Kiwi consumers "are feeling rubbish" but this is not likely to result in an outright fall in spending levels, according to ANZ economists.

In an NZ Insight publication, ANZ economist Finn Robinson and chief economist Sharon Zollner have done a detailed examination of the slumping consumer confidence.

The economists say consumers are miserable – and it’s not just Covid.

"Newspapers lately are full of one tale of woe after another about our malaise on all fronts."

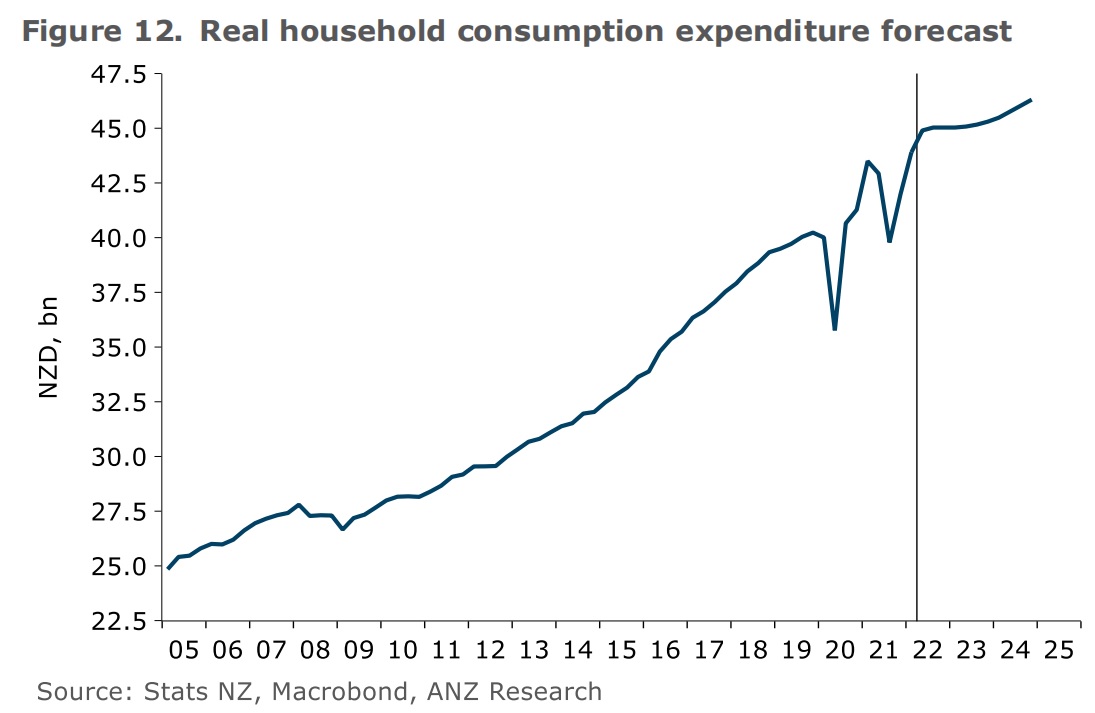

Historically, they say there’s been a very strong correlation between household consumption spending and consumer confidence.

"Taking this historical correlation literally, one might expect household spending to fall rapidly over 2022

"But that’s not our forecast – or the Reserve Bank’s for that matter."

They say there are a few key reasons. The drop in consumer confidence is likely a result of the surging cost of living and the monetary policy tightening (from the RBNZ) it has triggered. But the economists say they expect wage growth will catch up.

"So while consumers are likely to pull back on spending, rising wages should still provide a solid baseline. We do expect a significant slowdown in household consumption spending growth, but not an outright fall in spending levels (although we wouldn’t rule that out as a possibility, particularly if the correction in the housing market were to accelerate)."

They say a key difference between now and the pre-Covid decade is the level of savings that households have accumulated.

"Prior to Covid, New Zealand had a very low (often negative) household savings rate. But since 2020, Kiwi households have had a significantly higher savings rate – and households in other countries even more so. Australia in particular has seen a massive buildup of pandemic savings – and we expect that will provide a fairly sizeable offset as the RBA [Reserve Bank of Australia] hikes rates across the ditch.

"In New Zealand, our accumulated savings should help as well, although it’s a smaller buffer than in some other countries, and interest rates have risen faster here. But every little bit helps."

The economists say there are clearly headwinds to consumer spending and demand over the next year or two.

"Consumers are miserable and don’t expect things to get better, inflation is hurting, interest rates are rising, and asset prices are falling.

"But at the same time, the labour market has never been tighter, and household balance sheets have made it through Covid in pretty good shape.

