Nobody recognised New Zealand’s fifteenth Reserve Bank Governor, Anna Breman, when she first appeared in a Beehive hallway with Finance Minister Nicola Willis on Wednesday.

A report by Bloomberg had confirmed on Tuesday it would be a woman and foreigner—both are firsts for the bank—but nobody had floated the name of this 49-year-old Swedish central banker.

Willis appeared proud as punch to have found an accomplished candidate who could turn the page on the Reserve Bank (RBNZ) tumultuous pandemic years under the leadership of Adrian Orr.

“We're opening a new chapter today, a new chapter in New Zealand's history and a new chapter for the Reserve Bank,” she said at the press conference.

The new governor has a PHD from the Stockholm School of Economics. She worked for her finance ministry, taught at the University of Arizona, and rose to be Group Chief Economist at Swedbank.

In 2019, she was appointed Deputy Governor at the Swedish central bank, Sveriges Riksbank, and was promoted to second-in-command as First Deputy in 2022.

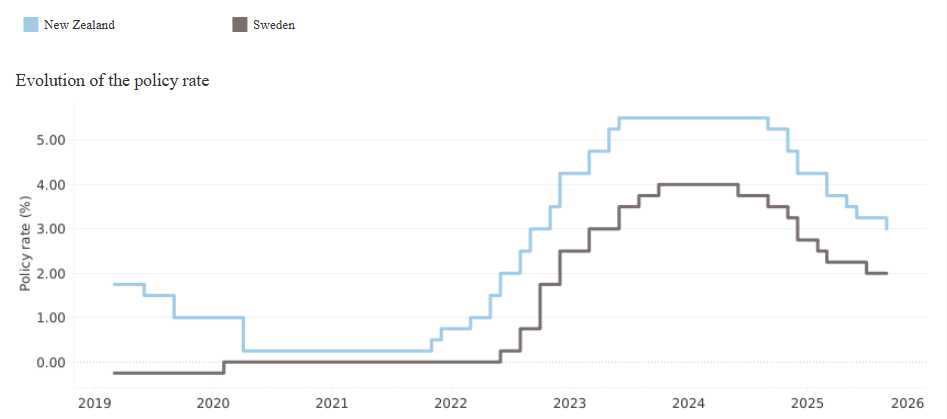

The Riksbank’s monetary policy during this period of global inflation followed a broadly similar trajectory to the RBNZ, albeit more moderately.

It held its policy rate at zero and purchased bonds to keep long-term interest rates low. After Russia invaded Ukraine in 2022, it reversed course and hiked rates by 400 basis points by the end of 2023.

