The dramatic drop in August At-Wharf-Gate (AWG) prices for logs delivered to ports around New Zealand is the main talking point in the current market.

The predominant reason for this drop in AWG prices has been the depreciation of the Chinese Yuan Renminbi (CNY) against the US Dollar (USD). In mid-April the Chinese log buyers required ¥940.75 CNY to buy a cubic metre of log at a sale price of 150 USD/JASm3. In mid-July the buyers had to pay ¥1,1003.61 CNY for the same volume at the same price. This severely reduced their buying power and sales prices dropped accordingly.

The drop in CFR log sale prices in China has been ameliorated somewhat by the weakening NZD against the USD and an easing in freight rates by 1-2 USD/JASm3.

The final result is that AWG prices for un-pruned sawlogs have dropped an average of 12-13 NZD /JASm3. Pruned logs have dropped on average 18 NZD /JASm3 as the clearwood products manufactured from these logs have also been hit with trade tariffs imposed by the USA.

The metrics still show the China log market to be buoyant. Total softwood log inventory has reduced to approximately 3.2 mln m3, and daily port off-take is still very healthy for this time of year at over 70,000m3/day. Demand for logs in China should increase in September as the weather cools.

The domestic non-clearwood market is still ticking along, albeit slightly behind expectations and capacity, and the export markets have strong demand but weaker pricing in Asia due to the same currency issues. The export clearwood markets of NZ mills continue to have strong demand and pricing so local mills utilising pruned logs have the capacity to increase production. All local mills will be looking at the log export markets and wondering what affect this might have on negotiations for pricing of Quarter 4 log supply.

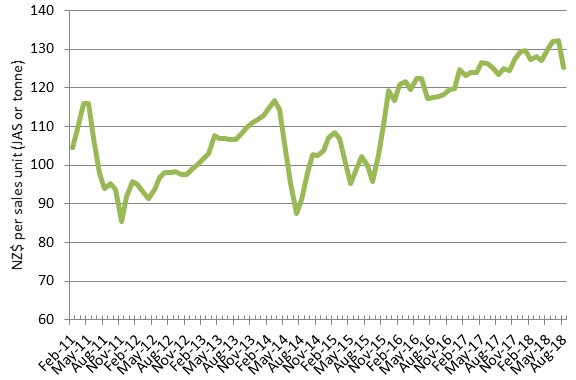

Due to the drop in AWG sale prices the PF Olsen Log Price Index dropped to $125 for August. The index is currently level with the two-year average, $3 above the three-year average, and $10 higher than the five-year average.

Domestic Log Market

There is little change for all domestic log markets, and mills are generally well supplied. Some mills buying pruned logs do need to juggle their FSC mix, as often log supply from woodlots isn’t FSC certified. The availability of pruned logs has increased in some regions as supply is diverted away from the export market.

Pruned

The domestic demand for clearwood lumber is stable while export sales are very strong. Their markets have shown no effects of the trade wars reverberating around the globe.

Un-pruned

Domestic demand for structural and remanufactured sawn timber is steady while down on this time last year. Usually there is a lull in demand during the New Zealand winter, but we didn’t see this softening in demand last year. Most insiders say the weaker current demand is more seasonal rather than the oft-mentioned drop in business confidence within New Zealand. Building consent numbers have been strong so there is an expectation demand will pick up in Quarter 4.

There is still strong demand in all their export markets, although prices are down in China due to the weakened CNY. Demand from the Australian market is always strong and the market balance between supply and demand is affected by Scandinavian supply and production levels from Australian mills. This is currently well balanced.

Export Log Markets

China

The recent drop in log sale prices in China have predominantly been caused by the depreciation of the CNY against the USD as graphed below. While one of the two main log exporters is trying to hold CFR prices in the 136-138 USD range/JASm3 for A grade, the other main exporter has already offered some early August shipments at 130 USD/JASm3. This price of $130 USD/JASm3 however is more a basket deal for buyers also buying vessels above market price, so it is hard to say this is the normal price. Most exporters think prices for A grade in the mid USD $130’s would work for all parties. While it was clear the Chinese log buyers needed some relief from the weakening CNY, everybody now seeks stability in the market.

Total softwood logs stocks in China have dropped to approximately 3.2 mln m3 and demand is still strong. Current daily port off-take is over 70,000m3 and demand is expected to increase as temperatures cool across China. We have also seen less softwood volume arriving from South America and the South East of the USA. There is talk of China imposing a 5-20% tariff on log imports from the US, and US log cargo already incurs costs due to time delays. Any log cargo from the US now even suspected of carrying pests is not allowed to pass through customs until samples have been inspected by laboratories. Previously, customs officers in China let shipments through while samples were being analysed. I am sure the samples are processed at ‘Trump Speed’.

