Budget 2023 has delivered a surprise $5 billion of new spending in the next year, which could fuel further inflation and trigger a reaction from the Reserve Bank next week.

This is despite talk from the Beehive of a budget that would focus only on the basics and do what it could to dampen down inflation.

Much of this is due to the cyclone rebuild, and was therefore unavoidable, but some extras were included as well. Notably 20-hours of free childcare and cheaper public transport.

ANZ’s economic research team said the ‘No-Frills Budget’ definitely contained frills from a macroeconomic perspective.

The current economic context was not conducive to further fiscal expansion, and yet the Budget added more than $5 billion of extra spending over the next year alone.

“That’s around 1.4% of GDP that the RBNZ wasn’t previously expecting based on the Half-Year Update, and could have implications for the interest rate outlook,” the bank economists said.

A Treasury report from March last year said as a “rule of thumb” additional fiscal stimulus equal to 1% of GDP would push the Official Cash Rate 30 basis points higher.

ANZ economists said it was therefore “odd” that the Treasury hadn’t incorporated a stronger monetary policy response into its economic forecast.

The RBNZ has explicitly warned the Government that any expansionary fiscal policy will be met with higher interest rates.

Trimming the frills

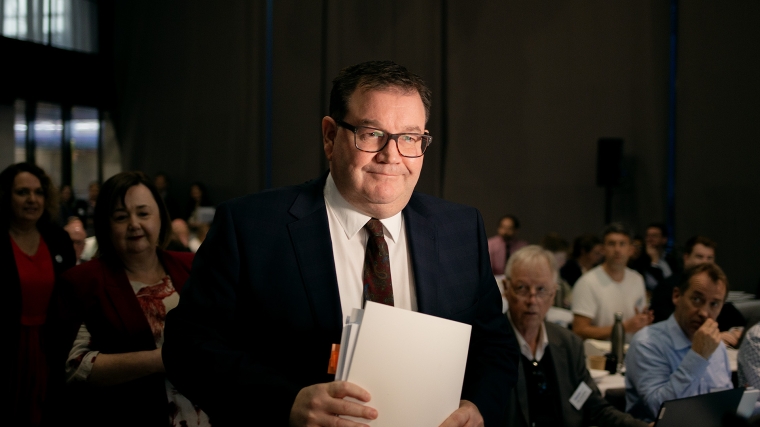

Finance Minister Grant Robertson said in his speech that the budget would target spending to help households with the cost of living, but not exacerbate inflation.

This is true only in the latter years of the Budget 2023 period, which are forecast to be contractionary and are subject to change.

Each annual budget covers the following four years and comes with the opportunity to increase or decrease previously planned spending.

Contractionary settings could never materialise if future governments decide to fund their own priorities, without creating room for them.

Operating spending—or OBEGAL—in the 2023 fiscal year will be a deficit of $7.6 billion and only return to surplus in 2026.

This will contribute to net debt climbing from 18% today to 22% in 2024, before retreating to 18.4% at the end of the forecast period in 2027.

(For readers who prefer the old debt measure, the equivalent numbers are 38.5%, up to 43.1%, and back down to 37.3%.)

Even a surprise tax increase, lifting the trustee rate to 39%, will do little to offset higher spending. It was forecast to bring in a total of $1.1 billion across the next five years.

S&P Global Ratings said the budget projected central government cash deficit for the 2023 fiscal year would be 6.5% of gross domestic product.

“This is a big uptick from the 4.3% deficit penciled in five months ago, and 2.2% a year ago. However, we still anticipate fiscal improvement in the subsequent years as emergency spending programs are rapidly phased out,” it said in a note.

The credit ratings agency said it was not worried about New Zealand’s debt levels, which it said were in the “midrange” of 18 countries with an ‘AA’ rating, but wanted to see stronger fiscal metrics.

Budget 2023 relies on future governments delivering on those better fiscal metrics and not being tempted into repeated deficits.

Cyclone Gabrielle and other infrastructure investment has played a significant role in pushing spending upwards, although operating expenditure has increased as well.

Robertson lifted the 2023 operating allowance to $4.8 billion, down from $5.9 billion last year but still $300 million above the budget policy statement in December.

The cost of the four headline policies in the cost-of-living package comes to $2.6 billion across four years, but only makes up a chunk of the $14.1 billion of new spending.

Robertson said a majority of new spending was consumed by cost pressures, as inflation increases the cost of providing government services as well as boosts tax revenue.

Massive infrastructure programme

In addition to the ongoing operational spending, Budget 2023 provided for $10.7 billion in capital spending and set aside another $6 billion to be spent in a National Resilience Plan.

