Independent global economic researcher Capital Economics (CE) is seeing irony in the new Government's move to "take the Reserve Bank of New Zealand (RBNZ) back to the past".

CE's head of Asia Pacific Marcel Thieliant says he doubts the imminent removal of the RBNZ's employment objective from the monetary policy mandate - to focus on a single target of inflation - would make much difference to economic outcomes.

However, he does warn that any decision to force the RBNZ to achieve its inflation target within too short a period of time "could cause unnecessary swings in output when inflation is being buffeted by supply shocks".

The idea of a time limit on inflation is included in the coalition agreements, as it having another look at going back to the single decision maker role on OCR decisions as was formerly the case before the RBNZ's Monetary Policy Committee was set up.

While both options are set to be looked at by the Government in the New Year after the receipt of advice, it's not at this stage seen as likely that either would be pushed forward.

"It is rather ironic," Thieliant says, "that at the same time that Australia’s government is tabling legislation to modernise the Reserve Bank of Australia in response to the recent review, New Zealand’s newly-elected government intends to take the Reserve Bank of New Zealand back to the past."

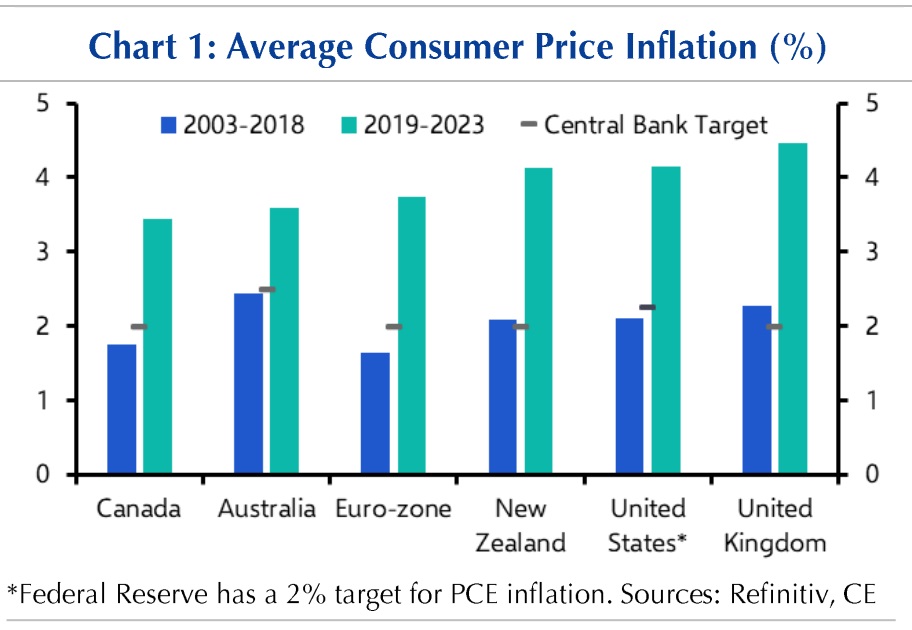

He does say that at first glance, the track record of the RBNZ in terms of meeting its inflation target has become worse since the changes to its institutional framework in 2019.

"Whereas average inflation was close to the midpoint of the RBNZ’s target between 2003 and 2018, it has been twice as high since 2019," he says.

"In practice though, we doubt that the removal of the employment objective alone nor returning decision-making solely to the Governor would make much difference to the performance of New Zealand’s economy.

"For one thing, inflation has been well above target in nearly every advanced economy over the last couple of years.

"And the experience from other countries is that solely focusing on inflation won’t necessarily improve the central banks’ ability to achieve price stability. As Table 1 [below] shows, there’s a broadly equal split among the RBNZ’s peers between those that have an employment target and those that don’t. (Note that the Bank of Canada and the Bank of England are tasked to “support” employment).

"Yet the country where average inflation has been the furthest above target both before and after the pandemic has been the UK even though the Bank of England is a pure inflation-targetter."

"Nor is there strong evidence that pure inflation-targeting central banks cause much larger swings in unemployment: the countries with the lowest as well as the highest variation in the unemployment rate both feature a central bank with an employment mandate, whereas swings in unemployment have been in the middle of the pack among countries with pure inflation-targeting central banks."

Thieliant says he does suspect that the NZ Government will eventually decide against requiring the RBNZ to meet its inflation target within a certain period of time.

"But if it presses ahead and opts for a short period (e.g. two years), that could make it more difficult for the Bank to respond to supply shocks.

"For example, if the Bank had been asked to return inflation to target within two years following the surge in energy prices caused by the Ukraine War, it would have had to lift interest rates even more aggressively than it already has, pushing the economy into recession and causing an even more pronounced rise in unemployment."

7 Comments

We're still not learning.

:)

I used to have this written and stuck on the back of the toilet door "The more things change, the more they stay the same"

A time limit on inflation.

The employment mandate was designed to open the door to the Labour Govt's true intention, which is "equitable employment outcomes" or in other words, applying the same race based rules to central bank policy that was applied to health and education.

Its the same path that all the Leftist central banks are going down as they push WEF policies onto countries.

https://www.fraserinstitute.org/article/central-bank-equity-quest-raise…

When National removes the "employment mandate", what they are really removing is the "diversity and equality" bit. Best thing National can do is replace the Labour appointees, starting with Orr.

re ... "The employment mandate was designed to open the door to the Labour Govt's true intention, which is "equitable employment outcomes" or in other words, applying the same race based rules to central bank policy that was applied to health and education.

Its the same path that all the Leftist central banks are going down as they push WEF policies onto countries."

What a load of tosh !!!

Put your tin foil hat back on. You're clearly suffering without it.

Clearly you didnt bother to read the article that quotes various central bankers, but just jumped on the comment to express your ignorance. But here's some more links for you to ignore

https://www.omfif.org/2023/01/should-reducing-inequality-be-a-central-b…

https://cepr.org/voxeu/columns/equality-monetary-policy-and-central-ban…

And if reading is too hard for you, here's a video https://www.youtube.com/watch?v=1h6dKbPXm6Y

So the new NACTF gummit is basically wasting their time and our money?

Who'd have thought, ay?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.