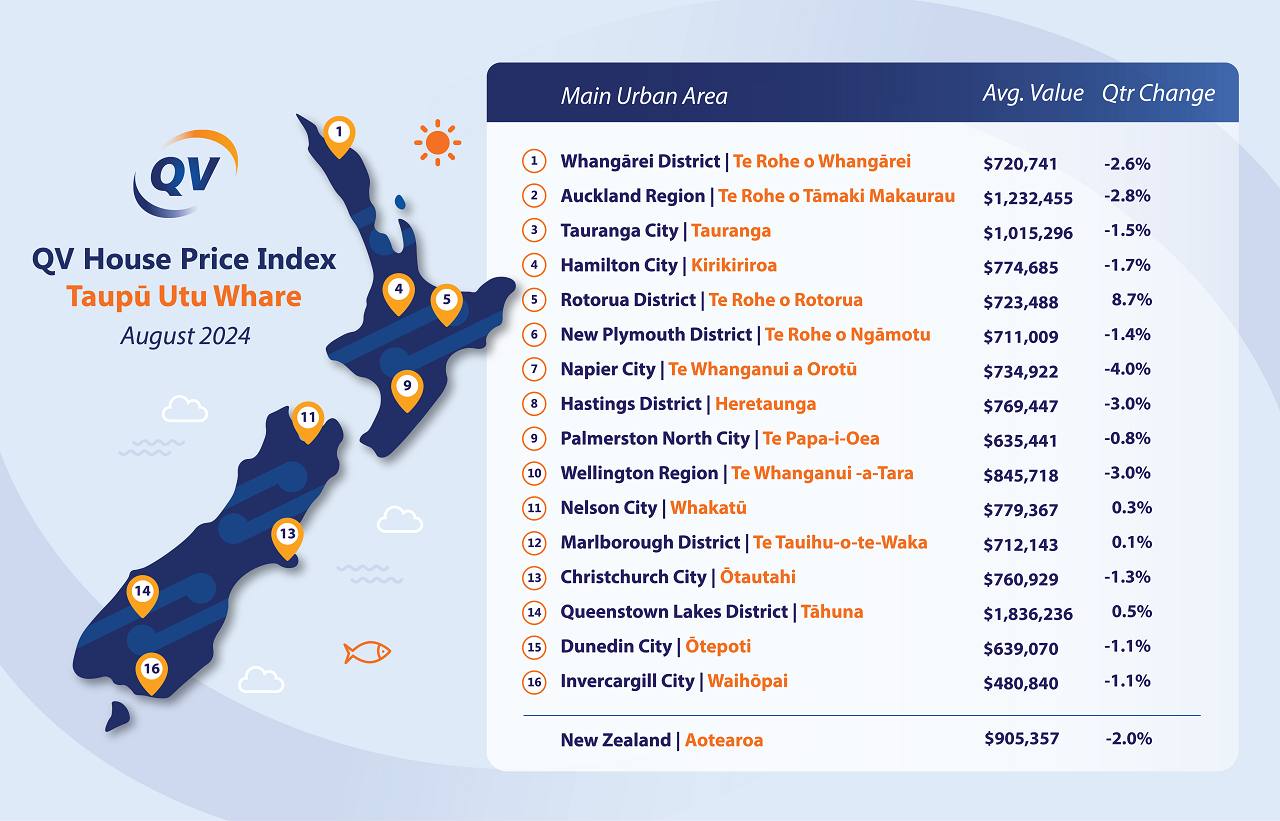

House values are continuing to slide - falling nationally by 2% in the three months to August, according to Quotable Value.

The average national value stood at $905,357 last month - down from $909,517 in July, and essentially flat since the end of 2023.

The largest city, Auckland, has now recorded declines in average value for seven consecutive months. The average value dropped $5,958 in August to $1,232,455.

Since January, average values in Auckland have declined by $58,932, which works out at $8,419 every month, or about $1,940 a week ($11.50 an hour). The rate of decline in August (0.5%) was a little slower than it had been in July.

QV notes house prices around the country "do not yet reflect the marked increase in consumer confidence following recent interest rate cuts".

QV operations manager James Wilson said the nationwide value trend was reflective of a housing market that has been "severely constricted by strong economic headwinds – including rising unemployment, credit constraints and, of course, high interest rates".

"Now that interest rates are finally coming down, we are seeing renewed interest in housing generally across the country. However, this won’t necessarily translate into home value growth while there’s such an excess of stock available for sale. Values will tighten again when prospective buyers aren’t as spoilt for choice as they are currently, which could take a while," he said.

It was the largest cities that experienced the largest average home value declines in the three months to August. Home values in Auckland and Wellington reduced by 2.8% and 3% respectively, while Hamilton (-1.7%), Tauranga (-1.5%), Christchurch (-1.3%) and Dunedin (-1.1%) also recorded modest home value reductions during the period.

Relative bright spots were few, but Rotorua saw a 8.7% spike in values to an average of $723,488.

However, among the 16 regions, there were 12 that saw declines and just four with rises in value.

Wilson said "an abundance" of real estate listings, especially in and around the biggest cities, is expected to "keep a firm lid on home value growth", even as increasing numbers of buyers start coming out of the woodwork as we move into spring.

He expects to see "even more" listings in the coming months as the spring real estate selling season starts ramping up again.

"More investors will look to sell properties following the changes to the bright line test back in July, and sellers who pulled their listings after trying and failing to sell earlier in the year may even look to try again now that there’s an uptick in activity and a general sense that confidence amongst buyers is increasing."

Wilson said this would continue to promote soft-to-flat value conditions nationally in the short term.

"Spring has sprung and interest rates are coming down – but don’t expect to see house prices suddenly take off again soon."

174 Comments

Last two aquisitions for this part of the cycle Greenlane and Mount Albert. Expect these to be +15% this time next year.

Time to look ahead.

