Buyers are now fully in control of the housing market as the number of homes available for sale doubles compared to a year ago, asking prices continue to tumble and the number of new listings remains above pre-pandemic levels, according to property website realestate.co.nz.

"The market has started to shift," realestate.co.nz spokesperson Vanessa Williams said.

"We've seen a record number of consents form councils to build new homes and buyers' FOMO (fear of missing out) decreasing.

"The scales have tipped.

"Buyers now have the edge," she said.

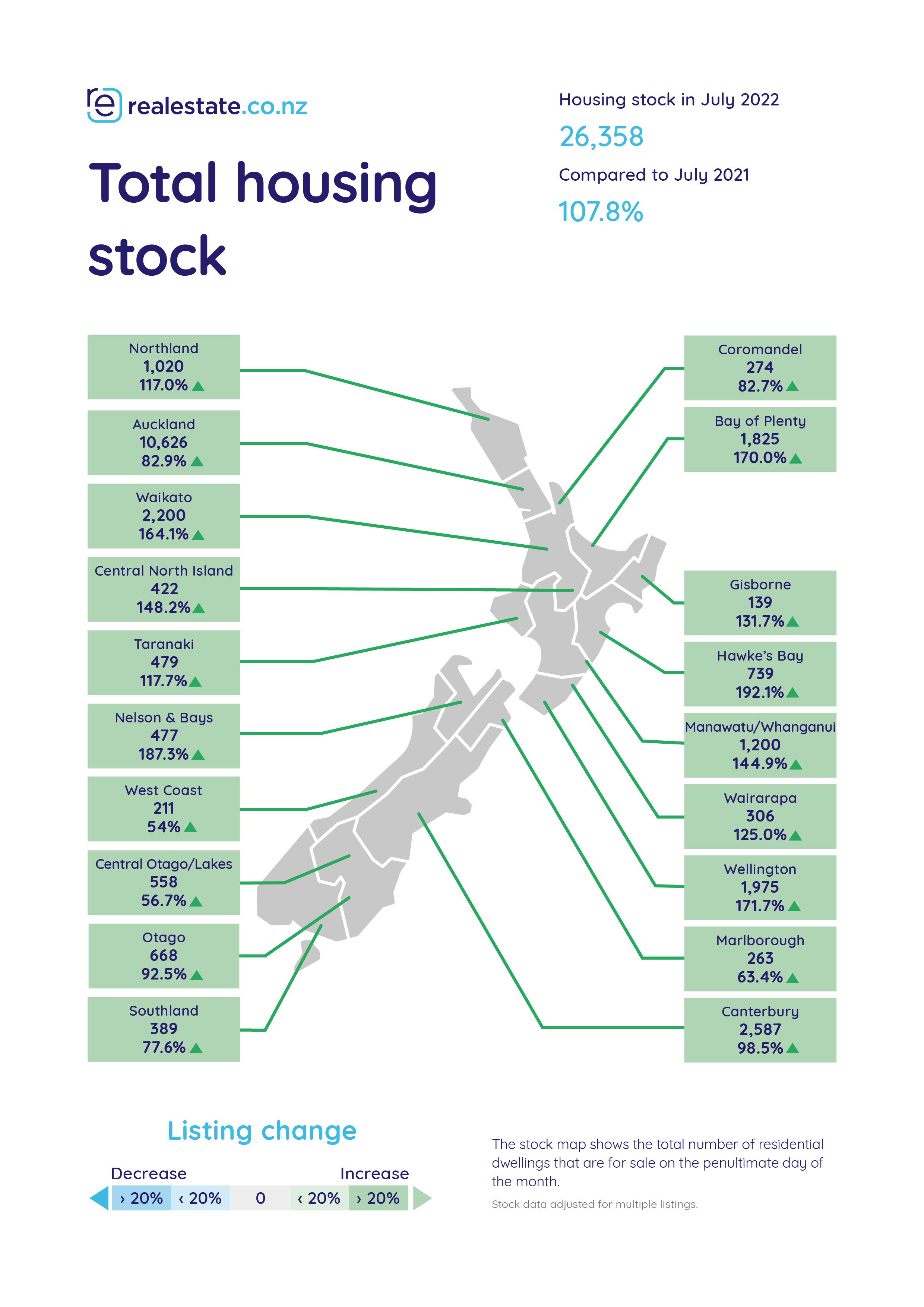

At the end of July realestate.co.nz had 26,358 residential properties available for sale, more than double (+108%) the number it had available at the end of July last year.

