The question of how far you can stretch a rope may be coming close to getting an answer - judging by the latest mortgage lending by debt-to-income ratio figures from the Reserve Bank.

I say "may be" because the latest figures are not conclusive and we'll probably need to wait till the next quarterly release of this information before being able to to state definitively.

But what can be said is that the latest data shows a levelling off of DTI ratios following the very sharp increases that were seen in the past couple of years as the housing market went into overdrive.

Make no mistake though, the ratios are still real high so it will be very interesting to see in future if they do start to drop - or simply plateau at these high levels.

The latest information is released as the RBNZ is currently in the midst of making decisions about potential implementation of a DTI limits measure. Public feedback is open till February 28.

I dare say what happens to DTI ratios in coming months will be very informative for the RBNZ as it decides whether it will officially introduce DTI limits. The data will tell the central bank whether it needs to act urgently, or whether the natural limits of what can be borrowed have kicked in - particularly with interest rates having risen and set to rise further.

For now anyway we have the information up to the end of December to take a close look at.

The information is compiled monthly by the RBNZ, but released quarterly.

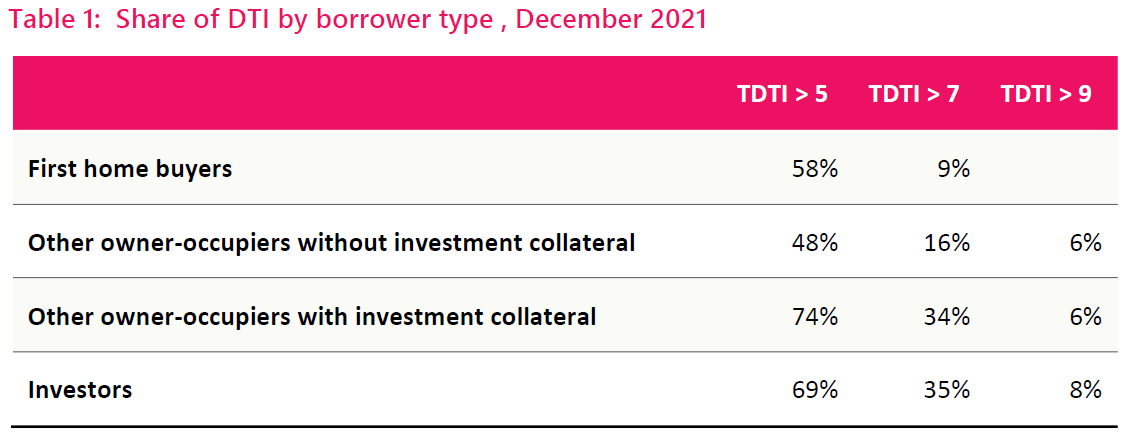

This is the highlights table produced by the RBNZ:

As we've done since the start of this data series we are comparing the latest month's figures (December) with the last month from the previous release (September 2021) and we are also comparing both these with December 2020.

DTIs of above five are regarded as getting up there, so we highlight the percentages of total mortgage money that is borrowed by both first home buyers and other owner occupiers at DTI ratios of five and above.

The table below shows the percentage of new mortgage money for first home buyers and other owner-occupiers that is on debt-to-income ratios of over five times:

| Group | Dec 21 | Sep 21 | Dec 20 |

|---|---|---|---|

| FHBs nationwide | 58.3% | 58.3% | 48.8% |

| Auck FHBs | 72.9% | 76.4% | 64.8% |

| Non-Auck FHBs | 46.6% | 47.8% | 35.9% |

| Other owner/occ nationwide | 48.5% | 46.3% | 42.8% |

| Auck other owner/occ | 62.2% | 61.5% | 57.2% |

| Non-Auck other owner/occ | 38.1% | 35.7% | 31.5% |

The first home buyers appear as though they may have hit the ceiling, albeit a very high ceiling - particularly the Auckland FHBs. While the overall percentage nationally of mortgage money for FHBs borrowed at a DTI of five or higher stayed exactly the same in December when compared with September at 58.3%, the percentage of Auckland FHBs' mortgage money on DTIs of five or more declined from a super-stratospheric 76.4% in September to a slightly-less stratospheric 72.9%. But notably that was still way higher than the 64.8% for Auckland FHBs seen in December 2020.

