By Elizabeth Kerr

Without a doubt one of my most popular columns has been the Harmony Peer to Peer Lending experiment.

I regularly get emails from people asking how it has gone.

So, I thought this week was a good time to give a little update.

Before I launch into it though there is something I want to get off my chest first.

'Elizabeth you are a hypocrite!!!'

Some of you have expressed “strong concern” I am endorsing a product that at its core enables people to take on personal debt, and thus you feel I am turning my back on the values of designing a debt free lifestyle. “You are no different thant a loan shark profiting on other peoples misfortune”.

Being the balanced individual that I am I can see their perspective but I want to remind you that Harmoney is neither a ponzi scheme nor a preying loan shark. If someone is borrowing on a credit card at 23%, but could instead borrow using Harmoney at 12%...that is simply a better use of their money. Additionally, if an investor can lend that money to the borrower at 11% then isn’t that a win-win outcome for everyone?

Moreover, why should the banks get all the profit, surely they make enough already? ANZ reportedly made $877 million in the six months to March 31. I don’t see them disseminating nearly as much in interest payments to anyone’s money machine. No, perhaps the banks are too busy paying for ATM’s, building fit-outs and leases, staff uniforms, pretty brochures, credit card technology and staff commissions.

I think that the “sharing economy” is here to stay and I am happy to highlight its potential for helping one's money machine grow. I would still counsel people not to take on unnecessary debt, but if people are/must then P2P lending is a cheaper option than using the credit card.

Summary:

Righty ho… Where was I? Yes, let’s have a look here at how my little experiment is doing this month.

If the image is a little hard to see, it can also be viewed here.

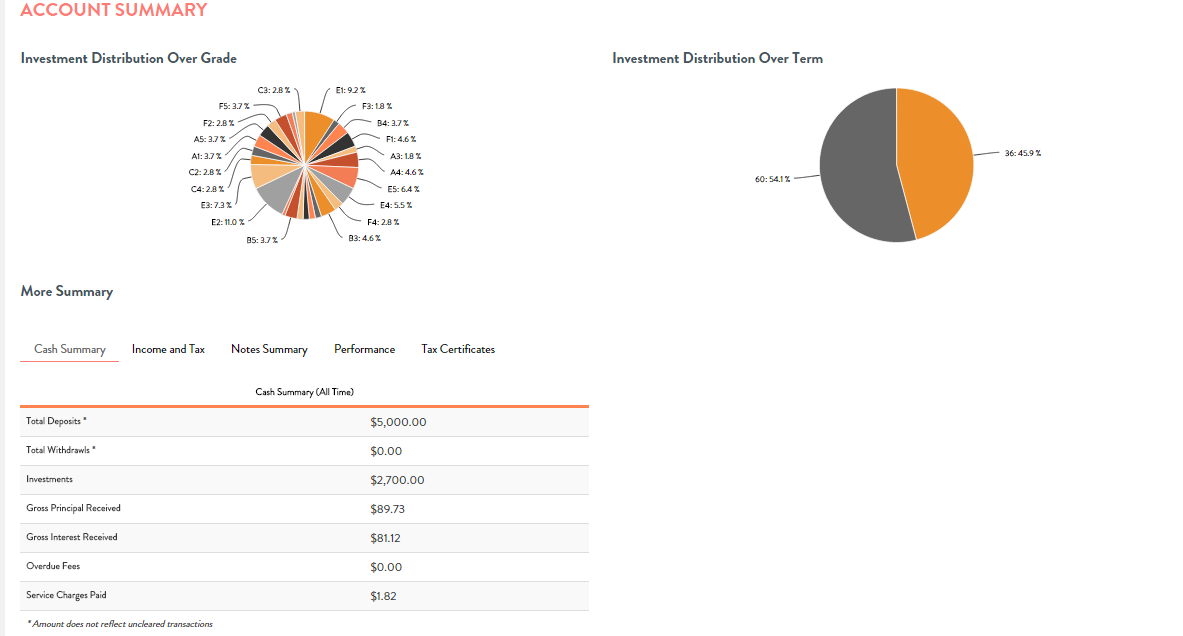

I have 60% of my money invested in 5-year loans and the rest in 3-year loans. My annualised return is currently 21%.

