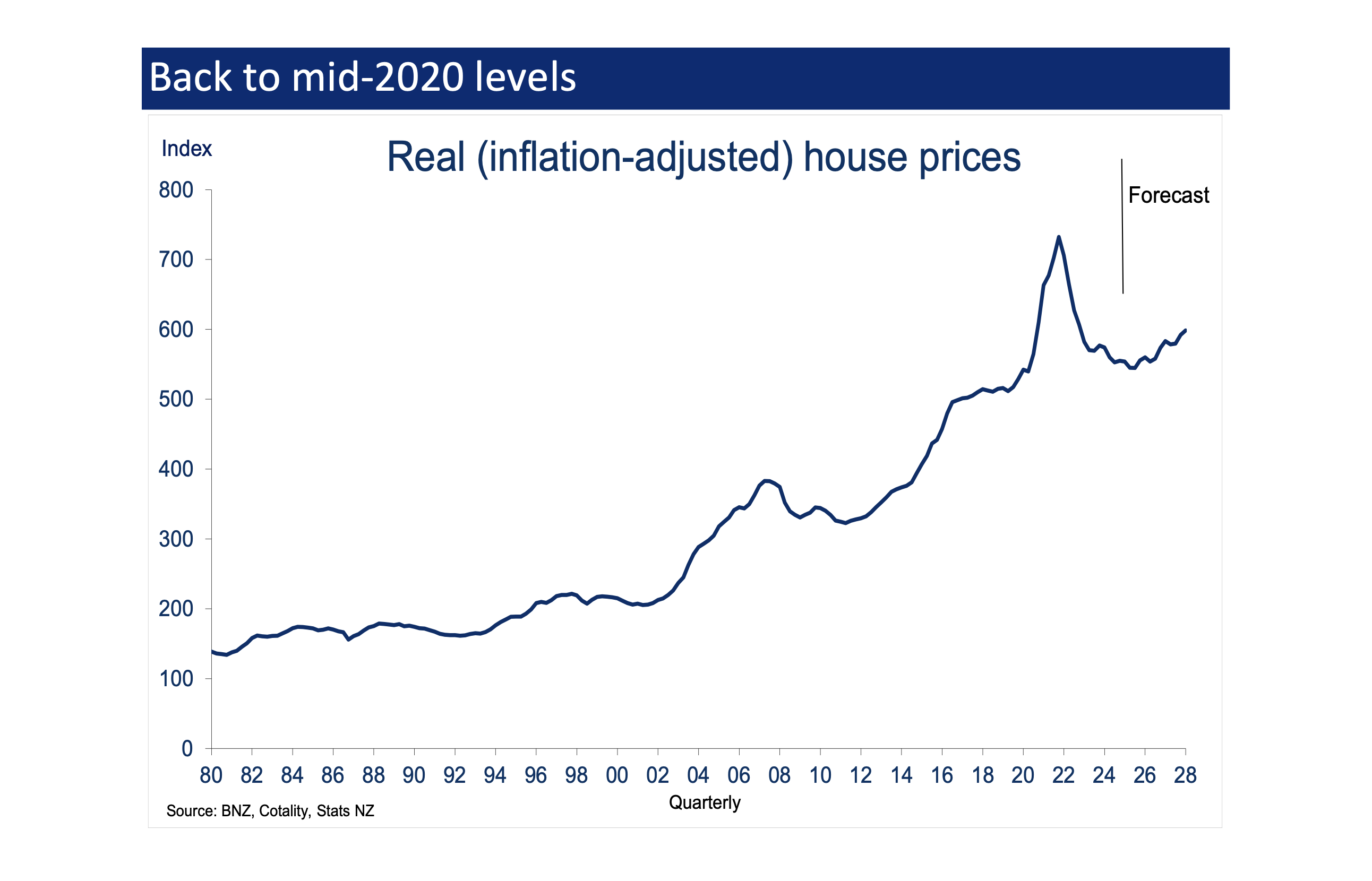

New Zealand’s $1.6 trillion housing market is going nowhere fast. Prices have barely moved since the bubble burst in late 2021.