The capital expenditure in the budget includes $6.7 billion to build public housing, $1.3 billion to build new classrooms, and $197 million to support City Rail Link.

In addition to these projects, a yet-to-be defined National Resilience Plan will be given an initial $6 billion. This will first be spent on reinstating road, rail, and local infrastructure damaged by Cyclone Gabrielle.

The government will also spend $100 million over five years to repurpose the Christchurch rebuild agency, formerly known as Ōtākaro, into an infrastructure delivery organisation.

It will be rebranded as Rau Paenga, or the Central Crown Infrastructure Delivery Agency, and will support less experienced organisations with large, complex projects.

Recession avoided?

Six months ago the Treasury expected the New Zealand economy to contract 0.8% in 2023, but it now expects 1.1% growth without any further increases to the official cash rate.

“While we no longer anticipate a technical recession during 2023, growth remains low and labour market conditions will deteriorate,” the agency said in its economic and fiscal update.

Despite this improvement, it has forecast the Official Cash Rate to be held at its current level (5.25%) throughout 2023, then falling to 3% by 2027.

ANZ recently lifted its Official Cash Rate forecast to 5.75%, but said the budget adds upside risk to even this forecast.

Earlier this week Westpac upped its forecast to predict a peak of 6% and the RBNZ itself has signalled a 5.5% rate, which throws some doubt on Treasury’s numbers.

But if they are to be believed, the Budget will deliver a $4.9 billion boost to nominal GDP over the forecast period.

This will allow the unemployment rate to peak lower than expected at 5.3%, but would likely stay high for longer as interest rates are held at 5.25% longer than previously forecast.

Even though their forecasts include stronger employment and a lower Official Cash Rate than some others, Treasury thought inflation would be back in the target range by December 2024.

The bad news for homeowners is that house prices would fall another 4.6% in this scenario, bringing the total peak-to-trough decline to 21.3%.

The recovery was also expected to be much slower than previously forecast, with house prices still well below 2021 levels at the end of 2027.

84 Comments

Adrian!

"The recovery was also expected to be much slower than previously forecast, with house prices still well below 2021 levels at the end of 2027"

But obviously then they would double between 2027 - 2031........right so that the mantra of doubling every 10 years is true. Yeah?

Is that quote from Westpac or the RBNZ? Hard to tell. More weight if RBNZ.

It’s from Treasury!

RBNZ will see 9.6 bil over 4 years and we going 50bps

You want a side bet?

I want the TAB thing where I can choose 25 or 50 and i get a bonus bet if wrong bucket.

They called it a "low frills budget" some time back. The media on "copy and paste" used they repeatedly.

It was , unfortunately, not a low frills budget. High five Grant, they fell for it again.

I'm not sure why my comment was deleted the other day when I pointed this out, but it looks like the government may have earmarked almost half a million dollars of tax payer money per year for Kate Hanna's "disinformation project". Here's Sean Plunket, from The Platform, talking about it with Jonathan Ayling from free speech union. Is this a good use of tax payer money? What outcome is this likely to yield?

Is she some sort of qualified truthsayer?

What are her credentials?

She's a self-professed Marxist / postmodern-critical-theory advocate with a Master’s degree in History.

fat pat,

Interesting stuff. I am a member of the FSU and regularly support them financially. I am particularly worried by the extent to which our universities have gone down this rabbit-hole. They should be bastions of free speech, but all too often no longer are.

That's a worthy cause to support linklater. As far as I can tell disinformation seems to be a euphemism for "disagreeing with the government" and Kate Hannah's unit are professional denouncers. The media, which also draws funding from the government through the public interest journalism fund, hangs on their every word. It's scary stuff.

I'm out. Not waiting for the election. Peace, love and co-governance, everyone.

That's good, because even if your desired party got in, it'd be years before their amazing policies made your life any better.

Go hither, and make your own changes.

It’s the right thing to do. NZ is stuffed. The country loses a tax payer and a football coach (I think you have mentioned) so someone who is positively impacting the local community and the government just don’t f##ken care. My bet is within 10 years this country will be a third world shit hole that is studied in finance papers to educate students what not to do.

I've been to the third world many times. I'll take that bet.

So have I. Bet done, only problem is you won’t be able to post how crap NZ is in ten years anyway…..disinformation project and all, and I will be in Australia.

Ah yeah, Australia, the place with all the same problems (or more), but with mineral wealth.

You have hit the nail on the head, Aus can have greater deficits and borrow more as borrowing is under pinned by assets waiting to be dug up. They also have all the assets that underpin our debt. Yes they ignore the environmental costs as those costs are socialised. We ahve taken the high road, unfortunately thats not stopping the tide.

