Bernard Hickey details the seventh in this series of Top 10 charts for 2010 in association with Bank of New Zealand.

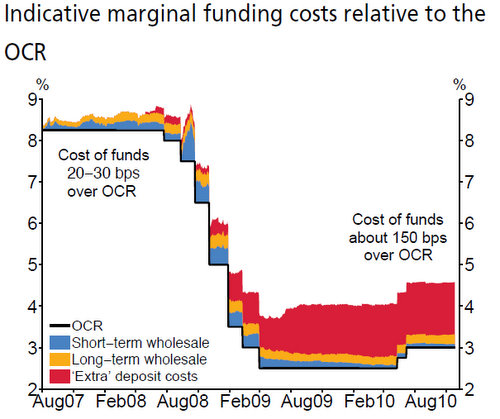

This chart from the Reserve Bank's December quarter Monetary Policy Statement shows the 'extra' funding costs banks must pay to borrow money.

The chart below expresses this 'extra' cost as a margin to the Official Cash Rate (OCR), which sets the base for all short term interest rates.

The banks pay a slight margin to borrow short term 'wholesale' funds from each other and international banks.

Our banks still rely on this short term 'hot' wholesale money, but to a lesser extent than before the Global Financial Crisis froze the markets for such funds in the wake of the collapse of Lehman Bros. This is the light blue area in the chart below. These costs are now back to the levels pre-Lehman.

They also rely to a significant extent on longer term wholesale borrowings, often from international banks and pension funds. These costs, shown by the yellow area in the chart, are back to pre-Lehman levels.

The big area of difference in the funding costs for the banks is for term deposits (red area). See all term deposit rates here for one to five years.

Pre-Lehman the banks didn't compete too hard for these local term deposits because they could get such funds easily from international 'hot' markets and they weren't required to raise funds locally.

That has changed because it is harder to get such funds internationally and the Reserve Bank has stipulated in its 'Core Funding Ratio' that more than two thirds of bank funding must come from long term and local 'stable' sources.

All this means the banks are now offeringing significantly more than the OCR to raise funds locally, to the extent that Kiwibank now has to raise funds offshore because of competition for such funds from the big four banks.

More than two years after Lehman's collapse total 'extra' funding costs are still about 150 basis points (1.5%) above the OCR. Before Lehman this 'margin' was about 20-30 basis pionts.

The banks are passing this on in the form of charging higher floating and fixed rates (relative to the OCR and wholesale interest rates) than before Lehman's collapse.

Some had expected this margin to contract back to 'normal' levels, but more than two years later it remains high.

It isn't expected to contract much over 2011, although the banks are expected to try to reduce these funding costs somewhat by issuing covered bonds offshore.

However, they are limited to issuing up to NZ$32 billion, less than 10% of total assets, which means any gains will be marginal at best. See more here on covered bonds.

33 Comments

Have a look at this chart: http://www.bom.gov.au/products/IDX1299.shtml The outlook for NZfarming and NZtourism our biggest earners doesn’t look good. Extremely heavy downpours in the next 2 months will cause major problems for our country. The prospect of loses in the Billions must be taken into consideration.

This is a practical financial weather report from a blogger, who gives a sh... of worthy charts, because the world is changing daily - fast and forever.

Firstly, how is your comment possibly relevant to the chart bernard is discussing.

Secondly, what you say makes absolutely no sense whatsoever. if we know anything it is not to rely on the forecasts of weather forecasters!! It was these people that said Europe would have a warm winter this year... well that worked out well...

And I would be fascinated to learn how your parlay your expectations of heavy downpours into major economic losses of some undefined 'billions'...

a bit of rain will keep the farmers happy

Too right Mike. Had some awesome rains over xmas/NY which sets us up for a great season but thats good news so it wont get any traction here.

Kunst, as if your Muldoonist economic theories were'nt enough, now you're a doomsday weather predictor as well.

You poor people hitting the small guy - but !

Interesting – when one writes a rather provocative comment, blogger’s come out shooting straight away - complaining/ arguing. When politicians/ ministers are underperforming – not one word – HA this is ridiculous ! Are we losing the real meaning of democracy - free speech - judging our authority ?