But is this a symptom of the country’s stuttering economic recovery, or is it the cause?

REINZ’s house price index showed a modest rebound after bottoming out in early 2023, but momentum has faded. The index rose just 0.3% in the year to June, despite a 170 basis point drop in the 2-year swap rate.

Economic activity has also stumbled. GDP rebounded through the December and March quarters after a sharp mid-2024 contraction, but likely contracted again in June. The Reserve Bank’s nowcast estimates a 0.3% fall.

The link between the two trends is a chicken-and-egg problem. Is housing weak because the economy is soft, or is the economy soft because housing is?

Bernard Hickey, an economic commentator and Interest.co.nz alumnus, wrote in his newsletter that New Zealand’s “housing-market-with-bits-tacked-on” economy was struggling because buyers weren’t bidding up prices as they had in past recoveries.

Kiwibank chief economist Jarrod Kerr said in a note that further cuts to the Official Cash Rate were needed to stimulate housing demand if “optimistic” growth forecasts were to be met.

But that kind of thinking frustrates Housing Minister Chris Bishop, who wants to break the link between rising house prices and economic growth.

“Destroying the idea that the economy should be based on house price growth is a fundamental formula this government is trying to embed into the New Zealand psyche and into the arteries of the economy,” he told Interest.co.nz on Tuesday.

Outrageous fortune

Property has an outsized influence on the New Zealand economy because of the sector’s scale. It contributes 15% to annual GDP and accounts for more than half of all household assets.

