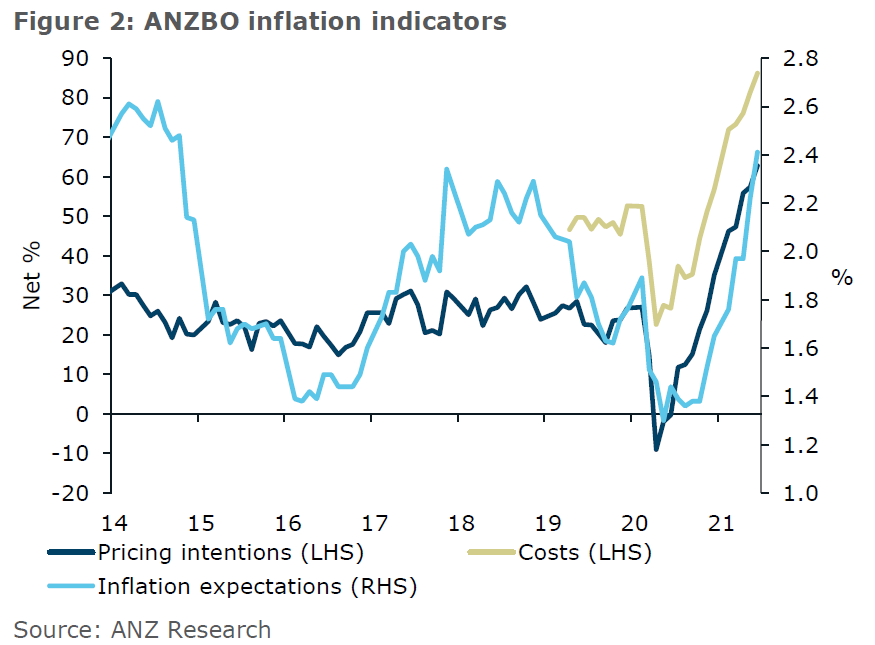

Businesses are now seeing future inflation rising well above the Reserve Bank's explicitly targeted 2% level, according to results from the latest ANZ Business Outlook Survey.

"Inflation expectations at 2.41% (2.53% in the late-month sample) can no longer be said to be 'close to' the RBNZ’s target range midpoint of 2%," ANZ chief economist Sharon Zollner said.

Firms surveyed are continuing to report intense cost pressures.