That’s it in a nutshell. I did hope to have invested the lot by now, but I got a bit sidetracked. Will commit to investing the rest this month I promise.

The actual investing process didn’t go as I intended it to when I wrote my last column. I assumed that in a few clicks I’d have the entire $5000 easily distributed between the two options – Self Directed and Quick Invest.

But that’s not what happened.

You see under the Quick Invest option there were not enough “notes” for me to use up my $2500 in one go. The highest amount I could invest across the loans available was $725 on that day so I invested that.

It takes a while for the loans to be fully funded. Other investors also need to invest in those loans, so, the borrowers can get the money and then my balance is reduced accordingly.

These loans weren’t expected to be funded for 14 days, so, I set a reminder to log back in and try to invest the rest then.

Tick tock tick tock…

Right, back again after 14 days. All of the loans I invested in were fully funded and that money was now in the hands of 29 happy Harmoney borrowers.

This time I thought I’d try Self-Directed investing.

Upfront honesty: I am ridiculously no good at this.

I mentioned about becoming judgeypants in my first column, but add to that I also keep double guessing myself.

Out of the $2500 that I have available for investing using this Self-Directed option, only $1075 have actually successfully made it into the hands of the borrowers as of today.

I can’t help but go through all of the loans looking at the borrower details and making humongous generalisations about the borrowers and their ability to pay back the money.

Because of my own views on money, instinctively, those that were consolidating more than $25k of personal credit card debt got my furrowed brow (how did that much credit card debt happen?). As did anyone borrowing more than $15k for a second hand vehicle (“seriously… there are great buys for cheaper than that”!). People borrowing large sums to go on a holiday also didn’t fare well in my choices either (“you might resent still making those payments five years after the trip my friend – just save first”!)

I know what you are saying “you can’t have it both ways” Elizabeth, but it’s my money and because I have the option of knowing these details about the borrowers, naturally my own buying choices will influence my decisions here.

One could take some faith in the fact that Harmoney actually decline approximately 80% of applications from borrowers. So, theoretically, only the cream of the crop actually makes it into the borrowing platform and somewhat reduces my anxiety that my investments will go down the gurgler.

Now, you could have different buying rules to mine, such as only funding a certain amount of notes per loan dependant on the interest rate return, loan grade and expected default rate.

Heaps of you have emailed through with spreadsheets and your ideas for using Harmoney to get the best return and I LOVE THAT!!!

I love that you are taking it and turning it around and figuring it out in your own way.

Still to go…

I have invested $2700 and still have $2300 to go. But I sense that whatever option I use to invest this money the real question you want to know is have I lost any money and do I think it will work?

It’s still a bit too early to tell.

Yes I have $5.76 in arrears, but investors I’ve spoken to say that when that has happened to them they eventually get paid back.

So tick, tock, tick, tock... whilst my investments are fermenting, let me address a few comments I often hear about P2P lending generally:

Objection #1: It’s just a Ponzi scheme

P2P is NOT a ponzi scheme. Ponzi schemes pay returns to existing investors from new money paid in by new investors. Given that there are borrowers in the mix, P2P lending cannot be called a ponzi scheme.

Objection #2: They’ll fall over come the next GFC or change in credit cycles…

P2P lenders are subject to credit cycles just like everyone else, but I think there will always be investors and there will always be borrowers.

When times are tough and people don’t rein in their spending then I’d imagine there would be more borrowers seeking P2P services than investors.

During those times I imagine P2P lenders would bump up their advertising toward Investors to meet borrower demand for the service.

Underpinning these companies are some clever algorithms watching for customer trends to make sure the company is evenly balanced between investors and borrowers.

So while credit cycles have an impact…. I don’t think they will force P2P lenders to implode. And if things do need to change, the mere nature of P2P platforms means they have the technology to be able to adjust quickly to these needs.

Objection #3: Banks will take over them eventually…

Maybe, but they would have to build a brand new technology as I imagine P2P lending won't work on their current legacy banking technology. They could set up a separate P2P platform alongside of their banking business…. But why would they bother? They make plenty of profit doing what they do now. In my opinion banks do their thing and P2P lenders to theirs and the pie is big enough for both appetites to be filled.