"So while we expect consumption growth to slow to a crawl from the second half of this year, we don’t think spending will fall to the recessionary levels implied by the level of consumer pessimism."

Robinson and Zollner say the softening in demand from consumers is one key reason why they think the RBNZ will return to "more normal" 25 basis point hikes after the August Monetary Policy Statement, and "only" lift the OCR to 3.5%. (The RBNZ's currently forecasting a peak in the OCR of just under 4% by the middle of next year.)

"We think they’ll be surprised by just how quickly demand starts to ease as the impact of OCR hikes flows through the economy – and weaker consumer confidence is just one symptom of monetary policy working.

"We’re forecasting two more 50bp hikes in July and August, and 25s in October and November, bringing the OCR to 3.5%. But beyond that, a seriously stretched consumer and a construction sector that’s likely to be in decline over 2023 should give the RBNZ the confidence that they’ve broken the back of inflation, and can give growth a chance," the economists say.

But they do say uncertainty "could hardly be higher".

"Inflation is still the name of the game. And while it is our expectation that evidence of softening demand will emerge over the second half of this year, the RBNZ can’t afford to give inflation any room to breathe.

"Any upside surprises on inflation and the labour market are therefore likely to go straight into a higher OCR path. We think inflation peaked at 7% in Q2 (which is also the RBNZ’s forecast). But with geopolitical tensions continuing to rumble and global food prices surging, risks are to the upside. Central banks will not risk losing their inflation targeting credibility – so don’t expect the RBNZ to spare the economy if they don’t see evidence of inflation falling."

And, they say, as part of that inflation battle, in the absence of a miracle recovery on the supply side (eg a huge surge in technological advancement and/or labour from abroad), the RBNZ needs weaker consumption spending.

"So in fact, the question is not, 'to what extent will lower consumer confidence translate into lower spending?' so much as it is 'how high will the OCR need to go to bring about the weakness in consumer spending that the RBNZ believes it needs to see?'

"Retailers face tougher times ahead, regardless."

28 Comments

Why do we even listen to anyone with vested interests in squeezing more money out of the sheeples? Bank Economists, Mortgage Brokers, RE Companies. When we start getting told that NZ households are ‘suddenly’ great savers you know they are clutching at straws.

I heard an interview on NTZB yesterday where a Mortgage Broker was interviewed and there were quotes like "Now that we know interest rates have peaked”, "People pileing back into the housing market” in response to some banks reducing their rates. We have seen this before where banks do this just prior to an OCR announcement, and guess what’s going to happen soon after the 13th!

I would suggest many people are lacking long term memory, but it was only several weeks ago where this same thing was happening. I assume they are bidding to pull in as many mortgages as possible immediately before the OCR increase. Two reviews ago, the OCR was "priced in" as well and look how far interest rates have come since then.

One thing of note which is surprising is the drop in swaps. Can only assume this is some sort of leveling phenomenon which we'll see more of over the coming months as things begin to level out? Unsure - I for one find the whole situation incredible to observe. If only NZ economy wasn't so tightly bound to housing things would be a lot clearer. Most other asset classes are easy sellers - but homes are sticky at the moment.

Yes you have swaps dropping, commodity prices dropping (including oil, gold etc) and you have central banks saying they will keep raising rates until inflation is back at 2%.

In the manner they completely overcooked the drops back in 2020 and over-stimulated the economies, its quite possible they overcook it in the reverse and plunge economies into a very deep recession by lifting rates too high in Q3/4 of 2022.

Central banks have demonstrated utter incompetence, and they ended up exacerbating the economic cycle rather than trying to partially smooth it. Their stupid, delusional and misguided attempt to pretend that an ultra-loose monetary policy would negate fundamental economic laws, and cancel the very existence of the economic cycle, has now forced them to induce a recession (hopefully, a soft landing) in order to try and correct the pernicious and highly damaging side effects of such excessively loose policies (not just rampant inflation, but debt explosion, mispricing of risk, unbalance of economic resources allocation, assets bubbles and financial instability). The result of their actions is exactly the very opposite of what they were supposed to do, and contrary to the reasons of their very existence. And Orr has been particular egregious in such stupidity, with NZ experiencing one of the steepest rates decreases in the recent economic history of developed countries.

Worse than that, Central Banks have lost their inflation targeting credibility, and it is going to take a long and aggressively tighter set of monetary policies (even tighter than necessary) for such damaged credibility to be painfully restored. What an almighty mess, un-necessarily created by these clowns.

I thought inflation was Putin's fault? (sarc)

Transient inflation.

Houses prices rate of increase to slow to 5% per year.

