The amount of non-performing mortgage loans had its biggest drop in nearly five years in July.

Latest monthly loans by asset quality figures from the Reserve Bank (RBNZ) show that the amount of mortgage money classified by the banks as non-performing fell by $55 million in July to $2.402 billion.

This is the biggest fall in non-performing mortgage debt since October 2020 when a brief spike in distressed mortgage debt caused by the pandemic was unwinding.

The July 2025 fall saw the non-performing percentage of the $375.483 billion outstanding mortgage pile reduce to 0.64% compared with 0.66% in June (when the mortgage total was $374.113 billion).

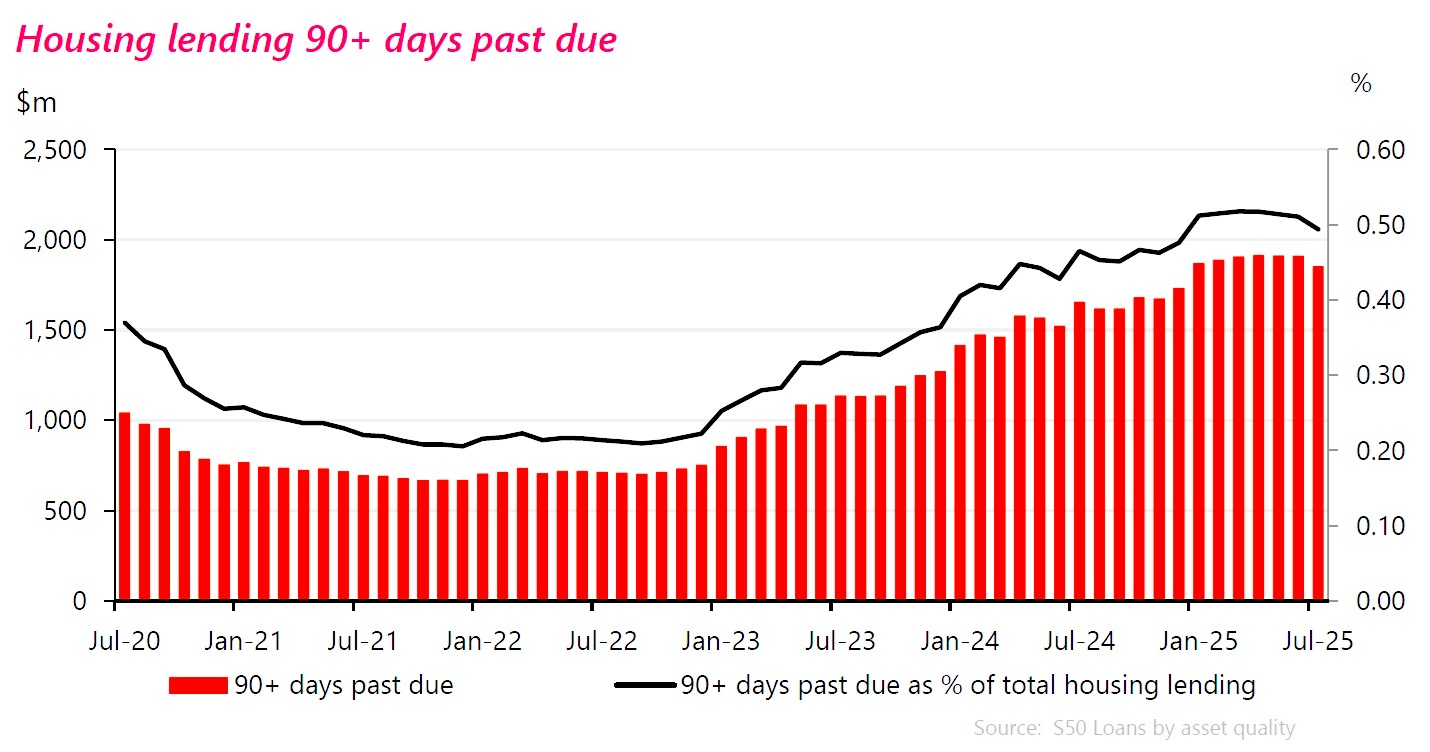

The distressed mortgage figures have been rising meaningfully from the end of 2022, following the sharp rises in mortgage interest rates that began in the second half of the previous year.