Objection #4: This is just a flash in the pan crazy idea…

Nope – wrong again.

The “sharing economy”, which is what this essentially is, has been around forever. This is just a forum for facilitating it between strangers.

According to the Wall Street Journal sources last week, in China there are over 1575 P2P platforms (facilitating NZ$23.4 billion), 50 if which have opened in the last year. I think it’s safe to say P2P lending is here to stay folks!

And finally…

Just because Harmoney (or any P2P lender for that matter) is not a bank is not a good enough reason not to trust it. In fact you might think that is the best reason of all for why you should give it a shot.

73 Comments

I invested 10k in Oct 14 to try it out, all in self directed, and I'm even pickier than you. I've received a net return equivalent to about 16% p.a. in that time, and no defaults yet, although about 4% have some arrears. In the same period I've received 3.2% from the bank; in the case of a wider banking crisis or default I am more or less unprotected. I think the biggest risk with ptp would be the skills of the owners to manage the business. The team at Harmoney all have significant relevant lending experience from the traditional sector, and I have confidence in their ability to manage, they also have institutional financial backing, and these were the main reasons I chose to use their platform.

Objection #5

What are the 3 most important things in investments?

Liquidity Liquidity Liquidity.

You can not get your money out at short notice.

In the early days of the product release, the PR guff said that there were plans to develop a secondary market where investors could on sell their loans to other investors.

This has not happened and any mention of it is now absent from the companies announcements.

No doubt this is in part because of the small number of investors who have signed up. Around 2,000 so far I think. Thus most of the loan amounts are fulfilled by the wholesale funds. Because of this I imagine the management of Harmoney have determined there would hardly be any demand for inter trading amongst investors so are not prepared to invest in developing such a system.

If this situation was remedied I would certainly increase my investment.

As it is, I’m slowly withdrawing my funds as they become available.

Also, the investor “Dashboard” has been (and still is) riddled with errors.

The original developers of the system obviously had limited experience of “realtime” transaction systems. I would hope that their IT department has been sacked and replaced by some talent from Trademe.

I think Harmoney was quite clear that there is no secondary market from Day 1. But yes, if you need access to your funds, don't invest in P2P or be prepared to access your money over the 36- or 60-month terms.

I'm also an investor with Harmoney. I don't know what real-time problems you're referring to with the dashboard. I think it's good but it would be good to hear more about this.

I often had "Cash available to invest" showing negative values.

I currently have 14 notes shown as "Paid off" yet for all of them the value repaid is less than that lent - some show only about 5 % repaid yet appear in list of paid off loans with a status of "paid off".

I have my "expected return" displayed with about 20 significant digits.

When withdrawing money, the status shows as "uncleared" for about 3 days after I am able to access the funds from my bank.

I could go on!

All but the first one above are still outstanding issues for my account.

I would also add that Harmoney is very poor in communicating with investors.

Just a few days a go they removed the ability to stay logged in without notifying us.

There has been no "official" announcement/update on the secondary market - hence my suppositions above.

About the call centre….. Yes sometimes getting a straight answer has been a challenge. However, in my experience they are over the top enthusiastic (if not a little too scripted) about making sure I have a good experience which I think is awesome. And I assume they are like this for everyone as I don’t exactly say “im Elizabeth and im going to write about you so its in your best interests to be nice to me”. No, they just know me as any other average customer.

I don't think that liquidity is the most important thing. It's a nice to have but if one is prudent one would have emergency monies to take care of any huccups in the meantime. As said, don't invest money you can't afford to loose (or access).

Yes there were some problems with the dashboard but i am under the impression this has been fixed and that no investors were left out of pocket at all.

Are you still experiencing issues?

I recommend keeping a external record (paper/pen/excel) of your investments just to be on the safe side of any technical issues. I didn't do this and I do wish i had as i was sure i had invested all my money only to log in and see i wasn't even close. I thought my mind was playing tricks on me but i had no external records to back me up.

The reasons to exit are many - not just that you need the money.

You might see a better opportunity.

You might see some down side coming (before others) and want to off load to those who are uninformed.

I wouldn't be surprised to hear that you hadn't had a senior moment and that it was another Harmoney IT gaff

deposited $5000 into the platform, have invested $2700 in loans and received a total of $170.85 back into my account of which $81.12 is interest earned. (It doesn’t show on this page but I actually have $5.76 in arrears as well).