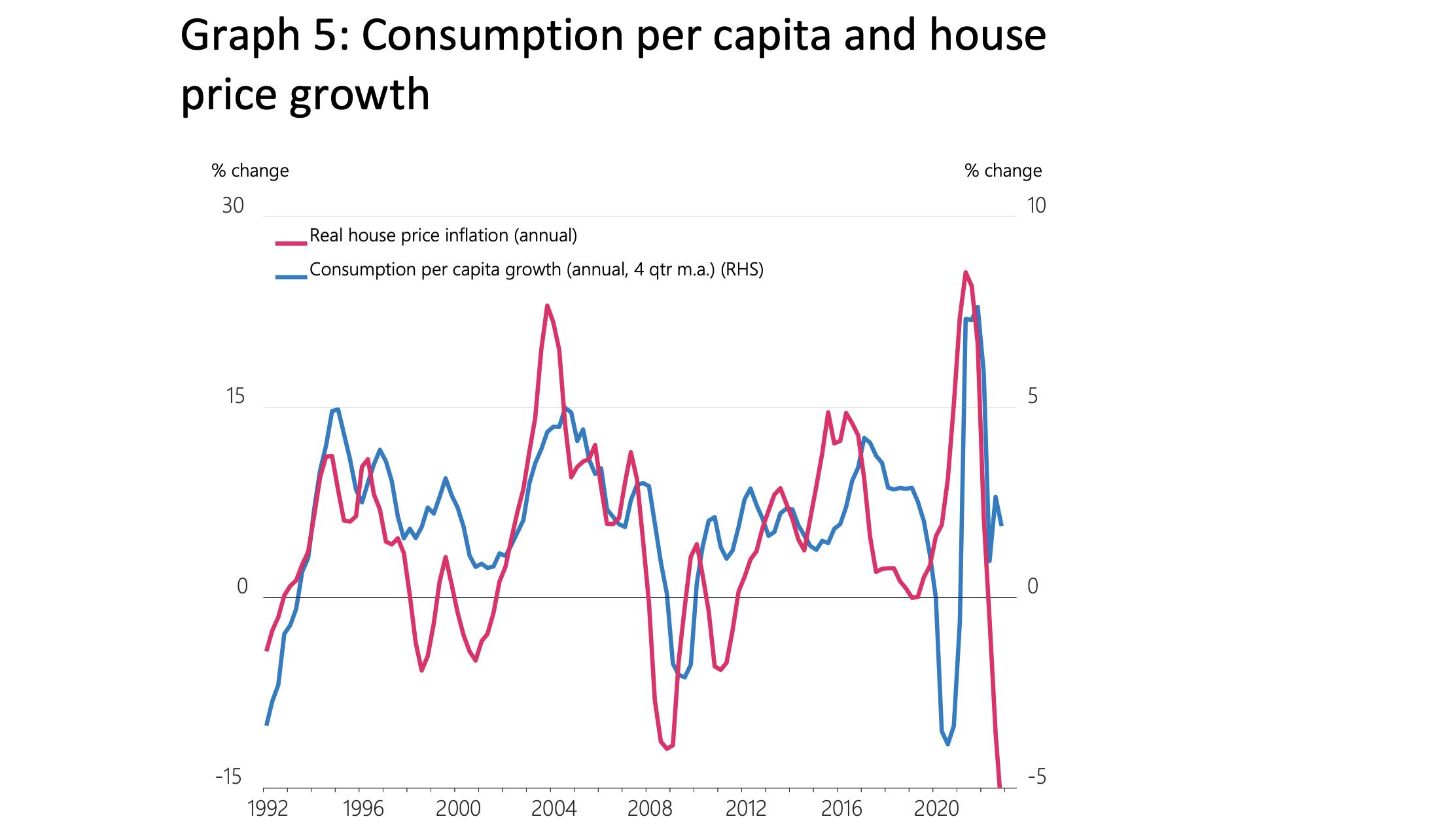

Housing downturns can deepen recessions by curbing household spending and slowing construction and employment. The reverse is also true, though the lift from rising prices is typically smaller than the drag from falling ones.

And it’s not just households. Weak house prices also dent small business confidence and activity, as banks often secure those loans against residential property.

While most economists agree that rapid house price growth isn’t necessarily desirable, many also acknowledge that a broader recovery will be harder without it.

“It sucks a lot of growth out for sure,” Kerr said, when asked what happens if house price gains are removed from Kiwibank’s forecast model.

The state-owned bank expects prices to rise between 5% and 7% in 2026, though it admits it had a similar forecast for 2025 which didn’t pan out. It now expects prices to rise about 2.5% this year and has revised its GDP forecast down from 1.4% to 0.9%.

Residential prices climbed roughly 8% a year in the five years before the pandemic and surged after the 2020 stimulus. Annual growth briefly hit 30%, setting up home-buyers for a painful correction a year later.

The Reserve Bank expects more moderate gains ahead. In May, it projected annual house price growth would settle at 4.2% in the coming years, after peaking at 5% in late 2026.

Housing-lite recovery

Mike Jones, chief economist at BNZ, said it wasn’t clear whether the weak housing market was slowing the broader recovery, or if it was the other way around.

“I tend to think about most of the causation running from house prices to the economy. Like any asset cycle when house prices rise there is a feel-good or wealth effect which goes on to boost consumer spending, housing investment, new construction and the economy more generally,” he said in an email.

“But I think we’re also seeing some causation looping back around in the other direction, particularly at this stage of the cycle.”

Many would-be buyers feel insecure about their jobs and are reluctant to take on large mortgages, especially after watching the previous wave of buyers get caught out.

Jones said lower interest rates had clearly lifted the number of transactions, but prices wouldn’t rise meaningfully until the backlog of listings was cleared.

“That’s no bad thing from an affordability perspective, but a ‘housing-lite’ economic recovery does slow us up relative to what we might have seen in past cycles.”

More butter, fewer builders

Infometrics, an economic consultancy, expects New Zealand’s “patchy recovery” to strengthen through the rest of the year—with or without house price growth.