The meant the number of properties available for sale was at its highest level for the time of year since 2015.

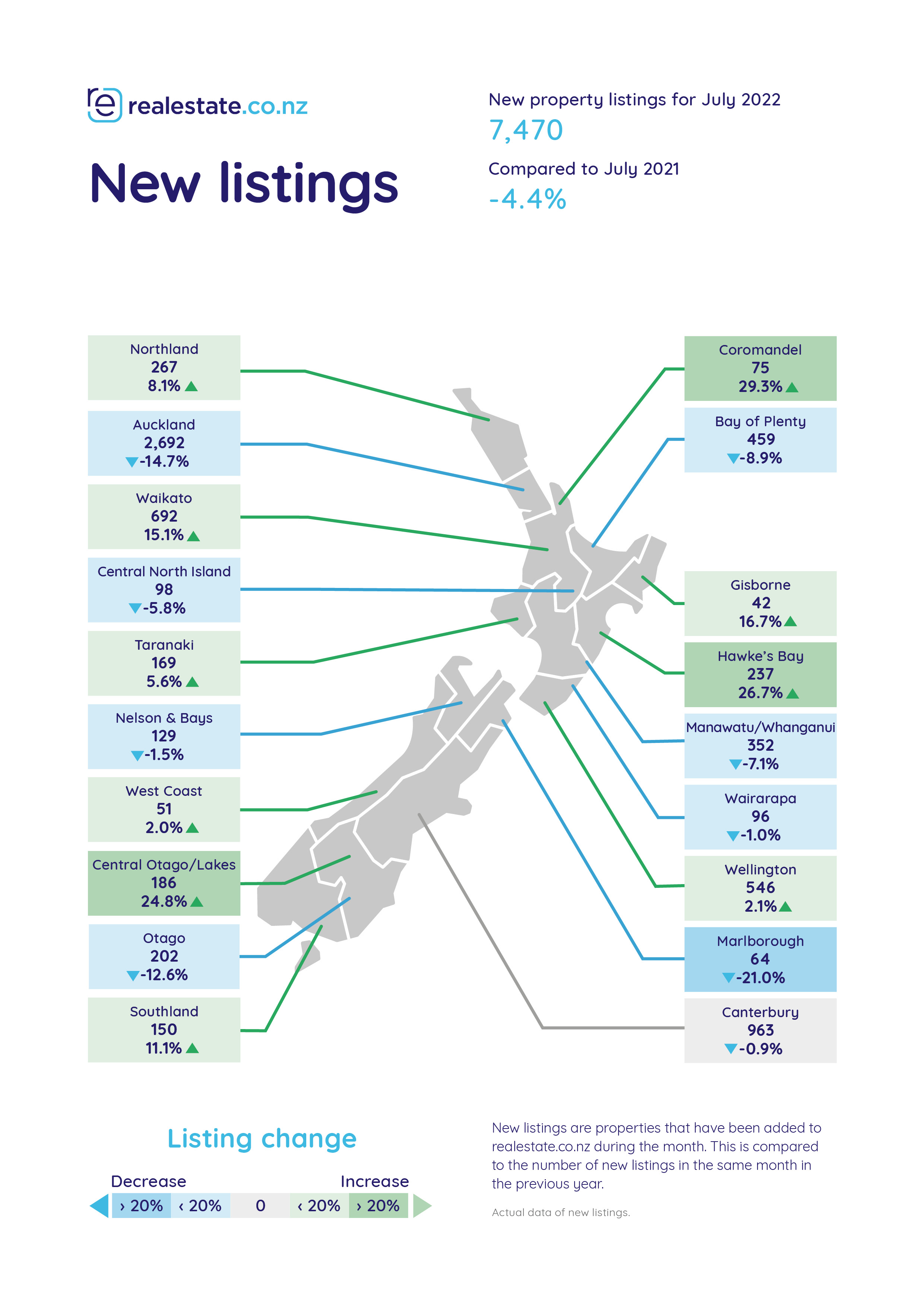

But in spite of the the higher level of stock that is available for sale, new listings remain at average levels.

In July realestate.co.nz received 7470 new residential listings, down from 7870 in July last year but still above pre-pandemic levels in July 2019 when 7295 new listings were received.

