The Reserve Bank has kicked off a public consultation process on potential changes its guiding remit for the Monetary Policy Committee. This may spark changes in its inflation target, or its employment target - or in how it balances the two inflation and employment objectives.

And there's also house prices. The RBNZ appears keen to remove direct reference to house prices from the remit.

The first remit was signed by RBNZ Governor Adrian Orr and Finance Minister Grant Robertson in 2019, and then amended slightly at the behest of Robertson to include reference to housing in 2021.

The consultation material suggests that instead of having house prices included in the remit, this could be included in the Minister of Finance’s Letter of Expectations to the RBNZ. The letter could define house price sustainability as a key research priority for Reserve Bank staff, the RBNZ suggests.

At the moment the current subclause 2(2)(d) of the remit says the RBNZ should assess the effect of its monetary policy decisions on the Government’s policy - which is to support more sustainable house prices, including by dampening investor demand for existing housing stock, which would improve affordability for first-home buyers.

Under the legislation passed in 2018, there is to be a five-yearly review of the monetary policy Remit. The Remit is provided by the Government and is used to guide the Monetary Policy Committee’s (MPC) decision making in its pursuit of low and stable inflation and supporting maximum sustainable employment.

Public consultation is open from June 1 to July 15.

“The Reserve Bank is seeking feedback to ensure that the Remit framework is the best it can be for our legislative purpose, and ultimately the prosperity and wellbeing of all New Zealanders. This is the first review of the Remit under new legislation that was passed in 2018,” Governor Orr says.

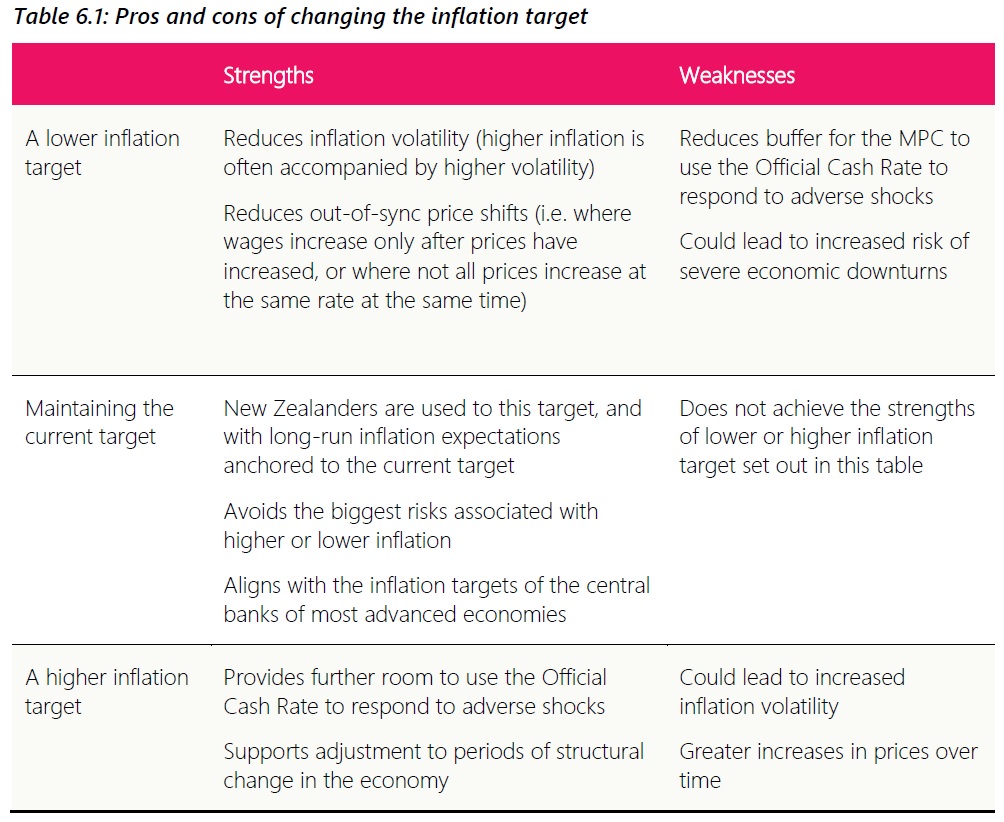

One key point of interest will be whether there may be any change to the current inflation target, which is a range of 1% to 3%, with the bank explicitly targeting 2%. Of course, inflation at the moment (6.9% annual rate as of March) is well above this.

