Residential property investors hit the $100 billion mortgage mark in 2025 and are growing their outstanding mortgage pile at a faster rate than owner-occupiers.

Reserve Bank (RBNZ) monthly figures showing banks' loans by purpose reveal outstanding mortgages to investors reached $100.736 billion by the end of December 2025.

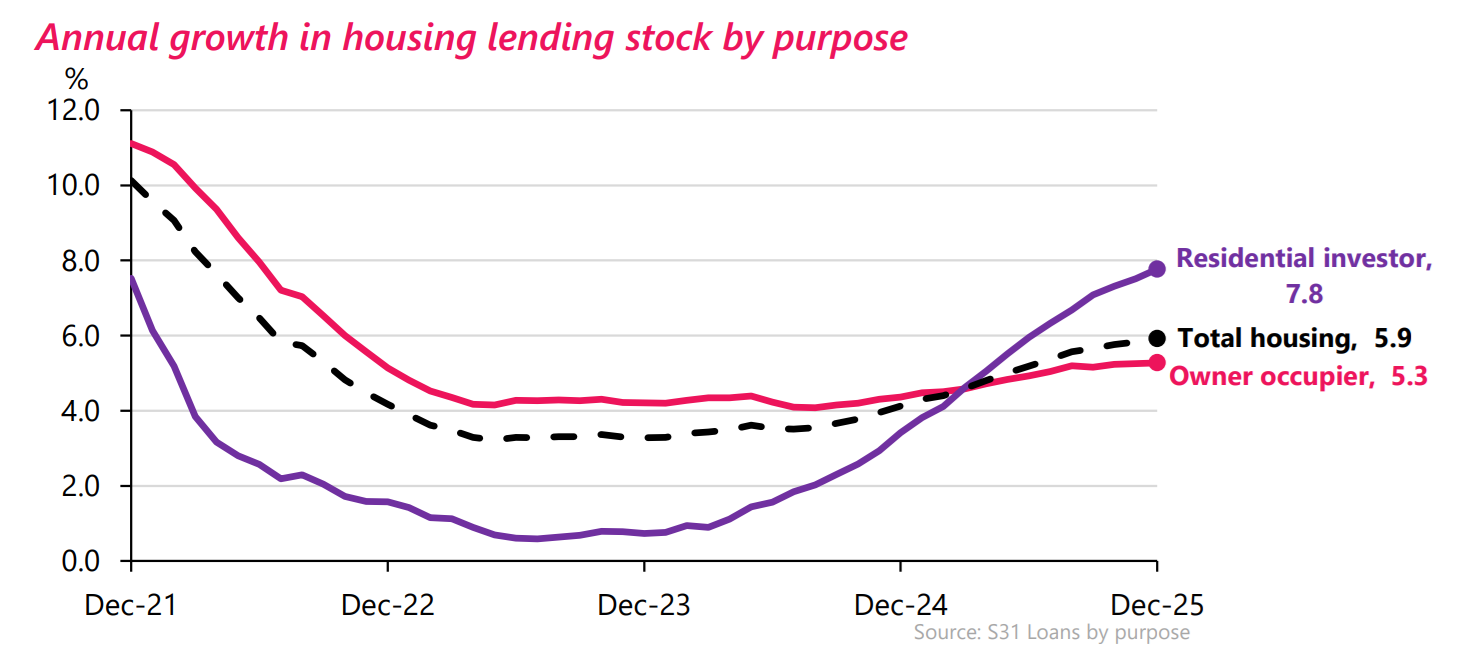

The investors' mortgage pile grew by $7.264 billion during 2025, a growth rate of 7.8% over the 12 months.

That's a considerably faster growth rate than owner-occupiers, with their mortgage pile growing by 5.3% ($14.274 billion) to $284.901 billion.

After leading the sprint into the pandemic pandemonium housing market of 2020-21, following the RBNZ's temporary removal of loan-to-value ratio (LVR) limits, investors very much retreated to the sidelines.

In 2022 investors' outstanding mortgage loan stock increased by $1.4 billion, then by just $385 million in 2023, and then $3.087 billion in 2024.

But while the overall flat state of the current market might easily lead us to believe the investors are still on those sidelines, in fact they have been much more active in the past 12 months than might readily be imagined.

That $7.264 billion increase in the investor mortgage pile during 2025 compares with a $7.373 billion increase during 2020 and a $7.697 billion increase during 2021, - and those later two were the 'hot' years of course for the market.

And in fact during 2025 investors were borrowing at an increasing rate during the year. During the first half of the year they increased their outstanding mortgage pile by $3.247 billion; during the second half it was increased by $4.017 billion.

The increased investor borrowing rate helped push up overall growth in the total outstanding mortgage stock during 2025 by 5.9%.

As at the end of December the total pile of outstanding bank mortgages stood at $385.637 billion.

The 5.9% increase during the year equated to a rise of $21.538 billion.

In the three calendar years before 2025 the increases in the total mortgage stock ranged between increases of $10 billon to $14.5 billion per year.

Which means that 2025's figure is a considerable increase. But it's still dwarfed by the momentous $30 billion increase in the mortgage pile we saw in 2021.

However, as I've said before recently, just because house prices aren't moving at the moment, doesn't mean the market itself is inert. These latest figures suggest some people are keeping themselves reasonably busy.

7 Comments

Yields are so awesome, but Specu dollars dive in regardless.

Your perspective on the viability of landlording always excludes the leveraging aspect. If you only have to put 40% down (or less, and not even cash) on the asset, and the tenant pays the rest, you are making quite a bit more than how you're calculating yield.

Whatever you do FHBs, don't buy! Continue to fund your landlord's wealth. I'm sure eventually they'll go bankrupt and you can sweep up their rentals for cheap for free! Or retire homeless.

Not so. Latest commercial project is yielding double digits quite nicely thanks. Your perspective excludes risk and diversification. My BTC and Au, purchased years ago with initial investment recovered have also done very well thank you.

There's always a risk in any investment. As you've slowly come to realize, new houses aren't getting cheaper anytime soon though, and that helps create a price floor. Likewise our government hasnt shown much to indicate they won't keep trying to grow the population.

Diversification is good to spread risk, although too much and you're playing with blackjack odds. I'd advocate making larger investments in a handful of areas.

None of what I said rules out you or anyone making money other ways. Just pointing out the flaw in your yield argument.

Interesting article on how investors feel and a possible indication about the future of the market. The range of conflicting factors mean that there is uncertainty as to the market’s future, however, despite what some posters on this site may think, the vast majority investors have experience and are not idiots. Barfoot’s January sales data is consistent with this possibility.

Why is there still so much stock sitting around and prices aren't rising if investors are so active?

Because people would rather invest in townhouses that are more affordable.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.