This time it won't be different🥂

😆🤣

Going down like a fat dog on wet lino

You topping up the mortgages much?

15% would be at higher end of my thinking in those locations and cashflow will be rubbish unless multi dwelling or similar.

I'm buying cashflow positive in growing cities that didn't get inundated with cheap nasty side by side townhouses. That means not auckland or even hamilton or greater welly or chch. Palmy with a 600sqm section is where you get land cap gain and cashflow. Don't tell anyone up here though I've still got buying to do haha. Que the john cleese joke! Been laughing along to the bank with you all the way

Buy something where you can add value. Be that a renovation, adding a granny flat, subdividing. Those townhouses will not appreciate much in value, and over time with the lack of maintenance (and no body corporate to ensure maintenance is done) they will start to depreciate as they become more and more run down (they are of such poor quality that it won't take long either).

Wow you have to have a body corporate to do maintenance done on your investment homes...go figure?

Most townhouse developments have Residents Associations (in lieu of Body Corporates), that require annual property maintenance.

Body Corporates exist under strata law and are enforceable. A Residents Association is just a niceity. What happens when 18 townhouses all need to be repainted? Who is going to force 18 owners to stump up for scaffolding and repainting costs? There is no sinking fund for maintenance like a body corporate.

I live in a townhouse subject to Residents Association requirements. We have a sinking fund for a number of things, including maintenance.

"cheap nasty side by side townhouses."

Like these you mean? 6 on a narrow 911sq m section:

https://www.barfoot.co.nz/property/residential/north-shore-city/milford…

Hardly cheap! And yet 4 have sold- though 3 were 2 storey and they were asking $1.6 million for those.

Been to those (twice). Very nice indeed. Good location too. Handy to mall, hospital, schools, beach, marina, motorways - very walkable. Generously proportioned and feel like a normal house. The two big balconies make for good entertaining spaces. My kind of project. (But I'd never put the bathrooms where they have.)

Just to harp on about 'density' once again. These 6 very livable dwellings replaced a single house. Ratio 1:6. The surrounding sections are similarly sized with 2, sometimes 3, houses. Ratios 1:3 and 1:2. Thanks to Auckland new Unitary Plan of 2016 we now have heaps and heaps of land on which to build. (Still have silly height rules hence two 3 stories and four 2's.)

Pricewise, yes, these aren't cheap. That's mainly down to quality of these ones. If you're looking to build exactly the same shape and size, meet code with a bit on top, no lifts, using less expensive land, they'd be way cheaper. As the Dutch say, lekker.

Reasonable space, the stairs take up a lot of room but look good. Only downside is of course that the closer you are to the road, the more residents you hear at all hours coming and going past you on the driveway. The price however, reminds me why I don't live in Auckland and don't intend to, but there's plenty who would love to live in units like that.

Oh bless me - there is someone caught by the past....

Even RE agents are pessimistic about the market.. that says a lot

"Green shoots..."

Green paint is easily available, countries have painted an entire stadium to appear Green..

10

9

8

7

6

5

4

3

2

1..

Lights out NZ.

It can't get any worse can It?

And I blame MMP.. "everybody's an expert and has their say!"

Dilution down wards to the base.

Perhaps try being a politician.

😎 😘

As per usual by the time buyers see in the data prices going up it will be too late and once again they'll moan about missing the boat.

These qv figures are old new based on sale several months ago just settling in the last 3 months.

REINZ will be a bit more up to date.

I just locked in a 5.99 for 1 year down from 6.95 I was paying.

Locking in under 5% I can see many cashflow options coming back again. And remember that cashflow just goes up as rents rise and mortgages reduce.

Gotta love nz property mate ;)

Nearly net 1,000 people have left NZ every single day for the last six months. Rents are like house prices. They only go up, right?

Edit: Just for perspective, in terms of supply/demand this is like having a stagnant population and a national building initiative constructing around 450 homes per day. Can you imagine the impact that would have on the housing market?

Its not the just the number leaving - its also the type leaving. We are losing professional occupations who earn good money and can afford to buy houses, and replacing them with low skilled, low income migrants who cannot. So the net number of lost "house buyers" is much higher than the overall net number.

Yep - the number of skilled workers entering the country is dropping like a stone. Our outward emigration stats would be much worse if it weren't for an increase in non-working family members immigrating in. Still sobering read. Interesting how we were getting monthly updates on the number of immigrants entering the country all of last year in MSM. Now that number is plummeting, silence.

Wrong.

Running at positive 80k plus net.

And incomes of those arriving are significantly higher than the NZ average, so they're lifting the economy.

Scruffy gen Z are ditching uni and heading to Aus looking for anything soft and easy - they won't find it in any of the main centers there. It's 10x tougher. But hey the cheese is cheaper so you can save the 10k needed for a 20 year old rust bucket of a car.

Source?

Degrees are watered down these days with the level of people with them. 2008 heralded a huge influx of university attendees due to the lack of jobs going, and with the level of debt one needs to own a home these days, who wants to hinder their savings opportunity by 1./ not working much for several years and 2./ Having to spend ones 20's paying down that debt, only to look forward to loading up on more with a mortgage. Scruffy Gen Z, or, astute, observant and adaptive to the world around them which has changed a lot in only 10 years.

Almost one year since the election. I'm glad Luxo and Willis got this country back on track.

Based on the level of damage done by Labour, 3 years isnt going to be enough to get the country back on track. The question you should be asking is "will it ever get back to delivering the standard of living it once did?". I believe it will not - we are headed down the South African path, only faster.

Time to pack up then KH...?

2nd time Baywatch. You mistake KW for me. With snark as well.

You must be a bit sensitive about something.

I agree. Most cities around the world with very high rates of violent crime have something in common: medium to long-term economic stagnation or decline disproportionately hitting low-income households hardest leading to high levels of wealth inequality.