One feature about the borrowing trends in 2021 was that as investors backed away again following the reintroduction of tough 40% deposit rules for them, owner-occupiers seemed more than happy to take up the slack - so helping to keep propelling the housing market up.

And this strong borrowing appetite of the owner-occupiers appears to be reflected in the latest DTI figures. The percentage of money borrowed by the owner-occupiers at a DTI of five or more has continued to rise and is now getting close to 50% nationwide. It will be interesting to see if this appetite is maintained this year.

So, that's the owner-occupiers and FHBs. What of the investors?

When the RBNZ released the September quarter 2021 figures it began releasing more detailed information that also included DTIs of investors and also of owner-occupiers with investment property collateral.

Having had time to now catch up on things a little, we've had a chance to dig back through the historical investor information and produce some comparatives. As can be seen from the RBNZ highlights table higher up this article the proportions of money borrowed by investors at DTIs of five and more are right up there; 69% for investors and 74% for owner-occupiers with investment collateral.

What about something a bit more bracing then? How about those who are borrowing on DTIs of seven? (which is really, really getting right up there - pass the smelling salts!)

Well, close to half the money borrowed by Auckland investors is at DTIs of seven or more. However, it is coming down, with the percentages having dropped for investors right across the board since September 2021 and particularly when compare with the giddy days of December 2020 when everyone was filling their boots before the loan to value ratio (LVR) limits came back.

The next table shows the percentage of new mortgage money for both investors and owner occupiers that have investment collateral that is on debt-to-income ratios over seven times:

| Group | Dec 21 | Sep 21 | Dec 20 |

|---|---|---|---|

| Investors nationwide | 35.5% | 37.5% | 38.2% |

| Auck investors | 45.2% | 47.1% | 49.3% |

| Non-Auck investors | 26.2% | 28.7% | 25.5% |

| Owner/occ + investment collateral nationwide | 34.0% | 35.1% | 33.6% |

| Auck owner/occ + investment collateral | 43.4% | 44.3% | 45.4% |

| Non-Auck owner/occ + investment collateral | 26.4% | 28.0% | 24.2% |

So, there we have it. As of the end of last year we were still borrowing money at eye-watering debt-to-income ratios, but the higher-and-higher trend of the previous two years appears as though it may be ending.

With the housing market having appeared to grind to a halt in December the next sets of DTI figures to come out for March 2022 and June 2022 look as though they may have a different story to tell from what's been seen up till now. But we shall see.

73 Comments

Wow.. Those ratio's look really high and still we have high levels of inflation in the country. Seems like people in the country like to spend and they do not care how much debt they are carrying. This is certainly a recipe for disaster if not controlled.

RBNZ is sleeping at the wheel and the vehicle (NZ) is going slowly down the hill into a ditch and crash very soon if no action is taken to put on the brakes.

Is it any wonder, we have been told for decades now that debt is good right? You'd be crazy not to borrow at these low interest rates right? People aren't going to change their habits overnight and many believe that our current situation is just a blip and we will be back to near zero OCR soon so the party can continue.

Whilst I agree with the sentiment. This debt party is going to have a bitter ending for sure... I can't tell you when the music will stop.

Sometimes the music stops all of a sudden (not this time), and sometimes it slowly winds down(this time I feel). People are given time to observe the chairs (read opportunities) around them. Then those who do miss out truly feel the pain and anguish of it, because they knew this was coming, they could see the opportunities that were presented to them, ones they still didn't take even as the music got slower and slower.

Perhaps they didn't bother to count the chairs and the players. Perhaps they thought only one or two would miss out?

This time I think the music will slowly stop, the players will awaken from their trance only to realize they've already missed out.