Heard all this before.

Just wondering, I am buying less but spending more, petrol being the obvious, but groceries etc..so does the above fiqures take in the actually $ amount or is it adjusted in the background for the increase cost on products. So they are correct in saying I am spending more, but on less products.

Yes, how many widgets?

The government doesn't care do they? GST is Goods and Services Tax. Not widget tax.

Yea I heard through the grapevine that consumers are spending 1% more at supermarkets than this time last year. With 6.999999% inflation, roughly 5.5% less goods.

I am managing to spend the same at the supermarket as I was pre inflation spike. In fact I quite enjoy the challenge of seeing what value I can get for my $$$. Yes some ‘nice to haves’ have gone but the family still eats well. I can’t control inflation but I can control how I spend my money.

So why are we trying to expand the labour supply instead of constraining it to keep wages rising? With the endless kvetching by big business for endless human biomass for wageslaving, we will find ourselves in a worse situation when wage pressure is entirely gone.

Bank economists, blah blah blah

whatever

“Everything is fine” *twitch*

I think they have got it wrong but let's face it when have they ever been right ? Spending is going to go off a cliff if rates keep rising and that's almost guaranteed. It's a non linear effect and there is a tipping point at which it suddenly affects the majority of people. All eyes on the RBNZ now the next two reviews are critical.

Are the main trading banks challenging the RBNZ authority to set interest rates and monetary policy? Would Orr push OCR beyond 3.5% just to show them who's boss? Not saying it would be a good idea. But when has that ever stopped the RBNZ doing anything?

1% over the neutral rate is too high even short term. Yet everyone is quite happy being 2% below for extended periods. I'll be laughing when OCR is over 4%

Kp - Historically interest rates need to be 2-2.5% above inflation to curb inflation, would 3 year fixed mortgages at 9-9.5 % cause any problems? Asking for a friend Orr any one else interested.

increase in consumer spending requires one or a combination of three things -- higher wages, decrease in core costs such as rent rates mortgage and/or increased borrowing to fund the spending

Wages are rising much slower than inflation -- and in many places not at all

Core spending - Rents, Rates, mortgages, Power water are all rising

Borrowing is tightening - and with falling house prices putting it on the mortgage is not an option

You could also add in that huge consumer confidence aspect -- So tell me -- How exactly are people going to spend more on consumerism ?

Exactly. And the taxman has a decent nibble at any wage increases.

Anz seems to be saying that consumers have ben managing to save so there is some fat there (reduce saving, burn savings) to avoid belt tightening.

Check Interest .Co chart on savings which show substantial reduction since last peak in 2015, if it correct then Zollner is wrong. Whilst you are at it check out misery index which has spiked since 2017 by 50% - and see if you see a correlation with the election.

So while consumers are likely to pull back on spending, rising wages should still provide a solid baseline.

Just a reminder that median weekly earnings at the start of the year were $1,154. Since then earnings have moved around a few dollars up and down each week. The latest available data (last week of May 22) has median weekly earnings at $1,158.

Perhaps low wages are going gang-busters? Nope. Lower quartile wages were $770 per week at the start of the year, and they are $770 in the latest data.

If any bank economists need to find the actual bloody data (rather than relying on reckons and anecdotes), it is here: https://www.stats.govt.nz/information-releases/employment-indicators-we…

Great post.

bank economists are godawful

What a great data set ! Assume those in the lower quartile would have people who a working multiple jobs. So the figure may not represent one persons total income. But the total median number is probably mosty made up of people with a single job as it works out to 60k per year. Would be great if they could break it down to an hourly rate. Or tell us the number of jobs in each of the upper, lower and median bands

It's already happening. Our households (3) have all reduced dining out & have all commented (grumbled) about the high cost of petrol ($183 for me yesterday) & the lower value for money we're getting at the supermarket. I need some new clothing but have postponed most of that until Christmas. This winter I have bought nothing. Even the ladies who used to lunch-a-lot have substantially cut back commenting on the lack of choice & high pricing post covid, along with the very poor customer service (lack of good staff) on display everywhere.

So, for us as buyers, the quantity is down & the quality is even worse. We're not in a great space are we?

Great point on the quality of service. Pretty poor overall. Another reason, along with soaring costs, to reduce dining out.

Yeah, well, income and sales taxes are very high in New Zealand and on top of that inflation has also kicked consumers. It would be far more surprising if workers where feeling optimistic as they get squeezed from all sides.

The soft landing bullshit is a myth. Central banks always overshoot. Kiwis leaving the country combined with a little to no immigration will be the final nail in the coffin for a recession.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.