If you promote it, they will come.

The recent moves by some of the major banks to advertise three-year fixed mortgage rates at rates appreciably lower than shorter term rates has seen a marked spike in new mortgage customers taking out that term.

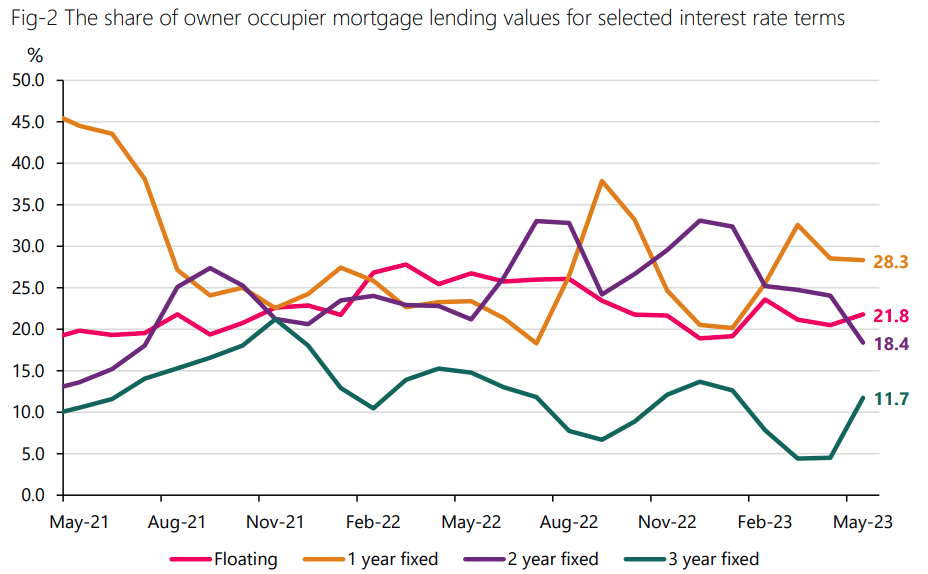

However, for owner-occupiers, the one-year fixed rates remain the most popular.

These are the stand out points for the May month in the Reserve Bank's new data series that covers new lending or facilities loaded in the reporting month. This is different to other RBNZ series on mortgage lending, which report new mortgages on the basis of when they have been committed to, rather than when they've actually been taken up.

It is the second month this new series has been published and when reporting on the first month's release, I did actually wonder whether subsequent months might show a spike in take-up for the three-year fixed terms.

Well, and how.

In its summary of the key points for the May month, the RBNZ says that the portion of new owner-occupier mortgage money going into three-year fixed rate mortgages shot up to 11.7% from just 4.5% in April.

In terms of numbers, the total amount of new mortgage money taken out by owner-occupiers in May 2023 was $4.397 billion, which was up from $3.705 billion in April 2023.

In May $516 million of new mortgage money went on three-year fixed terms, up from just $167 million the previous month.

It again highlights the responsiveness of customers on a month-by-month basis to rates that might be seen as more favourable.

However, as said higher up the article, the one-year fixed rates remain the most popular for owner-occupiers, with 28.3% of the mortgage money ($1.246 billion) going on this term.

The surge in popularity of three-year fixed terms seems to have come largely at the expense of the normally particularly popular two-year terms, with these falling to 18.4% of new owner occupier lending, compared to 24.0% in April.

The RBNZ noted that in April 18 month fixed terms made up 17.9% of new owner occupier lending, which was the highest share recorded in the data series since it began in April 2021.But in May this share fell to 15.4%.

New residential investor mortgage lending rose to $1.3 billion in May, up 16.1% from $1.1billion in April.

The RBNZ said that for residential investors, one year fixed terms were also the most popular, making up 38.2% of new lending.

The share of total new residential lending (both investors and owner-occupiers) on fixed interest rate terms fell from 79.5% in April to 77.9% in May. The share on floating terms rose to 22.1%.

15 Comments

I wonder what the Brokers and low LVR customers are getting for the 3 year off the big banks, maybe 6.29?

I hope we've all found something to do with that 3 year money?!