One of the questions the public is being asked is: "Do you think this target is about right? If not, what do you suggest the target range should be changed to, and why?"

In the consultation document the RBNZ says "there are some arguments" for changing the specification of the 1% to 3% inflation target, such as by changing the targeted inflation rate, or by changing the approach to measurement of inflation for monetary policy purposes.

"However, it is not clear that these alternatives are superior to the status quo, and there are also significant costs to changing from the current inflation target specified in the Remit.

"Changing the target may reduce public trust in the price stability objective by creating an expectation that the target will be subject to further changes in the future, or cannot be achieved. In other words, expectations of future prices might become more responsive to changes in inflation, making it more difficult for the MPC to achieve price stability," the RBNZ says.

The central bank also notes that the Remit includes guidance on how the MPC should achieve its objective of supporting Maximum Sustainable Employment (the highest possible level of employment that does not generate excess inflation).

"The value of MSE at any point in time is uncertain, must be estimated, and is likely to vary substantially over time in line with factors that are outside of the control of monetary policy, such as demographics and labour policy.

"Although societies generally want high employment rates, the MPC does not set policy to persistently increase employment above its maximum sustainable level, as this would undermine its price stability objective," the RBNZ says.

The employment target was added into the RBNZ's monetary policy target by the Labour-led Government in 2018.

The consultation paper says the best contribution that monetary policy can make to employment is generally to set policy so that inflation is low and stable.

"However, in some circumstances, the MPC may face a trade-off between its objectives. The Remit could be extended to reflect the MPC’s current understanding that inflation forecast targeting is generally the best approach to achieving the dual mandate, and/or include more guidance on how to balance the economic objectives when they are in conflict."

The paper, in talking further about this balance between the objectives, says there are times when inflation can increase due to factors that have nothing to do with the underlying level of demand in the economy, such as when global oil prices increase.

"Such ‘cost push’ shocks can have negative impacts on household incomes—reducing output and employment—yet at the same time put upward pressure on inflation. If policy makers respond by tightening monetary policy (to reduce inflation), this will tend to put further downward pressure on output and employment, and vice versa.

"There is currently no specific guidance within the Remit on how the MPC should balance any trade-offs between its objectives. At present, when a trade-off does arise the MPC considers outcomes for both objectives in setting policy. In general, if employment is projected to be below its long-run sustainable level, the MPC will let inflation overshoot the target mid-point for a time, and vice versa (while staying within the 1%–3% target range).

"There is increased uncertainty on how to manage trade-offs between inflation and employment due to the nature of the economic objectives. The inflation objective is precisely defined and measureable, while the employment objective is imprecisely defined and not directly measurable. This makes it difficult for policymakers to accurately trade off these objectives in real time."

The paper asks the public this question on the issue: "Do you think the Remit should include guidance on the weight of the inflation and employment objectives? What changes to the Remit, if any, should the Reserve Bank focus on?"

Back on on the subject of house prices, the following question is asked: "Do you have any comments about the relevance of house price sustainability for monetary policy?"

The RBNZ paper says the Remit "could require" the MPC to take into account house price sustainability in its decision-making, to the extent that doing so did not undermine its legislated economic objectives of price stability and supporting MSE. This would require the MPC to consider setting monetary policy tighter than otherwise during periods where house prices are above their sustainable level, with the objective of lowering growth in house prices.

It says There are two possible benefits of this approach:

Deposit affordability: By lowering house prices, at least for a time, tighter monetary policy could make it easier for prospective buyers to afford a deposit to purchase a home. However, any improvement in affordability would be temporary because, as discussed above, monetary policy cannot persistently affect the sustainable level of house prices over time. Higher mortgage rates would also make it more difficult for both prospective and existing homeowners to service mortgage debt, and would have unclear effects on renters.

