Just 25 days out from the next Reserve Bank Monetary Policy Statement, term deposit interest rates have fallen again with one bank now reducing all its key offers below 1%.

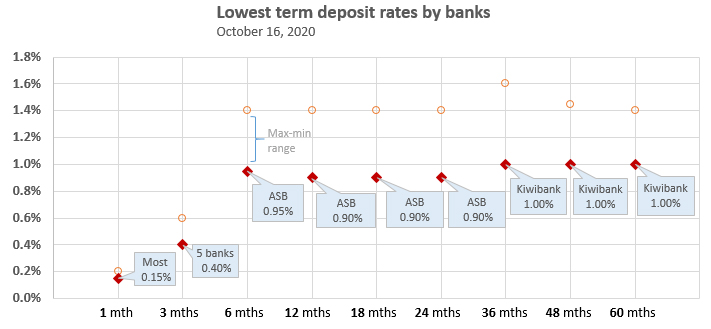

ASB now has all its rates for terms out to two years below 1%, the first bank to sink to this level.

This move accentuates the negative after-tax, after inflation returns from holding money at a bank. (Inflation is running at 1.5%).

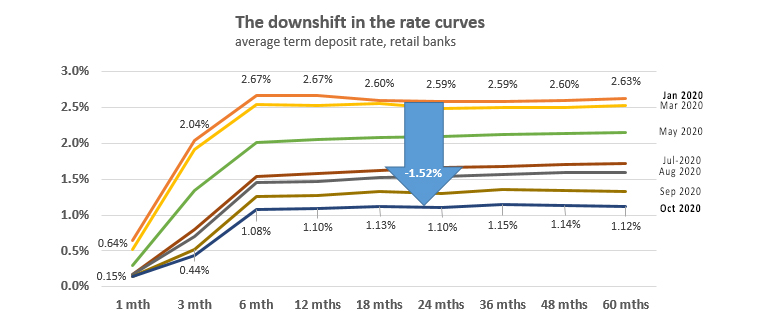

The Official Cash Rate has fallen from 1.00% to 0.25% so far this year. But term deposit offers have fallen more than that. In mid September when we last checked the downshift, it was -1.25% in average bank rates. It is now fallen to -1.52% over the past month.

This shift lower is not discouraging deposit inflows into banks - in fact it may be encouraging them. Depositors need to save more if they aren't getting a meaningful interest boost. What it is doing is shifting the growth to current accounts and others at call, and away from term deposits.

In this environment, few banks offer deposit interest rates designed to attract funds. In fact, the reverse is happening and offers tend to be grudging, minimum offers out of 'sympathy' for depositors - and don't count too much on the 'sympathy'.

The latest to cut term deposit rates to very low levels is ASB. We have noted these levels before, but here are the mid-October updates.

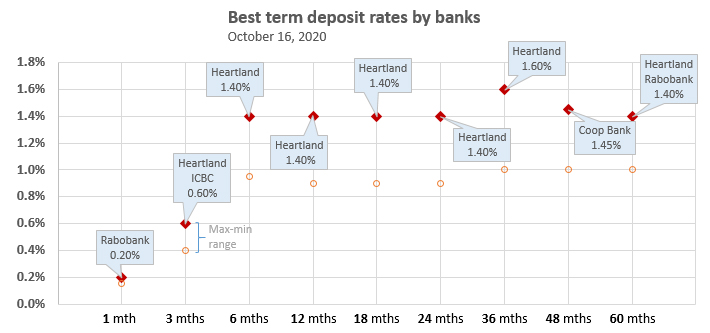

And the highest rates (even if they aren't high in the normal definition of the term) are as follows. Heartland Bank now features in this review.

59 Comments

Wow pretty happy with my one year fix at the ASB for 1.55%. Still its now so low as not to matter at all for the majority of people. If you have say less than 10K, a TD has been a waste of time now for years. However, not putting it in a TD and just a standard non interest bearing account will allow banks to sink even lower with rates if they have to pay you nothing for your money.

