The latest ANZ Business Outlook Survey (for May) shows the New Zealand economy is struggling to keep up with demand - and cost and inflation pressures continue to build.

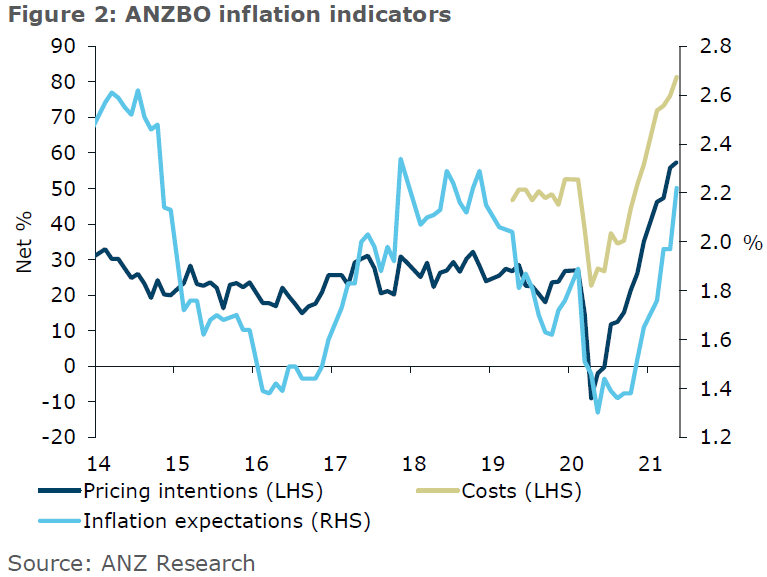

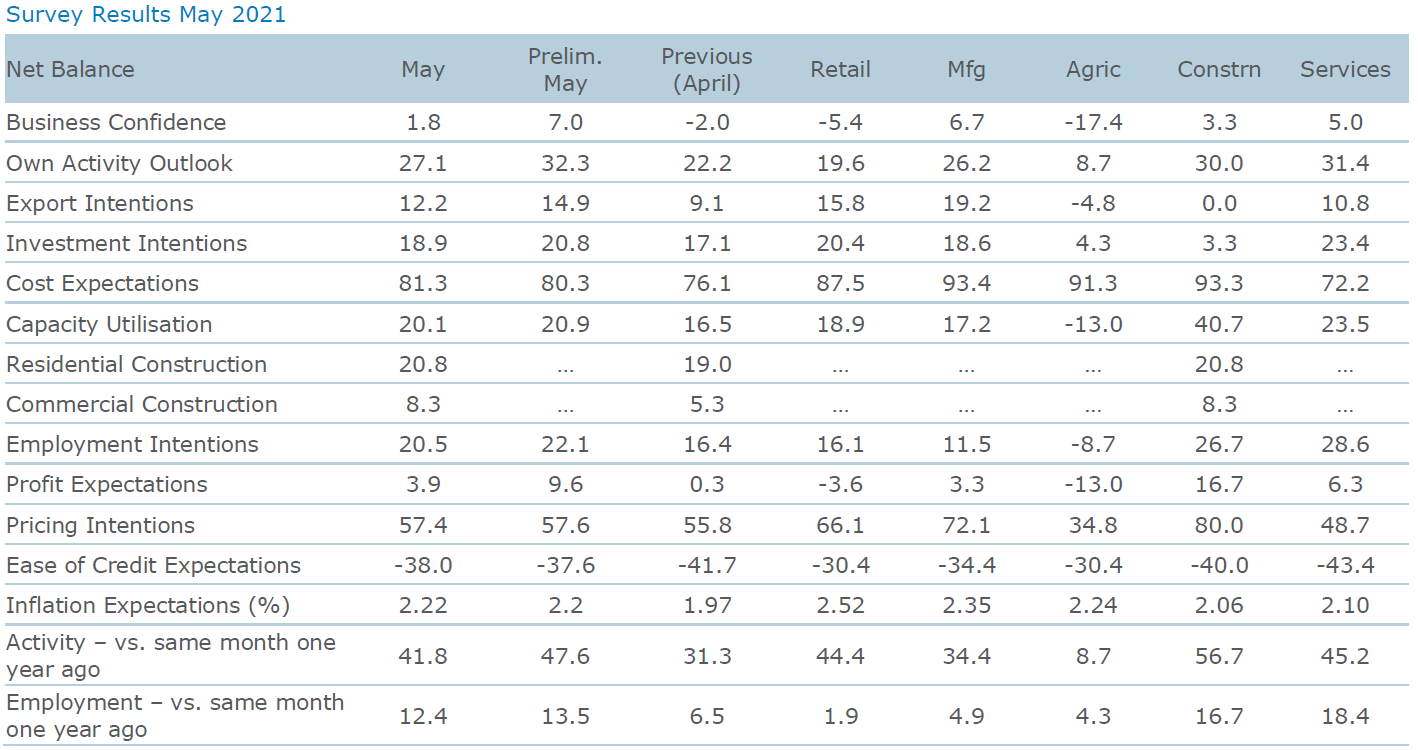

ANZ chief economist Sharon Zollner said inflation pressures continue to lift. The survey found cost expectations rose 5 points in the month to a net 81.3% of respondents reporting higher costs. A net 57.4% of respondents intend to raise their prices (prelim: 57.6%). General inflation expectations rose to 2.22%.

“Across the economy, cost expectations and pricing intentions stand out for being extremely high relative to history. Profitability remains relatively squeezed, hit by cost increases, and export intentions also remain lower than normal," she said.

Inflationary pressures "are not receding" but expectations remain close to the [Reserve Bank’s] target range midpoint of 2%.