Fresh forecasts published Friday predicted agricultural exports would lift annual GDP growth to 2% by the second half of 2026.

Chief forecaster Gareth Kiernan said he agreed with Chris Bishop that house prices were already high and unlikely to lead the recovery. His projections assume “pretty flat” price movements.

That would slow the pace of broader economic growth, he said, but was likely a worthwhile trade-off if it improved long-term affordability.

Unaffordable housing is often blamed for everything from poor health and education outcomes to weak productivity growth and reduced business investment.

But Kiernan said it was still bad news for the construction sector, which was being left behind and would likely need to resize for structurally weaker demand.

The government had signalled a lot of infrastructure work ahead of the 2026 election, but “the gap between rhetoric and reality to date remains stark.”

Infometrics expects a slow and uneven recovery. Rural areas tied to agriculture should perform well, while regions reliant on construction or government spending will likely lag.

“Forecast economic growth averaging 2.1% per annum over the next five years represents an improvement from the tough conditions endured by businesses during 2023 and 2024,” Kiernan said in a press release.

“But we do not expect GDP per capita to surpass its 2022 peak until the second half of 2027. The reality is that the economy was extremely overheated during 2022, so a quick return to those sorts of activity levels can’t be expected.

38 Comments

House prices don't have to recover, but unless building costs come down in that case the construction industry will also not recover and more people will leave New Zealand in search of work.

I'm amazed how many building consents though less than the heady days, are still being applied for and issued.

Maybe land prices could fall!

Lower Home Prices are a great aspect of the new investment Paradym/Epoch, that started at the beginning of 2022.

Many are still trapped and locked in the 40 year, lower forever interest rate world and mindset, that ended, ceased/stopped in 2021.

I think you correlate lower / higher mortgage interest rates directly with higher / lower property prices. Isnt it one factor in a range of factors

The RATE of cost of BORROWED funds is the ONE predominate factor, for asset bubbles. Along with the belief in constant capital gains, aka Ponzi- belief.

Nothing else comes close to having the same influence.

The Spiked Debt Punchbowl, was removed and tipped down the drain, from Jan 2022.

- The Day the music stopped and the chairs vaporized. NZ today....bewildered, walking dead property investors, with all hope sunk without trace.

Bank directors now carrying some liability for lending to those that cannot afford it has definitely had an impact. Let's face it, is if good for an economy/society to have its prime activities being chasing capital gains. The o ly winner for bank profit and bonuses, while society is crushed in debt.

Don't forget Banks are closing branches, closing ATMs and laying off staff. What do they see happening in the near future...?

You clearly haven't been brainwashed yet at a Property Investor Association meeting boomer11.

'Interest rates are about to drop again now so property will never again be a cheap as it is now. Falling rates means house prices will be more expensive next week no so BE QUICK. The best time to buy property is always yesterday'.

Not my thing exactly , I'd rather find underpriced land and build. Makes way more sense to me, more upside. What about you what's your penchant, squirrelling away or adding.

I think as a society we've become far to obsessed with material possessions that moth and rust doth corrupt. And need a shift in a different direction.

Live for today and what's not spent give to charity.

Unfortunately the psyche of the typical Kiwi the past few decades has been to spend the vast majority of spare earnings on turning their neighbour into their debt slave by building a property portfolio (and not on charity).

Even if one gives 1% of their wealth to charity (which is great - I encourage this), does that offset them trying to use 50% of their net wealth (by buying a rental on top of their own home) and taking weekly rent from their fellow man in society, while bidding up house prices to extremes that make it financially incredibly difficult and risky for future generations to purchase a home?

I get that... you said you value not obsessing about material possessions. Is that something you live by. You will know this quote

"Everything else is worthless when compared with the ... sake I have discarded everything else, counting it all as garbage"

Long term price supported by income is still some ways back. Spec town is still in denial. Fortunately most of that group couldn't afford 27c day to post their nonsense.

