.

I appreciate that only a fraction of the total contributions to Kiwisaver providers go towards equities on the NZX, but I would imagine at this stage Kiwisaver Providers have to be among the biggest purchasers of shares in the NZX. I'd love to know how much of the volume they make up. Will be interesting to see what happens to equity prices if they have to start cashing out significantly more than the average value of first home purchases.

VERY INTERESTING INTERVIEW WITH ROCKET LAB’S PETER BECK ( 7 minutes to read )

It’s a pity our journalists don’t access the short-wave networks of private USA radio stations, still plentiful despite the advent of Skype and email.

I dusted down my old SW high frequency valve-receiver the other night at the peak of the coronavirus panic and tuned in to CNYSW and unexpectedly found myself listening in to an interview with Peter Beck the New Zealand founder and CEO of Rocket Lab whose head office is now based in Long Beach, California.

I could barely hear the voices above the crackling and sound static, the background ‘noise’ so familiar to long-time short-wave enthusiasts such as myself. I had just put new batteries in my old “Grundig” portable tape recorder, and this fortuitous act greatly assisted my memory in my subsequent transcription of the interview:

Beck said that although the advent of Coronavirus had meant the indefinite postponement of medium-term satellite launching projects, he has been inspired by Richard Branson’s aerospace company, Virgin Orbit, which had switched from making rockets to Coronavirus-related manufacturing; Virgin Orbit is now making a revolutionary breathing aid product to assist in the fight against Coronavirus.

He also pointed out that the auto manufacturers Ford and General Motors are both now making ventilators instead of cars.

When the interviewer asked Beck whether he too would be manufacturing breathing aids, Beck said no, that he would be trying something he deemed to be even more desperately needed after the latest New Zealand Government’s modelling of the pandemic showed that in a worst-case scenario, most of the population of New Zealand could be wiped out; he said that, being an optimist, he doubted that scenario, but even if the population was seriously depleted some thought had to be given as to what human characteristics and talents would be required as New Zealand rebuilt its population; he said that such a project could beneficially utilize a similar methodology to that used by rocket technology, namely the science of trajectories.

In other words, and in very simplified terms, we would have to begin at ground zero. For example, say 100,000 people remained after the virus had rampaged across the land, those people would constitute ground zero and the population growth curve, or trajectory, would steepen progressively over time, just like a space rocket’s trajectory, until the ultimate destination, the agreed new population level, was reached.

“Well, we at Rocket Lab can assist with the management of that trajectory”, Beck confidently asserted above the radio’s persistent sound distortions.

Beck then said with great emphasis that “what Rocket Lab couldn’t do is determine what human characteristics that new population should have.”

He said it would be up to the remaining populace to choose the human genetics of the new population. They would have to decide what mix of old human traits and new traits would be selected for in developing a new nation. For instance, they could decide whether to retain the old virtues personified by current legends like Colin Meads, Lord Rutherford and Sir Edmund Hilary, or they may decide that these are yesterday’s men and that we should look for altogether new virtues, more beneficial to the predicament the new society would find itself in.

The ability to reproduce rapidly could be just such a virtue and, Beck claimed, we already have in our current ethnic stocks, assuming they survive the pandemic, those who could exponentially ramp up this well-established ability in the new society, although, of course, the new government wouldn’t be in a position to replicate anywhere near its current monetary support for multiple serial reproduction per female.

When the interviewer asked if Beck thought the new population would include those highly educated types who would be necessary if the likes of Rocket Lab and other high-tech companies were to be sustained, Beck said that he didn’t think so as the new society would have to go through a very primitive early stage in its early development whereby survival would solely depend upon brute, impulsive strength, a quality that had been bred out of his highly educated employees over the millennia in favour of intelligence. It would probably take at least a further millennium for such intelligence to naturally develop again, if at all. Throughout these last few sentences, I could sense in Beck’s tone the upwelling of a despairing emotion and even anger in his voice as if he suddenly realised that the new society would never again achieve its current level of civilization.

At this point, the interview was almost completely drowned out by the interference ‘noise’ and even though I later replayed the tape through some old RCA filters I could only make out the following few intermittent phrases despite the tone of Beck’s voice becoming more and more agitated and strident:

…………..…….’law of the jungle’………………………’dog eat dog’………..’the fall of Rome all over again’…..’descent into brutality and squalor’……….……..

At that moment the crackling interference to the radio signal completely overwhelmed the voices and I had to switch off my receiver.

Still, once again, I would recommend that all the journalists of Interest.co and elsewhere try and listen in to SW radio broadcasts if they can; there’s choice content to be had that you would be hard pressed to find elsewhere. I have seen SW receivers advertised now and again on Trade Me as old baby boomers’ estates are wound up. I can still remember purchasing mine at the now defunct SOS radio shop, in the 1960s, just up Queen Street from the Civic Theatre.

