ANZ economists are warning that a bigger than expected slowdown in migration-fuelled population growth in New Zealand could cause economic growth to "slow markedly".

In their Weekly Focus the economists say since mid-2013, net migration inflows have added more than 300,000 people to the New Zealand population – equivalent to over 6% of the current population.

"This has had substantial impacts on both the demand and supply sides of the economy. It’s no secret that population growth has been boosting GDP growth these past few years, with migrants adding to labour supply (lifting the economy’s potential growth rate) while consuming goods and services (including housing). In the meantime, per capita GDP growth has been nothing to write home about ," they say.

Now, however, the cycle has turned and the net increases are slowing.

The ANZ economists say that that even with further declines "baked into" their forecast, they are still expecting migration to add a nearly 100,000 people to the population by the fourth quarter of 2020.

"So while migration’s impetus to growth is expected to shrink, it’s not expected to be a drag on the economy any time soon.

"But there is always the risk that the downturn is sharper than we expect. And if that risk materialises, economic growth could slow markedly."

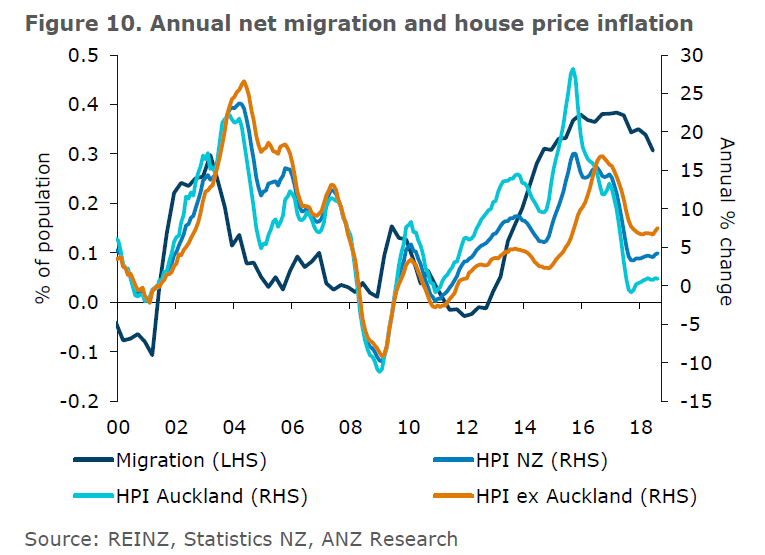

The economists say "another important channel" is the housing market.

Based on historical analysis, a 1% increase in the population has been associated with 7-9% higher house prices over three years, the economists say.

"A number of headwinds are affecting the housing market at present: LVR restrictions, government policy, affordability constraints, and credit availability.

"Nonetheless, it’s a fair assumption that a smaller population would mean less housing demand than otherwise, which would impact both house prices and residential investment."

The economists say that given New Zealand now has a large pool of recent permanent residents "who may have a higher propensity to leave" should economic conditions change, the risk that net migration exacerbates the next downturn – whenever that may be – is quite real.

They say is very difficult to forecast.

"In our view, risks are skewed to the downside."

There are a number of factors, they say that could cause migration to evolve differently to their expectations, including:

- Domestic or global economic conditions could surprise.

- The large pool of recent arrivals could be more inclined to leave again than assumed. Following the largest cycle of arrivals ever, might we see the largest ever cycle in departures? We won’t know for some time.

- Fewer (or more) arrivals could go on to permanent residency than expected.

- Migration policy settings could change. So far, the change of government has led to only relatively minor tweaks to policy, with the Government appearing content to let the cyclical easing continue. However, given the rhetoric leading up to the election, tighter policy settings remain a possibility.

- Non-economic forces such as geopolitical tensions could also enter the equation.