I have 60% of my money invested in 5-year loans and the rest in 3-year loans. My annualised return is currently 21%.

No time frame given. so work with "until y/e"

81.12 earnings gross. <- that's your revenue.

5000 <- that's your investment.

81.12 / 5000.00 = 1.6% gross yield p.a.

if you have a time frame you might want to round that out for a year.

But any other numbers games are just Jedi Mind tricks.

eg You haven't invested 2700. you invested 5000. you just only have 2700 of it working, carrying the other 2300.

eg your arrears are "doubtful debts". they aren't "potential earnings". Often in business it costs _more_ to recover these doubtful debts than it does to write them off so they must not be counted as revenue.

You make a good point.

It is important to drip feed money in at the rate at which you can lend it out.

Also, choose loans that are close to completion so that your cash is not sitting around committed, but not earning.

Also, as payments come in, you have to reinvest it quickly to avoid more dead time.

One big problem I have also found is that about 5% of my loans have been repaid within a month or so and I've been hit with Harmoney's 1.25% fee which in some cases is greater than the interest earned!

Of the 16 odd investments I have, most have been fully subscribed within 2-3 days. I plan to recycle payments back into loans on a 3-month basis. I have 10K invested and I tend to focus on the lower end of the interest scale (10-12%) over 36 months. It took me until April of this year to make my first loan even though I've been registered since the platform was launched.

You are really missing the point.

You should have $10k split over 100 loans not just 16.

If one of those loans goes belly up you're in the shit.

I'm no statistician but I would think that to gain the benefits of fractionalisation (and get the projected returns), your total investment should be split over several hundred loans.

With your 16 loans you might beat the projections but equally you might lose.

TANSTAAFL.

If you pick your investments well then you'll have a much lower risk anyway. If there isn't a default then diversification increases exposure not reduces it. Large diversification increasingly guarantees some default as it becomes harder to find 100 gems in 500 stones than it is to locate 20 in the same pile.

I think you'll find Markowitz was betting with OPM, his own yield was entirely skim from the top, about as "free lunch" as you can get.

Do you think you can do a better job of assessing the risk than the professionals at Harmoney?

Plus you only have access to just a small subset of the application data compared to them.

I may not be happy with their IT department but the track record of the principles in the consumer finance business is outstanding. Time will tell if my faith in them is justified!

Diversification can be thought about mathematically using the following variables: expected default, average interest rate p.a., number of loans, number of repayments. Simply to say, 17 @ 12% is more risky less risk than 100 loans at 22% because of diversification doesn't hold up.

To help you out, here is Harmoneys thoughts on diversification:

"If, for example, $10,000 were invested in one single loan, and that loan had a 3% probability of default, then there would be a 97% chance of the investor getting their principal plus interest back, but also a 3% chance of the investor losing the principal invested. Alternatively, if that same investment were fully diversified, it would be spread across 400 different loans. Say the probable loss of those loans is also 3%, meaning 12 of the 400 notes would probably default but the remaining 388 would be repaid in full. By utilising fractionalisation, investors can increase the likelihood of achieving their targeted return, net of defaults.

We strongly advise that investors take full advantage of our fractionalisation facility to diversify their investment across many distinct loans.

It is the nature of consumer lending that there is a risk of default. By spreading your risk over many loans, you are much less exposed to defaults of individual loans."

So, for full diversification your $10k should be invested in 400 different loans, of which all (or the average of all) of the loans match your target return.

Oh I know the maths, passed the university paper.

However I also invest and run businesses and trusts "for realsies". So I know what the real world is.

so you can stick with the theory, or understand the real world principles. Just remember though, the exactly maths and theories you ae quoting ar the ones used to re-package sub-prime mortgages right before the GFC, and those people were seriously clever experts.

What you babbling about wookie.

What's the return on a good investment 5k @ 12%?

what about 10 ok investments @18% (90% clear, 2 yr)?

If you've got lots of OPM and balancing the in and outward streams then the second one is good.

If you have a single point of investment, which individuals have, then the former features more highly.