I don't see a shock coming that will turn our mountain of debt into a landslide. I think those who have taken on too much debt will have all the time in the world to regret it. Perhaps some other disaster will come along to cause such a shock, but this time it seems to me that most central banks are singing from the same song sheet and will jointly generate at least a slight deleveraging. We haven't run out of road to kick the can down quite yet, but there isn't far to go.

Worse than the data might tell us. Many on min incomes with highly geared properties they can barely service. Throw in mortgage fraud and loss making rentals that are about to be tax profitable and the fall could be catastrophic. It's uglier than admitted.

So many town houses coming into the market lately. Guess all investors rentals which are not really making any profit and won't very soon in the future until realize. The rush is on.

Moreover, our dumbed-down education system has created a population of sheeple that are easily misled by politicians and central bankers, and fall prey to foreign banks and cartels. Here, elected leaders aren't called out for their outright dismissal of the words of experts when it does not suit their political rhetoric.

In the words of Ray Bradbury, "you don't have to burn books to destroy a culture. Just get people to stop reading them".

What use was paying attention to the traditional advice given the RBNZ and government made a mockery of it by devaluing wages and savings and rewarding speculation over the last two years? (Let alone twenty.)

Good to see the high DTI lending starting to reduce a little. And it's still very clear that any RBNZ limit on high DTI lending would target investors much more strongly than FHBs despite the crocodile tears we often see on FHBs behalf. I hope they ignore the lobbyists and get on with it.

Not having a % for TDTI > 6 and under 5 seems to be a glaring gap in this data as presented.

If 58% are > 5 and 9% > 7, then were is the remaining 35% distributed?

Is anything below < 7 and > 5 attributed in the 58% > 5, and what % is below 5?

Seems pretty obvious that the remaining 42% is at a DTI of <5

What am I missing?

Agreed. If 58% is at DTI >5 then 42% is at 5 or lower. Could be more granular with data >4, >6 etc but this is enough to get the general idea and follow trends.

I think I see the conceptual problem you're having. Remember the 9% > 7 are part of the 58% > 5, not separate. If your DTI is 8 then you are both >5 and >7. Each column is a sum of the percentage of all loans > that particular DTI - there is no reason to expect the rows to sum to 100% as there is double counting.

As rates go up at what level will we start to see defaults 6% 7% with huge amount of people at DTI over five and inflation up a disaster is about to happen in housing market lots of people will be losing all the gains made over last few years. Once this crash has happen maybe banks should stick with DTI rates of at most 3.5 housing is for living in not investing

3.5 is unrealistic. It was 3 way back in the day and it prevented me from even buying a dark internal facing shoebox apartment in Nelson Street, Auckland. A change in the rules allowed me to get ahead or I would have been totally screwed today. It is pretty hard just coming up with a fixed number, people have totally different priorities when it comes to spending and a totally different pain threshold when it comes to being able to cut back if they have to. The pain will start at 7% but with a vast majority of mortgages coming up for renewal this year we can kick the can down the road for another 3 to 5 years. The RBNZ is dithering about giving everyone time to fix.

That’s the point set it at 3.5 DTI this will stop house prices going over wage levels it worked for years.All you are doing with DTI at five or above is pushing up price’s beyond average wage earners and the crash which now seems unavoidable will cause people going bankrupt more people living in cars three families sharing a house and maybe two generations not being able to ever have their own home.

So for the first home buyer (FHB) segment according to the information above, the debt to income (DTI) ratio for FHBs with less than 5 are as follows,

Inside Auckland: 27.1%

Rest of the country: 53.4%

So the affordability issue is restricted only to the Auckland region while more than half of FHBs in the rest of the country are finding their houses affordable.

There is a clear boundary between affordability and wanting it cheap; clearly all those who are living outside Auckland with their relentless whining are from the latter group.

Policy makers should not entertain astroturfing when it comes to policy making.

So in your eyes, 72.9% of Aucklanders and 46.6% of NZers outside of Auckland having a mortgage of over five times DTI equals NZ still has affordable housing.

Ok....

And of course, this data by definition excludes those for whom housing is literally unaffordable.

That's seems like an oxymoron argument.