🍿

If they buying was based upon income then the real house price chart should be flat. ie price/income or debt/income levels would have remained more or less flat (as was the case for most western society for the 100 years leading to 1990 - some fluctuations but nothing like what we've witnessed the past few decades).

But its been a massive boom instead - based upon interest rates dropping for 30-40 years.

As soon as rates stop dropping or even stay flat, the housing market in real terms is doomed (in my opinion) and will keep falling.

I personally think using the CPI to determine interest rate policy and leaving land/house prices from the basket has been the biggest ^@%# up in economic management I can think of. All it has done is allowed asset bubbles to form in property because:

- House/land prices went up at 7% pa.

- We imported cheap stuff from China/Asia that was measured in the CPI

- 'Oh look there is no inflation because of the cheap stuff we've imported from overseas using slave labour'

- 'Lets drop mortgage interest rates then which aren't used to directly buy consumer items, but instead are used to buy land and housing'

- 'Oh look land and house prices went up 10% last years but we've got 0% consumer inflation...lets drop mortgage rates again so people can buy more property!'

- Cycle repeats and we wonder why housing is in a bubble. If we can't import deflation we are in trouble in the next decade or so wrt housing (in my opinion).

Agree CPI is more less a con job.

Nailed it!

The jury is still out for me on whether the NZ middle/upper classes really have gone through property market rehab or the next hit has just been delayed.

Makes me laugh how the apply the 1990 - 2020 trend line to their forecast in the real house price graph.

Ignoring that the line was more or less flat from 1900 - 1990.

So they believe 1990 - 2020 trend is the normal, not the anomaly.

We need goldilocks conditions once more for the 1990 - 2020 trend to start up again. That is we can drop mortgage rates from 10% (ie the 1990 rate) to 1% (the 2020 rate) and buy ever cheaper consumer items to put in the CPI allowing private debt to GDP to remain above 150% (downward pressures on mortgage rates with no consumer price inflation).

It's not the wealth effect that primarily links house price growth and the economy, it is the real hard cash effect. If banks are pumping $100bn of new money into the economy per year (new bank loans) and mortgagors are only handing back $80bn in repayments, then we have a net $20bn to support consumption, wages and profits. We call this 'growth' and we clink our glasses at our very good economic management.

Here's the chart that matters. See if you can spot the very moment that all the economics stats turned sour. It's when the lines cross.

Most economists don't understand this because their models wrongly assume that banks lend out other people's money. They don't correct those models because that would involve rewriting all their wrong textbooks and admitting that they have been talking crap for decades.

Yea but you need the house price growth for the banks to leverage up to provide the credit growth.

Yes, sorry, I was making that exact point, just too opaquely!!!

Not necessarily...you need bank confidence to provide credit (and confidence from the debtor)...whether that credit is supported by RE or something else is immaterial. We would be better served if it was something productive.

Most economists don't understand this because their models wrongly assume that banks lend out other people's money. They don't correct those models because that would involve rewriting all their wrong textbooks and admitting that they have been talking crap for decades.

Love the clarity here

It's not the wealth effect that primarily links house price growth and the economy

Can't agree with this. Anecdotally and empirically the wealth effect increases discretionary spending. We have friends who run a high-end discretionary retailer and the correlation is 100% according to them. Also Berger, Guerrieri, Lorenzoni & Vavra (NBER 2015 / Res Stud 2018).

Yes, of course they need to access credit or cash to spend it but the reason they are spending is they feel wealthier.

This also appears to apply to people I've been talking to the past few years who are low risk are mortgage free and have high levels of savings.

As interest rates went up, their return on investment increased, and thus were will to spend much more of discretionary items.

Now that rates have been dropping, they have been closing their wallets again.

So perhaps its not just a 'thing' in relationship to housing/stock market returns.