That's why the worst American cities are not the ones in their deep southern states that never had much to begin with but the ones that are adjacent to wealthy areas or in the rust belt - Oakland, Baltimore, Milwaukee, Chicago.

Reminder that "back on track" is an empty slogan, not anything they could be measured against.

I cannot shake the feeling that this government is demonstrably corrupt. Tobacco, gun reforms, fast-track consents (jobs for their mates), borrowing to fund tax cuts... The list is pretty impressive for only 10 months in power.

They have a mandate don't you know...(from their donating overlords)

Bullish for multi-generational homes at least

Not sure where you are getting your data from. Perhaps you can share your source. As of May 2024 we still have a net positive migration. International migration: May 2024 | Stats NZ

Sure!

Two sources, first is Migration data explorer (useful for breakdown of immigration, but excludes citizens): https://mbienz.shinyapps.io/migration_data_explorer/#

Second is actual border crossings via Customs: https://www.customs.govt.nz/globalassets/documents/statistics/oia-respo…

Both show we are deeply negative this year. Yearly migration is positive still by between 35-45k, but given the trend this year it could easily be negative by the end of the year. We need ~25,000 positive migration monthly for the next 6 months to avoid being negative yoy come Feb, or slightly less than 1,000 arrivals per day.

The 6 months to Feb 2024 was the highest positive net migration we've ever really had, and even that figure again would only put us back at ~40k positive (as is current). We turned deeply negative from March onward, ~1,000 outgoing per day, much more than twice as many as the same period last year. Hence the 6mo comment.

Thanks for the data set . I'm in Australia now as a health professional. Every time I turn around I see a new kiwi nurse. It's going to be negative for 18months. Main centres may hold as they have work elsewhere?.

The Stats NZ migration number isnt based on real numbers - its based on a computer model that outputs a "best guess" based on historical assumptions. Its only after 16 months when Stats NZ gets actual passport data and cross matches it against what they guessed 16 months ago, and then adjusts the number, is the "real" number calculated.

1000 net for per day for last 6 months hahaha your just making up lies - net loss of 180k that would mean -

Stats NZ has a net GAIN in last 6 months of around +40k - back to around pre-pandemic levels +80k plus a year - that's an extra Napier city every year to build houses for.

And consents have stopped.

Wonder what all that means for supply demand for houses over the next 3 years?

Try a solid 20% increase. Come back fact check me. You tend to guess right when you use real stats and not ridiculous claims like you make.

Source?

Oh right, this is using Stats NZ and their best guess. They assume that a portion of leavers are going for a holiday and hopefully coming back within 16 months. If not, they revise the stats. Actual negative border crossings is nearly 180,000 for the last six months, yes. Hopefully they come back, sounds like you need them to.

And remember that cashflow just goes up as rents rise

Rents are falling.

not exactly true, both of these charts shows clearly that rents have been increasing over time.

https://figure.nz/chart/azFwYTVvUcrcxT3m-Cn6TyuSQBZ8Kacee

https://www.interest.co.nz/charts/real-estate/rents-average-north-island

if you consider rents dropping $5 one month then maybe.

Just like any market there are peaks and troughs.

And no two markets are the same, nor the duration of the cycles they make

Or +4% year on year, normally tracks at or slightly above inflation and has done forever.

From your graph, a relatively recent 2018 property purchase was getting say 420 on average. That's now 600 a week. In another few years 800 a week and you've had 10 years of say a 20 year mortgage term paid off. Your sitting very pretty. It's why everyone does this.

Just don't buy rural backwater high maintenance low demand rubbish. Cause they might shut down your one industry (e.g pulp and paper.....) and the amazing yields you once got turn nasty as half the 800 population town vanishes overnight.

$1.6b investment company, PAG, wants to buy more property in NZ. In the Herald.

Which of those $1.6bn deals have been originated and completed in the last 12 months?

In my dealings with them and the likes of M&G, you do the work, the equity returns don’t work, so everyone puts their pens down.

Here's a couple.

Um, that’s 2022. You see my point yet?

lol... yes and it's just PAG saying jump in the waters fine, whilst they slowly boil

Its PAG pretending that everything is great in the NZ property market in order to keep their own valuations up. Nothing annoys your shareholders more than taking multiple writedowns on assets that you bought in a backwater country. That's a sacking offence.

That's my concern with PPP financing, great if the project has enough revenues to pay, but crap for the road to Whangarei imho, Puhoi holiday highway pays as its high traffic short road, traffic to Whangarei is low. They should have tolled transmission gully to help pay

Lotta Aucklander's traveling to coastal Northland above Whangarei, and a lot of freight back and forward.

They couldn't toll transmission gulley, the demand isn't there. It would have resulted in people using the old alternative route, and they would have lost the safety benefits they were claiming for the new road.

Tolls will only cover between 5 and 15% of the cost of roads in NZ. The rest will come from borrowing (hidden via PPP) or additional crown funding.

Yet another reason why more roads are not the answer

I’m hearing more and more about corporate landlords particularly in the US. Is this an area that is growing?

‘Build to Rent’. Big in USA, quite big in Aus.

Some are deeply skeptical. I was initially quite open to it, but have become more skeptical.

Macrobusiness ran a good skeptical article a couple of days back.

Before election I thought National liked this approach, seems not so much now. I wonder if the numbers do not stack up for anything but slum like projects..

The rents that are being advertised in places like the one at Sylvia Park are exorbitant. Like over $600 for a one beddie

tell ‘em they’re dreamin’

Needs to be circa $500-550 max.

A couple hundred per week more than that and you've got a reasonably nice 3-4br place just about anywhere you like in Wellington. The kicker for the tenant is paying ~$40,000pa for a property "worth" $1m to 1.5m.

Why would anyone buy here!?

IMHO it would appeal most to transient people / families unsure about buying or unsure of future requirements. I do not think its going to fly in a falling house price market.