This reduction in supply will assist with keeping inventory down, which in turn will reduce the likelihood of the price drops continuing. Most exporters forecast a stabilising in sale prices.

It is interesting to note the strengthening of the CNY against the USD over 2017, and in particular the second half of the year from the longer-term currency chart below. The recent depreciation of the CNY against the USD has negated these gains though.

CNY to USD Chart

India

The price drops in the Chinese log market have directly influenced log prices in India with some NZ based log exporters/traders dropping CFR prices in India sooner than required. Kandla prices for late July/early Aug loading from NZ are between 151 to 153 USD/JASm3 for A grade. At the same time some vessels landing currently in India are at 159/160 USD levels. It is estimated that prices will soon get into late 140’s USD/JASm3.

The sawn timber prices took a hit ahead of the log price drop, as sawn timber buyers started delaying orders in anticipation of price drops due to the falling log prices. Sawn timber prices have been slashed from Rs521 to Rs491 per cubic feet (CFT) in Kandla, and from Rs521 to Rs501 per CFT in Tuticorin. This has been a bad situation for saw millers receiving logs at 159/160 USD and then selling lumber at the new low levels. In the last two weeks there has been a stalling in sawn timber demand and dispatches from mills up to 30% due to price fall volatility. Packaging oriented demand was stable and orders were being fulfilled. Construction grade lumber, KIS fillers for plywood core, NZ pine recovery blockboards suffered because of price volatility.

The Indian Rupee recently fell to a record low of Rs 69.30 to the USD. It is projected to stabilise at around Rs70 levels.

Softwood log Inventory levels are low and GST upfront payments to the Indian Tax Department at port gate continue to force importers to do a just-in-time model for purchasing logs. In a way it keeps the market at real levels, but does inhibit chances of better growth. Banks are being cautious and now ask for 15-20% margin money for opening LCs. This can be compared to about 12-15 months ago when GST did not have to be deposited upfront, and margin money requirement was 10%.

In Tuticorin saw mills using NZ pine rely on industries requiring packaging material, as 80% of their output goes to packaging. However, the demand for packaging lumber has been subdued in the last few weeks and hence the stock movement and repeat orders are low. In contrast, the lower grades and construction lumber related stock movement has been encouraging in the last few weeks, especially from large cities in the catchment of Tuticorin - namely Bengaluru, Hyderabad, Amravathi, and Chennai.

September to November is projected to be a healthy period for log demand, and prices will continue to be dictated by China market parity and actions from NZ log exporters. There may be a bit of strategic marketing as a NZ exporter appears to be engaged in a battle to displace the more regular NZ Logs supplier to the Tuticorin market.

Ocean Freight

Ocean freight shipping costs for NZ log exporters decreased on average by $1-$2USD/JASm3, but costs arising from vessel congestion at ports both here in New Zealand and export destinations, means that total shipping cost have remained about the same as last month. The average ocean freight cost to China is about USD $30/JASm3.

Singapore Bunker Price(IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

The graph below shows the recent BDI rises have plateaued.

Exchange rate

The depreciation of the NZD against the USD has softened the impact that reduced sale prices in China have on AWG prices paid to log suppliers in New Zealand. The NZD has continued to soften against the USD, and this will assist with September AWG pricing.

PF Olsen Log Price Index - August 2018

The PF Olsen Log Price Index dropped to $125 for August. The index is currently level with the two-year average, $3 above the three-year average, and $10 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – August 2018

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Aug-18 | Jul-18 | Jun-18 | May-18 | Apr-18 | Aug-18 | Jul-18 | Jun-18 | May-18 | Apr-18 | |

| Pruned (P40) | 175-195 | 175-195 | 175-195 | 172-190 | 182 | 176

|

194 | 195 | 192 | 187 |

| Structural (S30) | 130 | 130 | 128 | 128 | 128 | |||||

| Structural (S20) | 114 | 114 | 112 | 112 | 112 | |||||

| Export A | 136

|

147 | 147 | 144 | 140 | |||||

| Export K | 128

|

140 | 140 | 137 | 133 | |||||

| Export KI | 114

|

132 | 133 | 127 | 125 | |||||

| Pulp | 50 | 50 | 49 | 49 | 47 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

A longer series of these prices is available here.

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.