By Gareth Vaughan

Analysis by Citigroup suggests two of Australasia's big four banks, ASB's parent Commonwealth Bank of Australia (CBA) and the ANZ Banking Group which owns New Zealand's ANZ and National banks, could maintain their dividend payouts even in a one-in-30 year Gross Domestic Product (GDP) "shock" scenario.

In a report entitled Stress testing bank dividends: ANZ and CBA get a pass mark, Melbourne-based Citi analysts Craig Williams, Wes Nason and Andrew Minton said CBA and ANZ could sustain their dividends even if GDP fell 7%, which would be a hit similar to the recession of the early 1990s. However, they said BNZ's parent National Australia Bank (NAB) fell short of their stress test hurdles and the Westpac Group performed "by far the worst" in their stress testing of the big four Australasian banks.

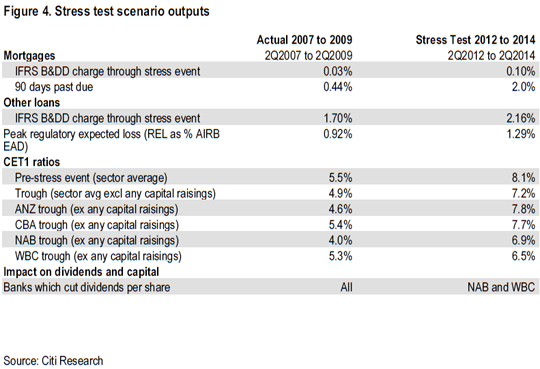

The analysts said it would take a shock the magnitude of a 7% GDP drop for the big four banks to breach minimum stressed capital requirements and make cuts to dividends. However, the four are in a better position than in the 2008-09 slowdown or the early 1990s recession (when many banks cut dividends and raised capital and the BNZ got bailed out with NZ$620 million of taxpayers' money) due to significantly higher levels of capital, a weak credit growth environment, and "well seasoned" business lending portfolios following four years of deleveraging. They say average capital across the four banks is 8% now versus 5.5% in 2007 and credit is growing at about 4% now versus 15% five years ago.

The analysts say the relatively weak credit growth and higher initial capital positions are the main reasons why ANZ and CBA are able to withstand such a shock.

"ANZ's much higher starting capital, surprising level of improvement in credit quality, and lower dividend payout ratio see it perform best in our stress test," Williams, Nason and Minton say.

ANZ paid a fully franked 2012 interim dividend of A66 cents per ordinary share on July 2, equivalent to 60.8% of profit (versus 68.5% in the last annual results). CBA paid a A$1.37 per share interim dividend, equivalent to 61% of profit, compared with the 78.3% profit payout ratio in its last annual results.

NAB's 'higher risk lending book' & Westpac's 'predominantly sub investment grade corporate credit'

NAB comes up short in the stress test due to a higher risk lending book. Westpac's "predominantly sub investment grade" corporate credit portfolio and large specialised lending portfolios acquired through its St George Bank acquisition in 2008, contribute to it also coming up short.

NAB's Core Equity Tier 1 capital ratio (CET1) fell to 6.9% in the stress test, below the Citi imposed 7.5% floor, with the analysts saying the drop is driven primarily by "significantly lower" asset quality than peers.

"This implies a A$2.3 billion capital raising to maintain dividends," the analysts say.

NAB's half-year dividend was A90c per share, up from A88c a share in the second-half of the previous financial year.

Meanwhile, Westpac's CET1 drops even lower, to 6.5% in the stress test.

The analysts said Westpac now had "much lower" corporate/business asset quality than is generally understood, mainly due to its St George acquisition.

"Hypothetically our stress test implies a capital raising of A$3.6 billion for (Westpac) dividends to remain untouched."

In its interim results Westpac disclosed an A82c per share dividend, up 3% from A80c in the second-half of the previous financial year, making it the bank's highest half-year dividend ever paid. Westpac's first half-year payout ratio was 78.4% of profit, or 65% given about 17% of dividends return to the Group via a dividend reinvestment plan. Westpac paid out 67% of profit in its last full-year.