Their market is a captive one. Its recently arrived immigrants who have no work or credit history, so nobody else will rent them a home. Thats why a recent BTR building had 26 different nationalities living there. BTR is not designed to house Kiwis, and any PR that claims its "solving the housing problem" is just that - propaganda.

Why would a BTR business want to take the risk where others won’t, in terms of work and credit history?

How many new immigrants can afford $630 pw for a one bedroom apartment? I guess if it’s a couple it’s quite doable, even on minimum wages. They will be warm and energy efficient, at least, keeping power bills down

Longer leases on offer, allowing people to get on with their lives without being uprooted every other year.

I could see why one would pay slight overs for that

They only make a commercial return if heavily subsidised by Governments. The people who are currently outraged over little landlords being able to tax deduct interest will be aghast at the BTR outfits who can tax deduct interest, claim depreciation, receive huge rent subsidies, and expatriate all income back overseas so little to no tax is ever paid in NZ. Its taxpayers paying for housing for the middle class.

The selfish vested interests will waive their magic wands and the price expectations go up. Tui ad.

Year right.

BTW, I went to the Home Show on the first day, and by 11am it was chokka. When I left at midday, the car park was full and attendees were having to park in nearby streets.

So much for your assertion I'd be the only one there.

I went to the Buckingham palace.. believe me!!!

I went to the Home Show on the first day, and by 11am it was chokka

If only nervous vendors and their Agents could report the same about their Open Homes - if only......

Something to do for a lot of people like walking around malls and not buying.

I went Sunday morning. Not as busy as previous years. My daughter met Buck Shelford. He's a lovely guy. We need more like, both on and off the field.

Stars aligning for a bottoming here. Just need inflation to start behaving.

Give me a 8% or so increase and I'll sell and never have to worry about investment properties ever again

"Last two aquisitions for this part of the cycle Greenlane and Mount Albert. Expect these to be +15% this time next year.

Time to look ahead.

This time it won't be different🥂"

HERE GOES ANOTHER DRUNKEN SAILOR>>>>

"This time it won't be different."

You sure it won't be like the 70s? Where prices fell for and then flatlined for almost 15 years due to zoning changes?

It's a quote from the first comment in this thread.

I see. Without the quotes I didn't make the connection.

Pretty likely very low levels of net migration from 1975 to 1985 would have been a significant factor.

Actually, no. I checked this.

How much will house prices go up in 2025?

ASB +10.9%, BNZ +6.9%, Westpac +6.4%, RBNZ +4.8%, ANZ +4.5%.

Median +6.4%, average +6.7%

https://www.opespartners.co.nz/private-property/issue-124

Would it not be better if house prices stabilised for a while which in turn might slow down the flow of our citizens who are currently exiting NZ to get ahead. Beware what you wish for. My children and grandchildren all live in NZ. My wife are I are quickly becoming the exception.

Remind me again what they said prices were going to go up by in 2024?

lets not let facts get in the way of a good spruik

On 31 Dec 2023, The Comb predicted 10% increases in 2024

The banks were all circa 7-8%

Independent economist Tony Alexander is among the most optimistic pundits, tipping prices to jump by up to 10 per cent next year.

https://www.nzherald.co.nz/nz/nz-and-auckland-house-prices-what-can-we-…

Anyone know how many houses Jarrod Kerr owns?

Anyone left wondering how we got into this mess?

-10% Dec 2023 to Dec 2024

They all seem pretty optimistic to me, it'll take all of 2025 at least to clear the overhang of stock.

Prices going sideway till late 2025 at the earliest IMO.

I think the banks are being more bullish - and they are talking about national figures.

Regions may increase but Auckland and perhaps Wellington will be relatively static. My personal guess is that Auckland will be within 2% of its current prices this time next year. Every chance of further declines when the reality that further interest rate declines don't result in house price increases.

In May Auckland had a record housing completion - of around 19,500 for the year. Given the numbers in the pipeline, that suggest that there will be another 10,000 completions before Christmas. That is homes for 25,000 people on top of current oversupply. And even where those 10,000 homes have been sold off the plans before completion - there will be 10,000 new rental homes on the market. And this is in a location will static population.

For Auckland (because it's where I live and what I know), I think the stats can be misleading. Values can still be going up slightly (and I think they are now) while the figures say they're going down.

I live in a nice, but not flash, suburb of Auckland. A lot of 1960s houses on 800 sqm sections. There's a fair amount of intensification happening and in one corner of the suburb there's a large battery-farm style development where street-upon-street of terraces are being shoe-horned in. The suburb averages are still heading down fairly sharply, because the median sale in the suburb now would now be a $700k, small terraced house, despite the values for pretty much the entire suburb being static or slightly up.

Given that the entire Auckland region is dominated by new terrace developments and increased density, decreasing values doesn't necessarily indicate decreasing value for every housing asset..... it just means that the average asset is decreasing in quality, size and amenity.

Will? So that's a certainty? L O L

(Oh, from opespartners, the worst amongst the worst)

What are the common denominators between these entities: They all rely on increasing levels of private debt for profit (minus RBNZ on this one) and credibility. Vested interest perhaps?

Don't these sources of the estimates have a strong bias to get Kiwis feeling prices are heading North like a rocket....I am unconvinced - in fact doubtful - I think the ponzi of our lives has just finished and there is no appetite among ordinary folk to reignite it.

correct its onto the next ponzi is it gold or bitcoin or silver?

Well yes, they are banks, they WOULD say that wouldn't they :)

And how have those projections from those same sources panned out this year?

The Fed will drop this month. NZ Interest rates are only going further south for the remainder for the of this year. It will take time to filter out the high interest loans and make your average Joe feel like they have more cash back in their pockets. Markets are cyclical and sentiment driven. I doubt the market will be going back in 6 months time from here, on the back end of summer. Taking the emotion away, lower and higher interest rates were the fuel and bust of this latest cycle. Whether the next cycle will go up at the same rate remains to be seen, but it will go up!

