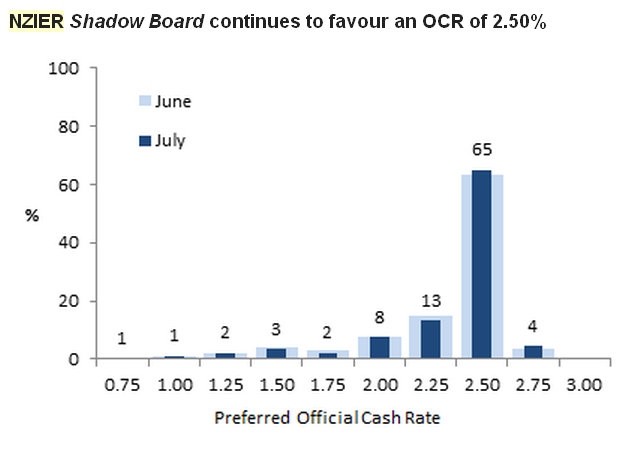

The Reserve Bank should leave the Official Cash Rate (OCR) on hold at its record low 2.5% on Thursday, according to a shadow OCR review board set up by the New Zealand Institute of Economic Research (NZIER).

The Board gave slightly more weighting to keeping the OCR at 2.5% or even raising it to 2.75% than in June.

Low inflation, flat business conditions and deteriorating commodity prices pointed to a weak recovery, the Board said. That meant inflation was not likely to be above the top of the Reserve Bank's 1-3% CPI target band in the near term.

“The NZIER Shadow Board prefers the current official cash rate of 2.50 percent over alternative interest rate settings,” NZIER Head of Public Good Research Kirdan Lees said.

“In June annual inflation hit the lowest point since December 1999 and the latest QSBO release suggests flat business conditions. Low global demand is reducing prices for New Zealand’s commodity exports. The Shadow Board’s recommendation to hold the policy rate at a low level is consistent with this weak recovery continuing," Lees said.

Last week, figures from Statistics New Zealand showed annual inflation, as measured by the Consumers Price Index (CPI) was 1%, right at the bottom of the RBNZ's band. Excluding an annual rise in cigarette excise tax, annual inflation would have been 0.6%, Stats NZ said.

Bank economists expect the next move in the OCR to be up, and are split between March and June next year. Economic forecasters Infometrics are picking a hike in mid-2013, while NZIER itself says the OCR could remain on hold until 2014, or may even have to be cut between now and then.

Shadow board

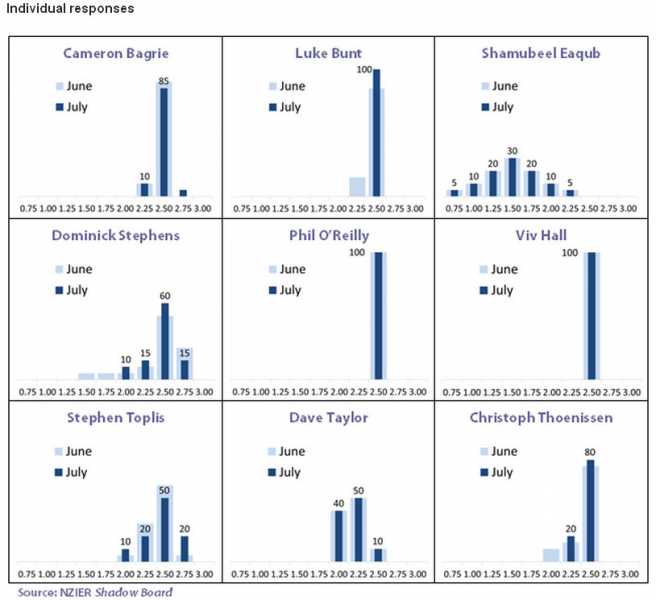

The members of the board are:

Cameron Bagrie, Chief Economist, ANZ National Bank

Luke Bunt, Chief Financial Officer, The Warehouse

Shamubeel Eaqub, Principal Economist, NZIER

Dominick Stephens, Chief Economist, Westpac

Phil O’Reilly, Chief Executive, Business New Zealand

Dr. Viv Hall, Professor, Victoria University of Wellington

Stephen Toplis, Head of Research, Bank of New Zealand

Dave Taylor, Chief Executive, Steel & Tube

Dr. Christoph Thoenissen, Associate Professor, Victoria University of Wellington

About the NZIER Shadow Board

Lees said the NZIER Shadow Board aimed to achieve three goals:

- to encourage informed debate on each interest rate decision

- to help inform how a board structure might operate relative to New Zealand’s current single decision-maker model, where the Governor is responsible for making each decision

- to explore individual board members using probabilities to express their uncertainty.

"The format closely mirrors the Australia Probabilistic interest rate setting project (PROPOL) run by the Centre for Applied Macroeconomic Analysis at the Australian National University," Lees said.

The Board does not meet but each member is asked to give a percentage value for how much they prefer each interest rate. These values are aggregated to form a collective Board view (see above).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.