You cannot conclude whether an asset is unaffordable to the asset owner unless the asset owner first owns the asset.

Therefore it can never be affordable or unaffordable to those who do not own it. The use of the term "affordability" for non asset owners is strictly hypothetical with the assumption of post ownership.

Policy making cannot be based on hypothetical assumptions and what-ifs, it must be made based on grounded realities.

I think you have this issue exactly wrong.

Imagine the extreme where there were no FHBs because they were priced out the market, and all market activity was churn between those already in the game. The inability of FHBs to enter that market would demonstrate its unaffordability.

Looking at the experience of the winners who managed to get in will only ever tell part of the story.

You may be technically correct on your own terms given your bizarre framing "You cannot conclude whether an asset is unaffordable to the asset owner unless the asset owner first owns the asset." Nobody is talking about whether assets are affordable to those who already own the asset. When most people talk about FHB affordability, it relates to whether prospective FHBs are able to enter the market.

"Looking at the experience of the winners who managed to get in will only ever tell part of the story. "

Winner of $ 1 Million mortgage YAY!

Your counter argument doesn't hold water because alternatives exist.

One of the most obvious alternative is renting.

The need is shelter, the form it takes doesn't matter.

Unless you want to argue the need is to participate in capital gains then your proposition may sound more credible; however in doing so, you would have brought up the real underlying causes of dissonance by the group you're fighting for which is all about envy.

The need is stable shelter, that is sustainable in the long term (including into retirement). Currently in NZ renting does not generally provide that.

Good try but misses it by a mile.

To say renting is unsustainable is to discredit lifetime renters who had been there.

Owning your own house or having investment properties aren't the only way to invest in your retirement funds.

I'm not 'discrediting' anyone. If you read carefully, you will find that I said that 'renting does not generally provide that'. I'm aware that owning a property is not the only way to invest in retirement, and that there is a very, very small minority of people who rent for a lifetime and are fine.

For the vast majority of people, though, this isn't the case - particularly for those still renting into retirement.

Virtually the whole Political spectrum, from Margaret Thatcher to the Greens, believe that home ownership is preferable. I've rented in NZ and found myself leaving houses three years in a row as the owners sold - ownership is much more stable and allows for more predictable outgoings in retirement. I have been happier since owning my home in NZ, and when I lived in my own home overseas previously. Home ownership is different to renting - just ask TTP who is constantly complaining about his lot as a renter.

Regardless - none of this actually targets my previous post or gives any support to your previous strange claims.

You cannot conclude whether an asset is unaffordable to the asset owner unless the asset owner first owns the asset.

Wait, what? So you can't say that a private jet is unaffordable for someone who makes the minimum wage? That seems nuts. Of course something can be 'unaffordable' for someone who doesn't yet own that thing.

Of course, there are different kinds of unaffordability. (1) unaffordable in that there is literally no way you could purchase it (no one is going to lend or give me the money for a private jet, for example). (2) unaffordable in that you might be able to borrow the money for it, but you can't realistically service the debt, (3) you might be able to borrow for it, and you might be able to service the debt for the moment, but continuing to do so would severely compromise your ability to meet the cost of other essentials or achieve other normal life milestones, like having a child or being able to retire.

It's only unaffordable when someone earning a minimum wage does actually owns a private jet and have to service one.

The alternative is to rent- you do so every time you buy an air ticket to get to somewhere.

A want remains a want and not a demand unless backed by buying power.

The lack of the latter would mean it's a fat dream or more specifically, a fantasy.

No policy makers should come up with policies to fulfill the fantasies of a fringe population of the society.

35% of households (and growing) is hardly a fringe.

https://www.stats.govt.nz/news/homeownership-rate-lowest-in-almost-70-y…

And this is an underestimate in terms of population - we all know the average renter household contains more people than the average owner-occupier household.

That's what you don't get when you read too much Karl Marx and Lenin.

If everybody is rich, who is poor; if every body is stupid who is smart? Should the society be for a few or a few for the society?

The affordability versus unaffordability ratio is pretty balanced. There's no such thing as affordable for everyone; because when it does, it becomes unaffordable for all.