Meanwhile US house prices have exploded forming a bubble bigger than prior to the GFC:

https://x.com/gameoftrades_/status/1833203719673958765?s=46&t=MUwQeKa7M…

A quick reminder of just how elevated house prices are in inflation adjusted terms:

https://fred.stlouisfed.org/series/QNZR628BIS

Not a prediction, but there is scope for another 30-40% drop as this recession kicks in. That is how out of control prices got the last 20 years.

And remember we’re experiencing the longest yield curve inversion right now since just prior to the 1929 crash the Great Depression.

https://x.com/gameoftrades_/status/1833166295120195932?s=46&t=MUwQeKa7M…

If things get really bad the next few years it can’t be said that there haven’t been ample warning signs (there are/have been). It’s just that they are being ignored by those who want to continue making money from what has been working in their favour in recent years/decades.

any recommendations on resources for the "what happens next?" post normalisation of the yield curves? My googling skills fall short to find useful info for that situation

There’s a reasonably detailed thread here on Twitter (or should I say X now?):

https://x.com/gameoftrades_/status/1833166295120195932?s=46&t=MUwQeKa7M…

Expect high volatility - it’s possible we see stocks experience an initial blowoff top when the Fed cuts but that is followed by a crash when the market adjust for just how bad the underlying economy really is.

For NZ housing my view is that we are unlikely to see the 2021 peak again this decade with a lot of downside risk the next 12-24 months. Even if rstes drop a lot - it will be difficult for government and RBNZ to keep inflation stable in my view given what has happened leading up to this point. So we could see either of a deep deflationary recession (think 1930’s) or a surge once more in inflation if they overcook any response (think 1970’s) - resulting in even higher future mortgage rates on this high pile of private debt (but private debt to GDP wasn’t a problem in the 70’s = problems for our economy going forward)

Basically we need a lower level of private debt to GDP for our problems to go away - but that is going to be painful in one way or another. That debt is a drag that is going to keep holding us back anytime inflation appears - which if your are a student of history it does and when you least want it to - which is why allowing ourselves to go in such a high private debt drunken splurge has been very foolish in my opinion.

As you can see here our housing bubble/problem is almost entirely related to the quantity of debt we’ve extended/leveraged against the market - which has been tolerated (even enticed) by ever falling interest rates for decades:

https://tradingeconomics.com/new-zealand/households-debt-to-gdp

But if you look at long term international interest rate trends, it’s possible we’ve just broken out of a 4 decade downward trend, which could mean big trouble for nations holding high debt relative to productivity/incomes. See the US 10 year long term trends: https://tradingeconomics.com/united-states/government-bond-yield (go to max timescale)

What properties bulls won’t tell you is that it is possible that mortgage rates are higher in 5 years time than they are now - so if you have a big mortgage, that pain may not be going away anytime soon.

Neat tool. Shows drop from Q4 2021 is about 22% to Q1 2024, and further REINZ HPI nominal price drop of -1.9% in the 3 months to July before inflation.

If you add in the 90 day rates line it's even more revealing https://fred.stlouisfed.org/graph/?g=1tzuP

The last time interest rates were similarly high for a significant period was 2004 (48% lower than Q1 2024), and also momentarily in a similar position as financial markets went into freefall in early 2008 (42% lower than Q1 2024).

Insulating factors could include rhetoric and hope for falling interest rates as CPI tracks a falling trajectory, potentially also QE and funny money seeking NZ property as capital markets seek higher returns / less losses.

IO - the tool from the Bank of International Settlements is even better Comparative view of New Zealand - Selected residential property prices, Real, Index, 2010 = 100 (bis.org)

Nice link - thanks 🙂

Imagine House Price, OCR, Lower Mortgage were having a great party, then Unemployment, Inflation crashed their party and brought along this party pooper guy Recession!

Even QV can't say the word 'decrease' instead its "keep a firm lid on home value growth"

RE industry have their own newspeak. What is worse is that I don’t think they are intentionally using it (ie they so completely blinded by poor heuristics and biases that they don’t know how to describe what is happening).

"A Wellington real estate salesperson who lost about $200,000 on a new build townhouse says a similar situation is being played out around the country.

Mike Robbers of Lowe & Co Realty..."

https://www.stuff.co.nz/business/350409933/wellington-real-estate-agent…

Yes there were a few of us in here warning that this could happen (when everyone were losing their heads and going long with debt) but only to be called doom merchants by vested interests.

Also from the article:

"He said the end result was that they had a bigger mortgage."

Let's assume that they had an additional mortgage of $200,000 (i.e the amount of the losses) as a result of this investment.

At mortgage interest rates of 6.5% p.a and 30 years, the annual P&I payments are $15,315 p.a (for an investment that they no longer own). Over the 30 year life of the mortgage that is total payments of $459,464 - for an investment that they no longer own. This is $459,464 that they will not have for use in their retirement.

Remember the property promoters: "House prices keep up with inflation." That investment certainly did not keep up with inflation.

Other marketing lines frequently repeated by property promoters:

1. "Buy when you can afford it"

2. "You can't lose with property"

Remember that property promoters will always tell buyers that this is the time to buy due to their vested financial self interests.

Owner occupier buyers: CAVEAT EMPTOR

It looks even worse if you consider they could have invested that $15,315pa instead of directing to the extra $200k mortgage.

$15,315 pa, invested monthly assuming 5% returns over 30 years would be a $1,040,019 opportunity cost.

This same calculation holds for anyone else who overpaid by $200k over the last few years

Peaker vs Buyer Today - calculations as at April 2024, but the essential point remains.