Financial imbalances and risks: Setting policy tighter than otherwise could also reduce the risks to the financial system and wider economy associated with unsustainable house prices. However, there is considerable uncertainty about how effective tighter monetary policy would be in limiting risks to the financial system. Although some research has found benefits from using monetary policy to pursue financial stability, most studies have concluded that the benefits are not likely to be large enough to justify using monetary policy in this way.

"The size of these benefits from using monetary policy to address house price sustainability are highly uncertain. In contrast, the costs of monetary policy being tighter than necessary to maintain price stability and support MSE—lower output and higher unemployment in the short run—are likely to have a higher expected value and are more certain. Having greater regard to house prices would also reduce the flexibility to use monetary policy to reduce volatility in short-run economic activity," the RBNZ says.

"Given the ways that house price sustainability is already taken into account by the Reserve Bank in its policy decisions, it is not clear that there are significant benefits in requiring the MPC to consider house prices through the Remit. To an extent, the MPC already takes unsustainable house prices into account through their impact on the economic objectives and financial stability. Moreover, financial policy can generally target financial stability risks in the housing market more effectively. Any additional benefits of tighter monetary policy for deposit affordability are temporary and are likely to be outweighed by the costs to short-run economic activity.

"The Reserve Bank will continue researching the interactions between monetary policy and the housing market. The Minister of Finance’s Letter of Expectations could define house price sustainability as a key research priority for Reserve Bank staff, as an alternative to the current subclause 2(2)(d) of the Remit. The current subclause has been misinterpreted by some as an active requirement to consider house price sustainability (rather than a reporting requirement).

"Over time, these perceptions may lead to unrealistic expectations about what monetary policy can achieve, and erode public confidence in the MPC achieving price stability and supporting MSE."

RBNZ Chief Economist Paul Conway is urging people to take part in the consultation process.

“Do people think the inflation target is about right? How should we go about supporting maximum sustainable employment? How relevant are major economic trends under public discussion, such as house price sustainability, distributional outcomes, or climate change? We hope to see a wide range of views,” he says.

People can have their say by completing a quick survey or by reading the full Consultation Paper and submitting feedback. The feedback will be used to inform an assessment of any possible changes to the Remit, which will again be consulted on later in 2022.

The RBNZ will then also seek views on the Monetary Policy Committee’s Charter – the document that sets out the MPC’s meeting processes.

The Reserve Bank’s advice will go to the Minister of Finance in 2023 for a decision on if and how the Monetary Policy Remit and Charter will change from 2023 to 2028.

53 Comments

How's that for timing...

Didn’t expect this to happen so soon. Change the rules to suit the game like sports.

So the new target range 4%-5%?

Why so low. They obviously struggle with a low target. Something a bit easier perhaps 0 - 20%?

Yes, why not, seriously. In a fiat money system, the value of the currency will eventually become zero anyway, it is inevitable. The current inflation is global, and muchly driven by supply chain issues. This cannot be addressed by interest rate hikes. It is illusionary to think the purchase power of the Dollar could be persevered.

The only question is, can we accept suffering inflation and 'offer it up' so to speak, as a good Catholic would. Or do we want to continue raising interest rates like a child on a temper tantrum, thus causing recession and potentially a deflationary crash?

Our debt-laden economy cannot stomach the current interest rates, let alone further rate hikes. Whether we like it or not (I don't), our economy is property market-dependent.

If we allow high inflation for a few years, the debt burden will be devlaued. THEN will arrive the Paul Volcker moment where interest rates can be hiked aggressively, to end inflation. Now is NOT the time to raise interest rates.

If you dont raise rates then you lose all tension over price. There is no need for business to be more competitive and find better solutions.

You will end up with a packet of weetbix costing fifteen dollars.A loaf of bread ten dollars.

if you think we have problems with a few ram raids now wait until that happens.

"Everything Is Awesome!"

Everything is cool when you're part of Zealand Team;

Drink over-priced coffee (awesome!)

Buy over-priced houses (awesome!)

Buy over-priced stocks (awesome!)

Everyone's living the dream...

Can see a pattern forming.