"Expected costs are in the 90s for manufacturing, construction and agriculture, and not far off it for retail. The aggregate is being held down by services, where ‘only’ a net 72% of firms expect higher costs," Zollner said.

“Freight disruptions remain problematic.

"Compared to six months ago, a clear theme is that things have gotten worse, and the sectors that had initially been shielded from inward freight disruptions (particularly services) are now feeling it more."

Zollner said the New Zealand economy is struggling to keep up with demand. Cost and inflation pressures continue to build. Firms are having trouble sourcing inputs to production.

Compared to ANZ's preliminary May read, headline business confidence was 5 points lower at +2%, while firms’ own activity was also 5 points lower at +27%. Both are still higher than April.

“Business sentiment and activity indicators were lower in the late-month May sample, but all indicators for the month as a whole were still higher than in April.

“The bulk of the later responses were received the morning of Budget day. The details of the Budget were not known at that time, but it’s possible that uncertainty may have affected the numbers.

“We wouldn’t read too much into the drop in activity indicators in the second half of the month just yet, as it may have been influenced by Budget uncertainty. We won’t have to wait long to get a fresh read, with the preliminary June data due to be released on 9 June.”

Turning to the detail, compared to the month of April:

- Business confidence rose 4 points to net 1.8% (prelim: 7.0%).

- Firms’ own activity outlook rose 5 points to 27.1% (prelim: 32.3%).

- Investment intentions rose 2 points to 18.9% (prelim: 20.8%).

- Employment intentions lifted 4 points to 20.5% (prelim: 22.1%).

- Capacity utilisation rose 3 points to 20.1% (prelim: 16.5%).

- Inflation pressures continue to lift. Cost expectations rose 5 points to a net 81.3% of respondents reporting higher costs (prelim: 80.3%). A net 57.4% of respondents intend to raise their prices (prelim: 57.6%). General inflation expectations rose to 2.22% (prelim: 2.17%).

- Profit expectations rose 4 points to 3.9% (prelim: 9.6%).

- Export intentions rose 3 points to +12.2% (prelim: +14.9%).

- A net 38% of firms expect credit to be harder to get (prelim: -37.6%).

- Residential construction intentions rose 2 points to 20.8%. Commercial construction intentions rose 3 points to net 8.3%.

20 Comments

Take away the printed fake money and the manipulated OCR and see how confident business is. The economy is in serious trouble and this blinkered view will help nobody in the long term.

Whether its about financial gains or economic troubles, most businesses in NZ have always had a blinkered view into the future.

A report from NZ Pacific Economic Coop Council finds that our dairy sector fails to extract much value out of its exports due the failure of exporters in breaking into defensible markets for more complex, premium products such as infant formula.

Rather embarrassing that the Singaporean economy extracts more value out of NZ's dairy exports than NZ itself does. Not uncommon in this part of the world where economies are stuck in the 20th century chasing gains in real estate and commodities.

Rather embarrassing that the Singaporean economy extracts more value out of NZ's dairy exports than NZ itself does

And Japan, China, and even Vietnam.

or that we import furniture and timber made with our logs ! the recent productivity stats are damming -- and until we address that issue -- all the talk about a more equal fairer better society is hot air -- even a 2% increase in productivity would be enough to lift thousands of NZ families out of poverty - and what would that really take -- people turn up to work on time -- businesses look at some basic lean thinking - slightly more motivated happier workforce - hell chocolate biscuits instead of plain - -cheaper if bought on special would do that --

yes, about to learn that printing money fuels demand but does not require the recipient to produce anything in return. Fake economy is the result.

RBNZ Guvernor was on Bloomberg just the other day saying that inflation was "normalising":

https://youtu.be/TNnt3MPJf3Q

That's about as useful as saying the weather is normalising.

(What the heck is normal?)

By inflation normalising, Orr means tracking towards 2%

Orr means the CPI is tracking towards 2% which has nothing to do with real inflation.

I'm no statistician but a quick look at CPI over the last couple of decades and you could probably argue that 2% is in fact abnormal.

This is how they normally talk, to create a smoke screen. Typical politician talk, keep it as neutral as possible. This is how they keep their positions. I would say he is referring somewhere between 2% and 4%. 2% is their target inflation rate and is their goal. If there is "pressure" as what he talked about in the video, it will be above 2%. "inflation pressures normalising", I would consider that it means the same as inflation pressures resume.

The cork bobbed up under inflation from fiscal and monetary stimulus, now it is settling down again.

However, without tourist income, I fail to see where treasury and gov are getting their rosy scenario from re GDP? As China begins to stumble (having been first to stimulus boost) what will happen to NZ exports?

There is only one ....fiscal (green marshall plan?) through increased gov debt....without that then there is nothing that will make up the lost activity, unless you think that tourism, export education and migration are going to exceed even pre covid levels anytime soon.

I know that the CPI is backwards looking but there seems to be a disconnect in what the business community is saying and what the c-bankers are saying / doing.

I for one are not that surprised.

Seeing of plenty of prices increases in the construction sector.

I'm in professional services. Had a letter from DX Mail today saying we're getting a 3.9% increase citing increased labour costs, compliance costs and supplier costs.

Be happy you dont deal with Steel and Tube....3 increases in 6 months to date...and all above that rate.

Oh, I totally understand. Commodity-linked prices are going through the roof. DX is interesting as it's effectively just a service based company and even then we're looking at double CPI inflation.

Steel prices are soaring, that's for sure.

Timber too:

https://www.newshub.co.nz/home/rural/2021/03/global-timber-prices-risin…

China is bidding up prices for NZ logs and making it more expensive here - highest bidder wins. US house construction also being choked off by supply.

Surely we can fix these resource constraints by more quantitative easing?

Enjoying the comments about inflation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.