(Note that the current median house price in Auckland is currently $90,000 lower at $950,000 than the $1,040,000 used in the calculations below. This means that the mortgage would be more than $90,000 lower due to continued savings and interest income on the deposit for a Buyer Today)

Here are some financial calculations for owner occupier buyers to think about. The Peaker and Buyer Today.

How does this compare with a Peaker and a Buyer Today (BT) in NZ? (Assuming that the Peaker can hold on and is not under cashflow stress to sell.)

1) Peaker

The median house price at the peak for Auckland was $1,300,000

With an 80% LVR, this is a mortgage of $1,040,000

The 20% equity is $260,000

2) Buyer Today ("BT")

In 2021, the buyer who waited, deposited the same $260,000 equity into a bank deposit earning interest. Also BT would rent an equivalent house and have still saved money due to the rental being below the monthly P&I mortgage payments of Peaker - in 2 years the savings would have been about $20,000 annually. So a Buyer Today would have an amount of $319,349 to use as a deposit.

The current median house price for Auckland is around $1,040,000

Equity deposit of $319,349

The mortgage at this purchase price would be $720,651 (an LVR of 69%)

The Peaker has a mortgage which is higher by $319,349 (mortgage of $1,040,000 for Peaker vs $720,651 for BT)

Assuming BT, pays the same exact dollar amount each year that Peaker pays for their mortgage, as a result of that additional borrowing, Peaker is paying $856,632 more over the 30 years than BT (This is due to higher borrowing amount of $319,349, and total interest on this of $537,283 over 30 years). BT is mortgage free by the year 2042, whilst Peaker continues to pay their mortgage until 2051 (9 years later) - so after the year 2042, BT can save all that money that Peaker continues to pay on the P&I mortgage.

Assuming same incomes, and same living costs (food, travel, etc except mortgage) , BT can save the $856,632 in payments that Peaker is paying.

Remember that at the end of 30 years, the house price will be EXACTLY THE SAME for Peaker and BT.

BT will have more money available for retirement than Peaker. Conversely, Peaker will have less money than BT at retirement.

That single decision to buy in November 2021 would have cost $856,632 extra to buy the exact same house for Peaker compared to a Buyer Today.

Updated calculations

1) Peaker

The median house price at the peak for Auckland was $1,300,000

With an 80% LVR, this is a mortgage of $1,040,000

The 20% equity is $260,000

2) Buyer Today ("BT") - Sept 2024

In 2021, the buyer who waited, deposited the same $260,000 equity into a bank deposit earning interest. Also BT would rent an equivalent house and have still saved money due to the rental being below the monthly P&I mortgage payments of Peaker - in 3 years the savings would have been about $20,000 annually. So a Buyer Today would have an amount of $340,233 to use as a deposit.

The current median house price for Auckland is around $950,000

Equity deposit of $340,233

The mortgage at this purchase price would be $609,767 (an LVR of 64%)

The Peaker has a mortgage which is higher by $430,233 (mortgage of $1,040,000 for Peaker vs $609,767 for BT). BT's mortgage is 41% lower than Peaker's mortgage.

Assuming BT, pays the same exact dollar amount each year that Peaker pays for their mortgage, as a result of that additional borrowing, Peaker is paying $1,232,229 more over the 30 years than BT (This is due to higher borrowing amount of $430,233, and total interest on this of $801,996 over 30 years). BT is mortgage free by the year 2037, whilst Peaker continues to pay their mortgage until 2051 (14 years later) - so after the year 2037, BT can save all that money that Peaker continues to pay on the P&I mortgage.

Assuming same incomes, and same living costs (food, travel, etc except mortgage) , BT can save the total $1,232,229 in payments that Peaker is paying. If BT invests the annual P&I payments that Peaker continues to pay after the year 2037 at 4.0% p.a, then in 2051 this amount will grow to $1,401,500.

Remember that at the end of 30 years, the house price will be EXACTLY THE SAME for Peaker and BT.

BT will have more money available for retirement than Peaker. Conversely, Peaker will have less money than BT at retirement.

That single decision to buy in November 2021 would have cost $1,232,229 extra to buy the exact same house for Peaker compared to a Buyer Today.

A good reminder of why one shouldn't take financial advice from real estate agents.

But there's something else going on here that few have commented on.

Lots of mum and dad 'investors' bought up these new builds as 'investments' (at 1.9% interest rates and word from the RBNZ that rates would stay low for quite some time). They're now sitting on capital losses. And most probably don't understand 'sunk cost'. So they'll continue to pay the mortgage making losses. The problem for the 'economic recovery' is that this money won't come flowing to aid of the economy and bolster spending.

Thus if I'm right in that property prices will flatline for years, then our recovery won't be assisted by spending from these 'investors'.

Who created this mess? Looking at you muggles in the RBNZ ....

"Lots of mum and dad 'investors' bought up these new builds as 'investments' (at 1.9% interest rates and word from the RBNZ that rates would stay low for quite some time). They're now sitting on capital losses. And most probably don't understand 'sunk cost'. So they'll continue to pay the mortgage making losses. "

Given that the market valuations have fallen conpared to their purchase price, how will off the plan buyers finance the shortfall?

1) more equity? either personal or invite family, friends, co investors.

2) main banks may now no longer lend a sufficient amount to settle the purchase so the buyer may need to turn to a non bank lender which has an even higher cost of borrowing. This is likely to put even more cashflow stress and if unsustainable the owner may need to sell at a loss (like the real estate buyer in the original report)

3) sell before settlement date?

4) choose not to settle. This means that the off the plan buyer may be on the hook for any sale price shortfall when the developer resells that property.

Yeah

Frankly I am surprised we haven’t heard more tales of woe related to this

The banks know. But they're hardly likely to be telling anyone. MSM? Nope, they need the advertising and the clicks. Social media? Nope. People lie.

And the 'investors'? They'll tell any story to justify their actions. You know, "It's a long term game", "Property doubles every 10 years", "Stay the course", "Interest rates are falling, prices will skyrocket", etc. Same old, same old. You read the same comments I do. They're all here.