The risk for used for proportioning the accumulative loss over the the total investments to give a required target. As they found in the GFC 10% risk of loss, is 10% level of catastrophy, and a 100% probability of less than 90% of EPV.

TINSTAAFL- name of a book by Milton Freidman, he was more likely the cause of the ongoing GFC with his feel good economics, I only wish he stayed alive to see the mess.

Higher risk, higher yield. Are you saying the P2P lending company is incorrectly pricing risk? Why are you investing with them then?

Diversification gives benefits to risk at no extra cost; I’ll keep my free lunch.

I see your point. There is some wasted money just sitting in the platform not working for me - but as i mentioned above I either had a senior moment (thanks finite) or experienced a technical issue so it would of all been invested by now. Will sort this out before long.

Not really my point. Seriously, when I'm critical there's no doubt.

It was just that it's common emotive thing that we all do to better report our position.

Yes you're getting good return on your 2700 - internal project-wise this is a good KPI and needs to be encouraged.

Just don't forget in your calculations to include the whole investment.

It's something that has to stay in mind when looking at the returns on margin debt. (eg FX)

You are bang on cowboy. I find some of the reporting around ptp rather amusing. As a model it isn't that different to what finance coys did. Each priced loans according to risk. On the funding side ptp appears fairly illiquid as an investment. And the financial reporting is virtually non existent. Investors are placing a huge degree of confidence in the managers ability. Talking about arrears at this early stage, and returns is misguided.

From a borrowers perspective, can't say i'm that impressed. I bought in to the hoopla, applied for a debt consolidation loan, excited to be seeing an interest rate south of 20%... but it wasn't to be. The interest rate was barely competitive with what I was already paying, and I have an excellent credit rating & secure income.

But I guess that's attractive from an investors point of view, i'd certainly look into it (when I don't have debt!).

Interesting. Some of my borrowers only have interest rates of 13-14%, which is about as good as it gets. I've never paid those kind of interest rates in my life. I've had a credit card for 20+ years, but I've lived in Japan for a good portion of that time where credit cards are de facto debit cards unless you choose a revolving loan option.

The laws surrounding credit cards have loan and consumer rights legal protections built into the contract and Act that governs them. Debit cards have no such protection. I've had to use it a couple of times with online buying. Also the banks are much more enthusiastic about recovering their money than recovering yours in cases of theft or dishonesty.

Just a little point Elizabeth. A couple of banks dont want to touch Harmoney from a transactional banking perspective because of how high the interest rates they charge are.

I like the idea, I just think that the rates are too high and really dont help those at risk in society. I understand you need to be rewarded for risk, but 40% is rediculous and a "well diversified 20%" is insane. Liquidity risk is one thing but it doesnt come close to justifying those rates. You only need to look at equiv platforms in the UK and US to realise we are out of kilter

When I started through the borrowing process, as I figured 15% was less than GE, and they advertised "why pay credit card rates" but my borrowing would have come out around 22%. that's higher than the 1.5% over your 12% return. Not that 12% isn't decent in a controlled transparent investment

One thing to note is Harmoney do help "those at risk in society", they don't offer them loans, because they know they won't be able to repay them.

As for the interest rates, my belief is that to take out a Harmoney loan you have a basic level of technical knowledge, so it is safe to assume that this group of borrowers have the ability to shop around for their loan (Harmoney is not a lender of last resort), this means that Harmoney can only market their loans at a marketable rate. That is the one of the good things about P2P lending/saving, the market justifies their rates, if they are too high people will go elsewhere, if they are too low they won't have enough investor funds to supply demand.

There is no point to compare NZ to the UK and US, it won't work. e.g. the largest PayDay (Wonga) lender in the UK charges an average 1509%, in NZ (PayDayAdvance) about 1400% (I say about because here in NZ we don't legally have to quote what the interest is.) this is where the real "people at risk" borrow, not P2P lenders. I'm sorry but the P2P industry/investors really don't want these type of borrowers they are just too risky.

FYI: I don't work for Harmoney, but I do believe that P2P is a very transparent borrow/lend technology.

I have close to $70k invested in over 1700 loans (diversification is your friend).

About 4.6% of the loans are in arrears, which places around $3k at risk of total loss (not all will be total losses, but that's the kind of exposure level).