Unless you march in and say "I'd like it in $100 notes please" and that is exactly what's going to happen.

Will 'they' outlaw cash then? We are about to find out!

Soon banks will no longer need depositors. The RBNZ will give the money and take the risk.

Agreed, not much point at all in TD - as matter of facts peoples just increase their risk if putting on TD. Put it where you can access it anytime, it's still the king to buy a food. But suggest to put with the bank that not too highly exposure to personal RE loan.

waiting for the long term consequences...

Why would anyone lend money and risk not getting it back for so little return? talking to you banks.

Lend it to whom ? You have to see the major banks as low risk. If the banking system falls over its all over rover for life as we know it so it simply will not be allowed to fall over. They are not even allowing the housing market to "Fall over" at this point so I see no change in the short to medium term. What do you consider as long term ?

I don't think it's going to be easy getting loans off the banks in the future. Money needs a time value otherwise we have unknown unknowns.

If you had an asset worth $100k, would you lend it to someone for about $1k for the year? That seems to be what the banks consider reasonable. This really shows how little a $ is now worth.

until you have to earn it, then it's not so easy.

Yeah, so the thing is the banks aren't actually lending you $100k. They're creating a debt instrument for $100k, backed up by about $10k they have in deposit.

Joe Public has earned it from his own sweat. Now he has it, he can't rent that cash out for b-all. The only value is in exchanging it.

Which lead to some thinking the best option to exchange it to RE (largely in NZ), BUT? if in the past some of us already done similar exchange to enhance training (investment), then surely there will be opening to exchange the current significant salary with more offering in OZ? thus at the same time exchanging to the local RE there (in WA, SA, Queensland, Victoria).. a lot to be weighed for sure, different case for each individuals. But for most professional qualified, certified, experienced Kiwis with skills on demands.. the see saw clearly tipping to the OZ.

What's the alternative?

Spend it. Ultimately this is what the government want you to do in order to boost the economy. Savings will turn negative at some point in the near future. Renovate/extend your home (if lucky enough to have one).

My personal experience on how low interest rates are detrimental to productive investment.

I have a few other co-investors in a mid-tech firm that makes good returns each year.

Up until mid-2019, we retained much of our earnings in the bank and once in a while invested in growth ventures within our industry whenever an opportunity came along.

At the last shareholders' meeting, we decided to pay out large dividends and rush the remaining into an asset portfolio (warehouses, apartments, office spaces, etc.) since we were losing money in real terms on our cash holding.

ie... no end to the debasement of money

Who needs a savings account, you have housing here in New Zealand...up up up! Don't worry if you're in your 60's, 70's or 80s. Housing will always make you money!! Up up up

You're joking but a 64 year old acquaintance of mine got approved for a 30-year mortgage. First home buyer, with no other assets besides her car. Mind you, that was last year, lending might be slightly more strict this year.

Very much doubt any bank would lend 64yo loan on 30 year term. It's irresponsible lending ... I think there must be more to this story.

Banks are not allowed to discriminate based on age. I had a family member take a major bank to the human rights commission many years ago and win.

I wonder how many people actually do believe the "can't lose on property mantra"? I would guess the majority of property speculators have more than 90% of their net worth in NZ residential property and often in the same city as well. Could work out for them but unsure if they realize what a huge gamble they are taking. There are valid reasons why any financial advisor that recommended you put almost everything into one asset class in one country would be stripped of his licence.

I wonder how many people actually do believe the "can't lose on property mantra"? - seems a significant chunk of the population believe it wholeheartedly. Housing investment, as all here know, has been the "go to" investment class since at least the '87 crash - many current investors probably still remember it vividly, some may even have been caught up in it. Then there was the Finance Company crash where people got burnt. The old saying - "buy land cos there isn't anymore being produced" is indelibly etched in many people's psyche. Housing is even better given the rent returns although there are more headaches. For "Mum and Dad" investors it's a pretty simple decision. It would be interesting to know the percentage of single"investment property" owners there actually are vs the professionals with multiple ones

It can't be all that great for landlords. As perhaps they are making tax free gains but not getting any rent in some areas.

