By Bernard Hickey

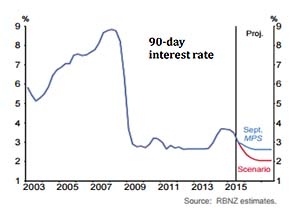

The Reserve Bank has cut its Official Cash Rate by a further 25 basis points to 2.75% as universally expected and has lowered its forecast for short term interest rates to imply one more 25 basis point cut later this year.

However, the central bank did include one potential scenario in Box D of its September quarter Monetary Policy Statement (MPS) where a weaker global economy would force three more cuts to as low as 2.0% over the next year.

Governor Graeme Wheeler also told a news conference there was plenty of room for the bank to cut its OCR deeply if a much sharper global economic downturn hit the New Zealand economy harder. He said the Government also had a strong enough balance sheet to stimulate if needed. He said a recession in China and a bad El Nino could be factors that trigger such a downturn.

The New Zealand dollar fell sharply to as low as 62.5 USc after the statement, which was seen by some as more dovish than expected. It had been over 64 USc overnight. Wholesale swap rates fell three basis points.

Earlier in the Reserve Bank's MPS, Wheeler said domestically generated inflation was below average and capacity pressures were expected to ease modestly in coming quarters because of a fall in GDP growth to just over 2% from over 3% a year ago.

"A reduction in the OCR is warranted by the softening in the economy and the need to keep future average CPI inflation near the 2% target midpoint," Wheeler said. "At this stage, some further easing in the OCR seems likely. This will depend on the emerging flow of economic data," he said.

Wheeler said lower interest rates and a lower exchange rate were expected to underpin a pick-up in growth and inflation from 2016. GDP growth was expected to rebound to slightly over 3% by early 2018.

He said the bank had revised its growth forecasts lower because of concerns about softer growth in emerging economies, particularly in China and East Asia.

"Domestically, the economy is adjusting to the sharp decline in export prices, and the consequent fall in the exchange rate," Wheeler said.

"Activity has also slowed due to the plateauing of construction activity in Canterbury, and a weakening in business and consumer confidence," he said.

"Several factors continue to support growth, including robust tourism, strong net immigration, the large pipeline of construction activity in Auckland and other regions, and, importantly, the lower interest rates and the depreciation of the New Zealand dollar."

NZ$ depreciation needed

Wheeler said further depreciation in the New Zealand dollar was appropriate, "given the sharpness of the decline in New Zealand’s export commodity prices."

The warning about further falls was softer than his previous comments about the need for a substantial depreciation and that the currency had been unsustainably and unjustifiably high. Those key phrases were not included in today's statement.

Slower house price inflation seen

Wheeler said house prices in Auckland were becoming unsustainable. The bank forecast house price inflation would ease steadily as new supply came on stream, but it said it did not assume a sharp house price adjustment.

"Residential construction is increasing in Auckland, but it will take some time to correct the imbalances in the housing market," he said.

Wheeler expected headline inflation to return well within the 1-3% target range by early 2016 "as the earlier petrol price decline drops out of the annual inflation calculation, and as the exchange rate depreciation passes through into higher tradables prices."

Although he noted: "Considerable uncertainty exists around the timing and magnitude of the exchange rate pass-through."

Economist reaction

ANZ Chief Economist Cameron Bagrie said the MPS was at the dovish end of expectations, although he was not convinced the Reserve Bank would cut at the next decision on October 29.

"We don’t get the impression the RBNZ is necessarily in a hurry to cut again," Bagrie said.

"The 90-day bank bill projection falls only gradually and future moves are conditional on the emerging data flow. As such, we are not convinced the RBNZ is set to pull the trigger straight away in October, but certainly the OCR has not yet troughed," he said.

ASB Chief Economist Nick Tuffley said the Reserve Bank's September MPS still had an easing bias, but it was not as explicit as in the statement after the July 23 OCR cut. He saw a further cut in October to a low of 2.5%.

"Next year we see the risks slightly biased to further cuts, with the risk that inflation doesn’t return to 2% as quickly as the RBNZ anticipates," Tuffley said, adding he saw growth slightly undershooting the RBNZ's target.

"With only one more cut factored in, the decline in the 90-day rate forecast is gentle, as it was in the June MPS. The strong easing bias of July (“some further easing seems likely”) has been toned down by adding conditionality similar to that in June (“this [easing] will depend on the emerging flow of economic data”)," he said.