In calendar year 2023 the non-performing mortgage total rose from $850 million to $1.517 billion - a 78.5% increase. In 2024 the total rose a further $646 million (42.6%) to $2.163 billion.

After seeming to level off somewhat during the course of 2024, the total began rising again in the latter part of the year, despite the fact that the Reserve Bank (RBNZ) had fired the starting gun for reduced rates by beginning a series of Official Cash Rate cuts in August 2024.

The reason the non-performing mortgage tally began rising again in the latter part of 2024 may well have been that fact that unemployment had started rising quite swiftly, with the unemployment rate increasing from 4.0% at the start of the year, to 5.1% at the end of it. As at the June quarter of 2025 the rate was 5.2% and economists and the RBNZ both think it will go a little higher yet before starting to slowly reduce again.

But mortgage interest bills are now coming down. RBNZ figures show the yields on the banks' mortgage books peaked at 6.39% in October (that's right, it kept going UP even after the OCR cuts and reductions banks made to their new mortgage rate offers), fell to 6.29% by the end of 2024 and has now started to reduce with increasing speed, down to 5.66% by June 2025. This figure can be expected to continue falling in coming months.

In forecast information provided to the RBNZ, the country's big five banks had expected non-performing loan ratios to peak at about about 0.7% by the middle of this year - which effectively is what we've seen - and then start to reduce in the final quarter of the year.

While the non-performing mortgage loan ratio did rise very strongly, up from just 0.2% in late 2022, the rise has been less marked than that seen after the Global Financial Crisis. Between 2009 and 2011 the ratio frequently hit 1.2%.

Whether the drop seen in July will prove to be the start of an ongoing reduction, time will tell - and we'll be keeping an eye on the figures.

But the $55 million drop was quite substantial, representing a 2.2% reduction.

With more and more people already rolling over on to lower mortgage rates (and with about $170 billion worth of mortgages potentially up for a rate reset in the coming six months) it would be imaged the non-performing figures would keep reducing from here - but whatever happens to the unemployment rate will be important in this regard as well.

7 Comments

This is good news. Interest rate reductions are finally beginning to provide relief for struggling mortgage holders.

I doubt that 55mil of lending just turned unhindered due to payback, rather I think a lot of urgent sales have occured... Be good to have more clarity... as below not behind but underwater. these guys do not show in stats... until they do.

Ray White Manukau co-owner Tom Rawson said the drop in property values in Ōtara meant some owners – including those who bought at the height of the market – were now stuck.

“Ōtara has dropped heaps in the last year. We’ve got people stuck with property they can’t get their money back on.”

Isn’t it due to lower interest rates? Can’t afford repayments at 7% but can at 4.75%

Agreed. I suspect this will continue to improve as those that took short term fixes at 6 and 7% roll off to the newer lower rates.

I disagree, that would show up in a spike of mortgagee sales.

Much more likely is the lower cost of debt and people are hunkering down. If you have a $500k loan and are refixing now vs last year, your lending costs are 1% lower, so $100pw. Also I think people are just spending less. During covid if you had any slack you bought a spa and got uber eats it seemed, now you put it on the mortgage and cook at home.

the negative wealth multiplier in action

I reckon jet ski sales are down as well

Second hand toys are up for sale, paid for by lost equity in the owners property values.

It takes a long time for a bank to proceed to a mortgagee sale which is final resort. Bank will often allow a client to sell and realise loss (which in most cases becomes unsecured debt if mortgage isn't fully repaid which generally accrues interest at the floating mortgage rate). The banks know the moment they advertise as a mortgagee sale the price will fall compared to ordinary open market sale.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.