No doubt about that.

They dont understand value for money or how to budget. Its been a cost plus exercise, where politicians and their executive leverage up the balance sheet, sell off assets that generate positive cashflow, then capitalise their less than commercial decisions on the poor ratepayers.

Perhaps it isn't.

Medicos keep refusing to test people who don't meet the strict definition of what they were looking for - definite links to known cases. They even turned away people with symptoms and a general connection to known cases (Marist).

On that basis, one could assume that we have turned away actual Coronavirus sufferers, who went on merrily infecting others. We won't know that until we widen our testing regime.

Look at the clusters, some now reaching 100. Yet we have 2% community transmission (20 people), meaning that there are 20 infections (each a potential cluster on their own) with no known source (and 14% where we haven't identified the source yet)

FB, I was objecting to a full lockdown for a long time because of the effects on the economy (= real businesses closing real jobs being lost). But now that we have done 2 weeks, we have to be team players and see the full LD through for the 4 weeks, not doing so would undo the last 2 weeks efforts.

I'd be more worried about the lender casting an eye over the 'value' of their collateral than the cost ( interest rate) of the loan....

"LVR 80% you say?. Not according to our latest figures, So be a good chap and chip in the missing 10% to make our equations balance. Now. About that rate...."

Wonder how many investors are sitting at 65% - 70% LVR Interest Only? Will the banks still be as generous in refinancing Interest Only going forward? I recall a couple of commentators on here are "in business" with their bank managers, whom reissue interest only lending at the drop of a hat. Is this still the case? Waiting with bated breath.

How many property investors are in the following circumstances?

Situation A:

1) own negative cashflow investment property

2) just lost their job

3) has insufficient cash reserves

Situation B:

1) own positive cashflow investment property, (financed with a high LVR mortgage)

2) just lost their job

3) their tenants are not paying the rent, the tenant is paying reduced rent, the investment property is now vacant, as the tenant has moved out due to the tenant losing their income and inability to pay rent - so leading to the property becoming cashflow negative.

4) has insufficient cash reserves

Situation C:

1) own positive cashflow investment property, (financed with a high LVR mortgage)

2) now the property is no longer earning sufficient income to meet mortgage payments - due to loss of tenant, inability to rent out property on Airbnb.

3) has insufficient cash reserves

Hi NB, It's hard to say without knowing your borrowing situation. If your LVR < 80% and cashflow is good, I would go for 1 year at 3.05% as 6 months have a premium of at least 0.5% which is quite high. To be better off with 6 months at a premium of 0.5% you'd have to expect rates to be lower than 2.55% in 6 months time, unlikely IMO.

Thanks yvil!!!I'm at about 40 percent lvr so even if my property's value halve I'll still be ok.this property is about 50 percent lvr but still owe quite a bit on it so want the best rate!!!!I've got resource consent to build four apartments on the front section but I'm thinking I'll shelve them untill building prices come down a bit.thanks for the advice yvil and stay positive☺

Ha CourtJester, I answered your question above at the same time you asked (see above).

I'll elaborate, yes I was against the full LD because of the effects on jobs & businesses. Now that we're half-way through, we have to go all the way or the first 2 weeks would have been in vain.

The way NZ is tracking, it looks like the goal of the full LD has shifted in a very major, beneficial way. The original goal of the LD was to "flatten the curve" so that the hospitals can cope with the huge influx of emergency cases. The question I repeatedly asked was: what happens whenever the LD finishes (4 weeks, 6, 8….) and there was no answer, no plan. Now that things are nowhere near as bad as media made them out to be, our goal has shifted from "flattening the curve" to "eradicating" CV. This is a monumental shift in a very positive way. If NZ can indeed eradicate CV, I will admit loud and clear that I was wrong opposing a full LD, if NZ fails to eradicate CV with full lockdown, I think a soft LD which would have allowed for businesses to remain open would have been better. Out of the 2 outcomes, I really hope I will have to admit being wrong.

Its a nice idea but if NZ eradicates the virus but the rest of the world goes to herd immunity, NZ will be like the south americas pre spanish invasion. The whole world would have the antibodies exept for us. Our options are to get vaccine, get immunity or get a giant wall built. We need to stop congratulating ourselves too early and be careful what we wish for.

While I agree that we should have clear(er) plans for post-lockdown (or rather, post-first-4-weeks), I don't agree with this:

"Now that things are nowhere near as bad as media made them out to be" - It's not as bad as it is in other countries, most likely exactly because of the lockdown and people actually following the lockdown rules. 17 thousand people have died just in Italy already, 1 person in NZ. The biggest difference is the way we curbed tranfers within the community.