"Interest rates hadn't just doubled, they'd quadrupled. Rents had tanked by more than 30 percent - unprecedented. The townhouse was no longer a viable investment and completely unaffordable for us to consider keeping. But property prices had dropped so much, that the property was now worth less than the remaining balance required to settle."

out of the mouths of babes

I would say we are closer to anger now then denial... but prices will keep dropping, You must be a buyer of a derillict WGTN bit of DIRT Wingnut

"When the tide goes out, you find out who has been swimming naked."

There will be people that went large and signed up for 2,3,4 of these hoping to flip them too. They are about to lose a million bucks.

House prices are crashing by any of the standard metrics you want to use.

Just like Ireland the Spruiking headlines went all the way down........

Average wage couple still has no chance of buying average home in most areas of the country from scratch many people leaving the country renting out house to pay mortgage with some who purchased in last few years deep in negative equity.The housing bubble burst and will be deflated of a number of years and if a recession does take hold hard it will take a decade to recover

On Newstalk ZB there are property rental companies advertising specifically targeting people about to leave but cannot sell, first month rent commission off.... just saying must be a big market if property mgrs willing to pay for Newstalk ad space..... another in Taupo giving first month off for gold card holders.

Smells more of old people and desperation than jet fuel about to explode.

I note the Spruikers, both pro and amateur, have been wrong for some time now, credibility is finished. Bank forecaster reputation also in tatters as well all now realize that we should not take advice from the biggest lenders to the Ponzi, people who cannot use works like decrease, fall or retreat, but rather use weasel words like flat, basing etc.

Its so entwined we cannot even trust the Herald to tell the truth, so tied up in Ponzi advertising.

Do your own research. See you at the bottom

There really is a book to be written about this whole travesty

They reckon the 4 most dangerous words in investing are...

"It's different this time".

People have been living in houses for thousands of years. If house prices over the longer term always beat inflation, then only the top 0.1% would own property today.

You are looking at things from the last 30 years perspective. 'It's different this time' depends completely on what timescale you are looking at.

I heard it's...

"Bare land in Riverhead"

You're right, Riverhead and adjacent Coatesville are both up.

Up the duff

It is not different 'this time'.

It is looking like the 70s all over again. (For those that don't know, the government in the 70s forced local government to rezone, a building boom started, supply increased, and we had flat house prices for 15+ years. )

We almost had no net migration for 15 years

As per above. I checked this factor. It had no effect discernable effect. And just quietly, the effects of immigration are IMO vastly overstated by vested interests.

Whenever I read your posts, I can’t help but hear them in Trump’s voice.

https://kpi.nz/kpi/median-house-price-vs-median-household-income

Interesting that the biggest house prices capital gains have been under a labor government and they are the ones wanting to make tax revenue from it.

Wouldn't be more accurate (and less partisan) to say: both government have done 'next to bugger all'?

In actual fact however, both governments have tried and mostly failed.

That said, if asked again in 10 years, I expect to say the NPS/UD and MDRS (Labour) built on work by Auckland and ChCh Councils (and to a lesser extent National) between 2011 and 2016 to fundamentally change things for the better. We'll see.

National were a much bigger factor than Auckland Council in terms of the Unitary Plan.

The plan was lame until the National government applied massive pressure.

I was involved throughout the process. I do not agree with that statement in any form.

And I was too.

Tell me why you disagree, I am fascinated. You often make completely incorrect statements. This is yet another (along with your latest, demonstrably false comments on net migration throughout the 1970s and 1980s)

Look forward to your response. Unlike you, I am happy to admit error if I am in fact wrong.

The truth is my obsession, not ego

Re migration - analyze the makeup people leaving. age / occupation / family size / etc. The numbers alone do not tell the full story as far as the housing market was concerned. Further, the impact immigration has is often vastly overstated (back test this against property prices, type by region and the overall state of the economy, especially employment, if you don't agree.)

Re this one: I would describe 2016 AUP debate as progressives vs. conservatives. Party affiliations really didn't come into it as there were both in each camp, with a progressive lean in L/G and conservative lean in N/A. National just happened to be government at the time and copied what they learned from Chch; which again was driven by progressives while being hampered by central government.

You haven’t addressed the question. I said the original council unitary plan as notified in 2014 was lame, and the final product in terms of massive uplift in terms of density and development capacity was due to the National Party (via submissions from Housing NZ etc)

you said that was incorrect

why?

2013 election sept/oct - progressives took control of the process. everything before that and even up to 2014 was the product of the conservatives who had ruled (and obstructed) before that.

?

You mean progressive wing of the national party?

It’s still the National Party. That was my point. Which you said was ‘incorrect’.

Sorry I can’t take anything you say seriously anymore. You said you were involved. Anyone who was involved in a meaningful way knows that the National Party, via its agencies, had a massive impact on the Auckland Unitary Plan.

I am no National fanboy but that’s the objective truth.

If you set up a tax system whereby the Govt gets a large chunk of its revenue from people buying or selling houses, and that tax revenue is guaranteed to increase as the price of houses increase, what policies do you think the Govt will enact to ensure that house prices keep going up?

As Charlie Munger once said "show me the incentives, and I'll show you the outcomes".

"what policies do you think the Govt will enact to ensure that house prices keep going up?"

Prior to November 2021, many people believed that the government in NZ wouldn't allow house prices to fall. That premise has since been proven to be incorrect.

The Crown's primary objective is not maximising revenues from real estate. This is in contrast to profit motivated non owner occupier buyers operating in the current system in NZ.

Currently because we dont have CGT/Wealth/Land taxes. But when they start taxing capital gains and "wealth" what do you think will happen? The primary objective will quickly become maximising revenues from real estate. Guaranteed.