608 vacant rentals in Wellington city (that not regional wellington) as of today https://www.trademe.co.nz/a/property/residential/rent/wellington/wellin…

Talking to a friend there who has had two vacant rentals since early Feb. Normally people are fighting over properties and 20 people at viewings.

No Chinese students and no visitors for Air BnB is have a big impact.

I am still think there us a chance of problems in the market next year if unemployment starts to grow.

I'm no economist but if there are 608 rentals available then the asking rent is too high. It may come to a point where the landlord withdraws the property from the market and leaves it empty, assuming the landlord has the financial wherewith all to do this. Sell the property is a further option. I have no sympathy for landlords who say they can't rent their property. Cut your price and if that doesn't cut it for you. Do something else.

Cutting rent will no doubt help.

But the point is there are less people looking for rentals in Wellington. Chinese uni students and Chinese english language school students are in China.

Note I don't own a rental property in Wellington. I am considering becoming a ghost landlord in Auckland and buying a few properties and installing monitor alarm and sending a gardener around once a month.

Surely you've read here from interest funny stats: rental in Queenstown av. $750/wk, Covid19 hits, reduce to 600 then waves of wages subsidy.. voila! up again to 700 - Now, with than in mind - One can easily conclude that apart from RBNZ actions, Banks mortgage deferral, the Lab govt. is really gives clear message to this sections of what usually Nat voters landlords, that they're safe under Red.. so, hence that magical vote numbers support. Leading as majority now? - it's united clear what happen to the economy, now how united is NZ govt. in leading to overcome it in nicely way, we cannot keep on changing the game rules, goal post, referee. Something got to give when managing resources, always.

Maybe this 'new reality' is a good thing. Now people don't make much for bank savings, they will start to actually think about the fundamentals of 'sound money'. One of the arguments I've heard is 'what about the pensioners? where is the interest on their savings?' While I have empathy, there are no easy answers and people have been too accepting of the status quo which means enabling the banks to create money through lending on a scale that has distorted the reality beyond recognition.

If you want your money to work, decentralized finance seems to be one of the only vehicles at the moment. However, you need to be vigilant. You can't just ignore your money like most people do with cash deposits sitting in a bank.

The Reserve bank might think they know what they are doing, dropping the LVR, but desire for home ownership is so strong in kiwis, just like the Mitre ten add says, its in our DNA , that the pent up demand will never go away, no matter what immigration does.

Tenants are trying to save money by moving in with friends, back home or whatever as they have less income, and landlords are competing for tenants. Surprise , surprise, dropping rents.

Low interest rates have sucked FHB into thinking owning is cheaper than renting, they forget about the cost of maintenance, insurance, rates, let alone the risk of earning less. Experienced investors are out of the market, waiting for a crash.

We have a government who know very little about economics and appear to be slow learners. We had the opportunity to be a world leader, in sustainable tourism, but what do they do, give a ton of money to all the unsustainable tourism, I'm talking every helicopter sightseeing business in NZ, plus a whole lot more. This was the perfect time to let the banks take a haircut, and close such businesses.

Trying to force us all to buy as many houses as we can, TDs useless, bonds and shares too risky

....and so buying houses becomes risky.

https://www.stuff.co.nz/life-style/homed/real-estate/123107799/bnz-warn…

...meanwhile Robertson still talks about the demand and supply side. Nope, govt and bank behaviour is driving this.

"House prices were about 30 per cent overvalued compared to gross domestic product, 66 per cent overvalued compared to earnings – having jumped

sharply since 2019 – and also overvalued compared to United States house prices, according to the BNZ."

One wonders why BNZ would issue any debt for an asset that themselves agree is overvalued. It looks highly irresponsible from their side.