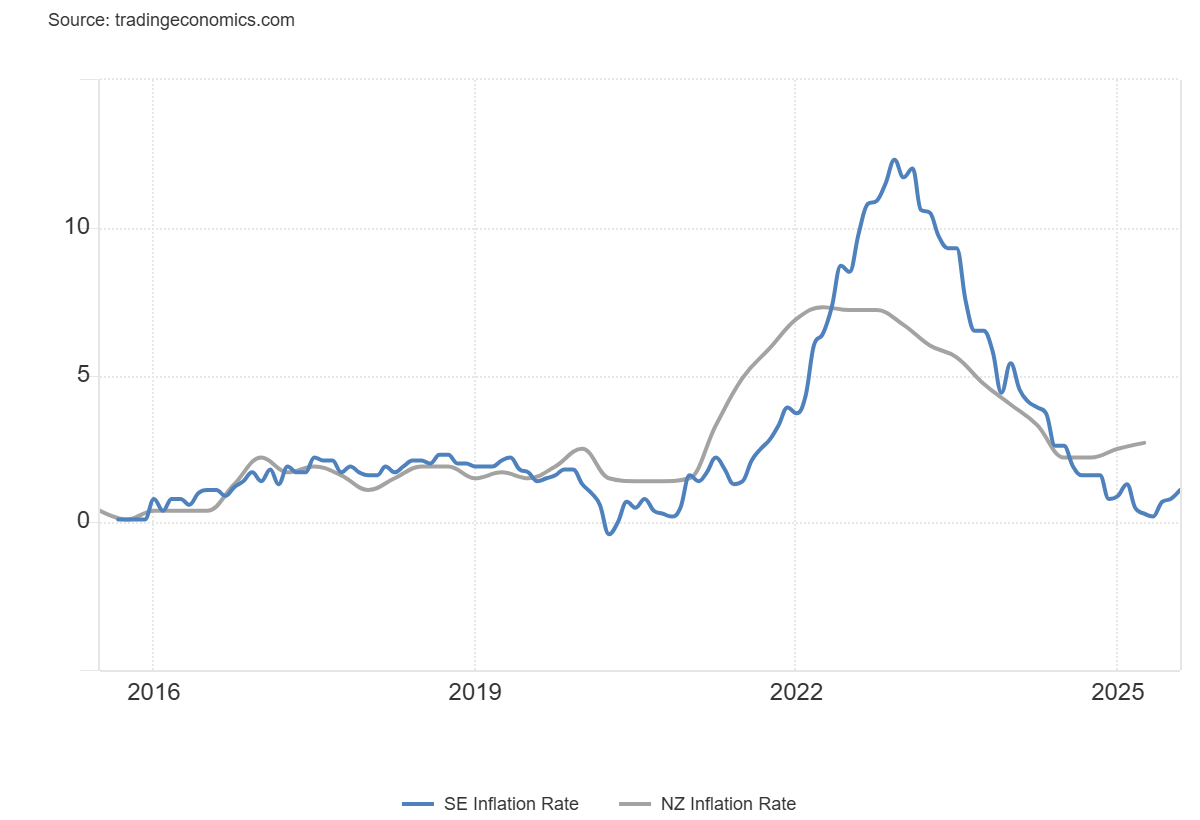

Sweden started cuts in May 2024 and has lowered its policy rate to 1.75%. The country was considered to be in recession during 2023 and experienced higher inflation than New Zealand.

Next challenge

Breman’s six-year term at the Riksbank was set to end on November 30, 2025. Instead, she will step down a month early to move across the world to start at the RBNZ on December 1.

This will give her two and a half months in office to prepare for her first monetary policy statement, scheduled for February 18th. Between now and then, she will be eagerly learning the inner workings of New Zealand’s idiosyncratic economy.

Rodney Jones, a principal at Asia-focused macro advisory firm Wigram Capital Advisors, told BusinessDesk he was disappointed an international candidate had been appointed.

It would be a “steep learning curve” for a European to learn how shocks are transmitted across Asia-Pacific. The board and minister should have selected a local with more regional expertise, he said.

But Breman told reporters she already felt familiar with the Kiwi economy: “I've read a lot, and I'm looking forward to learning even more, of course, meeting with staff and with people”.

She has placed an emphasis on transparency during her career as a central banker, and promised to make herself widely available to the public as RBNZ Governor.

“I will travel the country, try to meet with people from all different kinds of businesses, regular households, students and I would also try to ensure that more people from the Reserve Bank are out to meet households all around the country,” she said.

While the bank’s leadership and staff have always met with stakeholders, it most frequently been with financial market participants or academic experts. Breman wants to go wider.

The little-known central banker could soon become a household name in New Zealand, with the goal of building back the RBNZ’s bruised reputation.

“The Reserve Bank lists high in international rankings of transparency, but I do believe that there is more work that needs to be done, so we will strive for transparency, accountability and clear communication within all the work that we do,” she told reporters.

Breman said this would be key to building “trust and credibility” and that her “primary focus” would be on providing stability and morale after the recent controversies and resignations.

“I will be looking forward, and I will make sure the staff feel that we're now on a good path going forward,” she said.

Her short press conference hit all the right notes: stability, transparency, staff culture, laser-focus on inflation, and complete independence — most economists were impressed.

Praise be

John Carran, the chief investment officer at SFS Private Wealth, said Breman appeared to be a great appointment based on her qualifications and experience.

“From first impressions, she will be very focused on the Reserve Bank's core roles of inflation control and financial market stability,” he said.

“Given her comments so far, and the wishes of the current government, she may be more cautious about lowering the OCR than her predecessors.”

Satish Ranchhod, a senior economist at Westpac NZ, said she was “well suited to leading the RBNZ” but noted her role will include prudential regulation, unlike at Sweden’s central bank.

Governor Christian Hawkesby will resign when Breman starts, rather than return to his old job as Deputy Governor Financial Stability. This will leave the bank short on prudential leadership and needing a good replacement.

Martien Lubberink, an associate professor at Victoria University of Wellington, wrote in his newsletter that Breman was well-regarded for monetary policy and financial stability.

“From a capital point of view, this is an interesting appointment, as Swedish banks feature capital ratios about as high as ours. Watch that space”.

Sharon Zollner, chief economist at ANZ, said transitions between Governors have been relatively seamless and the monetary policy committee would keep policy consistent.

“However, priorities have been known to vary between Governors regarding some aspects of what the RBNZ does, such as bank capital requirements (which are under consultation until 3 October) and the broader research agenda.”

“The latter can certainly influence the Committee’s tone and emphasis (and hopefully enhance the quality of policy making). But the consequences for any given monetary policy decision of the change in stewardship is likely to be minimal (not that we’ll ever know, unless there is a change in how the Summary Record of Meeting is put together),” she said.

Past lives

As chance would have it, Breman may consider making changes to how the Reserve Bank announces and communicates its policy decisions in the Summary Record of Meeting.

Her most recent speech was about the benefits of Riksbank’s abnormally transparent policymaking process and announcements.