If we borrow to their level how will we pay it back, employing more people in government jobs is like growing the economy by selling houses to each other. The can is getting fragile and is not travelling down the road as far.

Also what underpins our debt?

Well Pa1nter, if Labour get back in then at least you will not be responsible for any carbon emissions getting there once again; you won't have to travel.

Where are you heading to nktokyo?

Send it. The higher the better. Talking for my own interests.

All the best investments involve huge amounts of finger crossing and hail marys.

Do you sail JC?

I have from a young whiper snapper p class kid, until the 2012 Tiburon Etchells Champs.

Have represented NZ a few times, but the AC, Grant Dalton, AND THE NZYF PUT ME RIGHT OFF. 🖕

I sailed Etchells out of Cowes.. tough fleet. full of world champs

Same here, sadly all that money spent and I don't get a cent, The only way I benefit is if it pushes the OCR higher than it would have gone. Sad state of affairs to be honest, could have been so much better.

A lacklustre budget from a Government that appears to be treading water. The prescription co payments measure is wasteful because it’s untargeted support that goes to people who don’t need it. Big chain chemists don’t charge it anyway.

free public transport for young people? Meanwhile everyone else pays more when short term subsidies are withdrawn but the services themselves are unreliable, either late or cancelled.

Early child care subsidies for 2 year olds? This is actually a sop to a sector that is contracting. Just so Mum’s can get back to work because the Labour market is so tight.

I had to laugh at the headline figure of new spending. Nicely matches the reprioitisation savings from the other day

Yeah I agree. It’s a weird budget, from a weird government.

Mad as meat axes. Mummy and Daddy won't use the train as it only for the poor in NZ, little Martha (6 yrs) is too young to ride alone in a dangerous place.

Better to stop spending and let inflation retreat.

Big bad landlord is gunna increase rent again sucking up the daycare and transport subsidy.

Meanwhile the NZD will lift and our exports end up less competitive. Mummy and Daddy may lose their jobs. Fat lot of good the daycare subsidy will be for them now at home on the dole.

Big win Mr Sausage Roll and Mr Cheese Roll.

Dare I? Dare I? Dare I say, I want Ruth Richardson to come back - just for a little bit. This country needs a hell of a kick up its lazy short focused low educated a.r.s.e.

Would a National finance minister really unwind so much of the long list of benefits and payments from the tax payers that ultimately flow up to business owners?

No, but Seymour might

Removing the subscription charge actually saves the health system money by reducing the number of people who turn up at hospitals. Inexpensive medicine is often effective to cure a simple problem before it becomes a big problem, but the surcharge was a barrier for low income individuals, many of whom have multiple health issues.

So that policy gets a thumbs up from me.

Yes but have you tried to get into a GP lately and even when you do, their fees have gone up so the $5 saving seems like nothing.

Redcastle?

Should be deep blue,given your comments. I am not a Labour voter, but support the waiving of the $5 pharmacy fee. There are a great many places in NZ with no Chemist Warehouse and to those who need multiple medicines, this will be significant.

Ideally, a targeted approach would be sensible and perhaps it should be restricted to those with a tax rate under 33%. That would exclude me, but I'm ok with that.

The maximum the prescription charge removal will benefit a household is $100 per annum. Once you hit 20 prescriptions the rest for the year are free.

Correct, the west coast will be loving it

Don't worry, the big election spend-up is yet to come from Labour.

The Government is throttling the economy with its ever increasing spend as a % of GDP.

im disappointed with its unwillingness to invest in infrastructure. We need roads and bridges that cater for all users.

Any stats to back that up?

You seem to have missed the $17 billion infrastructure spend above.

Is that the money from the train set for Auckland or the cancelled Otaki to Levin motorway

When was the Otaki-Levin stretch cancelled? Any links?

It was never cancelled, but that was a talking point that National were trying to push.

https://www.1news.co.nz/2019/11/25/national-joins-horowhenua-locals-cal…

I heard the cost has doubled since the original business case came in with the BCR of 0.2... so 0.1 now?

Yeah, the one thing this government is doing is spending on infrastructure. Something like $45b over the past five years with $71b planned in the next.

Whether there is enough people and resources to get much finished is a different question

You've highlighted it, I think a key difference to observe is spending on infrastructure vs delivering infrastructure.

We all know there are low hanging fruit begging to be picked, but no one wants to upset the status quo of (I'd hazard a guess) say, <50% of the designated infrastructure budget going towards actual labour & materials to build said drainage, retaining, road or bridge etc.