--

a bit of rain will keep the farmers happy – yes of course that’s brilliant.

Just let us judge - how happy NZfarmers will be by end of February. In case my predictions don’t happen it would be great, but consider and prepare, nature will be much harder on us – costing our economy a few more $ - ;-) making charts almost irrelevant.

Sheep Shagger - you should actually be grateful of my comments – supporting sustainable long term farming practices..

The history of money – wow – worth to watch and listen.

Fonterra auction up 7.1% last night.

-

WMP up 3.8% to $3750/MT

-

SMP up 10.9% to $3492/MT

-

AMF up 10.6% to $5984/MT

- BMP up 20.6% to $3390/MT

Getting to the topic......011 will see the cost of overseas funds rise to the point where banks must either pay up or fight harder for local deposits. There is no way round this bottleneck which is set to get worse and last longer.

The outcome will be rising deposit rates on offer and a hike in mortgage rates to keep bank profits fat. The only unknown being floating or fixed or a mix.

Coming at the same time as the new normal property sector level of activity pressures banks into pumping the market for mortgage fodder suckers....one can only see trouble arriving fast.

The trend is away from splurging idiocy and toward thrift and prudent behaviour...that's why retail is bleeding capital and laying off staff while running sale after sale.

Those on floating right now ought to move to fixed term and fast. Those without a mortgage must avoid being hooked and gutted. This winter is set to be a real bugger.

Budget austerity is a certainty. Higher real cost of living also set in cement. Increased mortgagee listings a sure bet....wider and deeper fiscal hole......likely downgrading of NZ as a credit risk!. ........and then you have the black swan events..north korea...iran....the euro...more QE criminal activity by the fed...bad weather....

Curious that the first 8 postings ( above ) were completely off the topic . Well done # 9 for spotting the gist of the article , that mortgage rates may soar this year , as banks scramble for funding . ............ But hey , who cares about that , how's the weather guys , good day for a picnic ? .......... [ please read this in the context of my many other articles , and don't shag any sheep ]

Hey Gummy, with some banks requiring farmers budget on 10% interest for new lending, I guess there are some of us fully aware that interest rates will rise. Truth is despite what the theory tells us should happen, no one knows what the reality will be. For me the question is not whether they will eventually go up but how much above 10% will they go?

It's a bit like the person, swimming in the sea, at Matarangi who on being told sharks had been seen in the water that day said 'Until I see a fin, I'm staying right where I am'. In talking to some young people (<45yrs) they say yes, they are aware that interest rates could go up but until they do they are just going to carry on as before.

Those who care about rising interest rates are likely to be those least affected when they do go up.

It is a beautiful day for a picnic here - and not a sheep in sight. :-)

We were using 8.5% on interest only terms to assess our long term lending and had been for 3 years (up from 7.75% prior to that). It is a bit of a moot point as all the interest rate used does is give a certain amount of 'conservatism' (stop sniggering now!) to a status quo budget. Same as using $5.70/kgms long term even though the last 5 year rolling average is well above $6 now. This must mean we are really poor at budgetting both production (income) and expenses!

One key thing to note is that the banks have been killing it on the residential floating rate - has been sitting about 300bps over 90 bank bills for the last 2 years. The market for the best quality (read 'bankable elsewhere') rural lending sees the floating rates to be about 230bps over bill from an industry that has to set aside greater capital than residential lending. Creaming it? Me thinks so..

I also note that for the last 20 months that everyone has been desperate to predict when interest rates will indeed go up and as yet every single prediction has been wrong. From my simplistic view point, interest rates will go up when our economy begins to grow at greater than 2%. Any thing less and Bollard will be too scared to contemplate pulling the trigger. Deposit rates may yet have an effect but again this will be led by the RB and its funding requirements for Banks.

Our bank manager has pushed his prediction out of when interest rates will go up to similar views as yourself ITYS.