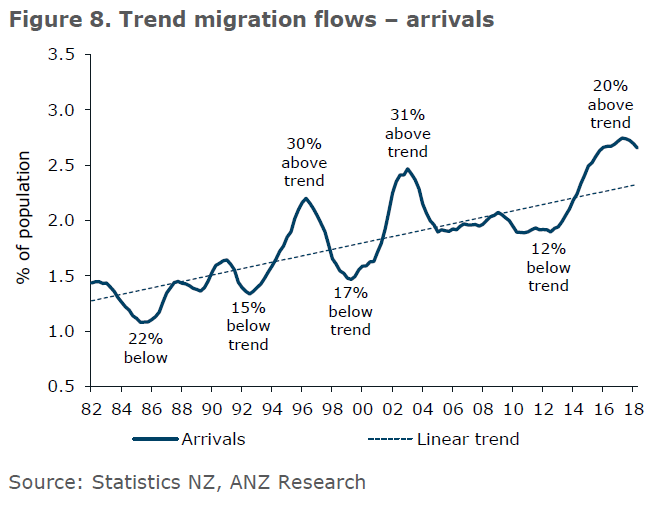

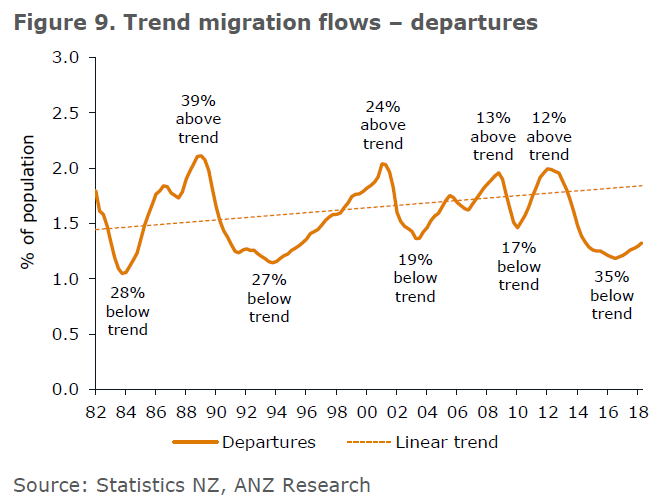

The economists then have a close look at the patter of historical deviations from trend to see how the migration cycle could evolve from here.

"While the estimated trend is sensitive to the choice of sample period, it is clear that over the past 30 years or so (up until the beginning of the current cycle), net migrant inflows have trended gradually higher."

The economists say that currently both migrant arrivals and departures are well away from their 30-year trends (measured up until the start of the current cycle).

"The current cycle peak in arrivals (as a share of the population) is similar to previous cycles, at 20% above trend in October 2017. But the trough in departures as a share of the population has been particularly low, hitting 35% below trend in September 2016."

In crunching some numbers, the economists say that If arrivals and departures were to return to trend within two years, "there would be almost 20,000 fewer people than our central forecast by Q4 2020".

Alternatively, an "overshoot" of trend in both arrivals and departures of 15% by end-2020 would lower the population by around 62,000 people relative to the economists expectations, This would be equivalent to 1.3% of the current population.

"All else equal, annual GDP growth could be 0.3%pts lower than our central forecast for 2.3% y/y growth at the end of 2020, although the effect is uncertain. And if migration continued easing beyond our forecast horizon, the effect could be even greater," they say.

Continuing the crunching, the economists say any reversal that saw arrivals (departures) 30% below (above) trend would be consistent with net migration "turning significantly negative and dragging on growth", with GDP potentially running at an "anaemic pace" of just 1.7% year-on-year by 2020.

"None of these scenarios would be unprecedented based on historical experience (in terms of magnitude, although the timing of reversals has varied). This highlights just how significant migration risks are for the economic outlook."

30 Comments

"All else equal, annual GDP growth could be 0.3%pts lower than our central forecast for 2.3% y/y growth at the end of 2020, although the effect is uncertain. And if migration continued easing beyond our forecast horizon, the effect could be even greater"

Well yes. But GDP is not necessarily an indicator of economic vitality. Migration obviously drives GDP through greater consumption, but what if GDP per capita is actually heading lower? Secondly, if housing and infrastructure are not keeping up with migration, the broader standard of living will deteriorate, despite the increase in population pumping GDP.

Same problem exists across the Tassie and the ruling elite is basically screwing people. This isn't about shutting up shop to migration. It's about having actual strategies to make it work and not relying on stupid debt-driven bubbles to drive the economy.

I'm yet to be convinced that if you take into account the entire cost of population growth (especially infrastructure and environmental impact including carbon liabilities) that it's even a win on the economic front.

This link estimates that when the population increases by 1%, 7% of GDP needs to be spent on infrastructure to keep up with demand. https://www.canberratimes.com.au/opinion/the-huge-hidden-cost-of-popula…

That's a scary piece of analysis that puts our infrastructure needs at roughly NZ$20 billion a year plus several billions in compounded backlogs from previous years of underinvestment.

Economic short-termism that was rather optimistically advertised as "Sound fiscal management".

Turns out, it was nothing of the sort.

I think I read somewhere that our infrastructure deficit is costed out at 128 billion.

Exactly.

The banks love immigration though don't they.

Quote from your link: ""population growth costs us over $500,000 per person added."". I find that figure high but not unreasonable. NZ stats publishes a figure for the value of public fixed assets which equates to over $200,000 per person; I guess this is all the roads and bridges and schools and hospitals but there must also be 'un-fixed' assets too such as trained teachers, police, health workers, etc so population growth could well be roughly $500,000 per head.

Of course if enough Kiwis leave we can keep absorbing immigrants but for those who believe in a fair go each immigrant ought to give $500,000 to the govt who then hands it to each Kiwi who leaves.

As the largest purveyor of household debt, they must be terrified.

They don't really give a rat's. Both sides of their bread is buttered. They live a gilded existence.

To a degree, yes, but when lower profits reduce the bonus it can be both painful and embarrassing when you have to halt the 'Country Club' membership.