Damn right. How much was spent on the Auckland harbour cycle bridge? And how many bricks were put in place. 2nd harbour crossing, anyone?

Just like the health budget. Most of it is sucked up by PR bullsh*t, working groups, consultants and Te Tiriti advisors

Please look at the actual data. Inflationary pressures are collapsing, because, guess what? It was 90% offshore pressures. RBNZ will be in retreat by September.

It was 90% low rates during covid followed by 40% Russia, followed by 30% increase in min wages........... but who is counting JFoe you used to provide balanced opinion now you just seem to sit to the Left.... who do you see wining the election and why?

Bull shit. 90% internal pressures.

Take fuel . Prices are set by the NZ cartel after Opec cartel stuffs around with it. Then the biggest influence to nz prices is the government taxes.

The trade deficit is not overseas controlled its NZ "screwed up" by no NZ Manufacturers, and poor export levels

Yep, timber price plunged.

Construction related labour rates and the associated margins are coming back to a level of common sense [material price +5% overheads +10% margin]. Poor bu .g.gers giving up their 40 to 100% mark-ups.

Time to give back your baches, jet skis, and utes.

The margin on a new house build is 5% or less.

Robertson has thrown down the gauntlet to Orr. He has spiked Orr's Inflation Gun. Interesting challenge.

Orr wins, he has a committee to hide behind, even though we know he votes first..... Grant and Liebour charge into the valley of death.... it's going to be a brutal ambush. So many people I know who voted Labour are now offering up "Jesus I hate these pricks..." before I even ask... JA did a dis service to Liebour, a winner does not leave a sinking ship.... she has made us ask why did you leave... answer we are dysfunctional.

Yeah no gas left in the tank excuse...That's why a near 80 year old Biden is running for another term running a country of 330 million people in a role that must be 10 times as stressful as the NZ PM.

No gas left to torch this country to the ground.

This is all starting to get serious now. These clowns are all smiling and standing up and clapping in parliament. If I wasn't in my current financial position I now would be shit scared of what's coming. The election will not come fast enough to get this lot out for most people.

The opposite could well be true.

Interest rate hike only seem to be driving down house prices (which most people want) and affect only a small % of the population directly (leveraged up peeps) who are probably mostly ACT and Nat voters. By spending big laboir avoid a recession at least before the elcetion they do.

The poor to mid class really dont have capacity to link the cost of their weekly shop to the budget of Grant ( its too complex to reason)... but they do see he gave them some extra lollies in their bank for childcare and benefits and he helped them keep their job - so will like him)

Luxon remains a mid aged, wealthy business owner who nobody relates to and with no policies of his own that will help anyone but landlords and big business. Nothing to see there folks. (Tbh i dont really consider running airNz which is almost a monopoly the same as building your own pvt business in a competitive environment).

My money is swinging back toward a lab-maori-green victory. Might be good if then nats finally get the message and rebuild under a good leader.

Ah, every single FHB is leveraged mate. It's not just 'Act and Nat' voters...

Just wait until the FHB who bought during the last few years realise their 20% deposit has gone. When they lose their jobs and their homes I wonder how they will feel about having to save 20% deposit all over again.

Yes but the 20% deposit will be less this time, although the fact that a bank is unlikely to touch them for at least 5 years (if the sale is a mortgagee sale- or they cant pay back the full amount still owed) might be a challenge.

By they get to save the 20% again after paying higher rent and cost of living expenses, house prices will have rebounded. So the lower deposit you talk about needing now will be irrelevant.

Correct and human nature being what it is they will all look for someone to blame and that someone is Labour.

Yeah. But they only care for votes. Total no of labour voting recent leveraged FHBs will be small (they threw them the childcare stuff as some will stick with them for that).. vs total maori/ poor / tenants who are their base and who they are throwing lollies at. Luxon has gifted them their entire bases votes by supporting landlords and refusung to work with MP.

Most older peeps who own homes want affordability up . Which this also achieves. For business owners it lessens recession risk which we like.

Unfortunately we live in very divided, misinformed and selfish times. Don't be surprised if we end up with this same bunch back in again after the popularity contest/election, things are bad but they can still get worse.

Spend spend spend. Based on spend todate just no faith in any constructive outcome. Overseas rating agencies will not look favorably on this. Rates higher for longer. NZ housing speculation takes another hit.

Is it .5 or .75 next week...?