As a dairy farmer personally I think at the moment any dairy budget out past this season is more crystal ball gazing than anything else. That Fonterra was selling some of it's product at the previous auction for contracts going in to next season at a higher than expected prices is welcome, though a lot still has to happen to have a good price next season. As Andrew Ferrier has said 'If payout goes up quickly, it can come down just as quickly'. There is less certainty now around payouts that there ever has been before hence why budgets are really just a paper exercise of 'what if' rather than any accurate prediction. However, I am positive about the dairy industry's prospects.

We are looking to add further investment so for us we need to look at a 'worst case' scenario rather than take what is happening now. We have always being more conservative than the banks when it comes to budgets :-). Our accountant tells his clients to do a $4.50kg/ms budget if they are looking to expand/borrow - to see if they could survive on it for one year. If it fell to that for more than one season then 'all hell will break loose' on the dairy sector he says.

I don't believe in interest only loans for a primary residential home. They should be interest and principal. If someone wants to buy a 2nd home or is a professional investor (as in multiple rental properties) I don't have any issue with interest only loans.

As for the banks creaming it - most definitely!

“In light of the existence of large speculative positions in today’s energy and agricultural markets, it is imperative that the Commission to do something now, and without delay, in order to address these large positions and send a message of confidence and certainty to market participants,” said Jim Collura, spokesman for the Commodity Market Oversight Coalition.

http://mobile.chicagotribune.com/wap/news/text.jsp?sid=289&nid=33947086… Its a crazy world. 31st December NONFAT DRY MILK PRICES SURPRISINGLY DROP SHARPLY: (by J. Kaczor) The sharp price drop reported on Wednesday for last week’s shipments of nonfat dry milk by California plants came as a surprise to many market-watchers. The reason it was surprising is because most market indicators of demand and prices for U.S. nonfat dry milk were supportive of recent levels, which have been heading upward since early Fall. Here is a sampling of those market indicators: • Inventories: end of month stocks were 294 million lbs in January (including government held product), 194 million lbs in July (manufacturers only), and 123.9 million lbs in October (mfrs only); • CME spot market prices: grade A and extra grade nonfat powder have been at $1.225 per lb or higher since September 2nd(It should be noted that the volume is nfdm traded on the CME is very small); • CME NFDM futures prices: the January through June monthly average cautiously rose $.127 per lb (to $1.234 per lb) from mid October through December 30 th; (Same note as above) • The NASS weekly survey of NFDM sales: prices rose fairly steadily from September 11 th to December 18th , increasing by $.0965 per lb, to $1.2163 per lb; • Western and Central regions price range weekly averages: western region prices rosefairly steadily from $1.12 per lb on August 28th to $1.22 per lb on December 25 th; Central region prices rose to $1.27 per lb over that same period; • Adverse weather conditions in Western Europe, Argentina, Australia, and New Zealand: Snow, severely low temperatures, flooding, and droughts variously have significantly affected milk production in these major dairy product exporting countries; • Prices for skim milk powder in Western Europe and Oceania: Dairy Market News, in its latest report covering December 13th to the 24 th, finds that supplies of skim milk powder for export are tight and prices are firm ($1.361 per lb in Europe; $1.406 in Oceania); Fonterra has recently shifted some of its production of SMP to WMP in order to fulfill its commitments to China; • International auctions: winning prices for skim milk powder in Fonterra’s internet auctions have risen from this year’s low of $1.256 per lb, on August 4th, to $1.403 per lb (December 1st and 15th average price); o While Fonterra’s bi-monthly auction provides important information on the international market, it should be noted that the volume of skim milk powder sold in the auction is significantly less than the volume of nfdm that is marketed by California’s powder makers. The most recent update of the volume of skim milk powder offered by Fonterra for bidding is 252,098,300 lbs for the next 12 months, or about 20 million lbs per month. By comparison, California’s powder makers have average 73.2 million lbs of production per month in 2010. This doesn’t diminish the value of the information coming from the Fonterra auction, because Dairy Market News verifies that the prices from the auction establish a useable base for all exports sales of skim milk powder from Oceania. • U.S. export volume and prices: the volume of exports of nonfat dry milk and skim milk powder this year will be a close second to 2008’s record volume, which averaged 71.8 million lbs per month, but is well below 2008’s average price (2008, $1.58 per lb; 2010, $1.20 per lb). Looking collectively at the market indicators above, it appears there are many reasons to believe the powder market should be relatively strong. It should be noted that the NASS price, which captures only “current” sales (sales of product prices less than 30 days before delivery) had a similar drop this week, so this does not appear to be an issue with long-term contracts vs. current sales. So the question on many people’s minds is why thesudden drop? With only one week of data to point to, it’s difficult to answer that question with any level of certainty. We’ll see what the coming weeks and months look like.Interesting Aj, thanks. Fonterra was trading only small volumes - around 10% (though I understand they are increasing that to possibly 20% during this season). I don't think anyone was expecting gDt prices to be where they are at the moment so it's a bit of crystal ball gazing as to what will happen. ;-)