Inevitably there has been downward pressure on asking prices, with the national average asking price of properties listed for sale on realestate.co.nz declining from its January 2022 peak of $994,885 to $907,411 in July, down by $87,474 (-8.8%).

The Auckland the average asking price has declined from its January 2022 peak of $1,279,330 to $1,127,236 in July, a decline of $152,094 (-11.9%).

Average asking prices in all regions have fallen from the peaks set late last year or early this year and two regions, Bay of Plenty and Wellington, have been knocked out of the million dollar-plus club, where they previously had average asking prices above $1 million, but are now well below that.

In the Bay of Plenty the average asking price peaked at $1,019,763 in February 2022. By July they had declined to $938,770. That's down by $80,993 (-7.9%). In Wellington the average asking price has dropped from its January 2022 peak of $1,013,206 to $927,395 in July. That's down by $85,811 (-8.5%).

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

94 Comments

"Inevitably there has been downward pressure on asking prices"

Yes - and there still is! 😲

Good Combo - Chicken and Chips, Gravy, Bread Roll and a Drink. ( Extra Seasoning ).

Bad Combo - Increasing Interest Rates, Rent Reductions, Crashing Property Prices, Tenants Moving to Australia, Housing WOF Upgrades, No More Tax Advantages.

Personal Favourite Combo - Popcorn ( Extra Butter ) and 3 Large Sides of Wait Wait Wait.

Enjoy !

-30% Crash in Home Prices By December, it's a Certainty !

I thought your were over-optimistic with the -30% by December. Sorry that I doubted

This is the kiddy slopes, we'll be on double black diamond by February. If you land-banked for resi development in inner city Auckland in the last 2 years you are cooked.

What proper f$&ked ?

Hi Joaquin.

The Last Words of The Prophet before he got Executed was to tell them that doubted , they are all Forgiven.

The Pendulum Always Swings. Forgiving Now Is a Good Investment for the Future.

TTP - Would you like some Forgiveness ? You will also be Required to Repent.

Please let me know so I can go to Church now and make a start on your behalf before the Sunday Service.

Haha that brings a smile. Should I be freaking out instead

All can be Forgiven. No need to be "freaking out". Maybe I need to pre book the whole Pew.

Amen

Well, considering that property values are up 60% over the last two years....

MMXX11,

Good Combo - Chicken and Chips, Gravy, Bread Roll and a Drink. ( Extra Seasoning ).

That sounds appalling. You're welcome to it.

This is just the start of a long downward journey for housing market.

Relative's house (original condition, large 4 bedroom 2 bathroom with a lift) finally sold in Porirua, 5m drive from SH1 interchange. In May Homes.co.nz predicted a sale price of $1.2m. Sold to first home buyers in late July for $835k. Was on the market for about 3 months (listing to settlement). My relatives were happy that it sold in that timeframe, knowing people holding out for those old 'valuations'/estimates were not getting the sales.

I see many "stale properties" on the market in Auckland and growing by the day. They are mostly asking just below or 100 - 200k below the peak pricing of last year.

The longer these delusional holders wait, expecting a rich fool to buy their Debt Grenade - the Much less they will need to take in another month or 3 when reality sinks in.

Reality = the banks only lending the average Jane or Joe family unit a max of 450 to 550K. This is where prices must go (+the 100 -200k deposit) and Ponzi speculating vendor capitulation, is only in its early stages.

Popcorn time.

+1 for 'debt grenade'

A neighbour listed their property at 1.6 6 months ago, then offers over 1.5, now priced at 1.45 . I can't understand why the agents don't walk away, the flogging is over and the horse is officially deceased.

They are hoping to resurrect the horse

The "horse" is still here !! ......krazee as ever and has munched his way through a lot of popcorn ! ......watching the likes of the great "Taking The P*ss" et al fall by the wayside ......"prices back to match incomes - and that's not rental incomes!" .....at long last, reality has come to this "greedy" market ! ...Right ! time to get to the supermarket and stock up on that popcorn !! ......the show is not quite over yet ..... Yee haa !! and away ! ......Adios amigos !

First major failure Believing Homes.co.nz is an adequate believable valuation. Only a fool relies on homes or trademes website or even CV as these are not actual valuations. They are as fictional as guessing for an entire area and the data they use for area averages has many levels of failure.

