The promised ‘Growth Budget’ has failed to live up to its name with only a marginal effect on economic growth forecasts, according to opposition politicians and some economists.

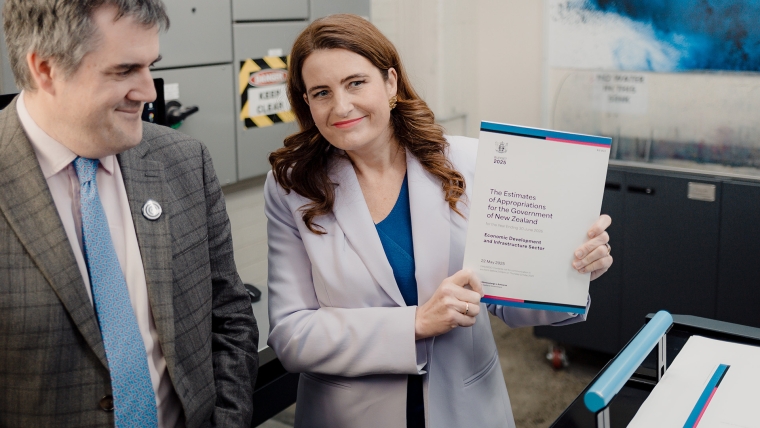

Finance Minister Nicola Willis unveiled the $6.7 billion reshuffle of Government spending on Thursday, after promising to secure New Zealand’s economic recovery.

Money saved from canceling pay equity claims and halving KiwiSaver contributions was used to fund a $1.7 billion tax break for capital investments and meet cost pressures in the health sector.

Before its release, it had been pitched as a bold budget which would deliver long-term economic growth benefits, but it left many analysts underwhelmed and the opposition parties fuming at the trade-offs.

Labour Party finance spokesperson Barbara Edmonds asked whether slower wage growth for working women was worth the marginal economic growth benefits forecast by Treasury.

“She’s taken $12 billion from the pay packets in the future. Women have a huge contribution to our economy. What does that say to them … that the work that they do is not worth it.”

This work included caring for pregnant mothers, all the way to looking after people dying in their final days. Money which was earmarked to increase their wages would instead be spent on “subsidies” for gas and big tech companies, landlords, and tobacco companies, she said.

What Edmonds describes as subsidies are the property and tobacco tax changes in the previous budget and, from this budget, a $200 million commitment to co-invest in new gas fields with the private sector, and the decision to withdraw the Digital Services Tax Bill.

Edmonds said you can’t call it a “growth budget” unless you were talking about the growth in unemployment, which is now predicted to reach 5.4% later this year.

Elusive promises

Labour leader Chris Hipkins pledged to restore pay equity but was elusive when asked if it would cost up to $12.8 billion—as estimated by Treasury—and whether he was aware of that fiscal risk when serving as Prime Minister in 2023.

He was also critical of the Government's decision to halve its contribution to KiwiSaver from $521 to $261, which he said would reduce a new saver’s balance by $60,000 by retirement age.

This analysis ignores the increased default contribution rate of 4% which employers will be required to match and will ultimately lead to significantly higher balances.

“I think saying to someone, we're going to take away the money that we were giving you, but you can save some more of your own money, isn't really helping New Zealanders to save for retirement.”

Hipkins was supportive of the tax break for capital investments, however, saying it appeared to be a good way to encourage greater productivity. This incentive works by allowing businesses to claim the first 20% depreciation tax benefit on a new asset straight away.

No room for growth

Labour’s argument that the ‘Growth Budget’ didn’t really live up to its name was backed up both by Treasury’s analysis and private sector economists who saw limited upside.

The only meaningful growth policy was the business investments tax break which Treasury estimated would lift GDP by 0.4% over the forecast period and 1% over the next two decades.

Prime Minister Christopher Luxon rejected the allegation he had over-promised and under-delivered on growth, as a half percent increase to GDP was “massive”.

“It is going to incentivize our small business owners to put more capital into their businesses, which will actually lift wages and productivity of those firms. That has been one of the big problems in New Zealand is our economic productivity,” he said.

Stephen Toplis, head of research at BNZ, said he was not “convinced that terminology is entirely apt” with the overall fiscal impact contractionary.

“It is clear the Government is trying to create an environment which fosters better growth over the medium term, but the possibility of a near term positive response is limited,” he wrote in a note.

Although it seemed “hellbent” on a surplus in 2029, it wasn’t clear whether the Crown would actually deliver it. The forecast surplus was just $214 million which rounded to 0.0% of GDP and relies on Treasury’s “heroic” economic forecast panning out.

Despite this criticism, Toplis was complimentary of the overall policy mix which he said should help to unwind spending increases and ensure net debt didn’t blow out.

S&P Global Ratings took a more negative view of the fiscal situation in a bulletin titled: New Zealand's Budget Repair Begins To Stall.

“Today's 2025 budget aims to curb operating spending and reduce the large fiscal deficit. But spending cuts only partially offset an expected decline in revenue growth due to a weaker economy and a new accelerated depreciation policy,” it said.

“The country's elevated twin deficits—referring to its fiscal and current account balances—are weaknesses that could weigh on the credit rating.”

Green Party co-leader Marama Davidson said it should be called “the no ambition budget” as the official child poverty report showed it would make almost no progress on reductions.

9 Comments

This government is obsessed with cost cutting and it showed in the budget. I'm all for eliminating lolly scrambles but some sound investment/infrastructure projects would have been a nice addition given there's a huge and growing infrastructure problem in this country.

Repeating my post from yesterday:

We could debate the merits of budget allocations indefinitely however Willis is still spending several billion more than Robertson forecast this period had he remained Finance minister.

Yes but Robertson wasn't cutting taxes, so incomings were greater... Willis is cutting taxes, damaging the economy AND spending billions more

some sound investment/infrastructure projects would have been a nice addition given there's a huge and growing infrastructure problem in this country.

The kicker is whether these projects provide a net financial gain to the country over time. Otherwise we are just adding to a tenuous financial position with more losses.

.

Of all people - Matthew Hooten's opinion piece in the Herald says it simply;

Titled: Budget reveals we’re going broke faster than we knew

Whatever its other merits – and they are few and far between – Nicola Willis’ second Budget at least forces Labour to admit it must introduce massive new taxes if Chris Hipkins returns to power next year.

We could have know.

We chose not to.

And it didn't need a Budget to tell us that - it needed the reporting of physical reality(ies).

8-10 billion a year in debt repayments is put front and centre of the discussion - that a lot of money that could be invested in our health , education and country's growth - going overseas to nameless institutions

The kiwi saver changes are long overdue -- should probably totally cut the governments contribution except a start up welcome incentive -- the extra employer contributions dwarf it anyway

sorting the debt -- would make the biggest difference - time to take the medicine

What they want:

1.7b in tax breaks for businesses to spend on upgrading plant and equipment

What they will get:

Heeeaps of new ute's on the road, purchased through the well known ute loophole where it's a "legitimate business expense", but is actually just a new toy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.