The rules around Debt to GDP too tough. Change them

The rules for inflation targeting too tough. Change them

That's what you get when monetary policy tries to make for fiscal policy failure - the usual ambulance at the bottom of the cliff approach adopted by whoever runs the government.

For as long as we are going to have muppets at the government and at the helm of the RBNZ, both promoting the delusional thinking and the fool's paradise of recklessly loose monetary policies and public debt policies, this is going to keep happening again and again.

Seems to be modus operandi nowadays to create organisations and authorities whereby one side can easily blame the other and the truth of the matter just be left in no man’s land. This is rampant in local government where elected councils and regional councils have mastered the technique. And for anything really tricky, employ consultants. Such employment always carries a disclaimer removing any liability from the consultant if things go pear shaped. That way the employer has someone to blame. This government though, prefers to call ‘em experts.

They've been hostage in some ways to the poor policy brought by MPs, who imagined that pretend economic policy of selling houses to each other for ever larger amounts of debt could stand in for actual economic policy focused on productive enterprise and achievement.

And fast tracking immigration as we are apparently desperate.

http://survey-au.dynata.com/survey/selfserve/53b/2205273?list=0#?

Best way to share thoughts with RBNZ if you’re not inclined to do a full response is via the survey link above … also available on their website

Best way to share thoughts with RBNZ if you’re not inclined to do a full response is via the survey link above … also available on their website

Wow. They commissioned the data collection to Dynata. Frightening.

So, entered my age, gender and location. 9% completed [maybe], but...

"Thank you for completing our survey".

Apparently middle-aged men are already spoken for, I guess.

I tried filling it out with alternative demographic characteristics. Got the same result. Maybe they got 10 submissions then decided that was enough of hearing from the unwashed?

Maybe have another try? It worked for me just now. If you have any experience with IT systems in the public sector (lucky you if you don't), you'll get why multiple tries are often the way to go.

Thank you for sharing the link.

I was able to complete the survey. The questions seemed sensible to me, although I do find it frightening that the people who are supposed to know what is best for the country ask questions like these to plebs like me (I have no background in finances or economics). But oh well, it's nice to get an opportunity to tell them that I'm worried they're screwing it all up! :-D They do seem to be pandering to the wants and whims of the asset-rich at the expense of the rest of society.

So adjust monetary policy settings to accommodate persistently high inflation as long as a bigger percentage of our workforce is employed.

As usual macroeconomists are doing what they do best: oversimplifying complex issues with simple numbers and ignoring qualitative aspects of employment.

For example, the average wage across the hospitality sector (all ranks and experiences included) was found to be $2.58 over minimum wage in 2019, dropping to $2.28 in 2021. Low joblessness from a bigger army of workers serving lattes to foreign tourists and a few wealthy Kiwis isn't worth higher living costs.

That's what governments and economists do. Over simplify a complex issue. Remedy the issue with a solution that doesn't take into account all the variables. Then suffer down the road from the law of unintended consequences.

Look at the RMA for example. A piece of law aimed at protecting the environment has contributed in a significant way to our housing crisis.

Deflation is what should be expected when a society becomes more efficient. That's why we have had consistent and enormous price falls (per unit of quality) of electronics for the past four decades. That's deflation in a limited sense. A cellphone you can purchase for ~$100 now far exceeds the capability of the first camera flip-top phone I remember seeing in 2002/3, which cost ~$1,000 at the time. It seems to me that there's merit in generally explicitly targetting a 0% inflation rate.

That is more down to advancements in technology. New tech is also not as well made and put together as older tech, so the material costs and manufacturing can be lower.

Yes it is. That's the point. We should expect to produce more at lower cost over time, ergo deflation should be the default assumption, and inflation an aberration. A 0% rate seems like a compromise.

Can't meet the target? Change the target!

Unreal. Absolutely unreal. The PTA is one of the core foundations of financial stability and consumer confidence in NZ. Rather than reconfigure monetary policy and decision-making to hit it, we're going to change it to enable the sort of monetary policy and decision-making we've seen to date.

If you've damaged the credibility of an institution by constantly missing its most visible benchmark then there's a laundry list of other stuff that should happen before "just change the target" becomes number one. It's like we're not even trying anymore.