I listened to the whole budget speech and responses from the opposition. It sounded as though Luxon had forgotten to prepare anything. His delivery was awful, it was like the rantings of a bloke down the pub. David Seymour was articulate, had a plan and sounded like a leader. Rawiri Waititi and Marama Davidson also delivered well for their audiences. It was good to see the Greens getting back to Environmental issues and poverty reduction and away from the fringe identity stuff. Chris Luxon might be a good manager behind the scenes, but he is not Prime Minister material. Are we looking at an Act/National government rather than National/Act?

Grant probably anticipates paying for the spend up with a new wealth and CGT in their election manifesto so will easily pay for it when they are re-elected?

$3.1 billion for 3,000 new state houses = over a $1million for each house - must be very nice houses!

See my comment above, $800k+ of that $1M will be for land, council, compliance and consultant costs.

I was involved HNZ emergency housing years ago and the engineers fees for foundation and civil DESIGNS (+ council costs), were as much as my build cost for the HOUSE. 100m2 ish 2 beddies. About $150k per lot.

Had a chat to a friend last night who has a trust fund - middle income earner - rental property in it.

He was unfazed by the trust tax increase - he shrugged - said it will mean an increase of $1200 a year in tax for him - he said the $40 rent increase he will put through over the next 2 years will cover it -with some more left over.

Thats the thing with these changes - its the unintended consequences - the trust isnt paying it- the renter is, but thats how it always goes.

Trickle down economics at its finest.

The more the govt intervene, the more the market gets distorted in some respects. They can pass whatever laws they choose but they can't fight human nature

That's not trickle down economics ikim, it's Government interference in the market. You get exactly what the Government gives you and Labour generally give the people that vote for them a shit sandwich. And then, hilariously, after eating the shit sandwich, they vote Labour again!

the definition of trickle down economics is a term used in critical references to economic policies to say they disproportionately favor the upper end of the economic spectrum.

Here Labour has implemented a policy designed to "hurt the upper end of the economic spectrum" but the reality is the pain can be passed on - ie trickled downwards - in this case the pain is passed downwards to the renter and its the renter who pays the cost not the intended person.

This is not too dis-similar to similar policies such as the GST being added to Kiwisaver last year or compliance costs/ fees and even excess profits taxes- ultimately the person who the pain was designed for - will pass them where-ever possible to a person lower than them in the chain.

that only works if he keeps his tenant. only takes a couple of weeks empty to negate a rejected rent increase.

So dumb.

Politics working against getting inflation down by throwing out a $5bn sugar hit that will quickly be eaten and forgotten - all in aid looking like they're doing something for election purposes.

In the meantime, don't think about inflation folks - eating away at your savings and the value of everything you own, pushing up the prices for everything and causing the RBNZ to have to raise the OCR even further just to balance.

Even treasury now admit it's higher for longer - the short sightedness of our politicians is staggering.

Of course raising the OCR isn't popular, oh woe my mortgage now costs more - people seriously need to be educated on what inflation is doing and what the medium term consequences are. Longer term we become a banana republic and the NZD isn't worth the paper it's printed on.

Tbh the other lot aren't much better, bleating as they are about tax cuts - which are also inflationary.

If any of them had an ounce of financial sense they'd batten down the hatches and work with the RBNZ in the short term to smash inflation by cutting spending as much as possible - then in the medium term when inflation was under control they could bring out the lollies again.

But no, 'have to spend - it's an election year' - in the knowledge that the vast majority of voters do not understand inflation - but do understand that $5 they now save on prescriptions yay!...

Is there any truth in the rumour that Chris Hipkins did a cameo performance of Shiley Bassey's Big Spender as Grant Robertson entered the room for the after budget party yesterday ?

A creative budget is expected from a finance minister with only an arts degree. At least we'll be well served with Kapa Haka for the next year. $34M buys a lot of dance moves.

Wow must be awesome money teaching that, what are the teachers on $200k each?

personally I'd rather kapahaka than the symphony, but prefer to cancel them all and the ballet and the sports in favour of health and beazley homes for the youngsters

Call for aggressive 20% OCR !!!! RBNZ must increase OCR to 20% to bring NZ into another 1930s or 100 time worse . That is only to destroy economy to bring down the inflation and make sure unemployment stay 80% . Only government employees have jobs. Rest of people live on benefits. Go RBNZ !!!!! Aggressive!!!!!

Yet the government paid off left wing media is trying to spin this is responsible and no frills, this government really got good bang for it's $55 million bribe money it gave to the media (the NZ journalism fund).

This government never gets held to account for anything by them, they just act as cheerleaders.

Robertson, you just cost middle NZ hundreds of millions with your $5 billion slosh up, interest will go higher again, and stay higher longer now.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.