I have had 4 loans fully default ($175 of loss)

We'll see at the end of the year, but I think the net pre tax interest rate will be about 14-16%.

General observation:

Yes, the front-end needs "work"

A lot of the loans are repaid early, so it looks like borrowers are using Harmoney as "bridging loan" option. This can cost the investor sometimes, and you make a very small loss of capital.

I wish auto-reinvest was available, as it's a very "hands on" platform at the moment.

I too suffered from early repayments - Harmoney should waive their fee if the loan is repaid within say two months.

Do not bet on your projected default rate based on your current arrears. Harmoney have an interesting graph that shows most defaults occure about 1 year into the loan.

I've heard rumors that an auto-reinvest option might be in the pipeline.

Wookiee - did you use the quick invest option for all of those loans? How long did it take you to drip feed in $70k? Today there is only 12 loans available so i can only put in $300 unless i choose the loans myself and increase the amount of notes for each loan which i don't want to do. It must have been quite the commitment to get rid of $70k correct?

Auto-Invest has been "in the pipeline" since they started, and always "a couple of months away", I think it's quite difficult to do for them as they have to be able to create some kind of investment profile i.e. 3 or 5 year term; what risk A, B, C, D, E, F; etc.

I have been in since near the beginning (1st loan was 5th Sep), at the beginning I had to invest larger amounts in to each loan as there weren't so many available, but now, investing $25 into each loan you can invest about $500 per day, but you have to log on twice a day. Most, if not all loans are fully invested within 24 hours, this could well be as a result of institutional investment sweeping (at a point in the day the institutional investors take all remaining notes), but I can't confirm this.

Elizabeth - I don't use the quick invest, I use a highly complex loan selection process.......I manually select one note on any and every loan that is available on the system when i log on, I call it the "ooo there's one" method..

It is a shame that you can't see the original loan info i.e. stated loan purpose, region, age etc. once the loan is in force, as it would be interesting to look back at the full defaulters.

So far I have four full defaulted loans C1, F1, F3, and F5

Interestingly three of them never even made the first payment, and the other one only make one payment.

Agreed, that would be nice to be able to do. My arrears are E3, F5, F4, E5 and B3.

I'd also like to be able to filter between loans i've invested vie quick invest and the ones i chose myself. Apparently I'm the first customer to call the call centre regarding this and someone had to go away and call me back. It wasn't easy for them at the back-end either.

At risk borrowers: as in people that are lacking in money management skills. What is a socially irresponsible interest rate to charge someone? Many people, including myself, believe credit card interest rates of 20% are socially irresponsible, as companies that provide that credit prey on the 30-40% of customers that dont repay every month and have a core balance that they never repay. So having rates as high as 40% to me seems immoral as the risk profile to justify that level of rate will mean those borrows will generally be paying interest rates they cant afford.. hence why there is a movement away from the pay day lenders.

As an example, in the UK, Zopa is the largest peer to peer player having lent around 1.8bill NZD. They offer investors rates around 5%.. so the equivalent in NZ would be about 8-9%. The borrow pays rates ranging from 4.8% to 7.9%.. which actually helps ppl restructure existing debt without penalising them. A lack of competition should never be a reason a company can take advantage of those in society that should be looked after.

I also have investments with Zopa in the UK, and Ratesetter in the UK and Oz (FYI: Oz Ratesetter has just started and is allowing NZ resident investment)

A few things to note:

In the UK interest rate generally are much lower. e.g 5 year fixed rate, you'd be lucky to get 1.6% on 50k.

Both Zopa and Ratesetter offer a protection fund to cover defaults.

Because of the protection fund both Zopa and Ratesetter only loan to the equivalent of what would be A and B risk borrowers in Harmoney, e.g. Ratesetter UK's 5 year average default rate is less than 0.82%. Harmoney A and B borrowers borrow at between 9.99% to 16.48%, which is much closer to comparable, taking into account NZ higher general rates.

This is no argument for the high rates for those who can least afford it, just showing that comparing Zopa and Harmoney can't be done without all the facts and figures.

Thanks for that... probably a little misleading of me to not include some of the points you have raised but i was weary of dragging on! I believe I did address part of your statement with the comment that their 5% interest rate is equivilent to 8 or 9% here. I didnt want to get into the protection fund side of things either but i think you have got my main point.