At best the lowest guess is closer to being accurate as the websites do get money from advertising for sales agents.

9 months into the Irish correction, the annualized rate of decline in asking prices was just 2% (link to article below).

Compared to previous corrections, ours is on rollerskates. It is happening FAST.

https://ww1.daft.ie/report/rossa-white?d_rd=1&d_rd=1&fr=touch

The Irish had a significant part of their economy - the multinational sector (euphemism) - running hot to help slow down the economic decline post-GFC.

Irish exports grew incredibly following the years after GFC, peaking at 122% of GDP and doubling between 2006 and 2015. This shielded their economy from the debt crisis looming in the region. Dublin property prices bottomed out in 2012 and jumped in the years after as more American companies got their hands on the Double Irish.

I am afraid you are looking at the wrong example: maybe Spain or Portugal would give a better understanding of where we are heading.

Yes correct. I worked for a Multi-National around that time (Tyco), an American corporate with their head office in Ireland. Tax purposes of course.

High competitiveness, english speaking, open markets, youngest population in EU and one of the highest educated globally. We also have a highly tuned cultural offering and punch very high in the soft skills and every table at the top has at least irish connection. Sure the tax is part of the equation but is minor relative to the mix

I just can't for the life of me figure out what happened to Printer8.

His enthusiam for handing "debt grenades" to hapless first home bagholders seemed to be boundless.

One whiff of reality and he vanishes like a fart in the wind.

Is he joining the queue of like minded real estate agents at Turners Auctions looking to offload some vehicles?

This was a classic indicator in 2007,8

His kids sold out of their property investment portfolios last year (at market peak) so he no longer needs to be on here acting as a sales person, convincing FHB's now is a good time to buy an investment property from one of his children.

That's why I took absolutely no notice of the likes of Printer8, as I always knew there was an "ulterior motive" behind his posts ......at times, he actually sounded quite desperate .....just another property spruiker with a "vested interest".

Overall, this country would be way better off without them .....for so many reasons.

Ashley, are you listening - some of us just aren't that stupid !

He ran out of ink

I suspect theres plenty of room for a downward trend given the rapid rise in some values in some of the regions. I looked at a random property Masterton ..10/2012 sold 103k, 2/2013 sold 125k ,2/2017 sold 190k , 3/2022 sold for 438k. First homebuyers are getting bargains....not likely from where I sit....

The gentrification of the Wairarapa is real. Try getting a rental practically anywhere. They're rare as hens' teeth, and if you have a dog, divide by 3.

It is by far the most desperate market of all the Wellington Regions.

Seems like lots of people picked up retirement properties there and lots of mum and pop investors purchased houses as investments. Now they are liquidating as rapidly as they can.

I know of a few FHB who bought there in the last few years and I really think they will regret it.

You can rely on the transport options available to Wellington, rain? hillside slides onto the road. mild frost? trains not operating.

Hopefully we are down 40% within a year in nominal terms, more than that in real terms.

All these retirees hitting the retirement homes now are going to want that liquid cash for their retirement. The cohort of boomers born 1945-1955 has started hitting the retirement homes on mass lately and this is their last chance to liquidate before prices fall more. It is going to hit hard.

My dad, now 82, had good timing. He sold his Wellington house about 2.5 years ago, and moved to a retirement village.

The price he got wasn't as high as the peak in early 2021, but is probably higher than what he would get if he tried to sell today.

Why not have him live with you? You keep the money in the family and have more support around.

I don't get this mindset of abandoning the old to these prisons to die in mild comfort. This weird abandonment complex exists where we kick kids out at a young age and they in turn send us to die in comfort cubes instead of having the family together. it is very alienated and abnormal.

Nice idea in an ideal world.

Also, he's starting to need some care assistance, which I am not qualified to offer, nor have the time.

The retirement village he is staying in is great, like high end apartments, very very far from the godawful rest homes of (mainly) yesteryear. We enjoy staying with him. Like a 4 star hotel experience.

There was an excellent episode of RNZ The Detail last week concerning rest homes. They are in crisis now with lack of funding and staff causing beds to be withdrawn from service. And the age profile NZ has means we will need 5 times as many beds in 30 years.

Think through the implications of that in terms of where the staff will come from and how will it all be paid for. I am being a bit nicer to my kids. They are keen to get me a hang glider.