@Nic ............ or send the new SUV or convertible back to he dealership

Indeed. One of my oldest friends never recovered from a spat with ANZ. They made sure of that....

"ANZ Bank's former institutional boss Steve Targett, who is suing the big four bank for $57 million"

https://www.theaustralian.com.au/business/bank-of-beirut-hires-steve-ta…

An economists idea of risk is too narrow.

There is greater risk to NZ of over population than there is to under population. But of course economist don't take science as part of their studies.

Lets face it, importing consumers is hardly a wise economic model.

What you get added to growth you lose on infrastructure, schooling and healthcare.

Better to have more growth per capita by improving automation and productivity

If there is another global shock, migration to NZ could slow significantly until the storm is over. Tourism is also going to slow significantly. When the last shock hit migration slowed dramatically in many countries that had previously experienced migration booms. Take Ireland as an example. We are obviously different to Ireland in many ways but there are some similarities as well. It's something to consider anyway as one of the many risks NZ may face.

The major factor that sets our economy apart from Ireland's is their large hi-tech export sector dominated by a few multinational players. A handful of global companies "account for 90 percent of all our manufactured exports, employ around 10 percent of the workforce and helped pull Ireland out of the eurozone debt crisis” as per Tony Foley, economics professor at UCD.

I don't see anything of material value in NZ that will help pull us out of an household debt led crisis. In fact, a recession would mean fewer of those hundreds of thousands of cooks, tour guides and baristas with permanent visas paying taxes and more of them milking our benefits system.

Rampant immigration - what an absurd dependency to be reliant upon.

So here we have it: GDP Growth is dependent on Immigration Growth.

As said above, this is ridiculous.

From New Zealand Immigration and the Political Economy - By Ranginui Walker 1994.

https://www.thesocialcontract.com/artman2/publish/tsc0402/article_316.s…

""Despite the flaws in the argument that a proactive immigration policy will resolve New Zealand's economic problems, and the lack of evidence that it will do so, immigration is put forward as the answer. ""

""This glossing over of Maori opposition is consistent with the procedure of elites generating policy from above and imposing it on the people below. ""

That was 1994, sounds like today.

He was a wise man.

If people think they have a housing crisis then just wait until they deal with the looming electricity and water shortage. Auckland does not have the electricity or water supply infrastructure for the population increases and Auckland does not have the money to solve this problem.

The only people raving about the benefits of immigration are immigrants from the third world and people making a living out of pimping third world labour, the average kiwi born and bred in NZ who can't afford a house and is facing a looming electricity and water crisis feels betrayed by the governments of the last 20 years. To top it off this latest government has offered these immigrants subsidised homes paid by NZ tax payers under the title kiwi build.

The government should just say PXXX OFF so we can put roofs over our own peoples heads and give our own people an electricity and water supply becoming of a first world country!

Well, Auckland property owners only want the free money betterment coming from that reliance on immigration, not the rates that are required to properly equip infrastructure.

Being a chief economist at a bank must be one of the cruisiest, high paying jobs in existence.

Just roll out the same old narrative, ad nauseum.

.....and perhaps one day get the top job at the reserve bank.

Rampant migration is creating major social problems in Europe, not that our MSM reports it honestly if at all. For example, Paris, France is no longer considered worth visiting by those that know what is happening there. I certainly hope our elites are wise enough to allow persons in on merit. But I am not at all confident they will.

I was there in 2011 the place was swarming with indians, pakistanis and other assorted immigrants, very different to how it was in the early 2000s

I was there on holiday this year; maybe you have to live somewhere to learn more but Paris seemed to be OK. On the other hand I was also in Lille, Belgium and Bradford on the same holiday - even those besotted by multiculturalism would have to admit they were not healthy societies. It is partly the numbers but mainly the way visible immigrants are doing the low level jobs. Quite different in Switzerland. It is the double whammy of low class and visible immigrant that puts a squeeze on the native working class and the unemployed. Sadly just beginning to go the same way in Auckland - there are certain jobs that seem to only be done by certain ethnic groups.

Population growth will increase ..

HOWEVER, I doubt growth will be driven by high skilled workers .. low skill workers are likely the only ones wanting to come here! Also, our current highly skilled workers will probably start fleeing NZ next year.

Makes sense to do so. The housing crisis has been so colossally mismanaged as to make the equation so much less attractive to skilled workers now. Construction workers are a fine example too, where wages are higher and housing costs lower in a place such as Brisbane.

It never made sense for John Key and Bill English to pretend no housing crisis existed.

It's all a big ruse anyway. Can we just admit our economy sucks and get on with fixing productivity! The first step to solving addiction is admitting to it.

The demographics of the country are changing. I can't go anywhere without hearing foreign languages. The UK and Sweden are now irreversibly Muslim countries. Vancouver is already half Chinese.

I don't want to live around people that want to economically or physically harm me.

I wonder if any of these economists and bank CEOs would pimp their wife or daughter out because it increased the family GDP.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.