You're not suggesting we are going to be the new Ostriches, are you!?

"Stick our heads in the sand" and do as we are told. Ostrich farming worked out well, didn't it?!

(NB: I'm sure we know - ostriches don't stick their heads in the sand to ignore something frightening in front of them; they are actually 'putting their ear to the ground' to hear what distant danger is coming. So, maybe we should be Ostriches after all!)

I see that today Bob Jones is saying he is holding a ton of cash ready for the inevitable crash. Unfortunately, many people on this site are so over-confident and blind to risk that even a warning by possibly the most accomplished and knowledgeable property investor NZ has ever seen will be arrogantly ignored in favour of advice by such luminaries (experts or astrologers?) as Ashley Church and Tony Alexander. Go figure.

When is this inevitable crash going to happen?People have been waiting a long time.Maybe its like Rachel Hunter says"'it won't happen overnite,but it will happen."

Has any company Bob Jones has been involved with ever tanked?

Yeah had to change my mind recently, came to the realization that the crash is never going to happen. Even Jacinda said on the last debate last night she did not want to see house prices fall. Pretty much everyone is now going "All in" on the housing market so 2021 is going to see just higher prices. Despite all logic that would tell you otherwise, I'm now expecting record house price increases next year.

Politicians could lose control in a crisis

This is a very intelligent comment.

So have you asked yourself what Bob Jones can see that you can't? He might be wrong but surely you can agree that he is infinitely more likely to accurately predict the direction of the property market than we are? It would be a personal affront to Bob Jones to even compare his track record, business acumen and property knowledge with that of Ashley Church or Tony Alexander. For laughs I would love to hear him comment on those two.

I do agree that record prices could easily happen in 2021 and maybe even further. But when Bob is saying "owning residential property is a stupid thing to do" and "I would rather be flogged than owning...." we should realize there is probably serious trouble brewing in the not too distant future.

Isn't Bob Jones into commercial property, not residential so on this basis he's likely to be correct.

Would-be retirees can forget about earning interest.

Just keep working until you drop.

This is true, and is the discussion I have with my father in law. He's in his early 60s and is fit and healthy.

I expect him to keep going until he's in his 70s.

Mortgage rate cuts in 5, 4, 3...

Actually, ASB cut 18 month rate to 2.49%, lowest of any term for main banks.

1.75% by March 2021, the banks will probably already be down there before Orr even needs to drop the OCR into negative territory.

The banks wont be down there without negative OCR, unless TD rates are 0.25% for all terms - as the wholesale rates cant fall much more.

Yeah, no major changes at the moment.

The OCR, TD rates and Kiwibond rate differentials have been restored for the present.

I'd expect the OCR to go to zero sometime soon though and that will bring everything down a bit more.

Kiwibonds to zero for example. Where they will be even with cash. ie real cash.

So that's when real paper (plastic) cash starts to crank. If it hasn't already.....

"That left interest rates, along with other Reserve Bank policy, as the key driver of house price rises." - Should we tell Mr Orr yet? Or is it too soon? At this point 99.9999%* of experts agree that it's bad policy. The only one who doesn't agree seems to be Mr Orr himself.

*high precision estimation based on intuition

Mr Orr is more concerned about virtue signalling with token Maori words than caring about what the real world consequences of his actions are.

There is no doubt that that he will double down on the housing stimulus. He's a one trick pony and the RBNZ is staffed by ideologically possessed clowns.

A financial crisis and a hollowed out economy is going to be the end result.

For the people dumb enough to stay in New Zealand it wont be pretty.