All good things have to come to an end eventually, maybe they'll have to cut back on avocados on toast and pay a higher wages for the luxury. The economic "tail winds" of the last 30 - 40 years is no consolation if there's nobody willing change your adult diapers in your last days. It becomes very hard to kick a can down the road when you have to be wheeled everywhere.

I thought along the same lines every time I'd see my boomer landlady... living the good life and screwing $700/week out of her rental house that hadn't been updated since the 80s. "No need to buy new carpets, I'm only charging market rent don't you know".

Good luck finding a younger generation that wants to stay in NZ and change your diapers, lady. 😁

Beanie,

They are keen to get me a hang glider. Ah, so that's why my son is so keen for me to go diving with these 'nice cuddly' Great Whites.

Ever had to clean the shit-stained pants of your Father every day?

If you have not experienced something, feel free to shut up about it.

Strike a nerve of guilt?

No guilt on my part, none what so ever, just want to call out woeful virtue signallers who clearly have not had to do the hard years of parent care. I see you.

What a dick - you could have kept that comment to yourself opinion..just take a breath and go outside works well

lol OK Gatekeeper

I see you LOL

I would be more than happy to have elderly parents to live with us until that point. I'm pretty sure that they would prefer the dignity of paid care also.

fortunately for me my parents were 16 and 19 when they had me, so depending on how things go I may be playing bridge with them in the same home.

Down vote. That comment may come back to you yourself... mr/ms justanopinion

I have no concerns on that front, reality is not something to be scared of, you should give it a try.

Reality actually works for me. Literally employed by me.

What a sad guy though. Your dad's final years and you have him cooped up in a prison because you don't want to run a separate warm wash for your father's soiled laundry?

Nzdan,

What age are you? I'm 77 and-apart from cancer-in good shape. I wouldn't dream of staying with either of my sons, even if they had the room. They are quite busy enough bringing up their kids.

Unless I have no choice, I will continue to live in my own home until they wheel me out on the final journey. Your post is just mean-spirited.

Abnormal compared to what? Talk to different people and you find views that abnormal is living in cities, or living past 40.

Personally if I couldn't drive or had mobility issues, living in a community seems a lot more practical than most housing in Auckland suburbs, even more so if rural.

"The market has started to shift,"

hahaha, only about 4-5 months behind, Vanessa!!!

There is so much stock about to come on the Auckland market in the next 6 months. New builds are months away from completion all over the place. Who is going to buy them all? China is our second largest migrant pool and their borders are tightly shut with hardly anyone allowed to leave.

Exactly.

Townhouses for rent in Auckland seem to have reached a plateau around the early 500s (up from early 400s a few months ago), but as you say lots of townhouses due to be completed in the next 3-4 months so I expect to see those townhoue listings rising.

Townhouses are an upgrade from apartments thus demand will remain high for sometime yet . Apartments are where the carnage will be - to much risk and too little amenity.

Looking at some of the townhouses that have been built lately, I would say they are worse than apartments.

Multi-unit townhouses with no body corporate are a ticking time bomb. At least body corporates will require ongoing maintenance, set rules for behaviour and control who units can be leased to (e.g. no Kainga Ora). Additionally, apartments can provide more security than townhouses I have seen that are built right onto the street.

Townhouses are covered by the Sectional Titles Act and a body corporate is established on the date on which any person other than the developer becomes the owner of a unit in the scheme.

Townhouses more often have parking and a small garden. Not nirvana but not an apartment.

No such thing as the Sectional Titles Act in NZ

Yeah, I've not heard of any Sectional Titles Act. The town houses I deal with have no Body Corp.

I am not impressed with the subdivision layouts. Rows of 4 brm, single gge TH's on narrow streets with the occasional single parking bay.

Berms are rutted bogs where the cars park and the public transport options are crap.

Correct - these are just one example of the terrible terraced houses I have seen being built around Auckland.

I'm still seeing these selling with asking prices +200K on their last sell-date in late 2020. Money was a lot cheaper then, I suspect they'll be for sale for some time.

I agree, but only to a point.

Trust me, there will be plenty of carnage in new build townhouse market too.

perhaps not quite as much as with apartments. Have a look at Ockham’s website and the sales info on their big new apartment development in Grey Lynn. To say their sales progress is miserable would be an understatement.