I agree as well Yvil, however i think eradication of COVID won't happen. Not unless vaccination technology can work off the unchanging part of the virus, else it will continue to plague us through it's mutations. I do believe international trvel will need to change significantly though, and the business model around it.

send them to Somes Island!

https://www.doc.govt.nz/parks-and-recreation/places-to-go/wellington-ka…

I don't think eradication was ever the goal. The idea is to spread out the infections "break the chain" so that you don't end up with 2000, 5000, 10000 people all in hospital at the same time needing ventilators that don't exist. Instead you might get that figure over the course of 3 months, 6 months, 12 months?

Yes check out Sweden. Get your facts right 8 and a half THOUSAND confirmed cases 696 DEATHS.Not so great https://www.google.com/search?client=firefox-b-d&q=sweden+coronovirus+n…

And it's not just the hospitals being overwhelmed. A largely uncontrolled rampant spread also means that your ability to trace contacts for all known infections gets absolutely overwhelmed as well. If you just look at the clusters being traced presently, in some clusters, nearly no one was spared. The wedding in Bluff had some 70 guests - 55 of which were infected (the last I heard). That's a yikes. Just think how many more weddings, meetings, sports fixtures and other gatherings we'd have had in the last 2 weeks had we not locked down 'hard and fast'.

Now the new infections have less than a handful of contacts that need tracing (follow up) and testing.

Can't wait until they start surveillance testing, if that ends up equally as hopeful - we'll be the envy of the world.

I will go one better and give a 50 percent reduction to parliamentarians and local govt Mayors esspecially those socialists who sit on huge guaranteed salaries. Take Robertson and Goff for example. One points the finger saying you MUST negotiate. The other HRH tells ratepayers to go jump.

As long as everyone else's house price goes down as much as mine has I don't mind. Have to say though, having put an offer on a house in the upward market and my house not getting any offers until after lockdown, I hope it will be a gradual depression, not a crash.

The "wealth effect" is a crock, it's been part of economic dogma for decades but is not backed up by observations. Studies show it is either non-existent or statistically insignificant. The only thing that actually matters is the "income effect", if people have higher incomes they tend to spend more - although marginal propensity to consume does decrease as incomes increase. So, you are right but for the wrong reasons.

There's a great correlation between house price growth and sales of luxury cars in Australia. Ignore the wealth effect by all means, but don't be surprised if those 'nice to have' FMCG products on the supermarket shelves see greater declines than bread, eggs, and store brands. As for incomes, the growth is largely derived from consumer spending, which comprises approx 70 pc of GDP. Bubble economics drives incomes, not the other way around.

Correlation, sure. There's also a strong correlation between those items and declining interest rates. I'm not ignoring the wealth effect, I'm denying it's existence. I won't be surprised when consumption drops, because a huge amount of people are going to experience a sizeable drop in their incomes.

If my house had sold for what the market was indicating it would in February (it is on the market now), I had planned on spending most of the $60k capital gain left over after my next house purchase was accounted for across a wide swathe of the economy. It was going to be a real effect for me. Now I'll be lucky to break even (probably $20k net loss) and the spending will definitely not take place just when it needed to happen.

I'm surprised at the resilience of sport media. No one has kicked or hit a ball in a month and likely won't for a few more but that hasn't stopped the "Sport" section on the six o'clock news every night. They are bravely soldiering on despite it being an act of utter futility.

There's still some excellent sports coverage going on if you know where to look:

https://www.youtube.com/watch?v=QTVYLdKqxcI

Some great overtaking moves happen in this one.

Just signed up to 12 months Sky Sport Now for the discount - 3 months Neon as a concession for no sport - debit facility might be unavailable next month - be interesting to see what they do over an unpaid account - waive the 12 month contract? Not holding my breath on that outcome.

Slightly unrelated, but any news of bank staff taking pay cuts yet? I've noticed that John Key has been critical in the media about the pay cuts that Fletcher's have announced (or lack of by senior management) - but isn't he chair of the board for ANZ? And as far as I understand they have announced no/zero pay cuts at all - and they're the ones who have made record profits pumping a credit bubble? Anyone seeing any hypocrisy with this?

Council salaries are driven by the private sector. We don't see councils going bankrupt and sacking everyone but they ought to match the downwards trends. Except for librarians because I love all librarians and the gardeners at the Auckland Wintergardens because they are geniuses nor the bin collectors because that is one tough job - but all the admin staff can take a generous pay cut.

http://nzx-prod-s7fsd7f98s.s3-website-ap-southeast-2.amazonaws.com/atta…

"The Board has fully supported the CEO’s recommendation that annual short-term incentives for 2020 be cancelled for the CEO and the Group Executives."