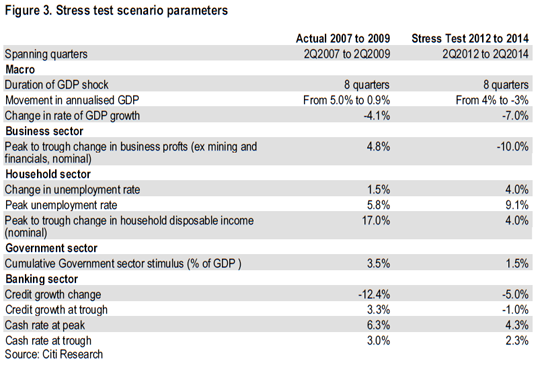

The Citi stress test scenario applied a more severe GDP contraction than seen in 2007-09, and assumed significantly less support from both the Australian Government, via economic stimulus, and from the Reserve Bank of Australia, through Official Cash Rate cuts.

"We take our existing earnings forecasts, adjust credit growth, ramp up bad and doubtful debt charges, though make little change to margins, as in previous sharp downturns margins have been maintained because of the minimal requirements to fund balance sheet growth," the analysts say. See further detail in their charts below.

Meanwhile, the analysts note the bank sector's forward dividend yield of 7.3% exceeded 10-year Australian Government bonds by "an almost unprecedented margin" of 4.4%.

"We believe this represents a fear spread, rather than relating to real risks around capital sufficiency or dividend sustainability," Citi's Williams, Nason and Minton say.

They also point out that, with the exception of Spanish bank dividends, "where sustainability must be more questionable," the Australasian banks have the highest dividend yields amongst Citi's coverage of developed market banks. This comes after recent analysis from the Bank for International Settlements showed the big four Australasian banks to be the most profitable in the developed world, when measured by pre-tax profit as a percentage of total assets. Interest.co.nz subsequently broke out figures for the New Zealand subsidiaries of the four, showing them to be even more profitable than their parents.

The Citi analysts forecast a full-year dividend yield of 7.6% for both Westpac and NAB, 6.6% for ANZ, and 6.1% for CBA.

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

14 Comments

The GD was 1930, 80 years ago, to day the problem looks bigger, so the Q is whats the damage from a 1 in 80 year when NZ GDP fell,

http://www.stats.govt.nz/

browse_for_stats/economic_indicators/nationalaccounts/

long-term-data-series.aspx. On this measure, nominal GDP

fell from £172 million in 1929 to a low of £117 million in

1932

more like 30%.....

"The global economic downturn, beginning in 1929-30, was transmitted to New Zealand by the collapse in commodity prices on the London market. Farmers bore the brunt of the depression. At the trough, in 1931-32, net farm income was negative. Declining commodity prices increased the already onerous burden of servicing and repaying farm mortgages. Meat freezing works, woolen mills, and dairy factories were caught in the spiral of decline."

http://eh.net/encyclopedia/article/Singleton.NZ

regards

What does Mr Hendry believe?

At the Milken Institute conference in May, he told the audience that France was just a year away from nationalising its banks and that politicians had still not faced up to the scale of the global debt bubble that was now imploding.

“We have reached a profound point in economic history where the truth is unpalatable to the political class – and that truth is that the scale and magnitude of the problem is larger than their ability to respond – and it terrifies them.”

Three years after Mr Hendry posted videos on YouTube of his visits to Chinese ‘ghost’ towns, he remains pessimistic about the Middle Kingdom. He is shorting the equity of Chinese state-owned enterprises, balanced by a long position in a basket of Asian non-discretionary consumer stocks.

He is also using credit default swaps to bet against the debt of financially leveraged Japanese companies such as Toshiba, which he believes are particularly exposed to a Chinese slowdown.

Mr Hendry insists that his reputation as a “contrarian” investor is wrong, and that his approach is in fact to take advantage of the prevailing momentum in markets. “Our ideas are harshly disciplined by market trends. You will never see us pursue a homegrown idea when it is to the detriment of the prevailing trend.”

For example, he reckons US government bond yields, already at record lows, will continue to fall. And, although he professes not to be a contrarian, he is more optimistic about the US than many investors and is “long the debt-saddled west and short the vastly over-vaunted and over-owned” Bric quartet of Brazil, Russia, India and China.