Good, successful company but they have got this totally wrong if they think there’s a decent market for 60 square metre apartments, 2 bedrooms, selling for $1.25 million on Great North Road…

Apartments in Auckland central never had the big price rises of 2020-2021. During covid they already fell back to their 2017 prices. They may come back a little more, but i think the over supply will be in the outer CBD suburbs. Where there is a lot of building that would normally be supported by FHB (that have left) and immigrants (that are no longer coming). Whereas international students and tourists are starting to trickle back, increasing demand for central CBD apartments. Also they are one of the only investments where yield can actually stack up.

100% correct. Might be only place in NZ where you can still find cash flow positive investments at 6-7% interest rates.

Auckland CBD values will hold up fine only because they haven't had huge capital gains since COVID, and have always been yield investments rather than capital gain plays.

Sounds like an actual business ?

But still no stock of houses people actually want to buy? I always keep an eye on DGZ listings and there is only a small amount of listings for quality family homes on full sections. Can an oversupply of townhouses and apartments drag down the whole market?

Yes. Because 1) some marginal buyers will slide down when the lower priced option drops in price and 2) one of the reasons that full sections are so hard to find is the development potential.

Anyone have a working link to the report? I get some weird re-direct error

edit: never mind found it thanks

I see that any pricing infographics are conspicuously absent.

lol good point, this (https://www.qv.co.nz/price-index/) would have added colour.

The engines of almost free debt have failed. Specarus's wings have literally melted off.

The truth is $1m of debt at 2% is quite different to 7%. The speculators that have done nil improvements but think spec boxes are worth the 2% rate prices are deluded, as are the agents backing that narative just to get a potential meal ticket. TA has always been clear in stating where Auckland leads on house prices, NZ follows with a 6-8 months lag in regional NZ.

$4m spec box in greater Taupo anyone....?

https://homes.co.nz/address/auckland/onehunga/46-alfred-street/PakwX

This property (705sqm THAB zoned land in Central Auckland) recently sold for $1101k, after last selling for $1015k in September 2019. Looking at the building consent history, the vendor also added in a new fireplace this year, so along with selling costs I estimate more or less broke even.

It seems developers are no longer active in this market.

8th of April 2022 to 28th of July 2022. Looks like an 18% drop according to the This Home Graph.

We have a couple of new kiwis starting at my work. One of them is looking to buy, this is the comparison he mentioned, both are roughly same price point, same distance to city. Very interesting to view!

https://raywhite.co.nz/auckland/auckland-city/point-chevalier/PCR31114/

https://www.mcgrath.com.au/22-victoria-terrace-gordon-park-qld-4031-for…

I really can't see the appeal of Pt Chev? A nice kids playground and one decent cafe but that's it. A pain to get to, more West Auckland than City Fringe. Has Cindy's decision to reside there make it trendy?

I lived in Blockhouse bay for a year, our daily rat run used to be Pt Chev Meola Road, it's a pain to get through!

Superficially, they've gone a bit overboard with the everything white in the Queensland one.

Houses here in Australia always seem to be better appointed. Don't know why. You also have to factor in stamp duty to your calcs.

Having said that I know where I'd prefer to pull up stumps after a hard days spreadsheeting.

# Houses for sale in North Shore is still just around 1400 & has barely budged over the last 2 months. We seem to be in a different part of NZ. I am not seeing vendors drop prices (sticking to Price by Negotiation) either?? Listings are stale here too.

It's quiet for sure. Lots of vendors don't really need to sell just yet. But those that do have had to, uh, recalibrate their expectations.

I'm picking that there's a lot of stock to come to market in the spring. What will be most telling is how motivated those sellers are going to be. Buyers will certainly have plenty of options.

Which part of NS? I've noticed a lot dropping their prices around Northcote Point, Hillcrest, Milford and Takapuna etc. Drops are around 150k over time on the first time they put a price up. But I don't monitor anything too much further out.

Is anyone else watching the new trend in the number of homes for sale and for rent. Stabilising and improving

The number of properties available is trending down. Lowest stock levels in 4 / 5 months. There is a blow you out of the park, strong shot of reality for you, JustAnOpinion!

Lies.. Lies and more Lies...

Economics 101.. house prices never drop...

Don't forget, price doubles every 7 years!

I found Finance 201 more interesting... The impact of leverage and interest tax deductibility on valuations ;)

Is Wellington going to be the epicentre of this crash?

Only when civil servant redundancies start after next election

Or when the govt pulls back on billion dollar consultant fund.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.