Your posts provide ample evidence of who isn’t smart

If Dunning and Kruger is right, it takes someone who is dumb to identify his peers whilst misidentifying others.

Oh dear. You realise the Dunning Kruger effect is all about peoples ability to accurately measure their own performance and not other peoples performance right?

More evidence for the catalogue .. you are the gift that keeps on giving

If everyone is a property investor, who are the renters?

Rent to each other and keep flicking houses back and forth at ever increasing prices!

NZ's own answer to getting rich. We are such clever baskets.

Don't worry I had this discussion with CWBC a few weeks ago...apparently if he/she says 'everyone should own a rental' he/she doesn't actually mean everyone. Because if everyone owned a rental there are no renters and the price of the rental is effectively just the price of the land as there are no cash flows for the property to be discounted to infinity in the future. (actually it would be negative after you pay rates etc). You now...all that supply and demand that property investors always tell you about to show why prices should always go up.

“If everyone is a property investor, who are the renters? ”

It requires a positive and a negative for things to work. Renters are not negative, DGMs are.

Anybody who has become wealthy on the way up of a bubble has considered themselves to be more intelligent than others. Unfortunately we've had a central bank (and government) who have done everything within their power to keep the bubble further inflated, providing confirmation bias for those in the market to falsely believe they are some how the next Warren Buffet of investing.

It takes a few hard knocks to be aware of ones real ability - but unfortunately the NZ property investor has never had to experience that (yet) because it would appear we no longer have a real housing market - but more a debt ponzi that is protected by the tax payers of the state - oddly which most property investors are not (or have mostly avoided being), yet reap the rewards of such a scheme. They may think that they are smarter than everyone else because of that, yet history would say that when the pitchforks come out, they are the first to find themselves in demand of the masses for the injustices they have inflicted and realise that what they have done, wasn't very clever after all.

And a wise investor would be aware of that reality and be far more cautious in their views. It isn't a time to be smug...democracies sometimes work slowly, but the masses usually get their revenge (see history).

In fairness, it's more a rule for others than oneself. That's the benefit of being born earlier and getting far better pricing ratios thanks to the efforts of preceding generations' governments to boost supply and affordability. One wouldn't want to have had such a ratio for oneself.

CWBW why do you keep pushing the narrative that debt is good.For a while debt has been cheap but now rates are going up inflation is high people who can’t afford million dollar plus houses are going to be in Hugh financial trouble.The game is now over if you are over leveraged sell what you can before you lose everything but stop giving people bad advice.

The best time to buy is when everyone is scared stiff.

No surprise why majority of people are complaining that they're poor.

Some have too much and yet do crave

I have little and seek no more;

They are but poor though much more they have

And I am rich with little store.

They poor, I rich, they beg, I give;

They lack, I have; they pine, I live.

Best time to buy is indeed when everyone is scared. That day is not here yet but is definitely on its way in the next few years. It is my hope that during that time you are still here reminding us to be quick so I can nod furiously in agreement.

People are not scared just not daft enough to buy in a obviously falling market.but CWBW you jump in and let us know how you do.

Remeber CWBC they are only affordable because the central bank has artificially driven interest rates to zero. If they lose control of that, which it appears we could be in the process of seeing, those "affordable" houses are no longer affordable. And everything goes out the window.

Every day for last 15 days 1-2% more people put house up for sale on trademe now at 28683 was under 24000 two weeks ago.people are realising that as interest rates and inflation goes up costs are going up with them and the chance of a huge fall in housing market is coming it might be to late for some as the exit started end of last year.

Probably a dumb question, but with investor DTI's do they measure the investors total income (i.e. rent + salary etc) or just rental income on the property they are lending on?

Kiwis have a common perception, take as much debt as you can to buy property. Govt will never fail us & it is true till date.

I don't have any issue with policies to support debt steroids in NZ but the issue is if it goes down the hill, govt shouldn't get a free hand to destroy the savings of hardworking kiwis & also shouldn't take debt as nation to cover it up.