In case you did not now? he's spreading the finger pointing? to the his 'team' which all including they govt. sponsor agents heavily invested in this NZ FIRE economy - it's never about knowledge, training, experience, believe etc.. it's about preserving 'what has being mandated by law' to RBNZ from govt. (cool eh?), you remember when around 2013 he asked Nat govt. to get DTI tool? rejected.. then he managed to injected the LVR 20, 40 etc..Then silently he expected Lab increase bright line test or give him DTI & absorb that Cullen CGT, darn.. he & his team treated like amateur... If I'm on Mr. Orr seat? I precisely did what he/we have to do push all this madness to the aircraft 'stalling up position': bugger, let's remove LVR, let's remove the TD guarantee idea, defer those Banks CAR idea, FLP soon, QE/LSAP into 100billion, OCR cut by .75 to lead in shocking the world, soon will be negative.. it is within 'our mandate'.. now, you can scream anyway you want.. but he's already preparing more billions to further counter any slightest FIRE economic corrections...excuse? for trickle down money effect into economy. Real reasons? - not a single govt as their partners the past 30yrs have a slightest clue on how to piloting the airplane.. ouh well, might as well stall it.. let's do this.

Savers are losers in an environment where low interest debt is used to inflate asset prices

Believe it or not? - despite playing here & there for residential & commercial properties flip-o-rama? the two famous NZ sir (J/Key & R/Jones) actually have more on their cash reserve than their flipper game.. they're losers too? or they can sense something else happening tick tick tick?.. thought anyone? - remember, land+house inflation is not recorded in the CPI.. so more QEs coming & negative OCR soon. It's never been a good time for Kiwis as 5million teams Not to support this intrinsic value of investment, place called home to raise family & guarantee wealth - Please, be kind and keep moving help govt & RBNZ to maintain NZ GDP momentum up again through strong housing economic.

Excellent article David. Interesting the point you make about low interest rates encouraging the accumulation of savings although I would not think that would be the case but instead uncertainty about work stability and delayed mortgage payments.

With TD rates being below inflation I think that there is an increasing incentive to spend.

What to spend it on? Right now, probably not cars or house improvements because the downturn has not started yet.

Builders rates have not yet become sensible. So wait a bit is my advice. Then in a years time build that extension, granny flat, bathroomless 30m2 sleepout if you have to (eeek, horrible PC Ak Council inspired third world thing...)

Hoarding cash like John Key & Bob Jones are for the looser, FHB & Investors must not listen to their selfish comments/actions - House, have magical intrinsic values.. you blink this 2020, you'll loose heaps in 2021.

Here's the DGM news link for readers to identify & avoid, don't believe them:

https://www.stuff.co.nz/business/property/123101150/well-be-buying-up-b…

https://www.stuff.co.nz/life-style/homed/real-estate/123107799/bnz-warn…

Jacinda herself already made statements: No CGT, No Wealth tax and the only way to fix current housing price frenzy solely resulted by RBNZ QEs/LSAP/LVR/FLP/OCRs is to 'build more supply'.. more wage subsidy to support renters & those that loosing jobs now the question is which one is faster? Jacinda build more supply? or RBNZ actions to counter it? the latter can undo the supply part at the flick of finger..at any moment. - Keep it up, Kiwis buy now, by any means, the more of you into the scheme, the more chances that it will get bail out for any sign of future trouble - really, this is how the herd immunity works!

Read this...The biggest and brightest star in the entire investment universe.

https://edition.cnn.com/2020/10/16/politics/trump-tax-returns-nbc-town-…

Oh! and guess who can spend the entire World out of poverty...

https://www.marketwatch.com/story/trump-says-im-ready-to-sign-a-big-bea…

buy now, by any means, the more of you into the scheme, the more chances that it will get bail out

So true - conversely the more people who jump in now the more likely a bail out will be needed. In a seemingly unrelated matter the the NZD lost 80% of it's purchasing power in the last 20 years relative to gold (55.5 mg/$ in 2000 -> 10.8 mg/$ in 2020). 35% of that decline happened in the last 2 years. The RBNZ has recently committed to let inflation run hot to preserve ultra low interest rates further exacerbating the decline in the dollars purchasing power.

Love the pic and sums up nicely what happened to TDs

My mum taught me - don't buy land unless you can get rent from it.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.