We don't use growth hormones in our herds to increase production like the USA does, so perhaps we get more because our milk is hormone-free? ;-)

You can, not have enough hormones, that is the right ones, dont want bulges in the wrong places, to much hair on the back, and enjoying the time at the hairdresser a little too much like Bernard. ;-)

It's growing back Andrewj, even with this very cold weather.

I'm in Truckee at the moment. Snow is a metre thick on the ground.

Winter wonderland.

Thinking of you all in the warm NZ summer

cheers

Bernard

Forget your local bank manager's wish list...cop a load of this:

"..........., the current VAT increase is being used to disguise a variety of price rises which have nothing to do with that particular burden — in other words, inflation by stealth.

It is no good getting indignant. What else were businesses expected to do, faced with remorselessly rising overheads in fuel, power, council taxes and all the rest?

Another row over a missed target looms up for the Bank of England’s Monetary Policy Committee and perhaps for the Bank itself — and even Governor Mervyn King, who is gradually losing the City’s confidence.

The MPC is supposed to keep inflation at or below 2 per cent (as measured by the Consumer Price Index).

However, it has been above 3 per cent for over a year. Not too alarming? Remember that this rate halves the value of money over 22 years — cuts it by three-quarters over 44 years, less than an average working life. Anyone saving for a pension just has to ponder this."

http://www.dailymail.co.uk/debate/article-1344150/VAT-increase-Inflation-Banks-creation.html

Which just goes to show that 'funding the deficit' attitude to Modern (Labour) Governments is the wrong approach in respect to inflation. You only have to look at the issues in the UK at the end of the 70's when inflation was running above 10% as things were heading into a recession. The first thing that was undertaken was a reduction in personal tax rates and switching it to consumption based VAT increases, The next action was to freeze then reduce the size of the civil service (is any of this sounding familiar yet?) followed by the privatisation of a number of very inefficient state owned organisations to give the balance sheets the ultimate kick in the right direction.

But I would be careful also of reading anything from the Daily Mail - tis a very dangerous publication.

Also, what's wrong with 3% inflation after the shelacking the British economy has taken over the last 3 years? NZ's band for monetary policy is 1 to 3%...

"Also, what's wrong with 3% inflation"....

You are joking right!.....10 years at 3% and what's left of your savings if you were not earning above the 3% mark in interest...on which you paid tax...on all of it...you will have been taxed on the % which was just keeping up with the debasement...you have been screwed by your own govt and RB...quite deliberate....!

Take another view....why is the target rate not zero to one percent?

answer: Because a higher rate means govt can rely on the consumer buying more before prices rise, thus boosting tax revenue.....and any borrowing on the local market by govt that is not inflation adjusted, and local govt!, will cost less as time debases the value of the repaid capital.

Running a 3% target, is a means of boosting activity, but it comes at the cost of destroying the incentive to save....and saving is supposed to be a govt goal for Kiwi....bullshit.