"You could borrow up to $80,000 at a 1% p.a. 3 year fixed rate to pay for eligible upgrades to your home or for electric transport options."

Is it actually avaliable? all my attempts to get info on it , have been met with get the quotes etc, and come back to us. They won't commit as to what would qualify or not..

1 year fixed is the way to go in my opinion. Interest rates likely to be substantially lower much sooner than 3 years away.

Maybe, maybe not. I think the best option if you are constrained is to fix for longer (presuming you can currently afford to), with the idea of removing the risk of interest rates climbing higher over the next few years. Inflation is still ripping so IR could go allot higher. The downside of fixing is that it holds you there (to avoid break fees), which of course would be an issue if you lost your job, or wanted to relocate etc. We don’t know where IR will be in a few years so I guess it’s down to risk analysis and luck.

Agreed. Peace of mind and less sleepless nights with longer fixed rates. It could go either way, but if your employment is fairly stable, seems worth any possible downswing in rates over a 3 years period. In the end it's all crystal ball gazing, but I prefer a good nights sleep :)

posted twice somehow

What b.s. Disclosure please.

Do you work for a bank or hold any interest in a bank, e.g. shares or TD? Are you, in any way, likely to benefit, if people fix now at higher rates?

"Bank economists" - i.e. economists with a vested interest in scaring borrowers to "go long" are all saying this. As as brokers and agents that have "deals" that ensure their commissions are higher if customers fix long.

You do know that if the bank forecloses you'll be paying break fees as well?

Disclosure please. I find your advice to be highly suspect.

Pot, kettle

6,7,8, 9 nothing is affordable.

Dumb slaves of the bank who love debt have taken the house prices to a level that nothing is affordable now.

Debt will kill the economy one day.

2.5% is not coming back. But I think people still don't realize it.

Even 500k is a life time worth of money at 7% interest rates.

Going long at this time will cost you!

But the banks have scared anyone with debt. Scoundrels! Absolute Scoundrels!

No matter. The wise will pick up the cheaper rates in about 6 months. And they will be cheaper as the banks are seriously struggling to make business and buffer their loan losses.

Boy, you’ve had a lot to say on this article. Much of it quite firm and somewhat flawed.

Firstly, people might choose to fix longer for all sorts of reasons.. certainty of payment is one. Could they drop? Sure. Could they increase more? Sure. That’s the nature of the beast. Swap rates, which usually are string drivers of retail fixed rates (as they are the cost base) indicate that long term rates will come down, with an inverted curve. However there’s been some volatility out long as I understand.

Few things…

break fees are based on differential between rate when you signed up and rate when you break. So 3.45% does necessarily mean you had low break fee when the rate dropped to 2%. But fixing at 6% you’d likely see a similar cost if rates dropped to 4.5%, assuming you had similar term remaining. Hard to see 1.5% drop any time soon.

second, brokers don’t likely want you to fix long. They would rather you fix short, as that’s more times they get paid commission to tell you to take 1 year again. They also have more bites and moving you for more commission. Cynical view of course, I’m sure many brokers aren’t driven by commission.

Do you have graphs for the 1,2,3,4, and 5 year take up between 2019 and now?

Sensible people would have tried to "fix long" when rates were low. Remember break fees were based on rates as low as 3.45% at that time, i.e. the break fees would have been very low.

Alas, many sensible people were misled by their banks who said that they couldn't fix long.

The banks used misleading tactics like "test rates" to fool people that fixing long wasn't a "commercially viable" option for them. These people have been screwed. Right royally screwed by the banks.

We can expect legal challenges to the bank's "commercial judgement" in such instances.

For anyone trying to break a mortgage and fix long at a low rate in 2020/21 - The bank's behavior wasn't anything less than shafting their customers while the banks hid behind the laws allowing the "commercial judgement" get-out clause.

What banks were telling people they couldn't fix long? Surely not regular mortgage customers? My mortgage broker advised against fixing long, but it was my choice as to what to do - I fixed for 5 years in mid 2021.

Maybe I missed it but events such as you've outlined would surely have hit the media, do you have any links?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.