You can email me at Elizabeth.kerr@interest.co.nz if you'd like me to take a look.

Wow - Merchants of Venice are throwing serious money at P2P. I've only been brave enough to test the water with 6K. The thing I can't get my head around is that the loans are unsecured. I worry that people might be turning to Harmoney to fund (either directly or indirectly) a house mortgage deposit - If so, what would happen in a downturn? Harmoney borrowers might find themselves with financial obligations which take precedence over their Harmoney loan repayments. Perhaps I worry too much.

Anybody know how they calculate the borrowers monthly payment as i can never get my excel PMT function to tally up with theirs - always close but still out. Even written my own function but still its out,

I can only assume that theirs is real world based ie takes holidays and leap years into account and non uniform months for example 31 30 etc into account where as excel( or other Microsoft provided pmt) does not. (it however does work for their example on the front of the site)

In regards to keeping records, there is a printer driver for pc called Microsoft Xps Document Writer its part of the os which allows you to print to a file instead of paper - so for keeping your records you just go "ctrl p" and type the file name you wish ie date-time.xps.

I too have created a software modeling of harmony. The model i have only however takes into account positive outcomes compounding (ie reinvesting in new loans as returned capital and interest comes in less tax, and harmony fees).

Its very difficult to actually model the risk part of the equation ie fit to their risk curve back into the model.

Thats where i got upto - and chucked it in crossing my fingers like everybody else.

In the model its most important to keep investing the returns back into the system as soon as it becomes available as those amounts only compound over time.

Now when i goto the shop and purchase something for $25 - i find myself thinking this could be worth $35 bucks invested into harmony for 3 years down the track and it changes my purchase behavior - in fact ive even lost weight from not buying those jelly donuts.

Another issue i got is how we claim the defaults in our taxation at the end of the year. For example in theory it should be interest less defaults - but that is not how the IRD will see it. Given that they are taking there pound of flesh as it arrives in RWT.

Your point about deducting defaults from income for tax purposes concerned me also.

I tried to have a conversation with the customer service about this but could not communicate with anyone whom I felt was telling me how it really is. I inferred from this conversation that Harmoney do actually take account of defaults in determining your tax payments.

It would be good if someone (Elizabeth?) could talk to some contact inside Harmoney to get the true picture.

The defaults i.e. the "Written Off Amount" on the dashboard should be able to be claimed as an income deduction under the "writing off of bad debt" provisions, but and this is a big but, there are a number of tests that have to be proven to show that the debt is truly bad i.e.won't ever be repaid. This seems to be a very gray area in personal taxation and I'm also finding it hard to get real info, best so far is The Income Tax Act 2007 sections DB31, where the question is how do we prove that the debt won't be recovered, i.e. the act require that the debtor be classed as legally insolvent.

Put in a business policy. Shift it to Doubtful debts for 12 months, then when collection attempts have failed or would cost more than the debt shift it to bad debts.

There is perfectly legitimate provision in accounting theory for recovery of doubtful and presumed bad debt. The main thing to remember; is that you do have to declare any recovered debts as gross income in an appropriate period (I'd recommend the one they were recovered for bad debt). This includes recovery via insurance claim (the premiums are deductible expenses but the money received is income, not reimbursement for a loss, since it's repaying a lost income, not replacing a tax paid for asset.)

As long as you aren't ripping off the system, or neglecting the debts as a way of giving freebies to others (and claiming a tax deduction on the transaction, where "a friend" was supposed to pay for a purchase, and you've essentially given them a massive discount ), or just having high bad debts in order to evade tax, I can't see IRD being too nasty.

with PMT() you will have to find out what the period is, and what it's based on - often real world loans are "highest value during period X" (eg day or month) and often calculated daily, paid monthly ... of for investors, it's the "lowest value during period X", calculated monthly and often there's a transaction of admin fee of a couple of points (eg to cover the banks transaction charge)

Hi all, I'm going to stop checking the comments on this column so if there is something you would like to share with me/ask me/ forward onto me for an opinion ... or just have a yarn about this or any of my columns... just email me at Elizabeth.Kerr@interest.co.nz xo

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.