Based on the table, FHB's have been benefiting and purchasing new homes (which was always the goal, to allow new FHB's entrants to get into the market). Now we want to make it harder for them for making qualifications harder and in return hoping there is a housing price crash? Sounds like a sound plan.

-7

The very best thing that could happen for prospective first home buyers and for second steppers is much lower prices.

Those with sound minds will celebrate that it is getting more difficult to get into suffocating levels of debt.

-8

Who's goal was it to make fhb to pick up the high house prices tab?

There is two categories now the ones that fomoed in the market with a huge mortgage and the ones that were reasonabe or unable to buy and stayed in the sideline.

Let see if free market capitalism, destructive creation still exist.

Let see if free market capitalism, destructive creation still exist.

Hope to be proved wrong but I'm not holding my breath. Seems like around '08 creative destruction stopped being a thing.

Here comes the feigned concern for first home buyers.

A DTI set to 7 times would remove around 30% of investors from the market. This reduced competition would be far more beneficial for first home buyers than the minor hit to credit availability to the tiny portion of high DTI FHB buyers. It would unquestionably be a good thing for prospective first home buyers

A medium-term goal of 4.5x income should be targeted. This is the benchmark in more enlightened countries.

Sure, but does anyone think either Labour or RBNZ intend to implement sensible limits?

Zero chance. Perhaps once we get a sharp correction they will realise their mistake, but I’m not holding my breath

Natbour both seem dedicated to house prices only being allowed to ascend - accompanied in their hymn-sing by the organs of the RBNZ and Treasury.

Very interesting. This has nothing to do with LVR speed limits and everything to do with expectations of prices falling.

They clearly have headroom in the LVR speed limits, but aren’t willing to lend with low deposits unless people are able to service massive increase in mortgage payments

Extremely conservative of ANZ, certainly interesting to see...

And a warning sign that people may need an extra $500 - $700 p/w (depending on the size of debt) in coming months to service their mortgage which is basically interest only. Paying principle is just not an option anymore.

The original uncommitted monthly income was $1000. So an extra $1500 per month.

$500k mortgage at 4% @ 30 year = $2400 per month. To use up just $1000 of that extra uncommitted income would be interest rates of roughly 7.5%.

On an $800k mortgage a 6% interest rate will take up $1000 of additional uncommitted income. 7% for the full $1500 per month additional.

$800k is considering the possibility of house price going down and people will be in negative equity ?

I reckon that's how we kept the low inflation economy for many years, by getting people buy overpriced houses so that they can't spend much into economy. In this case people's consumption demand had been controlled, all worked well until more people finding out the party gonna stop at some points and decide to sell, then we get all this extra money flooding the market, hence now we have inflation to deal with...

Yes I've been thinking about that scenario in the last 12 months or so....that if enough of the housing investors realise the game is up and try to sell, then you end up with a lot of housing capital being turned into cash, which is then looking for goods and services, during a period where the boomers are all retiring, when we don't have the same level of production, and it ends up driving inflation even higher. The feedback loop might be falling prices with ever increasing inflation and rising rates.

Our DTI is 2.80 and I think that’s excessive. I cannot imagine having a DTI of 5 or more. That seems madness and just asking for trouble.

Hear hear. Ours is 2.4. Our 'savings' are all depreciation on things like cars, phones, beds, washing machines. With DTI of about 3.5 we'd start to struggle and not depreciate anything.

Went from 1.2 to 4.2 in December when we traded up :(.

DTI is a pointless nature as it is dependant on interest rates and other spending by borrowers.

The banks own affordability measures are sufficient

A DTI on investment income of even a 9 is affordable. 9 times income is a 11.1 percent return so 11.1 us sufficient cash flow to pay all outgoings.

I'm not saying you can get an 11.1 percent return.

Hahahahahahaha.

This is the kind of article that keeps me coming back for more

What business is this of the Reserve Bank, I thought we were all free to make our own decisions. Have we become a communist state overnight and I missed the alert, is Russia taking over Ukraine and NZ ?

If people have the required deposit, and wish to buy a house, what business is that to anyone else ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.