"The primary objective will quickly become maximising revenues from real estate"

Let me clarify my earlier comment. From the World Bank:

All governments take responsibility for producing a range of goods and services called public goods that only they are in a position to supply adequately. These include national defense and internal security, money, and the provision of a legal system. Among the most important public goods is a legal and institutional system which reduces the costs and risks of transactions. Certain other goods and services for instance, transport, power, education and training, and research provide a foundation which enables the rest of the economy to work more smoothly.

https://openknowledge.worldbank.org/bitstream/handle/10986/5970/9780195…

"That premise has since been proven to be incorrect."

Early days yet. Too early IMO to conclude that.

What about when the state owns 60000 houses or so and plans on building 100000 new houses in kiwibuild, does increasing the house prices also increase the value on their books, allowing them to borrow to build more houses?

As Charlie Munger once said "show me the incentives, and I'll show you the outcomes".

Government is made up of elected politicians. Politician's incentives are to win the popularity contest. To win the popularity contest, politicians engage in political rhetoric, political spin and the blame game.

Look at politicians in developed democracies around the world.

In the US, with the current presidential campaign, one candidate has chosen to engage in name calling as a method of attempting to win the popularity contest.

Labour outright ruled out CGT, now Chippie is advocating for it. He failed in 2 portfolios before being gifted the Prime Ministerial role, and now he has flipped completely on what his party vehemently opposed not long prior. like a parent making too many failed promises, and their child no longer giving any credence to their hollow words, so to do the public with Labour.

I like your analogy.

I just wonder if the undecided voter will see this in 2 years time.

Opposed or ruled out in their last term?

Its normal for policies to change between terms as voter demands change. Proper tax reform is gaining favour, as seen by the green vote - Labour likely to better position themselves in order to get those voters back. Politics is a lot of borrowing ideas from other parties and branding them as your own.

Poor analogy, as children don't vote their parents into power triennially

Report from Reuters. Expecting NZ house prices to rise.

https://www.reuters.com/markets/new-zealand-house-prices-rise-6-next-ye…

according to a Reuters poll of property strategists

The bottom will only be apparent in retrospect.

The property market is down a lot, those sitting on the sidelines stand to make nothing, if those taking a punt recently get it right, they'll make a fortune.

Tax free, especially if it's geared up.

Sometimes making nothing is better than losing everything

"Sometimes making nothing is better than losing everything "

These owners never recovered the amount paid for their property.

Paid JPY26 million in 1990's. Just sold for JPY1.1 million - loss of over 95% in 34 years (a loss of 8.8% p.a). Remember that this is before the impact of leverage.

https://youtu.be/j3de0l8Pq-8?t=152

Note :Japan property prices have yet to recover to their peak 1991 levels after 33 years. House prices are currently back at 1987 levels (37 years ago - imagine getting back to your original purchase price 37 years after you bought it - not really a source of funds for retirement).

This basically a doco about the future that PowerDownKiwi forecasts. This is a prime example of social infrastructure deficit - both physical infrastructure, community, transportation and services

FYI, interestingly, the house price growth for the last 50 years since 1974 in Japan is 1.4% p.a.

Glad your finally "head out of the sand" see the market is down a lot.....well its actually just 1/2 way, in the BIGGEST HOUSING CRASH since the 1970s.

This rabbiting on about a certain area, are plainly desperate to hawk off a piece of dirt.

Traffic past Westgate is just terrible and will not attract many punters, unless you love holding a steering wheel and tapping your brakes for hours every day........

knees to shoulder's ass clown, pigs get slaughtered ....

Increasing desperation in your posts wingman, it's almost sad.

Salient bit:

"The median forecast from an Aug. 20-30 survey of 11 property market analysts estimated a 1.0% average price rise this calendar year, down from 4.5% predicted in a May poll. Forecasts ranged from -4.0% to 2.5%.

That was in sharp contrast to the 6.3% gains predicted for Australian home prices this year."

Housing speculation is turning this country into a third world cesspit, where the rich just keep getting richer and richer - while they pat themselves on the back for being such good business people. We need to tax wealth more effectively than we do. Our current system is a huge waste of human potential, where some people are funelled straight to the trash heap while other mediocre trust fund babies spend their whole lives falling up.

Why don't you join the club then if it's so easy?

Go and see the bank, borrow a million or two,and Bob's your uncle.

Right?

Kmart to open colossal store at Westgate. Another boost for the West.

https://www.nzherald.co.nz/business/kmart-to-open-colossal-new-auckland…

As much as I love Auckland the increased traffic caused by the new K Mart will not make me want to go out West.

Not sure if I'd call a hoard of Kmart shoppers a win. Cheap ass consumers seeking the cheapest price (made in PRC) fast-everything junk. They'll be in and out via maccas back to their pre-fab homes. What a time to be alive

Thank God this is not Australia. Australia's GONE - Housing Destroyed It (youtube.com)

If you believe Biko, you'll believe anything.

That dude spruiks gold, one of the riskiest, worst, non-dividend yielding bets on the planet.

https://www.youtube.com/watch?app=desktop&v=OtEJyuIYmSs

"Buy gold before the price explodes."....yeah right....suckers only.

Wingman, could you please explain "riskiest" for those hard of hearing in the back?

Agree that gold only has store of value and hope of capital gains. What makes that risky?

I have a relation in Sydney who retired early as a result of holding gold bullion long term and also from his crypto trading. He has made an absolute fortune. For years he told me to buy gold and silver. He stores both in a secured storage area.

I've heard stories like that for years. Gold's a massive dud. There's scams galore, it costs to store it, it's got no dividend.

And it certainly isn't 'insurance'. In WW2, the most destructive conflict in history, gold declined in inflation-adjusted terms.

Silver's been one of the very worst bets.

Errr....gold has done quite nicely in the last decade or two. Most tech stocks don yield dividend either but are worth moonbeams.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.