What's remarkable about the lockdown isn't the hue and cry about the economic damage--it's the absence of any critical curiosity as to how our economy became so fragile. While everyone is busy screaming about the damage done by the lockdown, nobody's asking why costs are so high that few can survive a few weeks on their own means. If costs weren't so crushing, more households and enterprises might have savings. Empires don't collapse because everyone ran out of money; they collapse when the costs exceed earnings.

Wrong. John Key is solely responsible for this mess. And Max, he must somehow also be implicated. Anyone born with that much privilege is guilty by association, especially if they are male. And white. Bronah seemed nice but married a banker which shows she must have her own personal demons. Worse than the Addams family that lot.

Happy realization.

Once the corona virus storm passes will understand the carnage it has caused to economy not just in NZ but world over.

No one, not even the experts are able to fathom what is going to follow as this type of event of world shutting and the entire world population lock down in their home has never happened before.

At the moment government, fed are doing and throwing all that they can to survive and rightly so but every action has reaction so free and cheap money will all come at a cost.

It is wonderful that the statistics of Covid 19 in NZ show 1200 cases and only 1 died.Well done NZ, BUT We must get the economy back working as how many people might commit suicide from failed businesses or worry how to cope financially into the future!NZ should keep all most at risk people in Lockdown and let the fit and healthy back to work.What happens if the rest of the world becomes herd resistant to the virus and we don't?We must rely then on a vaccine

China 'left the starting blocks' in all likelihood because the residents of Wuhan were going to starve to death if they didn't get 'let out'. China still has strict quarantining measures in place - and they are only the ones we are told about.

New Zealand isn't 'going backwards'. On the contrary. If any place on the planet is going to be sort out to live in, after in this lot, will it be New Zealand.

Our challenge won't be about 'Going Forward" It will be to decide "who goes forward with us?" and if we have any sense, it will be primarily those who are here already. The next question then becomes "Who else should we let in?" and the answer to that will come after many years of compensating those who are already here; have done the hard yards and who deserve to be repaid, and will be as few in number as we need for sustainability.

Our stats look good but Taiwan looks better - 16 cases per million, 0.2 deaths per million. We could have learned from them whereas they had only unreliable and downright wrong advice from China and WHO. Jacinda didn't do badly but if our govt listened to Taiwan instead of China we would have been acting far earlier - number of test kits ordered, ventilators, enforced quarantine and earlier lockdown alert stages. We need Taiwanese input to the Royal Commission that must follow this crisis.

Economists using sophisticated models not available to we armchair crystal ball gazers are predicting GDP contraction of 7-10%. Which will result in severe hardship but not the ending of civilisation portrayed by more than a few int.co commentators. Zespri intriguingly reports its premium priced kiwifruit is in strong demand in the usual markets, meat exporters moved with agility to secure new markets for product rendered surplus by the wuhan shutdown and dairy auctions have not collapsed.

The Level 4 lock down needs to run for at least 6 weeks total followed by a Level 3 for another 6 weeks.

All citizens should be required to wear a face mask outside of their own homes until a vaccine has been found.

There should be zero commercial passenger flights into or out of NZ until a vaccine has become available.

Anyone arriving back in on repatriation flights over next 6 weeks should go in to military style quarantine.

We cannot afford to let Covid back in to NZ once we have eliminated it - just not worth risking a second wave

In the meantime a universal wage until the economy is back on its feet.

We need to postpone the election until Sept 2021 and have a 4 year term thereafter. There is no need for a standard style government for the next 12 months.

Short term pain for long term gain.

Bblue. The govt seems to have got your message, with a survey showing overwhelming support for tighter screening, testing and quarantining of incomers to NZ. We have just this one shot to make elimination work, level 3 would be difficult to police and reliant on voluntary compliance, thus likely to be ineffective.

How will NZ pay for our holiday? It will be either by cutting govt services or by increasing taxation or - most likely- both. When it comes to increasing taxation there will be two highly visible targets: CGT on private and residential rental properties and superanuation.

No to land tax. That was Bernard Hickey's nonsense idea years ago.

The whole point is that land is being used unsustainably now. We don't need to be getting more out of it, we need to be getting less. We need to be paying for it to revert to native, to go fallow, to be made more biodiverse.

A land tax would force people to try and make money out of a static (stock, not flow) item.

The Zollner, JK/ANZ/Blue RE team just about to ramp up from last year last quarter result of lighting up the FIRE economy again, courtesy of exception on capital outflow by CCP, alas even the mainland master did not foresee this Covids, now.. what a mess, back to agriculture, fresh produce.. aka what NZ good at traditionally to survive. Any FIRE economy beneficiary here in NZ expecting the rosy BAU with the new motherland back-bone economic ties... dung dung dung.. 2021 watch how those angry Americans react though,.. 'either you with us or against us' - History told us the Pearl Harbour moment, some touted the same now, as their death toll rises. Blue team, you better sure how strong this new back-bone for NZ.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.