RE: UK VAT 20%

An interesting battle going on in AU among retailers including Harvey Norman and Bunnings etc. Doesn't appear to be getting any traction in NZ but is relevant to ex-Agent and his retail friend. Locals are buying competing products on-line from overseas at prices up to 50% cheaper than domestic retail offerings for the same (imported) product and no GST. The guts of the fierce lobbying is that the imports purchased on-line bypass the 10% GST and the billionaire retailers want the playing field levelled. The UK with its VAT (GST) at 20% could face the same dilemma. Do mail-order imports into NZ get caught for NZ GST ? or will the same screams eventuate. It seems a matter of time before virtual retail stores arise that give you a virtual tour of the store, live virtual demonstrations from any angle. Compare similar products side by side in operating mode. Architects have being doing virtual-tours of house designs for years.

Books / CDs / DVDs I purchase from Amazon UK and Amazon America appear to have no sales tax on them . Apart from the cost of postage , it's a cheap way to shop . Enormous variety , compared to local retailors , too .

UK retailer Next has is own 'New Zealand Website'. Delivery is just $7.50USD.

http://www.nextdirect.com/nz/en

Debenham's is another UK retailer that ships some items worldwide.

The retail association here has just started to lobby. They certainly in the past year are asking the question more when you import goods. The $400 threshold here also includes the freight charge and the debate will get some traction here as NZ customs has just asked for submissions on the current policy.

One for Alex to watch for us in Wellington

cheers

Bernard

Good grief I have never seen a concession by an ecomomist like this:

Welcome to the first issue of the BNZ Weekly Overview for 2010

"Misinterpreting or simply ignoring actual data on the state of the economy was a common mistake last year when we focused too much on good stuff coming down the track and missed the fact that the economy was nowhere near as robust as we assumed. So we shall look to avoid the same mistake this year."

Harhaaaaaaaaaa hahaha. Funniest item ever.....Bernard will have to put it up at the top of the site....brilliant Speckles.

It would cost a fortune to monitor all the imports especially gifts, and all those people who have caught onto prescription glasses, cheap cameras,cell phones, and almost anything else you need and are prepared to wait for, also get to vote.

The other thing is that trade me is where many of the imported products get sold and most of these are gst registered sellers, retailers are getting it from both sides. I think ultimately its the internet thats the cause of the problem.

I was up hunting and a local had imported a gun from the USA, he got it at half price, even after paying gst. Dick Smith are importin g apple computers from Australia and its great what they have doen to prices here, my mate at Harvey norman said its hurt to have to match the price.

I also think that the consumer society we live in is in for a bit of a shock over the next few years whatever happens to cheap imported products. After all the hunter with the new rifle either got a gun he could afford without borrowing or he has money left to buy other things.

The question that we should be pondering is how the hell we got into a situation were we are going to pay 37 billion in interest a year, to offshore banks.

It has been suggested to add gst to all overseas transactions incurred on credit cards, administed by the banks for the Government. The additional consequences of this are obvious. I will have to have an overseas credit card to incur cost on overseas trips to avoid additional costs.

Credit card fees would rise to cover the banks administration of this.

As it stands now if you go over the 400$ (including freight charges) to get it in here you pay addition administration charges on top of the customs gst.

The retailers are fighting a future trend which may put their cost plus approach and business models in danger.

The Governmentt gains a greater tax take.

There is one loser in all this the final NZ consumer. Its a money grab.

Somewhere in the muddle is the Law of Diminishing Returns speckles....I suspect we are seeing this regards house building with the latest gst hike. The straw that broke the.......!

Average handover to Govt and Council on a build must be near $60ooo.....stuff that....rather live in a tent mate.

The technology is "now" .. its here already .. it's called "Google Street View" and it's gonna be the death of the shopping malls .. all thats required is a warehouse with a motorised trolley with a google type street view camera mounted in it .. might be time to sell your shares in those shopping centre property syndicates ..

No it bloody isn't icono....Most over 60 refuse to touch the bloody computers...rather have a trip to town to enjoy the airconditioned store, regardless of items costing more. You have to factor in the fear factor icono. Bet you've lost count of the number of times users have been done over by Rsols in some overseas shithole when paying bills on computers. Go speak to 100 over 60s and you will get a shock. They hate the dam things.

Of course in about 2 decades that will have changed a little

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.