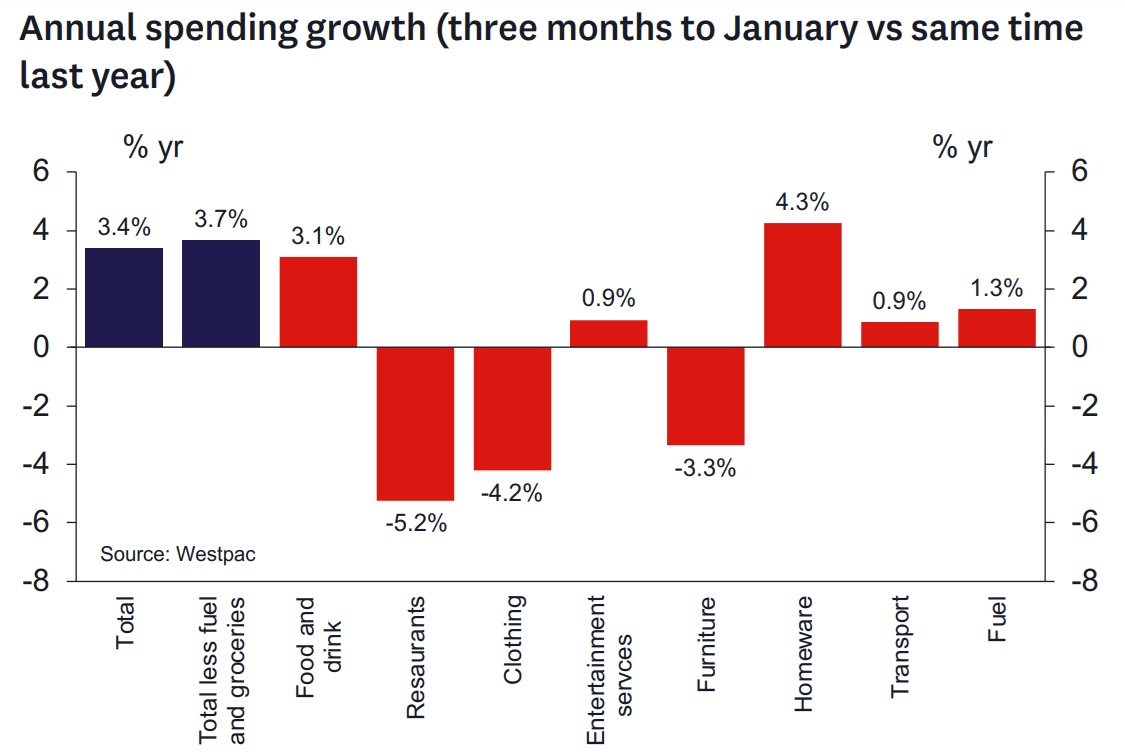

Westpac says its customers are spending just 3.4% more than they were a year ago, while the population's increased 2.8% and retail prices are up around 4%.

Westpac senior economist Satish Ranchhod said that combination means that "even though we’re splashing out more cash, many New Zealand households are actually getting less in their trolleys".

"...Many New Zealand households are actually getting less bang for their buck each time they tap their cards," he said.

The report from Westpac follows on from Statistics NZ's December quarter figures, which showed that spending had now declined for eight quarters in a row.

And it came a day ahead of the Reserve Bank (RBNZ) making its first decision for the year on whether or not to raise the Official Cash Rate again from the current 5.5%.