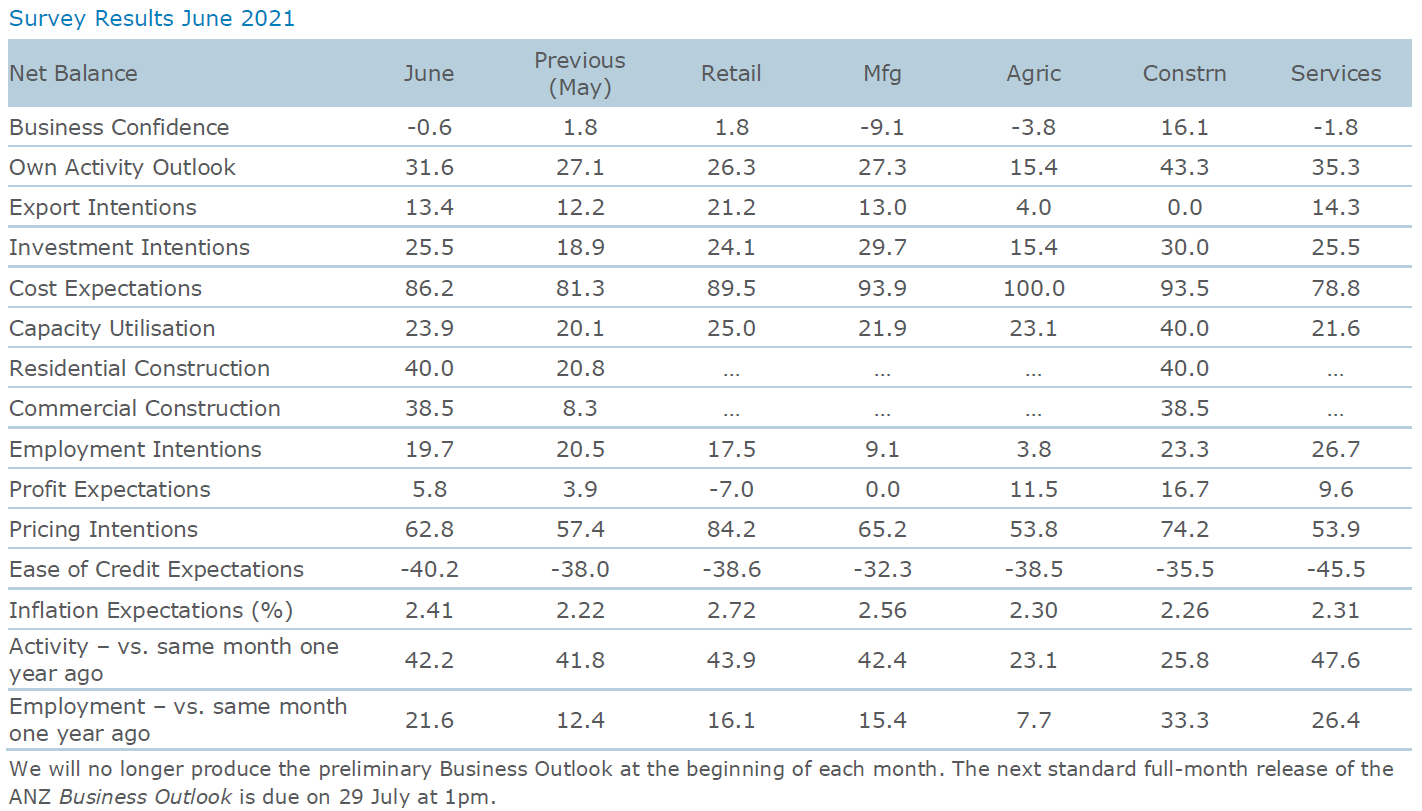

The net percentage of businesses expecting higher costs rose 5 points in the latest survey to a net 86.2%. A net 62.8% of respondents intend to raise their prices, up 6 points.

"Expected costs hit the maximum possible 100% for agriculture, and are in the 90s for manufacturing and construction," Zollner said.

"The risks around upcoming CPI [Consumers Price Index] outturns are all to the upside, and the RBNZ needs to get a wriggle on regarding raising the Official Cash Rate." she said.

In its May Monetary Policy Statement the Reserve Bank forecast that it may have to raise the OCR (currently at just 0.25%) from the second half of 2022 onwards.

But as economic data has subsequently kept coming in much stronger than expected, then so economists and the markets have been anticipating the need for an earlier start to interest rate hikes.

"With firms keen to invest and employ, and both cost-push and demand-pull factors suggesting strong inflation ahead, it’s past time to unwind the emergency OCR stimulus," Zollner said.

"We are forecasting the RBNZ to raise the OCR in February next year, but odds are rising that we’ll see hikes this year."

In terms of other results in the latest survey, compared to May, headline business confidence eased 3 points while firms’ own activity rose 5 points to +32%.

“Broader activity indicators were little changed compared to the preliminary read [of the survey results released on June 9]. Now that the data has settled down we will return to monthly releases,” Zollner said.

Turning to the detail, compared to the month of May as highlighted by the ANZ economists:

- Business confidence was down 3 points to net -0.6%.

- Firms’ own activity outlook rose 5 points to 31.6%.

- Investment intentions rose 7 points to 25.5%.

- Employment intentions eased 1 point to 19.7%.

- Capacity utilisation rose 4 points to 23.9%.

- Inflation pressures continue to lift. Cost expectations rose 5 points to net 86.2%. A net 62.8% of respondents intend to raise their prices, up 6 points. General inflation expectations rose 19bp to 2.41%.

- Profit expectations rose 2 points to 5.8%.

- Export intentions rose 1 point to +13.4%.

- A net 40.2% of firms expect credit to be harder to get, down 2 points.

- Residential construction intentions rose 19 points to 40%. Commercial construction intentions rose 31 points to net 38.5%.

- Freight disruptions remain problematic.

“Every third month we ask about firms’ largest problems, and about what’s driving their investment intentions. Finding skilled labour ranks very highly economy-wide and has been a steadily increasing problem for firms, as are non-wage costs. High rates of pay are also creeping upwards as an issue," Zollner said.