It is one of the only central banks which publishes what specific committee members said during policy discussions. It also publishes a rate forecast and alternative scenarios.

“My assessment is that the advantages outweigh the disadvantages, mainly because everyone can see how all the members have reasoned, what considerations they have made and what motives they emphasise. Outside observers can then decide for themselves how reasonable they think the arguments are,” Breman said.

It is possible she might replicate this approach at the RBNZ, as recently suggested by Westpac chief economist Kelly Eckhold. However, she also said in her speech that central banks were all different and “one size does not fit all”.

“Their mandates are different, monetary policy committees differ in size and structure, as do the processes by which a monetary policy is developed. This means that what works well for one central bank may not work as well, or even at all, for another."

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

16 Comments

'PHD from the Stockholm School of Economics'

That explains 2%, 2%, 2%, 2%, 2%, 2% forever.

It's not the who? it's the what.

In Sweden, the annual inflation rate measured by the Consumer Price Index with a Fixed interest rate (CPIF)was 3.2% in August 2025

They cut their cash rate to 1.75% two days ago.

"Laser focused on inflation"

At the expense of economic growth ? No more OCR cuts then… I doubt it. Didn't Sweden recently cut their cash rate despite having high inflation?

Found it, Sweden's inflation rate is 3.2%, they cut their cash rate to 1.75% two days ago. Maybe Breman's view of inflation control is stricter than Sweden's current reserve bank.

I suspect Sweden's economy is not as reliant on property and it's ties to their cash rate. Greater diversification in trading portfolios and closer neighbours for trade lend to greater resilience IMO.

Somehow we still rely on the OCR which was set up when home ownership was a higher percentage and thus had greater impact.

You can't just look at a headline rate a determine what to do with policy. The Riksbank says it's elevated because of a change in the index weighting, tax changes, comparison to weaker quarters, and a few specific elevated prices. Underlying inflation is weak, they say. 🤷🏼♂️

Incessant global depletion figure anywhere?

https://www.aljazeera.com/news/2024/2/7/sweden-ends-nord-stream-probe-c…

and the blind leading the blind:

https://www.government.se/press-releases/2025/08/swedish-economy-burden…-

It's a very left economy/society so likely to be natural doves when it comes to monetary policy.

But will Nicola and Anna be friends?

Hopefully not, and Nicola will see what logic, reason and transparency looks like for once.

Possibly, if Stockholm syndrome kicks in.

😆

Monetary policy needs friends

Much the same really. The banks will be happy.

OECD Economic Surveys: Sweden 2025: The Swedish economy faces headwinds | OECD

Following a recession in 2023 and weak growth in most of 2024, Sweden faces growing risks from an insecure and swiftly changing international environment. While financial stability risks have eased, Sweden’s high exposure to housing and commercial real estate requires continued vigilance. Household debt remains high, making it risky to relax macroprudential parameters as currently being contemplated by the authorities. The overall fiscal stance in the slightly expansionary 2025 budget is appropriate to support the recovery but it includes measures, such as fuel tax cuts and tax-free savings thresholds, that are not well-targeted. The proposed shift to a balanced budget target provides more flexibility but should be complemented by improved oversight to prevent inefficient spending and secure long-term fiscal buffers to meet spending pressures from ageing and climate change adaptation costs.

Sweden’s economic challenges are closely linked to its high household debt and the housing market. For years, low interest rates and favourable lending conditions led to surging property prices and a rise in already elevated household debt. Changing demand for housing during the pandemic pushed prices even higher. However, as interest rates were raised to combat inflation, Swedish mortgage borrowers, roughly 80% of whom hold variable-rate mortgages, faced soaring interest payments. While households generally possess substantial assets and strong repayment capacities, rising mortgage costs coupled with high inflation have eroded disposable income, playing a major role in dampening consumer spending.

Restrictive monetary policy also triggered a sharp decline in housing prices, reducing household wealth and further weakening consumption. Indeed, in Sweden, a 10% drop in house prices typically leads to a 2% decline in consumption. Falling housing prices have also squeezed developers’ profitability as they faced rising financing and construction costs, leading to a sharp slowdown in residential investments and new housing projects. In 2023, housing starts plunged by approximately 50%, the steepest drop since Sweden’s deep financial crisis in the early 1990s. This downward trend continued in 2024, with further drop of around 18%. The construction sector continued to struggle with elevated borrowing costs and a tepid housing market, even as housing prices ticked up. This combination of factors has led to a protracted period of economic stagnation.

Looks like Sweden calculates their inflation and GDP figures monthly (and quarterly for GDP). It would be good if she expects more up to date data from Stats NZ.

Perhaps we should ask the WEF, class of 2011?

"What we are very proud of, is that we penetrate the global cabinets of countries with our World Economic Forum Young Global Leaders"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.