Orr must go. Now. He has done enough damage in the last 2-3 years with his ultra-loose monetary policy. Also, adding "full employment" to the remit of the RBNZ has been one of the most stupid decisions ever made by a government in modern times.

You forgot to throw in Grant Robertson as well. Equally to blame.

Did this really happen

The 'how will we lose votes ' public consultation.

How about we all submit saying that rents and house prices should be considered in inflation metrics?

It's simple control theory, really. You can't control what you don't measure. And your ability to control is proportionate to your sampling frequency.

At the moment housing costs in inflation are only measured via rent, and even then given an absolutely tiny weighting. And the OCR control changes are very far between.

It's a system primed for instability.

They won't allow that. How can they keep persuading people to continue to play a part of their ponzi scheme if they allow it?

Having a fixed value (2%) for such a dynamic and hard to target variable always struck me as silly and naive. They should just set the range at 0-3% and be happy as long as it's anywhere in that range. Targeting a single number leads to excessive tinkering and a "whipsaw" policy regime. Panic loosening followed by panic tightening - seems to be the essence of "least regrets" as advocated by Orr.

Note that the band approach (with no midpoint target) was the approach applied in the original Reserve Bank Act legislation (except back then the band was 0-2%).

Suppose they have to be careful not to be tasked with solving political issues with fiscal tools..!

The housing affordability and full employment remit was a bit of a hospital pass by incompetent politicians

Issue is the RBNZ has been a major contributor to the current debt burden and inflationary pressures and may simply want to move the goal posts to claim success?

Who knows... all I know is that I won't be voting for labour

Remove the unemployment one

How to completely destroy the credibility of a once globally respected institution the RBNZ

At the moment the current subclause 2(2)(d) of the remit says the RBNZ should assess the effect of its monetary policy decisions on the Government’s policy - which is to support more sustainable house prices, including by dampening investor demand for existing housing stock, which would improve affordability for first-home buyers.

Impossible while RBNZ capital risk weight policies encourage banks to maximise shareholder returns by extending ~60 % of their lending to collaterallised residential property mortgages attracting decidedly lower risk weights.

Banks have migrated away from lending to productive business enterprises because the risk weights can be as high as 150%. Thus around 60% of NZ bank lending is dedicated to residential property mortgages owed by one third of already wealthy households

According to the Reserve Bank, the new capital requirements mean banks will need to contribute $12 of their shareholders' money for every $100 of lending up from $8 now, with depositors and creditors providing the rest.

Neoliberalism impoverishes. Neoliberalism is a class war against labour by finance, primarily, and a class war against industry. A class war against governments. It’s the financial class really against the whole rest of society seeking to use debt leverage to control companies, countries, families and individuals by debt. And the question is, are they really going to be able to convince people that the way to get rich is to go into debt? Or are other countries going to say, this is a blind alley. And it’s been a blind alley really since Rome that bequeathed all the pro creditor debt laws to western civilization that were utterly different from those of the near east, where civilization took off. Link

Rents are continuing to rise in the US. According to realtor.com, February 2022 was the seventh month in a row with a double digit increase in rent prices from the year prior. Rents in February were 17.1% higher than in February 2021. The median rent in the 50 largest metro areas has risen to $1792 a month.

This is why the United States cannot industrialize as long as the house prices absorb this high a rate of income, and as long as the banking sector is supporting this, and as long as the political parties say we will not tax real estate so that all of the rising land value will be able to be pledged to banks to pay interest instead of to pay taxes. Essentially, it’s the (lack of) taxing of real estate in the United States that has subsidized the increase in housing prices, because housing prices are worth whatever a bank will lend to buy a house. If you have to go to a bank, and if they lend more and more and this money isn’t taxed away, the price is going to go up. So you have the government policy, the bank policy, all trying to promote this high diversion of income into paying land rent. Again, this is the exact opposite of what Adam Smith and John Stuart Mill and classical economics and the whole 19th century had advocated. This has priced American labor and industry out of world markets.