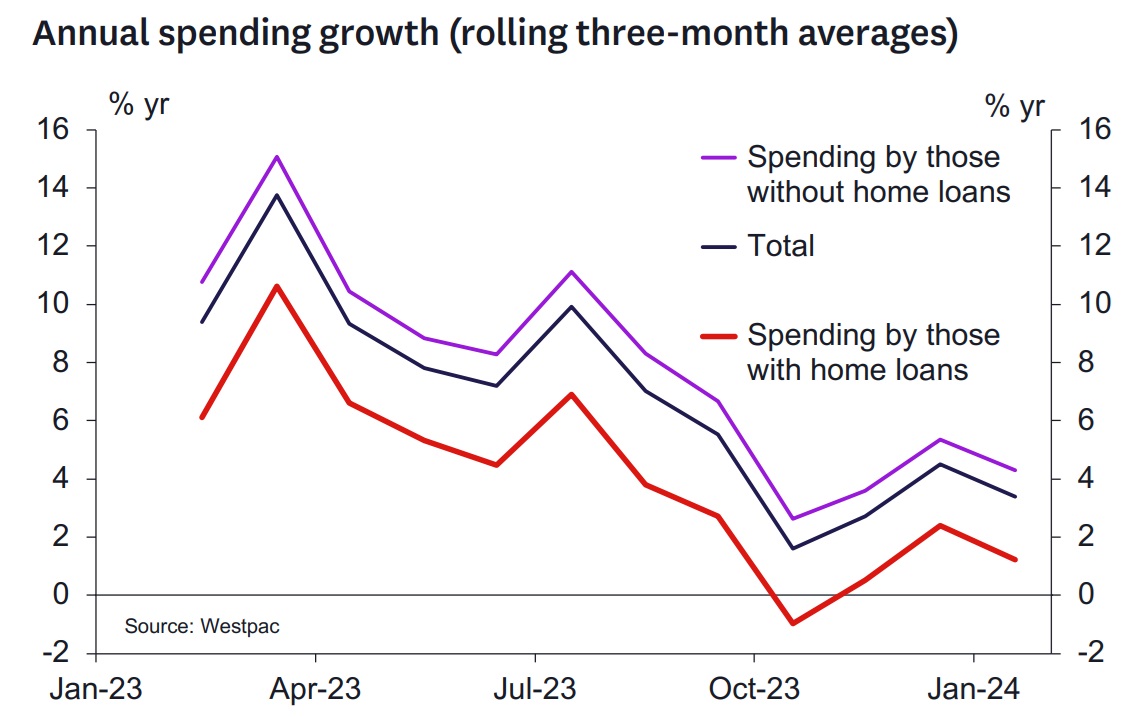

Ranchhod said all households have seen their spending power eaten away by strong price increases, while the pressure on household budgets has been "especially stark" for those households with mortgages, many of whom have kept their cards in their wallets as interest rates have pushed higher over the past year.

Westpac's rolling three month spending data is up to the end of January, and it shows clearly much less spending by those with mortgages.

Ranchhod said adjusting for when households fixed their mortgages, the average mortgage interest rate that households are paying has risen by around 260 basis points (2.6 percentage points) since 2022.

"For households with mortgages, that’s seen their spending on interest costs rising to around 15% of their disposable income (up from around 10% in 2022).

"Looking at households with and without mortgages, the impact of interest rate increases over the past year is clear. While spending by households without mortgages was up 4% over the past year, among households with mortgages it was up a paltry 1%."

Ranchhod said that "importantly", even though the Westpac economists don’t expect further rate increases from the RBNZ, many households will still face increases in their debt servicing costs this year.

"Around 90% of New Zealand mortgage interest rates are fixed for a period, and over the coming year around 60% of all fixed rate mortgages will come up for repricing.

"That will see many borrowers rolling on to higher rates. In fact, we estimate the average mortgage rate that borrowers are paying will rise by a further 60bps on average in 2024. (Note: We are basing this on current mortgage rates and are not assuming any changes in the interest rates that are on offer from lenders.)"