If both those with housing stop discretionary spending (as house prices aren't going up) and those with savings stop discretionary spending (because TD rates have been falling) - as appears to be the current state of affairs, I don't think its a great scenario for our economic prospects the next few years.

Yes, I have said many times on here, the interest income channel works against monetary policy.

I'd didn't say it didn't count, I said I didn't think it was more important than the hard cash effect. That's what I meant by 'primarily'.

Things are getting weird. My reckon is that we don't pay enough attention to the Aussie Ponzi and its implications for the greater good. Same same but different.

Anyway, it appears that CBA honcho Mat Comyn appears to be getting spooked. Remember, CBA is quite possibly the most successful Ponzi bank in history. Michael West breaks it all down in this short video, but essentially it boils down to the idea that the boomers hoarding all the "wealth" while expecting the young / poor to carry the tax burden is unsustainable and coming to a head. Comyn is arguing for more wealth tax, less income tax.

Does this signify peak Ponzi? Difficult to say. But it can't keep chugging along forever without dire consequences. Feels like we're driving headlong into a Mad Max future if things don't break soon.

https://michaelwest.com.au/the-heretic-commbank-boss-drops-bombshell-th…

Australia, from memory, has the highest proportion of tax revenue from income tax than any comparable nation.

Read the press there, the AFR are cheerleaders for lower rates, egging the RBA to ease. Even I who benefit have grown to see just how nauseating it all is. I am happy to have flat prices here if it means we become less property obsessed, it's a massive turn-off. If you are prepared to move to regional Australia, or Adelaide or Perth, I believe you are still much better off there than NZ, but Sydney you're dreaming.

Yes. I think Sydney is a disaster zone. Hugely over-reliant on the Ponzi. The primarily white upper middle class all comfortably nesting in the Northern beaches while the more ethnically diverse migrants are locked away in the West. The political class is dreadfully corrupt and / or woke with no sense of direction. A huge managerial / professional class that needs high income just to make ends meet. Mind you, imagine if you were an entrepreneurial tradie focusing on the fancy pants suburbs - you'd be making out like a bandit.

Credit where credit's due - to mangle a pun.

Good article Dan - the comparative graph particularly.

You're giving Dan credit..... instead of berating him for being willfully ignorant? Is it the 1st of April or what?

Because he's starting to think,

And thinking is to be encouraged.

:)

Looking at the real house price growth vs consumption per capita graph. Real house price growth is the leading indicator and its completely fallen off a cliff - there is nothing in the past 30 years that compares (perhaps nothing in the past 100 years of data (if we had it)).

If the relationship between real house price growth and consumption per capita plays out in the same/similar manner as it has in the past three decades (per the chart above), then its quite likely we're heading into an economic slump much bigger than the GFC and what we've witnessed these past few years is only the opening act of what is to come (ie consumption per capita hasn't even turned negative yet according to the chart...but real house price growth is deeply negative..more so than anything recorded in recent history).

This would also align with what has happened with economic activity in relationship to yield curve inversions - and we've just lived through the largest/longest/deepest yield curve inversion since the 1920's that was a precursor to the 1930's depression.

We may come to regret the irrational exuberance of the 2000's and 2010's. Just as people look back at the roaring 20's where excess prosperity for some (asset owners) resulted in economic despair for nearly everyone as a result (high unemployment, negative growth). Slow and steady is a much better method instead of what we've just experienced (even though many people with financially vested interests were cheerleading for this outcome..they just didn't understand what they were cheerleading for....perhaps they will in the coming years).

Agriculture is such a large contributor to export earnings. Participants in that sector for GDP purposes (my, perhaps misguided understanding) are widely dispersed geographically but thinly spread in density (population/km²).

There's mention above re GDP/capita. For the agricultural sector, what are the stats on: GDP/capita, productivity/capita trend, and how do these compare to other sectors measured for GDP?

A successful economy is one where the cost of good house is low and all folk can readily buy what they want where they want.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.