“For those planning to invest more, the decision is increasingly being driven by skilled labour shortages and labour costs, but the domestic and global economic outlooks remain key. For those intending to invest less (far fewer firms), the domestic and global economic outlooks are becoming less important as skilled labour shortages and labour costs take over.

“The New Zealand economy is stretched, and firms are clearly facing enormous cost pressures. Increasingly, they are planning on raising their prices in response, with little fear evident that demand will collapse as a result. Shortages of labour are driving investment decisions to a greater extent, but it’s confidence in the economic outlook that will always be key here."

40 Comments

So why is the OCR still so low. This was obviously going to be the case before Christmas when it started emerging that the economy had been grossly over stimulated and was highly likely to lead to an asset bubble as I posted at the time. Here we are now 6 months later and the RB foot is still hard to the metal without any corrective measures. What the hell are they playing at? Are they doing their absolute best to put house prices through the roof and drive our young people out of the country. All the while the Labor government sits on the sideline, inert and useless.

March CPI was 1.5% and June not out until 16 July 2021. Even if the inflation expectation of 2.41% is correct this is still within 1-3% target range for RBNZ. RBNZ has operated below 2% for 35 out of the last 40 quarters so nothing to see if in upper range of target for some time.

https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-inflation

The CPI is a totally rigged indicator and in no way reflects what people are experiencing by way of how much more they have to pay for houses. This is after all singularly by a large margin the largest household cost for most Kiwis.

He did answer your question though. You asked why interest rates are not rising & he pointed out that the CPI hasn't gone above 3% so the RBNZ will hold rates. The fact that the CPI is the most fudged statistic in the history of government statistics is a separate issue.

I'd say it is part of the same issue, the reason why it is fudged in the first place is so they can precisely pretend everything is still looking fine when we have some rampant hyperinflation.

the same reason they fudge the manufacturing stats by using the PMI..

when plants close down they don't do the survey any longer so it has survival bias.

we might be about to find out whether closing down businesses that actually produce stuff was a good idea or not

rampant hyperinflation

hyperbole

Debatable

Supporting political gains not economic stability is the new game in town for the RBNZ.

Government debt borrowing made cheap with bond buying and low OCR supporting the housing market. Additionally, going into this the RBNZ assumed that inflation was a thing of the past and that QE never caused inflation in the west for 20 years, so why would it this time? But hey, now that everyone's doing it you can't just export inflation so welcome to the great reset upwards....

"The New Zealand economy is stretched, and firms are clearly facing enormous cost pressures".

Orr MUST RAISE THE OCR, NOW.

Not doing so will cause the economy to overheat, inflation will kick in and destroy the purchasing power of consumers, and this will force the clowns at the RBNZ to raise rates even higher later on. The OCR must be raised immediately to 1%, and keep increasing until the economy is rebalanced.

It is high time to stop subsidizing a minority parasitic class of housing specuvestors, and start considering the longer term interest of the whole economy and of NZ society in general.

Something on the horizon said one Mr Orr of the Reserve Bank to one Mr Robertson of the government. Is it smoke or clouds? Dunno but whatever it is, it is black and growing and moving towards us fast. Oh, best not to look that way then.

Wild how this would also stuff up home owners with mortgages, but I keep forgetting that you're either a property hoarding investor parasite or a downtrodden renting hero of the oppressed mass and that there is no possible middle ground.

I've heard from a reliable source that log prices are going up 40%. Building material prices have gone up twice already this year approx 5% each time with another rise expected towards the end of the year... Yeah inflation is going to be well above 2%

Steel for framing in horticulture structures (e.g. kiwifruit) up over 10% this season

brother in law has a shop and said the other day the cost to bring a 40ft container in has gone from $4000 to $14,000

It won't affect inflation though coz the importer will suck all those costs up. (said no importer ever)

https://www.stuff.co.nz/taranaki-daily-news/news/300345236/new-plymouth…

From July 1 +12% on our rates.

Then +6% every year for the next 9 years.

That's the price of home ownership and years and years of undercooked infrastructure investment that rates pay for.

Don't businesses pay district and regional rates too?

I'm not so sure they'll just swallow these increases and not push up their prices.

Then send the bill to the people who got cheap rates, cheap housing and tax-free gains on their rental properties for years.