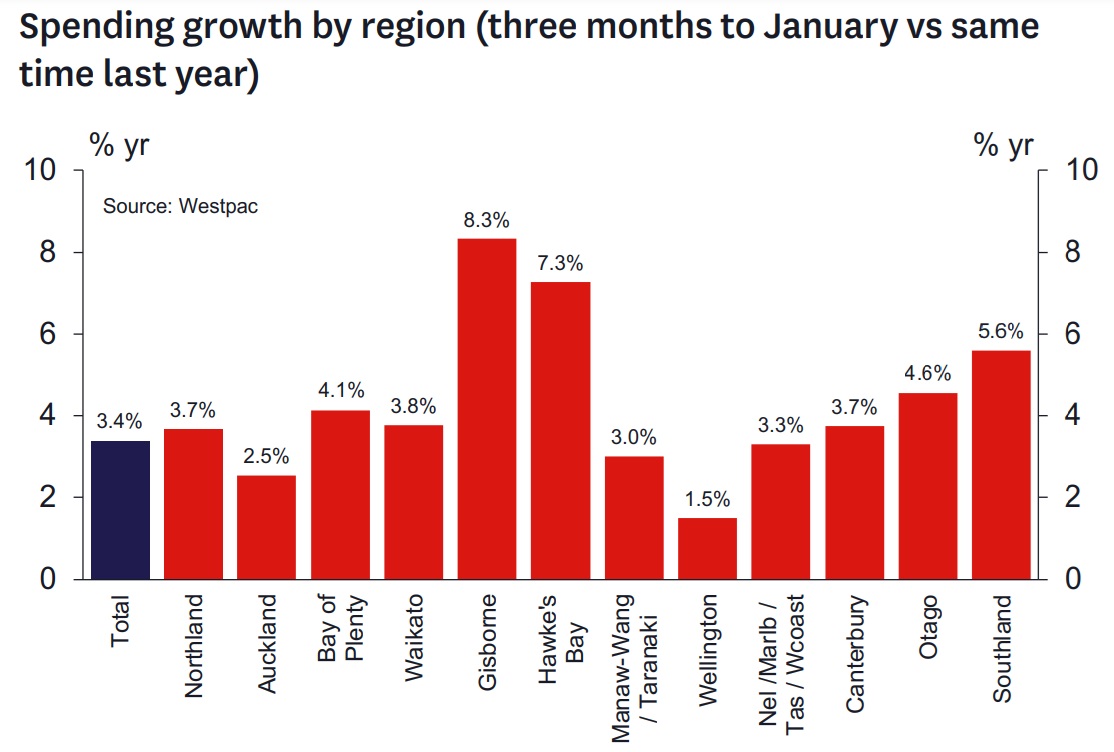

The Westpac spending data shows some big regional differences.

Spending in Auckland is up just 2.5% over the past year.

"That’s despite surging population growth – with Auckland attracting the lion’s share of new migrants, we estimate the region’s population has grown by more than 3% over the past year," Ranchhod says.

"In part, that softness likely reflects that housing costs are particularly high in Auckland. In addition to high house prices and increases in mortgage interest costs, the cost of new housing rents in the region are up nearly 7%."

Spending in Wellington has also been cooling, with spending growth slowing to just 1.5% in the year to January. Households in the region have been spending less on apparel, furnishings and appliances.

"Our recent talks with businesses in the region highlighted growing concerns that spending will turn down sharply this year in response to reductions in public sector spending," Ranchhod says.

Bucking the trend, spending in the Hawke’s Bay and Gisborne is up around 7%.

"As the recovery from last year’s severe weather continues, we’re seeing strong spending on appliances and household furnishings. We’re also seeing increase spending on apparel. Many in the region are also spending more on travel."

In terms of spending on various categories on a national, basis, Ranchhod says spending on groceries and other food items has held up, supported by strong population growth.

"However, in our recent talks with grocery retailers, a number of operators have noted a change in consumers spending patterns – there’s an increasing focus on value for money, with households switching their spending to lower cost options and necessities, rather than ‘nice to haves’"

Looking at spending non-essential items, the past year has seen spending on furnishing dropping by 3% and spending on apparel falling by 4%.

And notably, Ranchhod says, that reduced spending on goods isn’t being offset by spending on services. Spending in restaurants is down 5% over the past year, and spending on other entertainment activity has been tracking sideways.

5 Comments

Why spend when you can shoplift?

Stop giving ideas to wannabes 😀 Anyone's guess why Gisbornes at the top 😄

Nice to see a bank in NZ publishing data on what it actually sees occurring in its own systems.

Good on Westpac. Will the others follow?

Supermarket datasets are gold.

The price of most commodities (like oil, grain, metals etc.) have stabilised at pre-pandemic levels as have most manufactured goods. Our inflation problem is a domestic problem. I would single out areas like housing (construction, rents etc.) as being unable to respond to demand.

We've just created this labyrinth of regulation for each step of building a house like zoning and planning. Imagine if Toyota had to get consent for every car produced, they could only use certain steel zoned for car production, the car had to be inspected by government entities at various stages and you neighbor could object to your new car before it was built. Housing is expensive because we made it expensive.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.