"At this point the RBNZ sees it is near the end of the easing cycle."

Westpac Chief Economist Dominick Stephen pointed to the Reserve Bank's alternative scenario for a cut in the OCR to 2.0%.

"Our view is that the falling exchange rate will produce only a temporary burst of inflation, whereas the RBNZ believes that the low level of the exchange rate will produce ongoing tradables inflation," Stephens said.

"This difference of view on tradables inflation, combined with our slightly more downbeat view on economic growth, leaves us very comfortable forecasting a 2.0% low-point in the OCR," he said.

"If anything, we feel that the RBNZ has given a slight encouragement to our view - the RBNZ's alternative scenario opened the door a crack to a sub-2.5% OCR."

BNZ Head of Research Stephen Toplis said he saw a 65% chance of another cut in October to a trough of 2.5%, although he pushed out his forecast for the first hike from that level to February 2017 from December 2016.

"One thing’s for sure, interest rates are not going up any time soon," Toplis said.

"Furthermore, growth will remain under pressure for some time and inflationary pressures (whatever they prove to be) will be almost exclusively driven by the extent of the drop in the NZD’s fall and the magnitude of the pass-through of that decline to headline CPI inflation," he said.

BERL Chief Economist Ganesh Nana said the Reserve Bank's downgrading of its GDP growth forecast for the year to March 2016 from 3.2% to 2.1% was "jawdropping" and lifted its unemployment forecast from 5.3% three months ago to 6.1%.

"Given that the Reserve Bank picture now suggests below-potential growth to 2017 and headline CPI remaining below 2% over the forecast horizon, the chances of further OCR cuts through to 2016 are relatively high," Nana said, adding he continued to expect the OCR to be cut to 2.0% in the first half of 2016.

(Updated with more reaction, detail)

13 Comments

Governor Graeme Wheeler said domestically generated inflation was below average and capacity pressures were expected to ease modestly in coming quarters because of a fall in GDP growth to just over 2% from over 3% a year ago.

Is this a disguised call for a fiscal response from the government similar that proposed by Fed President, Narayana Kocherlakota?

Back in July, in remarks ironically prepared for delivery at a conference hosted by the Bundesbank, Kocherlakota noted that in order to lift the neutral rate, US lawmakers might want to consider issuing more debt. Read more

What you mean they've finally figured out that only decent sized fiscal deficits cause inflation in consumer prices? Surely not. I mean, it's only been 6 years.

Yes, but banks will prohibit the government crowding out their compounding interest claims on the citizen's limited endeavours.

how will banks achieve this?

Is this government not already reliant on a surplus budget fiscal management policy to source corporate funding for it's election campaigns?

When in the zero bound trap even seemingly big numbers have no traction. Interesting thing is NZ shouldnt be in such a trap aka the Fed. So is our rate too high? or is it external factors dragging us down? or what %?

While exporters might be seeing a better return as the exchange rate collapses there will be a big burden on some aspects of a business, licencing. Spend $200,000NZD on software which vendors always insist is in USD and going from 0.85 to 0.65 is big hurt, you have to find $61k more.

I agree we still have significant imports and anyone paying in USD is really going to start hurting. Consumer spending is going to start to slow and NZ still has too many eggs in one basket as far as exports so will it offset this ? Lower milk prices are great but consumption has to dramatically increase or you no better off.

Finally some relief for mortgage holders. It will help but it's not enough.

Very true OnwardUpwards - "its not enough" because asset prices and mortgage sizes have skyrocketed - why have asset prices and mortgages sizes rocketed ? .........rates are too low. Sooner or later there will be a wake up call.

I'm going to put it out there and say there are still more rate cuts to come. The USA has been sitting on 0% since like 2009, we have a long way to go to reach this and seemingly no other tools in the toolbox to try and prop up a tanking economy. The interest rate has an immediate effect on the USD exchange rate and we appear dead set on making our currency as worthless as possible again.

Looks like an OCR of 2.25% even 2% is probable (funny a few of us thought it was a possibility some months back). However NZ doesnt seem to have a tanking economy yet, flat and struggling yes clearly. The problem is as you do one thing it gives hopefully good results but there are side effects that seem quite serious. So as we drop the OCR the exchange rate also drops and that makes energy and imports more expensive impacting businesses and consumers. So when Dr Wheeler says 0.65 need to be lower frankly that worries me.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.