Those of us who have never had any of the above can't take everyone bumping up their costs by 6% year on year on our food, transport, standing costs, housing. Once everyone has their 6%, what is left? Even less than there was last year, in real and nominal terms.

That only works if employers are prepared to dip into their own pockets and increase wages ahead of inflation.

If that was likely or realistic then we wouldn't be in this mess, would we?

That's fair. 6% a year is basically keeping up with inflation. You can't blame New Plymouth council for the monetary system mismanagement caused by RBNZ & Central goverment.

How can 6% be basically keeping up with inflation when the CPI inflation is like a "Claimed" 2% ? You cannot have it both ways. Everyone knows that actual inflation right now is closer to 10% than 2%. If the RB are going to try and use a hopeless indicator to try and manage the economy we are in deep shit.

I am sorry if this is a newfound revelation. Many people don't realise how neck deep we really are.

"If the RB are going to try and use a hopeless indicator to try and manage the economy we are in deep shit".

You sort of answered your own question there because that is exactly what the RB is doing. Though i'm a bit less cynical the "real economy" is more resilient & can fare relatively well even with poor monetary policy. What is happening now is more of a robbing peter (bank depositors/ govt bond buyers) to pay Paul (debt ridden home owners/govt bond sellers) scenario.

If housing prices double every 10 years that's a 7.2% a year of extra wealth effect (wink wink), that should be more than enough to pay an extra 6% a year in rates. Just need to use some cash you don't have but hey maybe ask some neoliberal guru who knows better how this works.

Adrian Orr goes brrrrrrrrrrrrrrrrrrrrrrrr.

Your savings and your labour are worthless, peasant.

Peasants with savings, funny guy.

I can confirm that the product I import will be heading an average of 6% north, we have had up too a 19% increase on some product. Not to mention freight has tripled in the last 12 months. We are eating some margin in the hope that freight and demand normalises over the next 12 months.

Construction industry price rises are everywhere. We are noticing

It takes more than 12 months to get a ship from signing the cheque to transporting freight.

Inflation is going crazy. Good time to not be the Govt. Orr fiddles while NZ workers burn. Asset holders smiling all the way to the bank.

Yes it is but I'm 2/3 house and 1/3 cash so the housing sugar rush is offsetting any inflation here but I'm at the very end of the scale. Those at the very other end trying to save for a house are getting totally screwed right now.

Lol. It's all just transitory. Nothing to worry about.

So is our time on this earth though I suppose.

What this story is actually saying is that temporary price rises + loads of 'inflation is coming' stories are increasing inflation *expectations*. Well no sh*t Sherlock - of course they are. Now ask yourself who stands to benefit from the 'inflation is coming' and 'interest rates will rise soon' stories? Errrm, mortgage lenders who make a fortune when people lock themselves into medium-term fixed rate mortgages maybe? Who do you work for again Sharon?

The Reserve Bank will just look right through this transitory period of inflation. My only question is if this'll end in a gentle deceleration or a crash.

That’s everyone’s question……I’m not sure that history offers up many examples of a gentle landing though ..

Got new tyres on my work truck today. Cost 20% more per tyre than this time last year. The product I carry on the back of the truck has increased by a similar percentage.

Not sure how much my employer has increased their rates by.

Can’t comment much on wage inflation as I haven’t been with this company for too long, pretty impressed by the money I’m on though, if my hourly rate is reflective of the rest of the transport industry then wage inflation is real as well.

Yes, time to hike interest rates up high.

As the boomers have now paid off their 1.5 million houses benefiting from decades of falling mortgage interest rates so time for them to ride forward the benefits of rising term deposit rates now.

Got to time your lifeline just right!

It’s crazy how different this thread is to the mainstream ambivalence to the risks inherent in the current cocktail of monetary policy, mangled supply chains and distorted asset markets - I feel like a few of you guys need to break into the mainstream start ringing a bell or something ….

It’s crazy how different this thread is to the mainstream ambivalence to the risks inherent in the current cocktail of monetary policy, mangled supply chains and distorted asset markets - I feel like a few of you guys need to break into the mainstream start ringing a bell or something ….

RBNZ's 2% inflation "target" is a misrepresentation of reality. Other central banks too are conspiring in concert to gaslight the public that the "everything" bubble is not more than a few percent. It's time they get called out in the press and exposed for the peddlers of b/s that they are.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.