If you have to pay 43 percent of your income for rent, then even if the government were to give you all of your goods and services for nothing, all of your food, all of your clothing, all of your transportation for nothing, you’d still have to pay so much money for rent and for health care that you couldn’t compete with labor in Asia or the Third World or even Europe. And so this is what has essentially excluded the United States from having a successful empire. It’s the greed of the financial sector, basically, and the takeover of the government by the financial sector here as happened under Margaret Thatcher in England and then Tony Blair. You’ve had both countries essentially enter permanent austerity programs, and the only way to cure this is for housing prices to go down. But if the housing prices go down, then the banks will go broke. That’s why Obama said he had to support the banks: because if he’d actually lowered the housing prices to realistic levels, that would enable America to survive, but the banks would go under. Until you’re willing to restructure the banking system, you’re not going to be able to industrialise the American economy. - Link

No mention of housing but will act or change policy in such a way that it supports housing ponzi.

When price were rising in double digit on a monthly basis, if not weekly than the policy was wait and watch but just two months of house price fall and are active.

"Having greater regard to house prices would also reduce the flexibility to use monetary policy to reduce volatility in short-run economic activity," the RBNZ says."

For fucks sake.... How does this shit come out of their mouths? They are delusional, if they believe this.

Central Banks are the amplifiers of volatility... The blowers of bubbles.

Took me yrs to realize that they know and understand far less than they want us to believe they do.

Central bank have become ,more and more , a part of the political economy....

I dont trust them to make wise decisions.

Would love to understand if house price stability, as well as sustainability is being considered. A housing market with wild swings upwards or downwards is not good for a nation.

Muppets!

Edit: Absolute muppets!

Here it comes, buckle up for more rushed, knee jerk, ill considered and irrational decisions that will no doubt make things worse. Honestly, seeing those two sitting together with pens in their hands and smiles on their faces scares the crap out of me.

Have MPs and RBNZ staff been selling off rentals and about to pile into bitcoin?

Looks like another win for the conspiracy theorists

"In the consultation document the RBNZ says "there are some arguments" for changing the specification of the 1% to 3% inflation target, such as by changing the targeted inflation rate, or by changing the approach to measurement of inflation for monetary policy purposes".

This is interesting. I think they will go down this road. By altering the basket of goods the RBNZ will be able to drive down CPI several percent towards the target band.

All in all it looks like our currency is going to lose its capacity as a store of value. So Kiwi's will be forced to store wealth in real assets. A tedious process that creates a whole raft of other issues.

I don't know if the basket of goods is ever static for that long is it?

And CPI is recalculated every time the basket is re-defined?

I mean they do all sorts of hedonic and quality adjustments to beat it down. However this sounds like they are going to start adjusting it in a structural way.

At the moment. I think "true inflation" is about 3-5% higher than CPI. These structural changes may make it 5-7% higher.

All in all the NZD will not be a good store of value for wealth.

OK - so why do we target 2%?

Why do we not target 0% or a negative (i.e lower prices)?

Inflation is a tax - don't forget it.

Why do we not target 0% or a negative (i.e lower prices)?

Monetary policy ( mainly jaw-boning) is ill equipped to challenge entrenched deflation.

This is like a flat earther asking for feedback on their plan to circumnavigate the planet.

1) The only logical inflation target is 0% but we aren't willing to accept the higher interest rates and higher unemployment that goes with it.

2) Housing (house & land capital prices) should absolutely be included in the measurement of inflation as it used to be. Housing for everyone except investors is not an asset but an essential service. The current absurb peak in housing (house+land) prices would have never occurred had housing been included in the inflation measure as interest rates would have stayed much higher than the circa 2% low they briefly bottomed at.

3) The RBNZ should be prohibited from dropping the OCR below 3% - 4% as asset prices are proportional to 1/(interest rate) & low interest rates simply blow asset bubbles. If inflation requires theoretical interest rates < 3 to 4% then the government should use helicopter money and fiscal policy (this could include the immigration rate) to do the leg work.

If I where going to make a recommendation it would be to move the target band back to 0-2% CPI where it always should have been.

These people are corrupt. They keep getting it wrong then instead of fixing it they shift the goal posts. Inflation hurts all but the lower to middle class the most and now they are priming us with discussion documents to lock higher levels in.

The quicker the OCR gets to the projected 4% the better.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.