He believes that financial markets are single-digit years away from a crash that will present investors with opportunities of a lifetime. “Bad things are going to happen and I still think the closest analogy is the 1930s.

”http://www.zerohedge.com/news/hugh-hendry-when-i-speak-tv-it-gives-impr…

I agree with him very much (1930s) and hence opportunties...given the numbers of $s in the US bonds and teh huge cash reserves of some US corporations I wonder if this is also what these ppl are waiting for....cash on the nail at firesale prices.

Where we differ is I read his stance on the US shale oil bonanza, he thinks its a game changer...I think too many ppl are taking it on face value myself....and it will never happen....

regards

So it would be advisable to take deposits out of the BNZ and Westpac before OBR comes into force ?

Andrewj - are you insinuating that more than the dividend is at stake for shareholders?

I, like you, am a little more pessimistic when one bank's analysts condemn a competitor or two. More dirt will fly before it's done. And the tone will progressively turn more downbeat in respect of stakeholder's prospects. Just as it has in Europe.

It's shaping up as though depositors and salary earners are increasingly at risk as banks will protect as much of their proprietary capital by issuing covered bonds leaving unsecured creditors to struggle with the decisions of ill equipped and possibly bank captured civil servants.

This is moral hazard executed on a grand scale behind the veil, yet publicly defended as the opposite. Lax, poorly executed regulation is favouring the strong at the explicit expense of the weak and innocent.

Why are salary earners that exposed? In effect their capital is their earning potential in the future unlike a depositor whos capital exists as 1s and 0s and can be taken away when the bank closes its doors.

So yes I can see depositors are at risk, but there are things they can do, for instance invest in "cash like things" or with deflation hold the cash....hmm not sure if a deposit box would get raided if a bank closes or not.

I think the RB has also said not more than 10%...my worry though is banks may swap assets in and out....so the 10% is guaranteed....

regards

Why are salary earners that exposed?

Some people live hand to mouth and to such a degree the more callous side of my nature suggests I should set up a payday loan racket to get around any compromise the RBNZ might make on behalf of my deposits and others paychecks. The risks, while not the morality of the operation, are better.

An yes it's 10% until it's not. I go for the later.

What concerns me is that if things continue to play out the way the regulators are pushing we will end up with one superbank.

In otherwords the strongest will sutrvive at the expense of all other players who may not be quite as well capitalised; or perhaps have a bit more exposure to one particular sector; or have an auditor who takes a slightly different stance on impairment; or maybe has some bad press (refer Rabo this week).

What next - nationalising the banks? I see no other option if the competition is wiped off the face of the landscape.

Don't agree, well take a look at the mortgage stats at the moment. A gazallion mortgages are being written each month, and collectively mortgage growth is zilch. in other words the banks are clambering all over each other, cutting deals here and there, all whilst trying tto get that new customer, and screw over the opposition at the same time.

How about the banks start funding business and let's start making the country productive again instead of all this BS

Don't agree, well take a look at the mortgage stats at the moment. A gazallion mortgages are being written each month, and collectively mortgage growth is zilch.

Data links please?

Stephen

You could try www.rba.gov.au/statistics/by-subject.html

Table D2 lending and credit aggregates has some loan data for Banks, NBFI and AFI's

regards

Craig

Thanks Craig - I believe kaneo2 was referring to NZ developments despite the fact the article was referring to Australia's domestic banks.

hi Stephen - the reason is that because rates are so low and generally each bank is undercutting the other - in many cases now the "break fee" is of no consequence. unlike the old days before the re-write of the credit contract act - now referred to as the CCCFA 2003. the break formula is often nil. Hence it is easy to braek terms loans with no penalty = result equals massive switch going on at the moment. I guess good for the consumer. Until the OCR jumps a bit I see this pattern continuing.

I would be more interested to see some analysis as to how far Aussie property prices need to fall before the big four get into trouble. The figure used of 2% of mortgages being 90 days past due doesn't seem to be particuarly high if there is a major property price correction.

Yep - totally agree - we are ignoring reality and yet steadfastly implementing the legal changes to create structures (OBR +Covered bonds) designed rob the innocent and powerless in expectation that it will roll over.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.